- DEGEN crypto has a bearish structure and short-term bearish momentum.

- The price is expected to bounce from the nearby Fibonacci support level.

As a seasoned crypto investor with a knack for spotting trends and reading charts, I’ve seen my fair share of market fluctuations, and DEGEN has caught my attention lately. Despite the recent bearish structure and short-term bearish momentum, I remain optimistic about DEGEN’s potential. The Fibonacci support level at $0.008 is a key indicator that the token might bounce back soon, especially if buyers demonstrate their strength in this region.

In October, DEGEN experienced a significant price surge. Originally launched as a meme-based coin on the BSC network, its current market value stands at approximately $124.6 million.

Looking at the token’s performance, even though its price has decreased by 28% from its peak on the 14th of October, it’s important to note that it has managed to surge an impressive 128.5% since the beginning of this month, suggesting a promising trend.

Analysis indicates potential for further price increases, with the area around $0.008 serving as a crucial support zone over the next few days. The response at this point will offer valuable insights into the buying power.

Retracement phase is in progress for DEGEN crypto

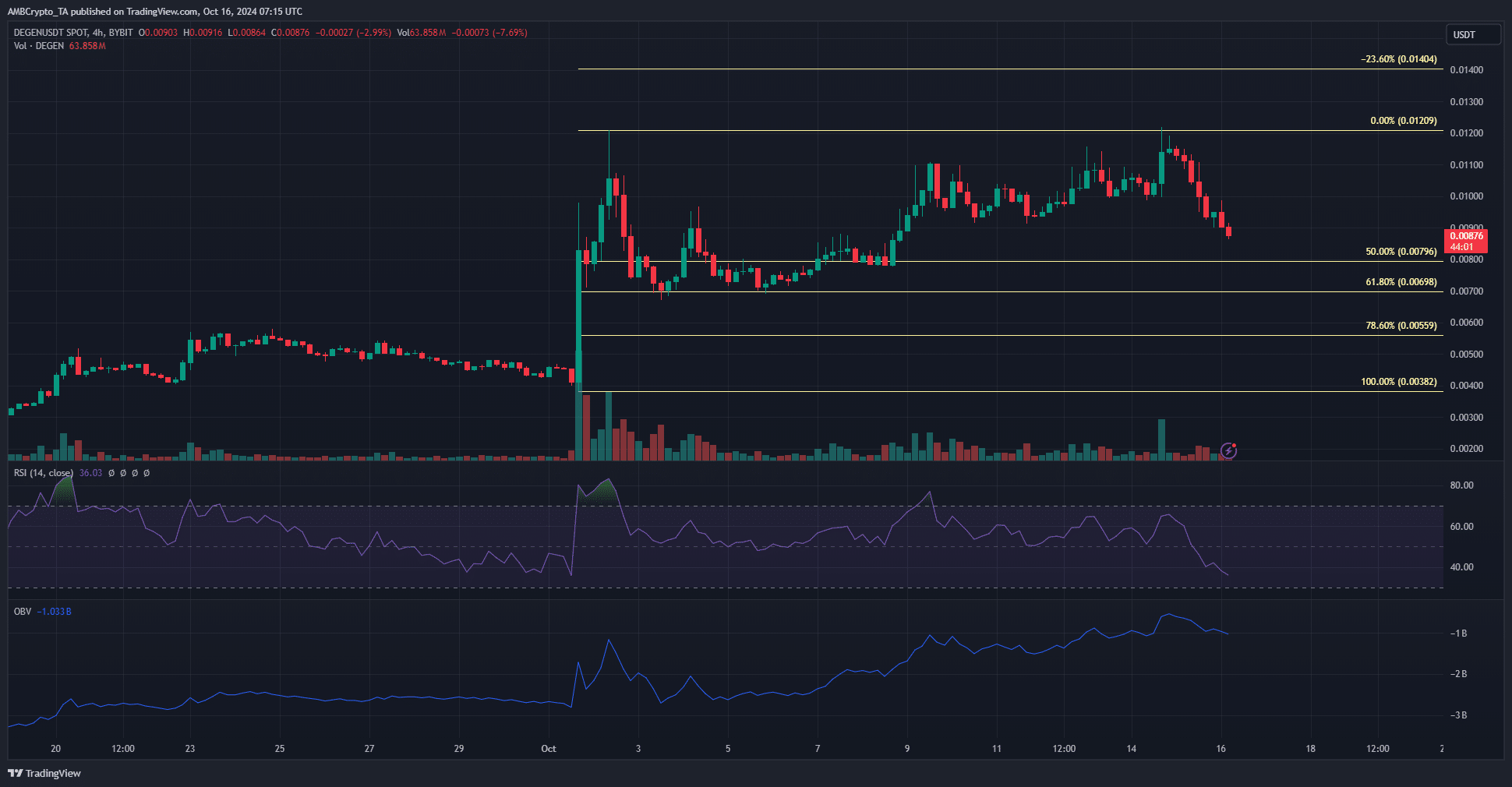

According to the 4-hour chart, the market’s direction shifted negatively on October 15th, indicating a potential short-term bearish trend. This change in trend might suggest a pause or reversal period for DEGEN, which had been moving upwards until then.

In simpler terms, despite the Relative Strength Index (RSI) showing that the market momentum favored the sellers because it dropped below the neutral 50 level, the On-Balance Volume (OBV) didn’t support this conclusion.

As a researcher, I’ve observed that the recent sales volumes, which triggered a nearly 25% adjustment, were not substantiated by particularly high trading volumes.

As a researcher, I’ve observed that the Fibonacci retracement levels have delineated crucial support points. With the noticeable decrease in selling pressure, it seems plausible that the 50% level, specifically at $0.0796, will function as a strong support, potentially driving prices upward.

Sentiment bullish after recent gains

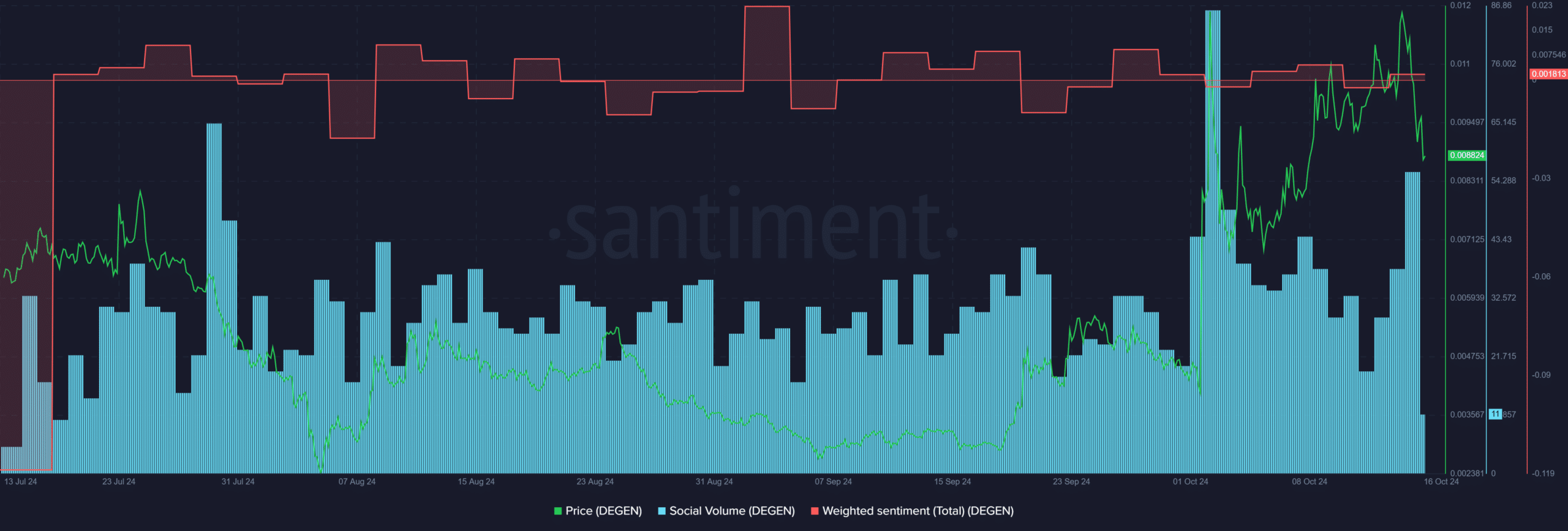

On October 2nd, there was an increase in public interest for DEGEN, but it has dipped slightly since then. The overall sentiment towards DEGEN leaned slightly positive as well.

Together, they showcased bullish expectations from participants on social media.

According to Coinglass, Open Interest figures were increasing along with the prices, indicating growing optimism in the derivatives market. This bullish sentiment was a promising signal.

On Tuesday’s New York trading session, the fluctuation in Bitcoin [BTC] caused Option Open Interest (OI) held by speculative traders (DEGEN) to decrease. However, there seemed to be a promising outlook for recovery.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- PGA Tour 2K25 – Everything You Need to Know

- MrBeast Slams Kotaku for Misquote, No Apology in Sight!

2024-10-16 16:07