- HODL waves, NVT and MVRV ratios show strong signs of a bull run soon.

- Other indicators like stablecoin reserves also support the notion.

As an experienced analyst, I believe that based on the current on-chain data and trends, a bull run in the cryptocurrency market is not only likely but also imminent. The decrease in short-term trading activity and increase in medium to long-term holding, as indicated by HODL waves, is a strong bullish signal. Furthermore, the downward trend of the NVT ratio and the recent increase in both price and MVRV ratio suggest a bullish sentiment in the market.

The volatile cryptocurrency market is not for the risk-averse. Following a prolonged bearish trend, the beginning of this year brought about a shift in power from the bears to the bulls, instigated by the green light given to US Bitcoin [BTC] exchange-traded funds (ETFs).

Over the ensuing weeks, Bitcoin experienced a significant surge, which in turn triggered similar gains among alternative cryptocurrencies. This development sparked anticipation within the crypto community, prompting many to get ready for an imminent bull market.

As a researcher studying the cryptocurrency market, I’ve held onto the belief that Bitcoin could surpass its previous all-time highs and reach new heights. However, this optimism is starting to wane as Bitcoin currently hovers around the $60K mark, displaying no apparent intention of breaking through to fresh records.

But on-chain data is showing us that a bull run is, indeed, still happening. Soon, in fact.

Let’s take a look.

A shift in the crypto market

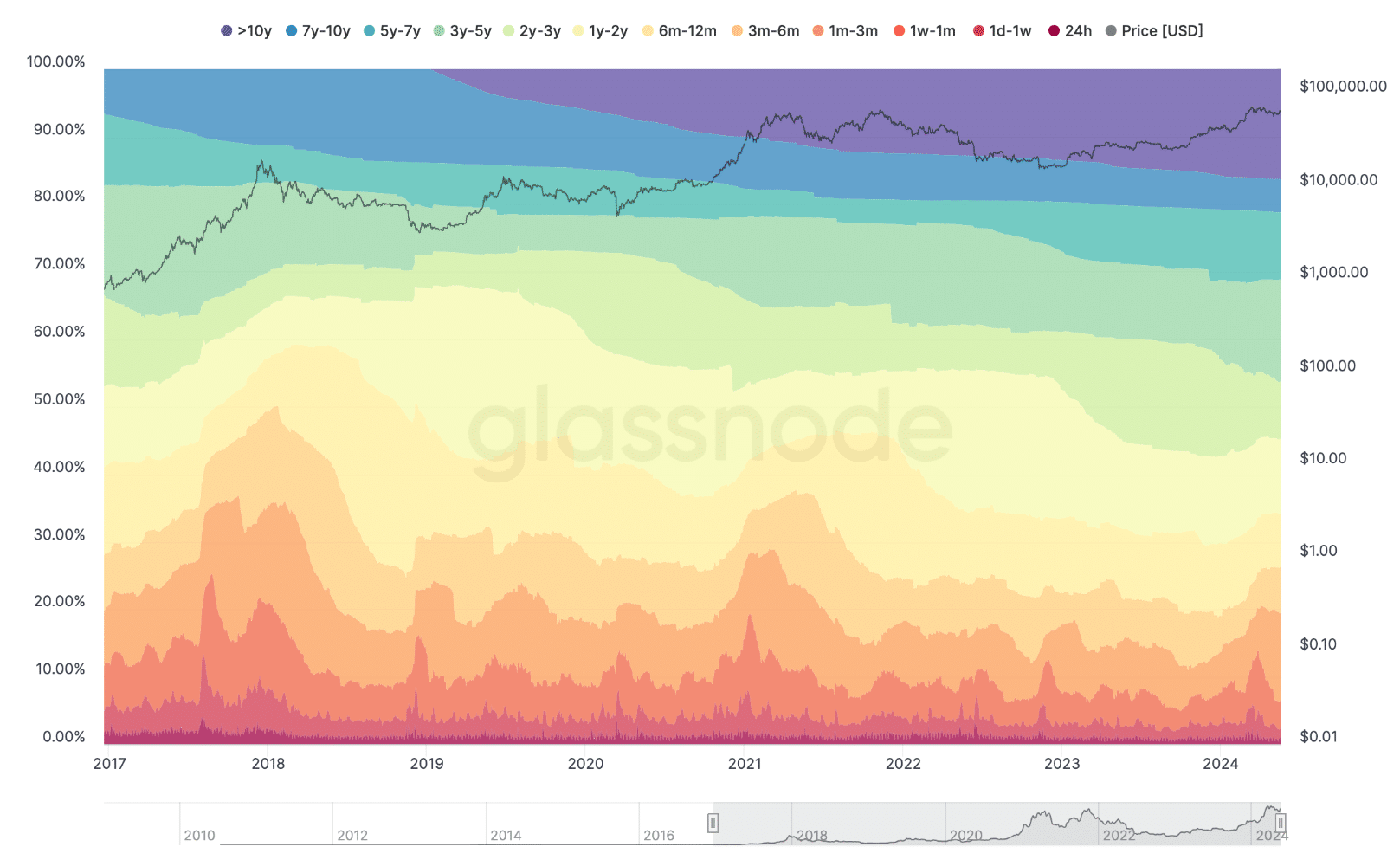

According to AMBCrypto’s interpretation of Glassnode’s “HOLD Waves,” there was a reduction in short-term trading transactions and a rise in longer-term investment holding.

As a crypto investor, I’d interpret this trend in the following way: With each price increase, there are fewer and fewer sellers coming forward. These investors are holding on to their assets, believing that the value will continue to climb higher in the future. Therefore, this trend signifies a bullish outlook for me.

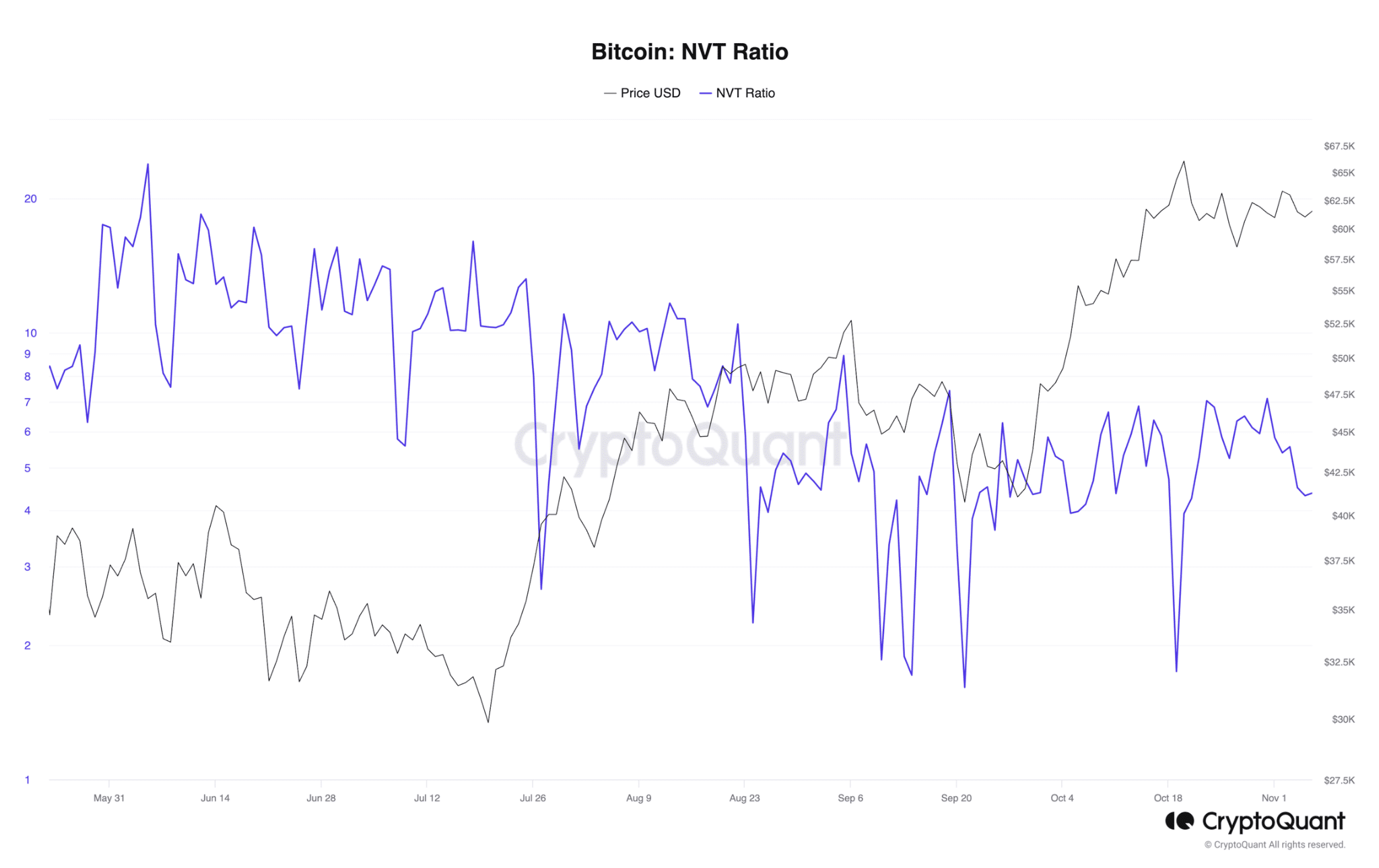

After analyzing the network value to transactions ratio (NVT) of AMBCrypto since the beginning of 2024, it was noted that this ratio has been decreasing as we approached the end of the observation period.

Experts view a declining NVT ratio as a bullish sign. According to our findings, this could imply that a bull market might be imminent.

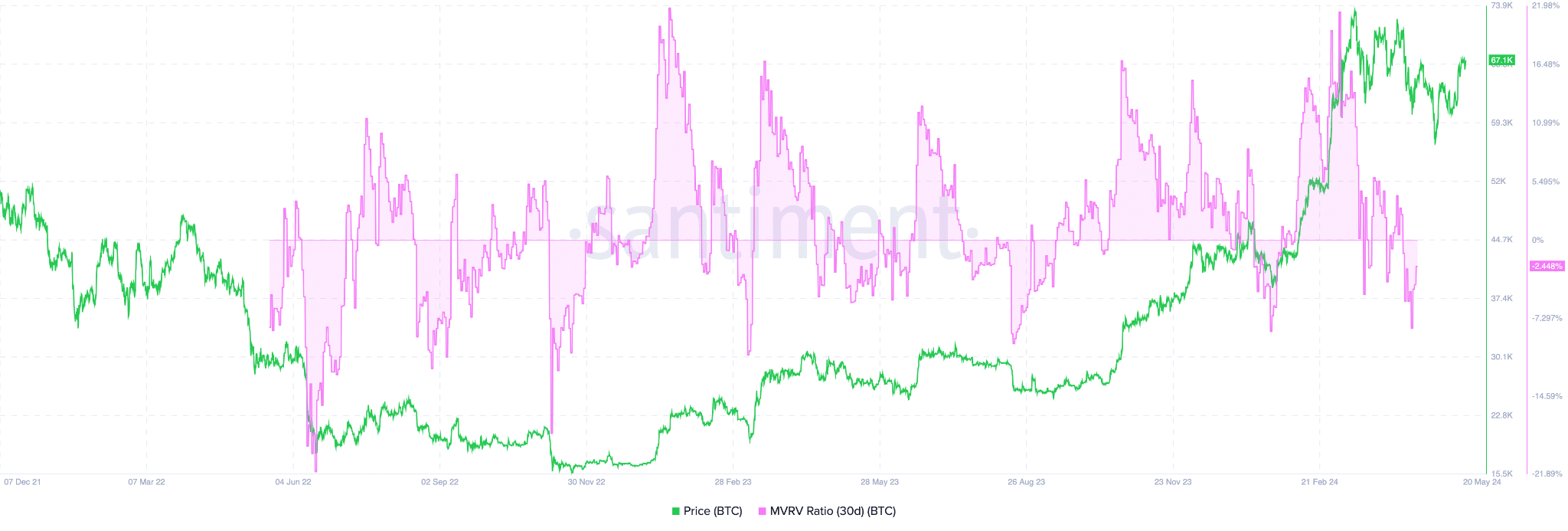

Regarding the MVRV ratio, we observed noticeable changes. At certain points, it exceeded the benchmark of 1.0, while at others, it fell short.

As a researcher observing market trends, I’ve noticed an uptick in both Bitcoin’s price and its Miners’ Sentiment Value Ratio (MVRV). Notably, the MVRV ratio has surged significantly above its baseline following a recent dip, suggesting a robust bullish sentiment among miners.

Stablecoin reserves and on-chain derivatives activity

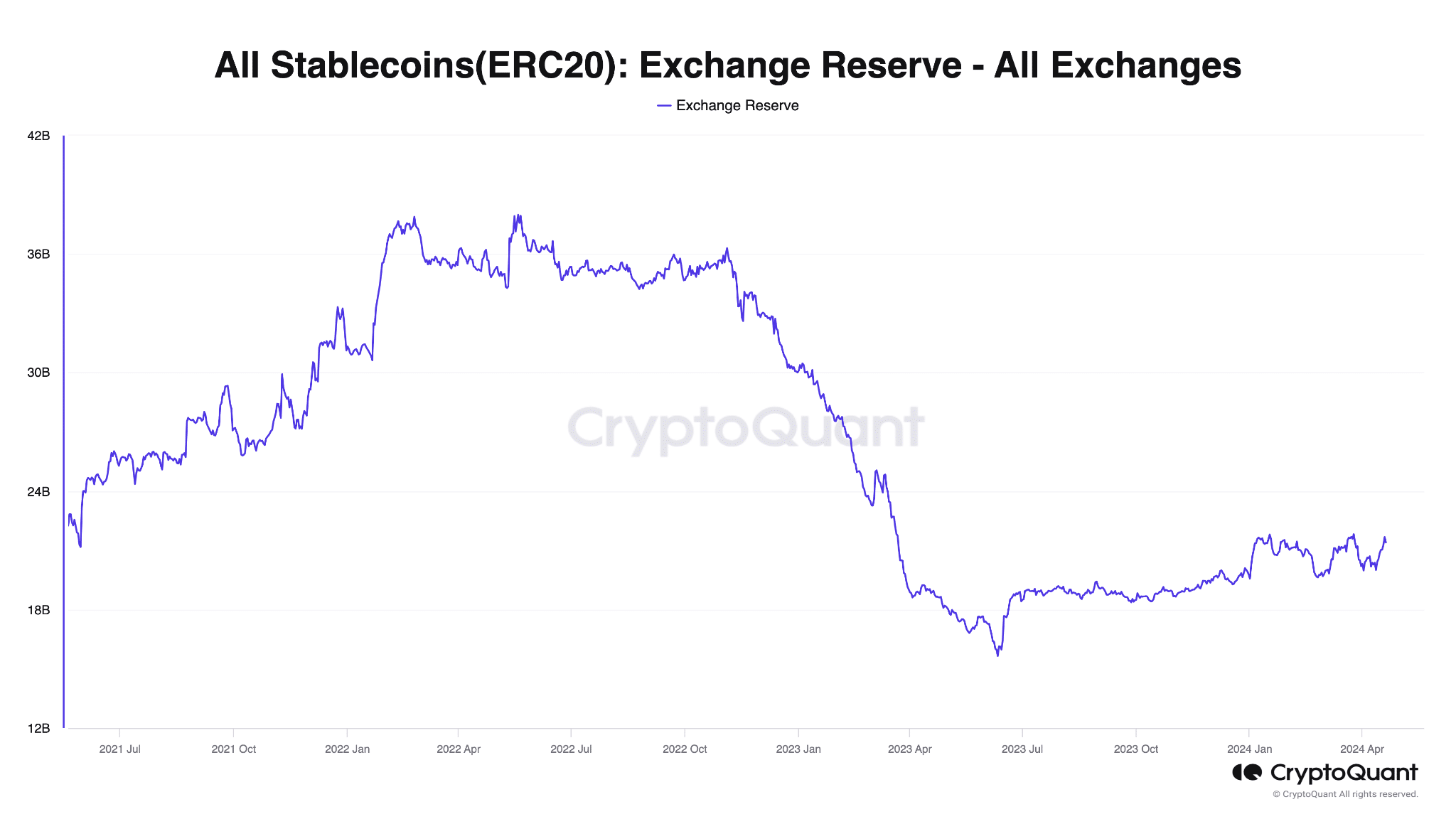

Based on AMBCrypto’s analysis of stablecoin reserves, it appears that market conditions were already favorable for a potential bullish trend.

A significant portion of investment capital may be shifting towards riskier cryptocurrencies, which could lead to price increases for these assets.

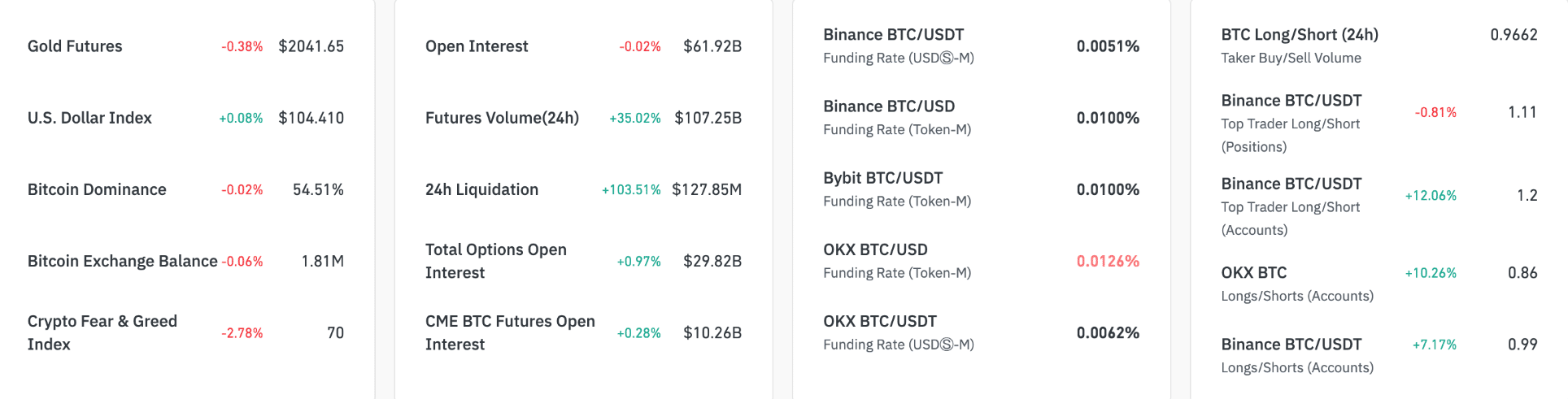

The data from Coinglass reveals exceptionally high market activity in derivatives, indicating a bullish trend due to elevated buying demand.

At the moment of reporting, the amount of Bitcoin being traded on exchanges had gone down, resulting in fewer Bitcoins available for sale. Over the longer term, this decrease in supply could potentially drive up the price.

Additionally, when the index reached 70, it fell into the “Greed” zone, signaling a bullish market mood.

The query about whether a bull market is yet to continue holds just one solution: Affirmatively, it most certainly is. However, be sure to carry out your own research, as ever.

Read More

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- WCT PREDICTION. WCT cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- PGA Tour 2K25 – Everything You Need to Know

- ETH Mega Pump: Will Ether Soar or Sink Like a Stone? 🚀💸

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- `SNL’s Most Iconic SoCal Gang Reunites`

2024-05-21 02:16