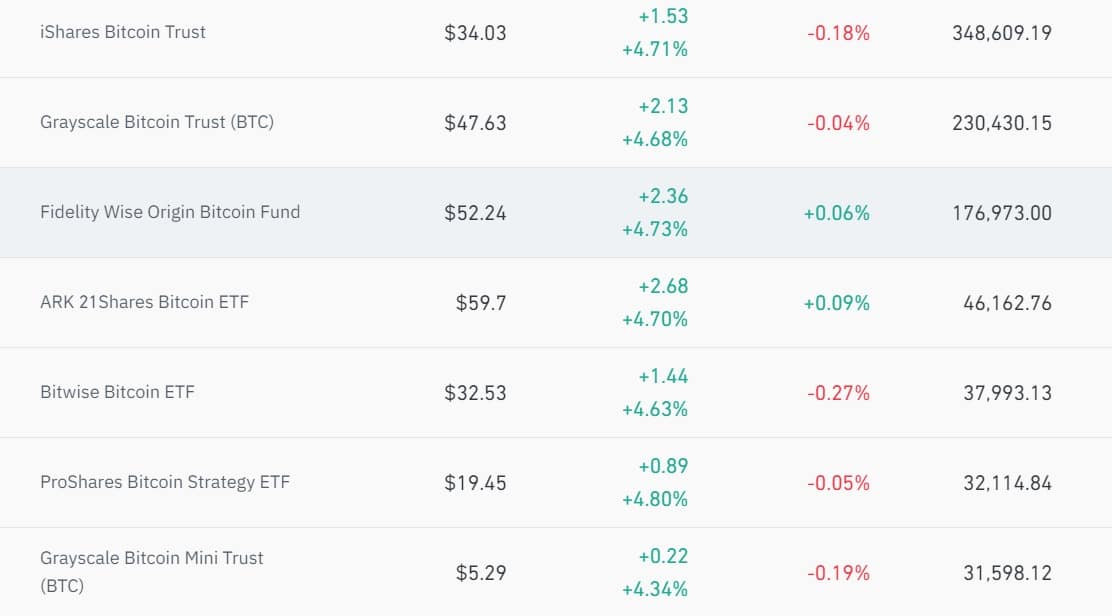

- BlackRock surpassed Grayscale in ETFs holdings for the first time.

- BlackRock ETFs hit $21,217,107,987, while Grayscale ETFs stood at $21,202,480,698 at press time.

As a seasoned crypto investor with a decade of experience under my belt, witnessing BlackRock surpass Grayscale in ETF holdings is nothing short of momentous. I remember when Grayscale was the undisputed king of the ETF market, and now, BlackRock has taken the throne. It’s a stark reminder that the crypto landscape is dynamic and always evolving.

As a researcher, I’m excited to share that I’ve observed a significant milestone in the world of Exchange-Traded Funds (ETFs). For the first time, BlackRock ETFs have surpassed Grayscale ETFs. This fascinating shift was recently highlighted in a post by Arkham Intelligence, previously known as Twitter.

” Rocket ETF holdings overtake Grayscale for the first time. BlackRock’s ETFs IBIT and ETHA have just overtaken Grayscale’s ETFs GBTC, BTC Mini, ETHE and ETH Mini in on-chain holdings. Blackrock ETFs now have the largest collective holdings of any provider.”

With this advancement, BlackRock now stands at the helm of the Exchange-Traded Fund (ETF) market, surpassing Grayscale, a position it held for quite some time as a leading force.

Currently, BlackRock’s overall assets under management stand at a staggering $21,217,107,987, with Grayscale ETF not far behind, managing a total of $21,202,480,698.

Implications for Ethereum, Bitcoin

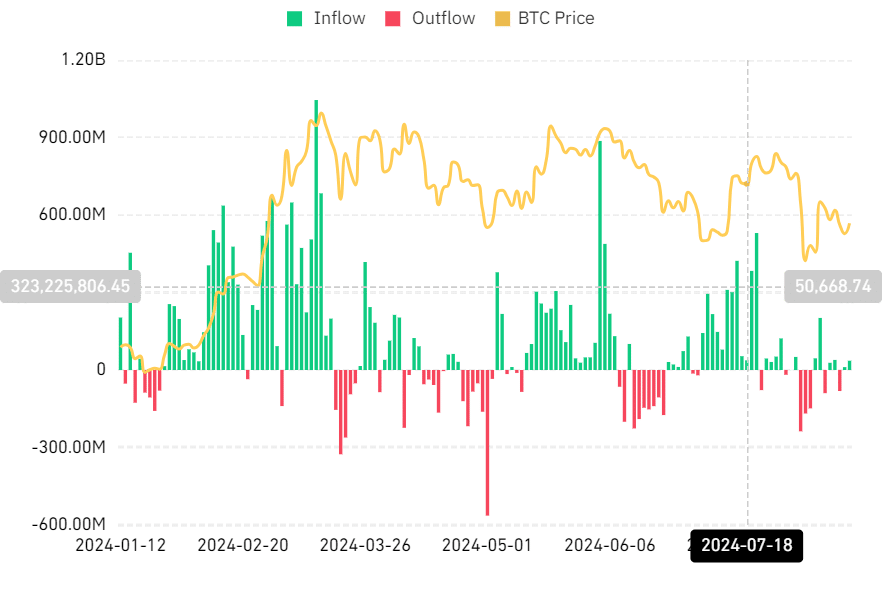

The cryptocurrency market experienced significant movements in ETF flows since this news broke.

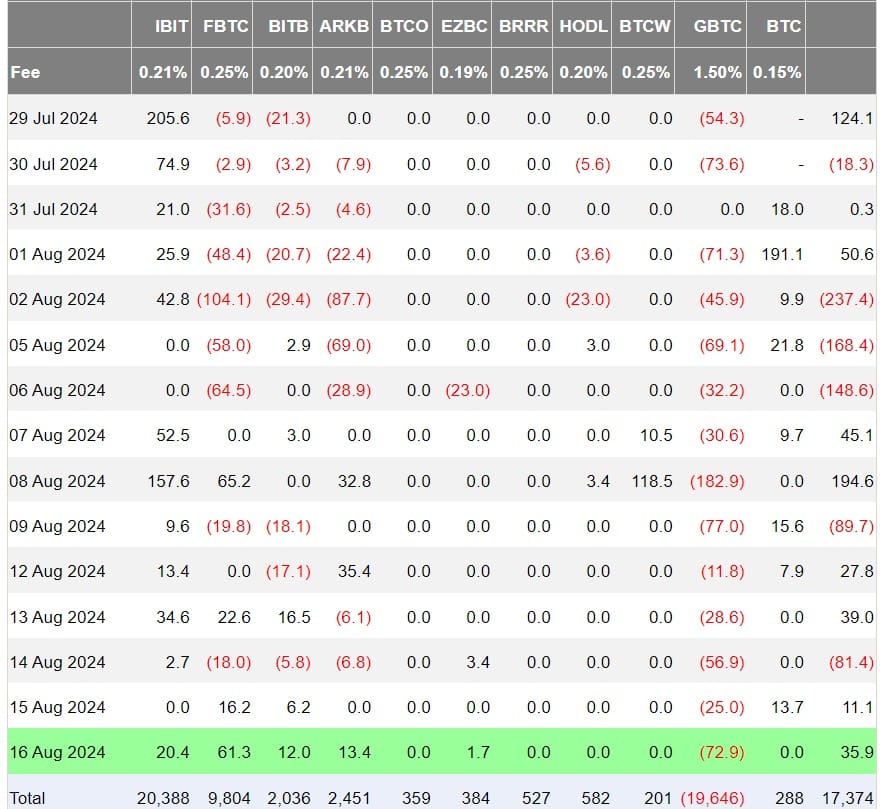

Significantly, there was an overall investment of around $35.9 million in Bitcoin [BTC] ETFs, primarily driven by Fidelity’s investment of $61.3 million and BlackRock’s investment of $20.4 million.

Meanwhile, Grayscale’s Bitcoin Trust (GBTC) saw an outflow of $72.9 million.

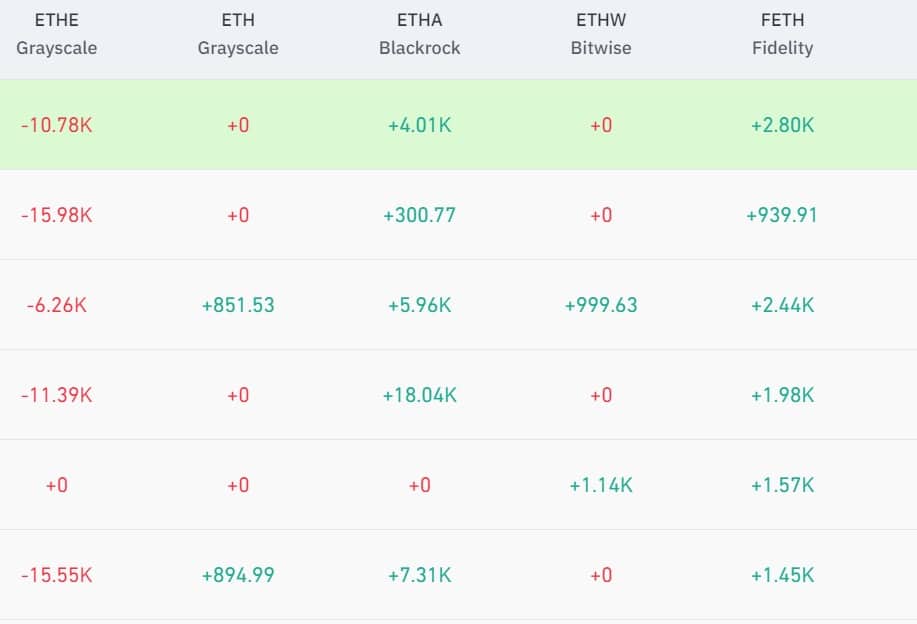

There was significant activity with Ethereum [ETH] Exchange-Traded Funds (ETFs) too. Specifically, these funds that directly track the price of Ethereum experienced a withdrawal of approximately $15 million.

In the Ethereum-based Exchange Traded Funds (ETFs), Grayscale’s ETHE experienced a withdrawal of approximately $27.743 million, while both BlackRock’s ETHA and Fidelity’s FETH saw deposits of around $10.33 million and $7.21 million respectively.

Therefore, the total net flow for ETH spot ETFs was $7.352 billion at press time.

A change in investment choices between BlackRock and Grayscale could potentially have a substantial effect on the cryptocurrency market, particularly when it comes to maintaining investor trust.

Increased demand for ETFs

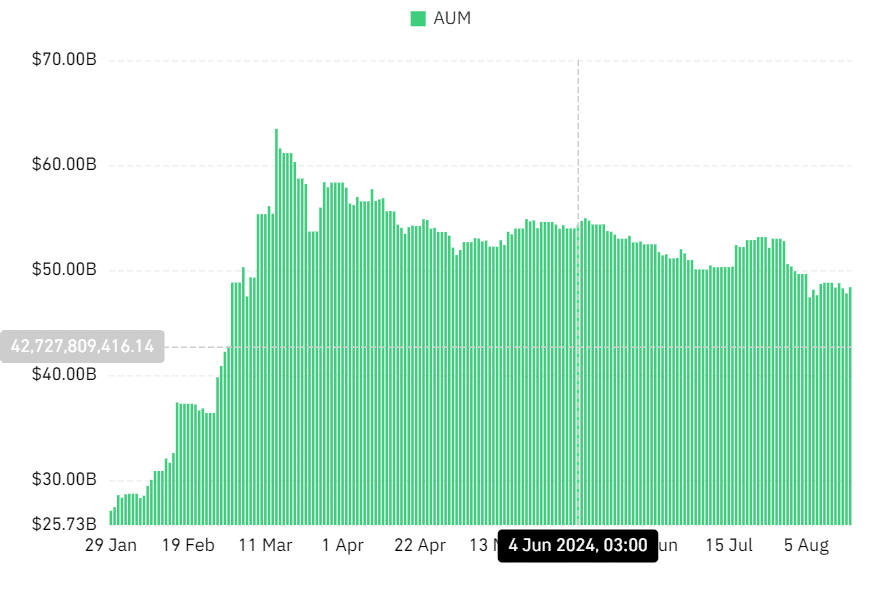

The demand for ETFs has experienced exponential growth YoY. For instance, in 2022, the net share issuance of ETFs was $609 billion. In 2023, it was $597 billion.

In 2024, there was a significant increase in demand following the approval of Bitcoin spot ETFs in January and Ethereum spot ETFs in July.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Quick Guide: Finding Garlic in Oblivion Remastered

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- BLUR PREDICTION. BLUR cryptocurrency

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

- Disney Quietly Removes Major DEI Initiatives from SEC Filing

- How to Get to Frostcrag Spire in Oblivion Remastered

2024-08-18 12:07