“`html

- DeFi dominance is under 3%, potentially signaling a buying opportunity for undervalued tokens.

- Despite challenges, innovative DeFi projects continue to attract investment and show resilience.

Well, well, well! DeFi’s market share has plummeted to a staggering low of under 3%. It’s like watching a once-popular sitcom get canceled after one too many seasons. But hold your horses! This decline might just be hiding a treasure trove of opportunities. 🏴☠️

As the big boys, Bitcoin [BTC] and Ethereum [ETH], hog the limelight, a curious bunch of investors are peeking at those neglected DeFi tokens, which are gathering dust in the corner of the crypto room. It’s like finding a forgotten sandwich in the fridge—might be a bit stale, but who knows? It could still be good! 🥪

Tokens like Chainlink [LINK], Hedera [HBAR], Avalanche [AVAX], Uniswap [UNI], and Aave [AAVE] are still flexing their muscles, showing strong fundamentals despite the hype train leaving without them. 🚂

With everyone’s attention diverted elsewhere, this could be the perfect time for savvy investors to scoop up some high-conviction plays in the DeFi ecosystem. Think of it as a clearance sale—everything must go! 🛒

DeFi dominance hits historic lows, but…

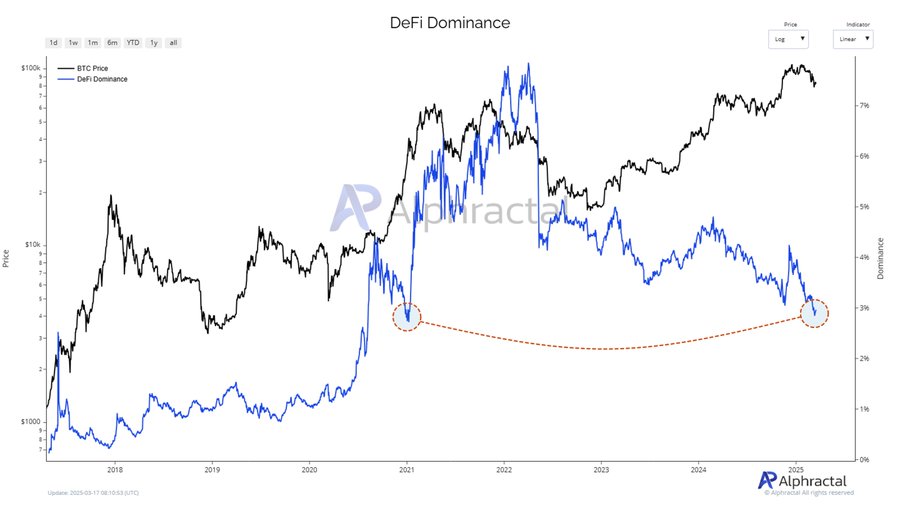

Recent data from Alphractal reveals that DeFi dominance has dipped below 3%—a level we last saw during the early 2021 cycle bottom. It’s like déjà vu, but with less excitement and more existential dread. 😱

That previous dip, however, was the launchpad for a DeFi resurgence as capital pirouetted out of Bitcoin and into undervalued altcoins. It’s like watching a dance-off where the underdog suddenly steals the show! 💃

The current situation is eerily similar, with BTC strutting its stuff near local highs while DeFi tokens are left in the dust.

This sharp divergence could be a sign of a cyclical pivot point. Investors who jumped in early during the 2021 dominance trough saw returns that would make even a seasoned gambler blush. And guess what? The same setup might just be unfolding again! 🎰

As the broader market sentiment remains as cautious as a cat on a hot tin roof, this dip in DeFi share might just be the golden opportunity that patient accumulators have been waiting for. Or it could be a mirage—who knows? 🤷♂️

Sector shakedown or undervaluation?

With DeFi dominance falling below 3%, the sector is at a crossroads. Recent events have added to the uncertainty—like AAVE’s rollercoaster price action tied to its fee switch proposal, which raised more eyebrows than a bad reality TV show. 🎢

Meanwhile, February brought a glimmer of regulatory clarity when the SEC decided to drop its appeal against a ruling that exempted DeFi platforms from securities laws. It’s like getting a surprise refund on your taxes—unexpected but welcome! 💸

Still, the scars from previous enforcement fears linger like a bad smell. Broader market jitters—like 17 straight days of Bitcoin ETF outflows—have pushed investors toward safer assets. It’s like running for cover when it starts to rain. ☔

Yet, historically, similar DeFi lows have been the precursors to major rebounds. So, will this be the moment we’ve all been waiting for? Only time will tell! ⏳

DeFi projects are quietly performing

Despite the decline in DeFi dominance, several projects are quietly flexing their muscles and showing resilience. Hemi Labs recently launched its mainnet with a TVL of $440 million, aiming to integrate Bitcoin and Ethereum into a unified network. It’s like trying to get cats and dogs to play nice—ambitious, but not impossible! 🐱🐶

Similarly, Converge, developed by Ethena and Securitize, is set to debut in Q2 as an Ethereum-compatible blockchain featuring native KYC and custody solutions, targeting institutional adoption. It’s like putting a tuxedo on a

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2025-03-19 05:18