-

DIA has a strongly bullish structure and high buying pressure.

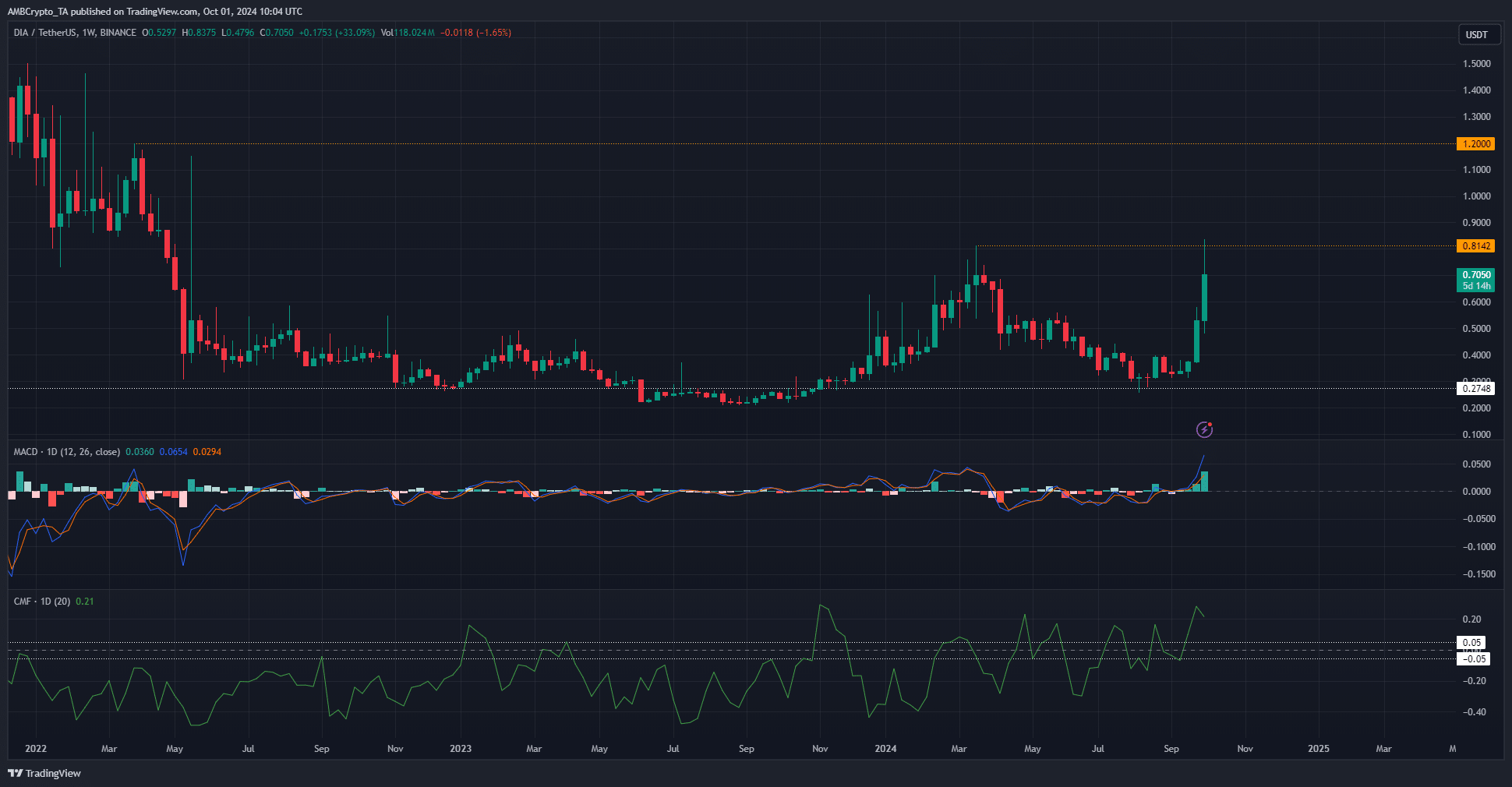

The rejection from the weekly resistance and the 16% drop meant the market could be overextended.

As a seasoned researcher with years of experience in the cryptocurrency market, I have seen my fair share of bull runs and market corrections. The recent surge in Decentralized Information Asset (DIA) has caught my attention, especially considering its 68% gain since September 29th. However, as a cautious investor, I find myself torn between the strong bullish structure and high buying pressure, and the potential for overextension after such a swift and significant rise.

As a researcher delving into the realm of Decentralized Information Assets (DIA), I’ve noticed an impressive surge in its price trajectory. Since the 29th of September, this token has skyrocketed by a substantial 68%. To put it into perspective, the trading volume on Monday was a staggering sixteen times greater than what we saw on the 28th of September.

After such significant increases, the token encountered a zone of opposition on its weekly graph. The rise in Bitcoin [BTC] has influenced the optimism surrounding DIA. Is it wise for long-term investors to sell now for profits, or should they hold on for even larger returns later?

The case for a sustained move

Many traders found themselves on the sidelines or hurriedly trying to join the ongoing rally with DIA, as its sudden powerful and swift upward climb left them behind.

A significant increase in attention towards DIA might potentially drive its price up, yet it may also cause fluctuations as a result of intense trading in the futures market by enthusiastic latecomers who are joining the bullish trend.

As a researcher, I observed that the shift to $0.81 was met with a reversal, resulting in a 16% decline from the recent peak of $0.837 it had reached. Despite the bullish indicators on the daily timeframe, the overall trend appears to be bearish at this moment.

In simpler terms, the Capital Management Fund hit its peak since November 2023, while the Moving Average Convergence Divergence (MACD) climbed above levels not seen since September 2021.

But they are lagging indicators, and hence will follow the price and do not predict the next move.

Arguments for the recent surge marking a local top

According to the price chart for this week, there’s a chance we might see a dip in price between approximately $0.54 and $0.38. These levels correspond to the 50% and 78.6% Fibonacci retracement ratios.

Given that many traders were caught off-guard by the swiftness of the market movement, a pullback and stabilization period might offer an opportunity for these traders to regroup and prepare for the potential upswing in the following months.

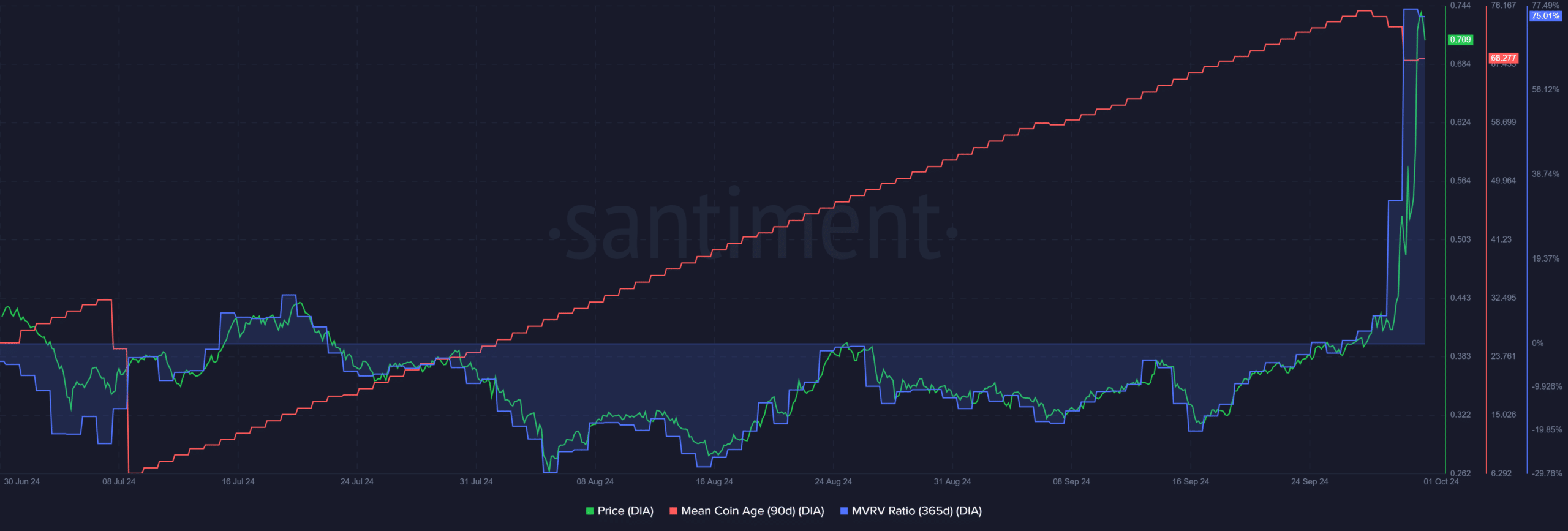

The mean coin age has trended higher since July, showing accumulation. The 365-day MVRV ratio showed that 75% of the holders during this period were in profit.

Realistic or not, here’s DIA’s market cap in BTC’s terms

This could lead to intense profit-taking activity and a price slump.

It’s thought by AMBCrypto that the bulls may struggle to push prices above the $0.81 area due to the market appearing extended. A pullback towards significant Fibonacci levels might trigger the next upward trend.

Read More

2024-10-02 00:07