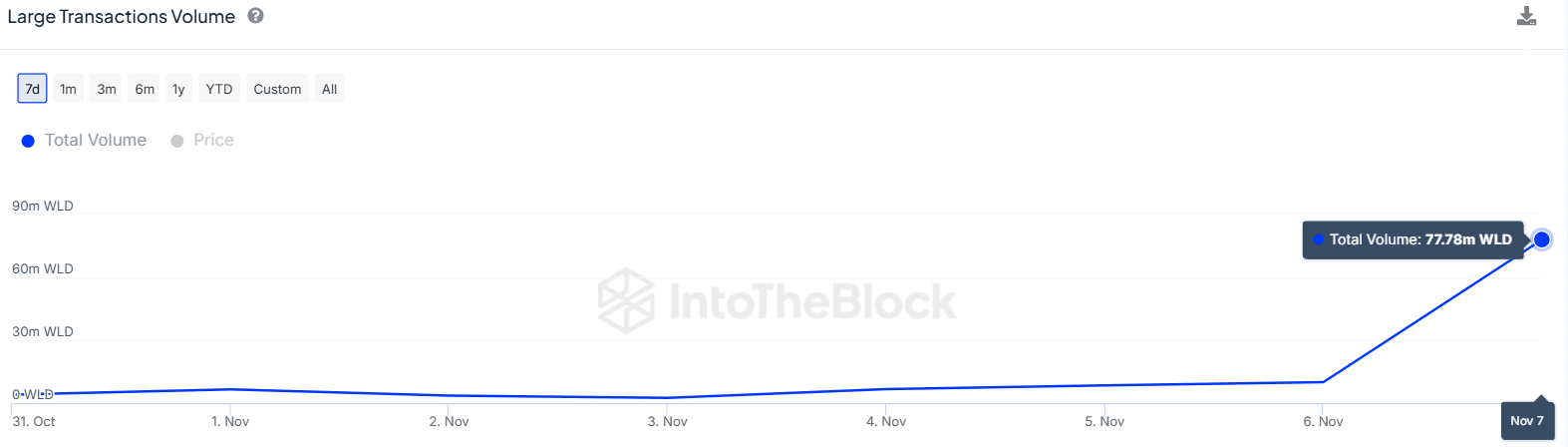

- Worldcoin large transaction volumes have surged by 600% from 9.98 million to 77.78 million in 24 hours.

- Despite this rise in whale activity, WLD price has failed to record significant gains.

As a seasoned analyst with years of experience navigating the volatile crypto market, I find myself intrigued by the recent developments surrounding Worldcoin [WLD]. The 600% surge in large transaction volumes within 24 hours is undeniably eye-catching, yet the token’s failure to record significant price gains raises a few eyebrows.

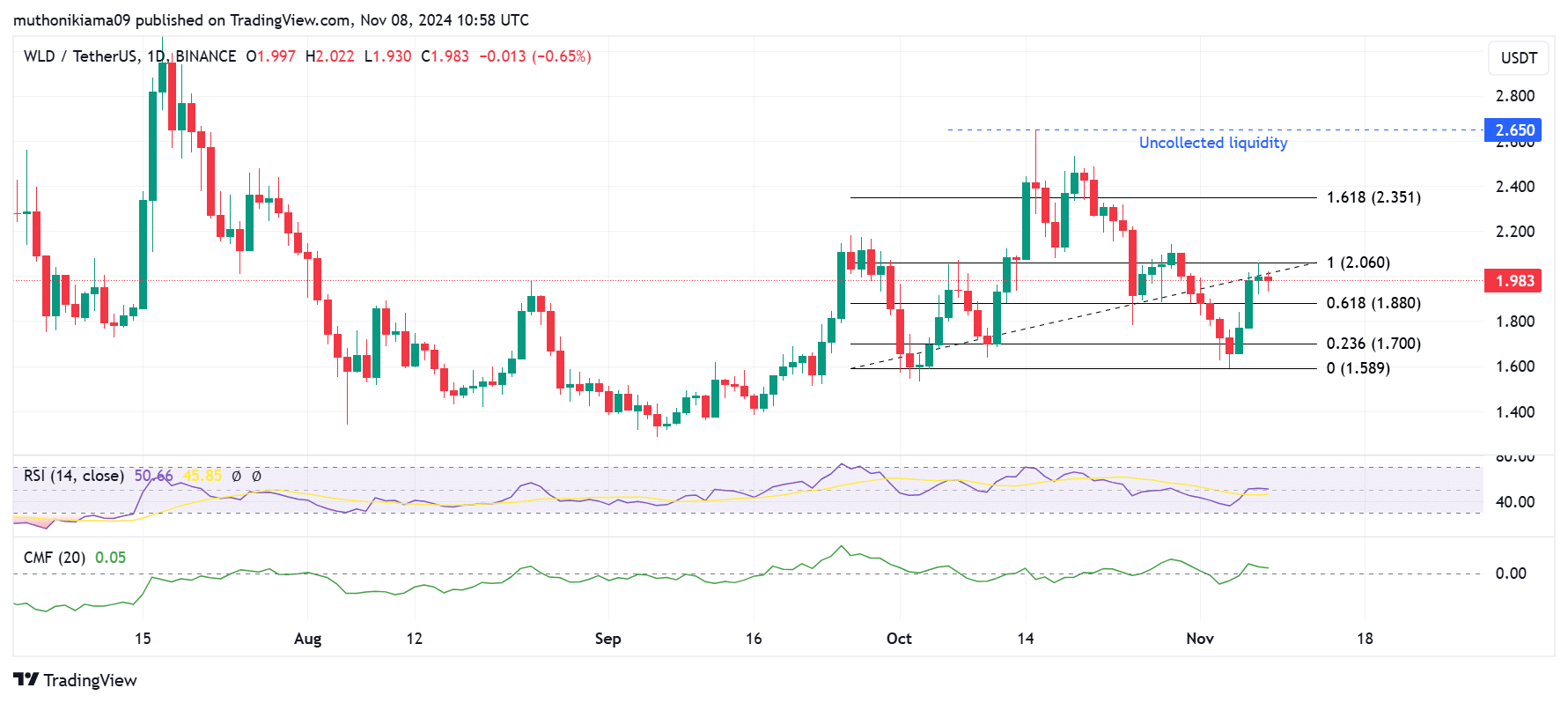

Earlier in the week, Worldcoin (WLD) experienced modest growth alongside Bitcoin (BTC) and the overall cryptocurrency market’s surge. Nevertheless, as we speak, WLD has seen a minor dip of 0.35%, causing it to trade at $1.98.

Regardless of the volatile price fluctuations, an examination of blockchain data hints that Worldline (WLD) might be on the brink of a significant shift in its market trend.

Whale volumes spike

The number of substantial whale transactions involving Worldcoin’s WLD tokens has seen a dramatic rise. In a single day, the volume for transactions exceeding $100,000 skyrocketed from 9.98 million to an impressive 77.78 million.

The behavior of large investors, or “whales,” might contribute to Worldcoin emerging from its bearish trends. This is due to the fact that these whales own 84% of the total Worldcoin supply.

In order for the WLD token to surge due to whale involvement, it’s essential that this particular group is actually purchasing the token. The Relative Strength Index (RSI) on the daily graph currently indicates a balanced situation at around 50, suggesting that both sellers and buyers hold an equal amount of control.

However, the RSI line was above the signal line, indicating that bullish momentum was surging.

Simultaneously, the Chaikin Money Flow (CMF) shows a value of 0.05, suggesting increased buying activity. Yet, for the uptrend to become more robust, further buying momentum seems necessary.

As a crypto investor, if the upward trend persists, I see $2.35 as the next significant resistance level ahead. It’s crucial to keep an eye on potential market congestion around $2.65. The accumulated liquidity at this price point might function as a magnetic force, potentially driving prices higher due to its unrealized potential.

If the upward momentum (bullish trend) weakens because there isn’t enough demand (buying pressure), it is possible that the price of WLD may fall towards the $1.58 support point.

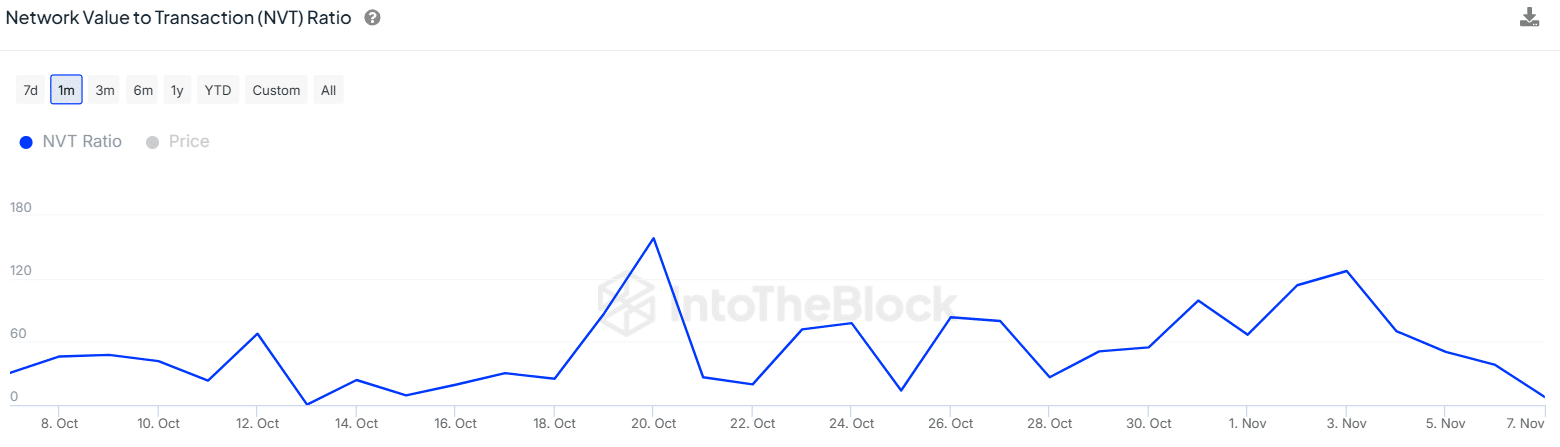

Analyzing Worldcoin’s NVT ratio

Based on the Network Value to Transaction (NVT) ratio analysis, it appears that Worldcoin might be underpriced. This indicator has decreased significantly, as at the current moment, it’s reached a three-week low.

An increasing NVT (Network Value to Transactions) ratio suggests heightened on-chain engagement surrounding Worldcoin, indicating a positive outlook for WLD, as this increased activity could potentially drive up its value.

If the expansion of the network isn’t mirrored by an increase in its price, this might suggest that Worldline (WLD) is underpriced. This situation could open a path towards positive growth prospects.

Realistic or not, here’s WLD market cap in BTC’s terms

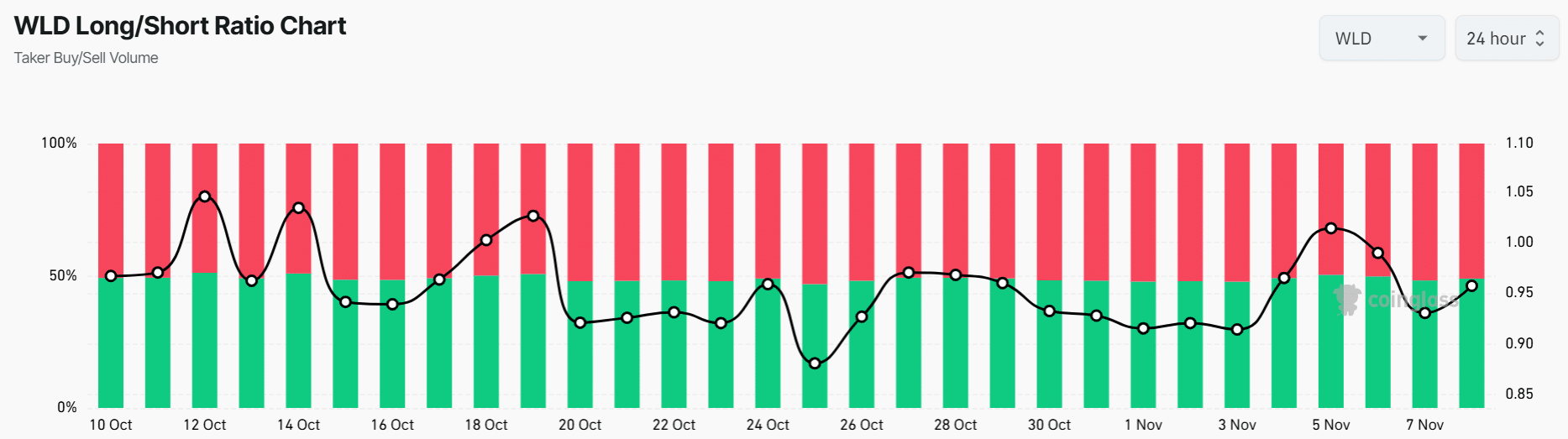

Nevertheless, although WLD appears to be undervalued, traders focusing on derivatives persistently wager against this particular altcoin.

Over the past three days, the number of shares being sold short (short positions) has exceeded the number of shares being bought (long positions), as indicated by a ratio of less than 1. This trend suggests a pessimistic outlook on the market, often referred to as a bearish sentiment.

Read More

2024-11-09 04:07