- Bitcoin’s recent recovery hits $64,000, raising market optimism.

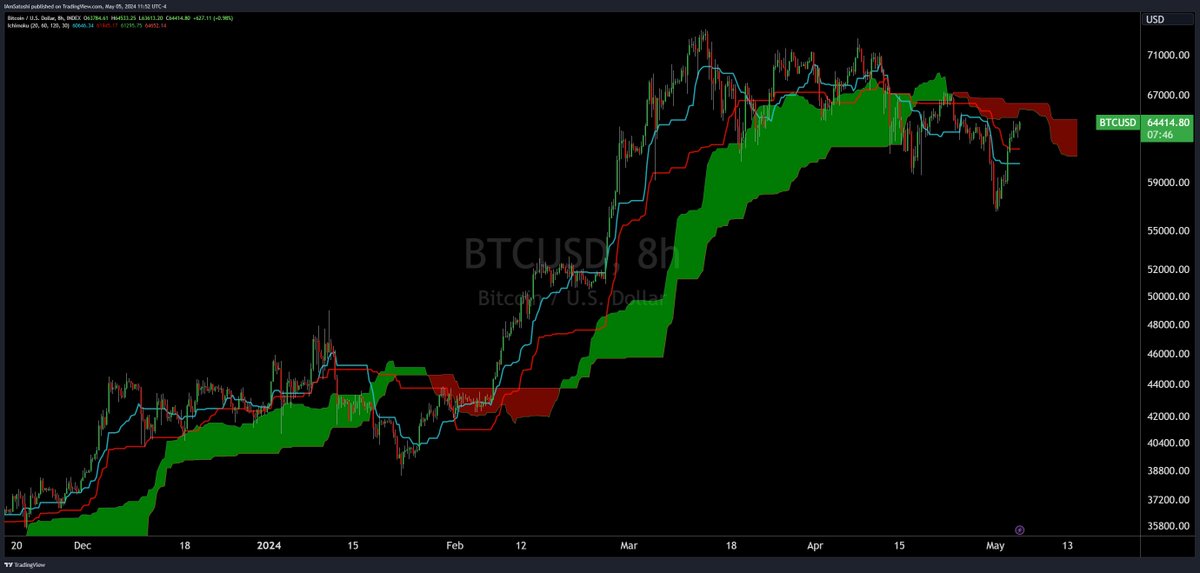

- Technical indicators like the Ichimoku Cloud suggest bearish market

As a crypto investor with some experience under my belt, I’m keeping a close eye on Bitcoin’s recent recovery to $64,000. While the optimism surrounding this milestone is understandable, I remain cautious due to underlying concerns that could potentially dampen any upward momentum.

🌪️ EUR/USD Turmoil Warning as Trump Escalates Trade Wars!

New research shows euro-dollar volatility about to spike — are you ready?

View Urgent ForecastAlthough Bitcoin’s [BTC] market value has seen a notable increase lately, the path to reaching the $64,000 threshold again is clouded by lingering worries that may undermine the enthusiasm for its revival.

Despite reaching $64,000 once more, which could signal additional price increases, a cautionary note comes from an analyst who presents valid reasons for traders to exercise caution in light of the seemingly bullish indicators.

A fragile recovery amidst optimism

As a crypto investor, I’ve noticed that Bitcoin’s ability to bounce back from setbacks is a good indicator of the market’s overall strength. In the past week, Bitcoin showed signs of recovery, adding 2.4% to its value. And just within the last day, it managed to increase by a modest 0.6%.

Bitcoin has reached a significant milestone by surpassing the $64,000 mark once more. This level is considered a key benchmark for potential price increases.

However, the celebration of this milestone may be premature as underlying issues loom.

BTC’s decline by 13% from its March high indicates a potential bumpy road to recuperation.

While the latest advancements are promising, they signify a fragile equilibrium in a market that is still in the process of healing from past disappointments.

Experienced trader Josh Olszewicz cautions that even though Bitcoin has surpassed the $64,000 mark, the digital currency still faces some risks.

The Ichimoku Cloud, a sophisticated market tool, is utilized in his examination to present a comprehensive perspective on market trends and to identify prospective resistance and support points.

At present, the cloud in the chart maintains a red hue, indicating that the downward trend is continuing, and Bitcoin’s price is under this important marker. This cloud now functions as a formidable hurdle for the cryptocurrency.

The Ichimoko Cloud indicates that downward price movement for Bitcoin is likely to persist unless the cryptocurrency manages to consistently surpass this cloud’s level. Once this happens, the cloud could shift from acting as resistance to becoming a source of support.

As a researcher, I would advise keeping an eye out for a potential bullish signal using the inverse head and shoulders pattern in conjunction with cloud dynamics. These indicators may suggest a more robust reversal from the prevailing bearish trend.

Where will Bitcoin head next?

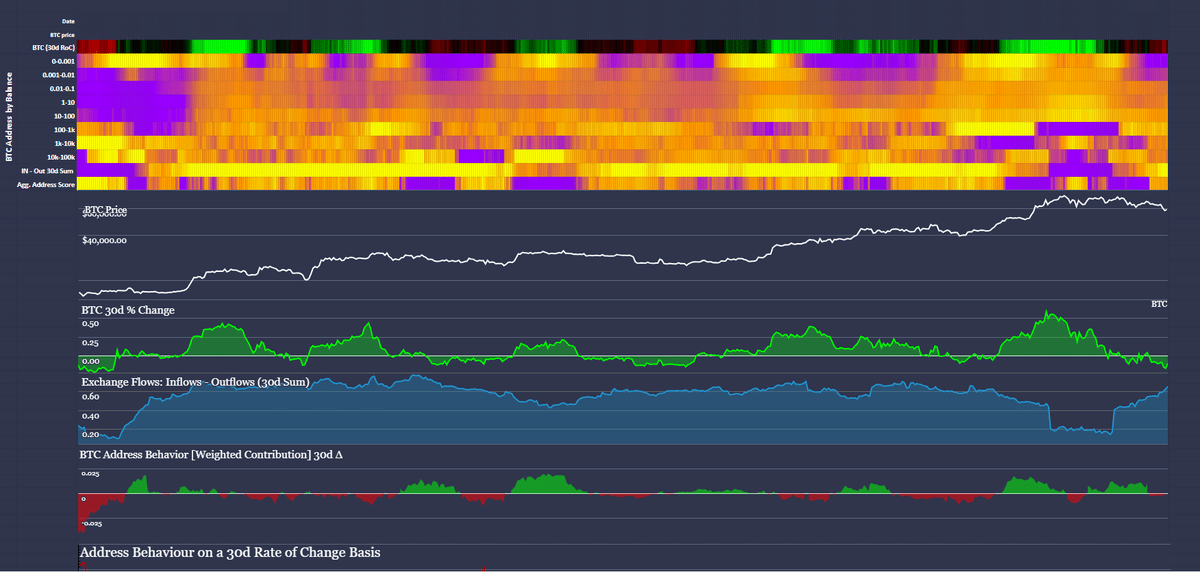

As an analyst, I’d like to add some depth to the story with insights from Santiment’s data. Their findings offer a more intricate perspective that warrants our attention.

The signs suggest a distribution trend, but the overall wallet activity points to strength without notable structural vulnerabilities.

As a researcher, I would interpret this as follows: While some positive developments may be observed in the short term, there is a lingering sense of apprehension among investors regarding the overall market trend.

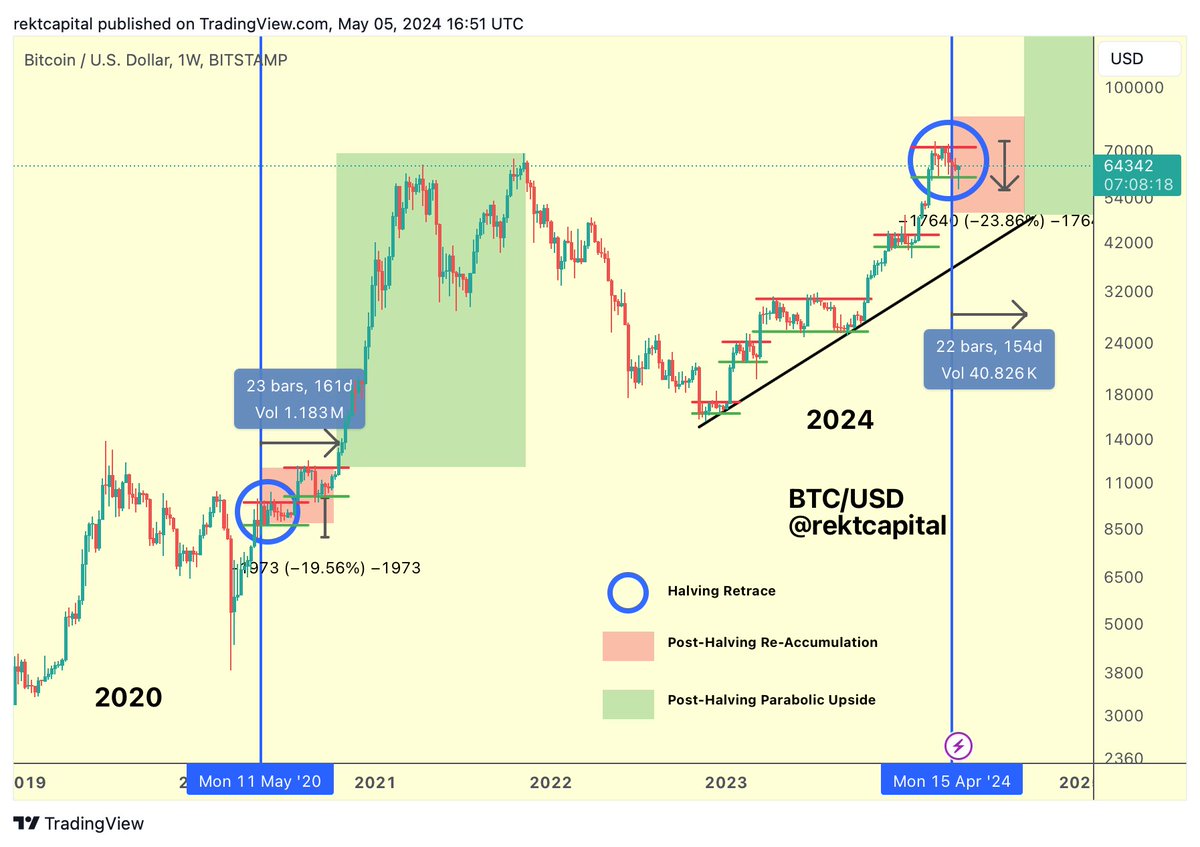

As a researcher closely following the cryptocurrency market, I’ve noticed that, in accordance with crypto analyst Rekt Capital’s assessment, Bitcoin seems to be shifting from a price-driven sell-off to a period of consolidation following the Halving event.

This aligns with historical patterns that typically precede substantial bullish runs.

During this extended period, which is projected to span approximately 150 days, there’s a possibility that we may be witnessing the beginning of a longer-term growth phase. Historically, such prolonged periods of stability have been followed by significant upward trends.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

Recent reports from AMBCrypto have indicated promising developments, signaling a breakout from a descending triangle formation and hinting at growing purchasing pressure.

According to Glassnode’s data, Bitcoin’s reserve risk is on the rise within historical zones known to precede price growth, suggesting a bullish outlook.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-05-07 04:07