- After breaking out of a bullish pattern, Destra crypto now faces a significant resistance level.

- There was an influx of liquidity into DSYNC, influencing the overall positive sentiment.

As a seasoned crypto investor with a knack for spotting trends and interpreting market signals, I’ve learned to read between the lines when it comes to assets like Destra (DSYNC). After a challenging month where DSYNC dipped by 9.32%, it’s encouraging to see this asset bounce back with a 18.27% gain in just one week and accelerating further over the past 24 hours, surging by 27.23%.

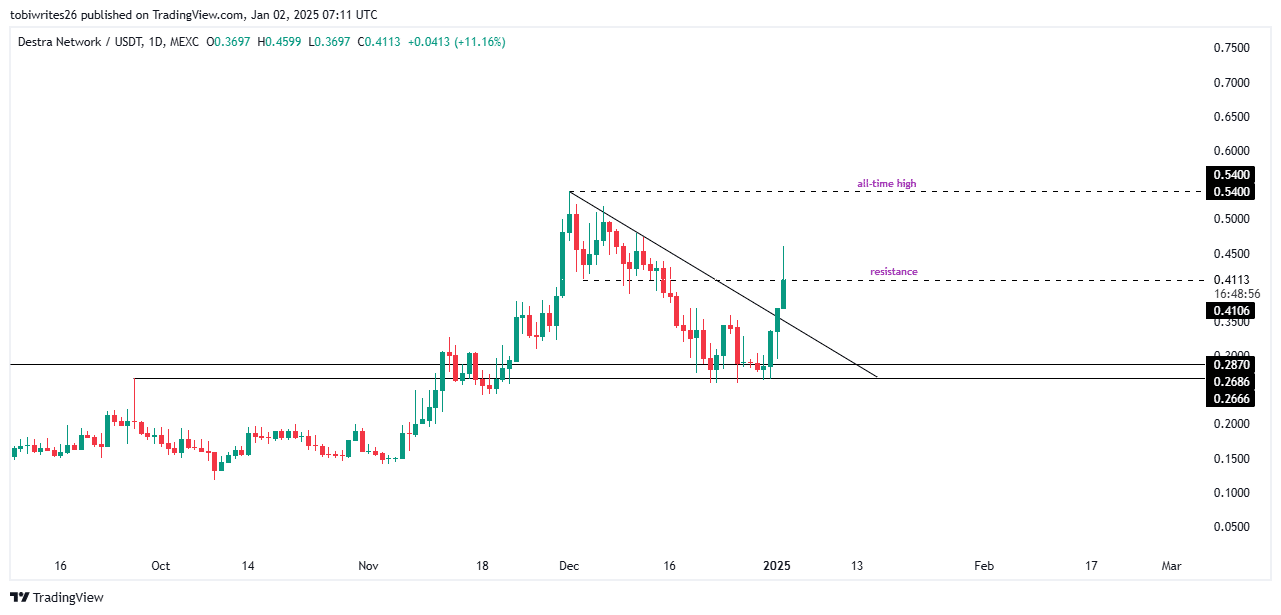

The technical analysis I’ve conducted suggests that DSYNC has broken out of a bullish triangle pattern, which often signals an early rally. However, to maintain this upward trajectory, it needs to breach the critical resistance level at $0.41026. If successful, the asset could potentially reach its peak at $0.540 and extend its rally towards the $0.60 to $0.70 range – a clear sign of a bullish continuation.

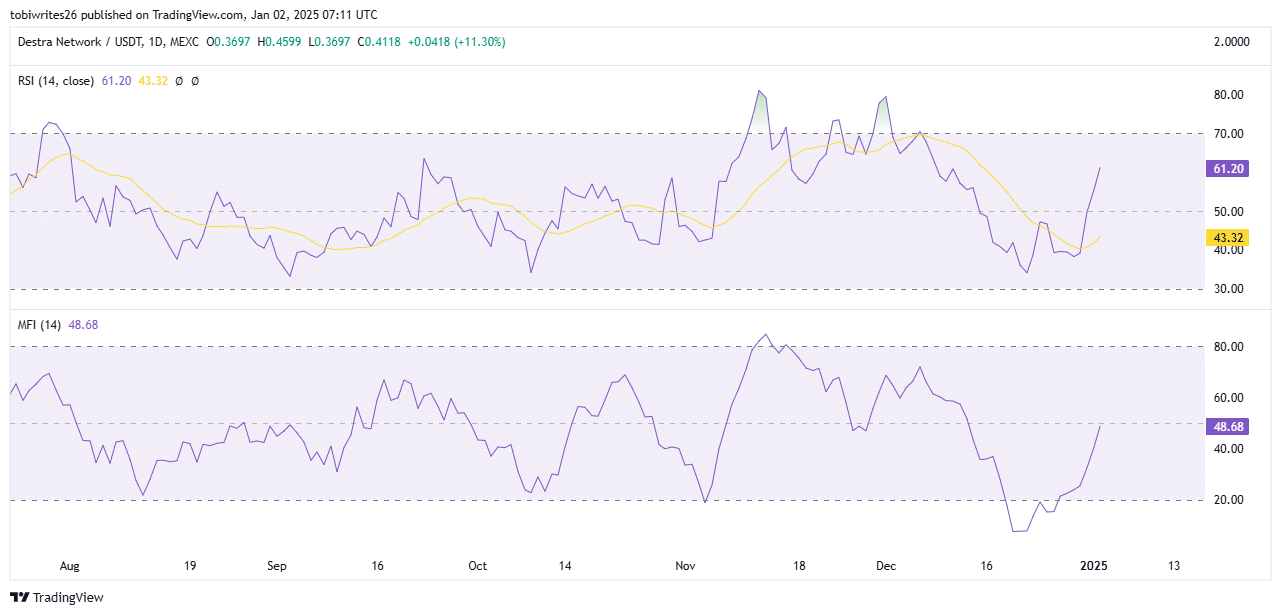

The recent influx of liquidity into DSYNC, as evidenced by the rising Money Flow Index (MFI) and Relative Strength Index (RSI), further supports its upward momentum. These indicators suggest that both the market sentiment and price momentum are strongly in favor of DSYNC’s continued rise.

With a background in finance and a keen eye for market trends, I always take these technical signals with a grain of salt. But when it comes to DSYNC, I find myself feeling optimistic about its potential to reach new heights. It’s like watching a phoenix rising from the ashes – if you can catch it at the right moment, you might just ride the wave all the way up.

Of course, as they say in crypto, “never invest more than you can afford to lose,” but I must admit, this one has me intrigued and excited for what’s to come. And who knows, maybe if DSYNC reaches its peak, it will help fund my next vacation to the moon! 🚀🚀🚀

After dropping by 9.32% during the previous month, Destra [DSYNC] has started to bounce back, experiencing a 18.27% increase over the last week. This upward trend has picked up speed within the past day, with the asset spiking by 27.23%.

Market signals indicate that DSYNC still has room for additional upside.

Based on findings from AMBCrypto’s analysis, it appears that the asset’s recent growth can primarily be attributed to investors adding liquidity even during periods when growth was initially sluggish.

Halfway to a new all-time high

DSYNC has just burst through a bullish triangle formation, which was created by a flat base at $0.2870 (acting as support) and a downward-sloping resistance line. This breakout frequently indicates a possible upcoming surge.

To maintain its upward trend, DSYNC needs to surpass a crucial horizontal resistance point around $0.41026. If it manages to overcome this hurdle, it will be poised to hit the projection’s top at approximately $0.540.

The intensity of the breakout hinges on if the candlestick conclusively finishes above the resistance level.

If the current trend continues, it’s likely that DSYNC will exceed its past highs and potentially push even further upwards, reaching between $0.60 and $0.70, which would indicate a continued bullish momentum.

Liquidity flow supports Destra crypto

DSYNC has seen a notable influx of liquidity, further supporting its upward momentum.

During the assessment, it was observed that the Money Flow Index (MFI), a crucial marker used to gauge market sentiments based on the movement of liquidity via price and volume, has shown a consistent upward trend.

At the time of publishing, the Money Flow Index (MFI) stood at 48.68, gradually inching towards an uptrend and approaching the optimistic mark above 50. Breaching this threshold would signify a robustly bullish outlook for DSYNC, reflecting a significant positive sentiment.

Much like the Relative Strength Index (RSI), a tool that gauges price movement and trend, suggested a positive outlook. Specifically, the RSI was holding steady within the bullish territory, showing a value of 61.20.

Given that both the Moving Average Financial Indicator (MFI) and Relative Strength Index (RSI) are indicating a bullish direction, it seems probable that DSYNC’s price will persist in its ascending trend, potentially allowing for additional increases.

DSYNC rally gains strong momentum

The sharp increase in the price of DSYNC can be attributed to a significant rise in its trading volume, which climbed up by approximately 90.64%, reaching a staggering $12.54 million.

Realistic or not, here’s DSYNC’s market cap in BTC’s terms

An increase in both cost and activity at the same time typically indicates a powerful surge in buying interest, a distinct signal suggesting that the asset might continue its rising trajectory.

Based on my years of experience and extensive research in the financial markets, I strongly believe that if this surge in volume maintains its correlation with the price increase, DSYNC has a high likelihood of further advancement. This could potentially take it to the critical levels suggested by my chart analysis, which have consistently proven accurate in the past.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Gold Rate Forecast

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Solo Leveling Arise Tawata Kanae Guide

2025-01-03 00:08