So, digital asset trading is all the rage now, huh? Everyone’s jumping on the crypto bandwagon in 2024 and 2025, but guess what? With great power comes great responsibility—like taxes. Who knew? If you’re one of those poor souls staring at a spreadsheet, trying to figure out your tax liabilities while your brain slowly melts, fear not! Crypto tax calculators are here to save the day. They’ll take your chaos and turn it into something resembling order. It’s like magic, but with numbers. 🎩✨

In this guide, we’re going to dive into how these calculators work, why you need one, and the seven best tools out there. Spoiler alert: they’re not all created equal. Some are like a warm hug, and others are like a cold slap in the face. But hey, at least they’re doing the heavy lifting for you, right?

Key Takeaways

- Many crypto investors are using tax software to automate the process and avoid penalties. Because who wants to deal with the IRS? Not me!

- Different countries have different crypto tax rates. It’s like a game of Monopoly, but with real money and real consequences.

- Some tax-friendly regions offer tax-free crypto benefits. But remember, compliance is still necessary when cashing out profits. Don’t get too excited! 😅

What is a Crypto Tax Calculator?

Picture this: a user-friendly software that helps you figure out how much you owe Uncle Sam for your crypto escapades. It connects to your exchanges and wallets, tracks your transactions, calculates gains or losses, and generates reports that won’t make your accountant cry. It’s like having a personal assistant, but without the awkward small talk.

How Does a Crypto Tax Calculator Work?

Unlike the stock market, which has normal hours, crypto is like that friend who never sleeps. It’s 24/7, and it’s a mess. You’ve got trading, staking, mining, airdrops, and who knows what else. Tax authorities are like, “Good luck figuring that out!” But that’s where crypto tax software comes in:

1. Importing Transactions

These calculators sync with your exchanges and wallets to fetch your entire transaction history. No more endless copy-pasting from CSV files. It’s like a miracle! 🙌

2. Categorizing Transactions

Not all crypto activity is taxed the same way. The software automatically identifies taxable and non-taxable transactions. It’s like sorting laundry, but way more important:

- Capital gains (from selling, trading, or swapping assets)

- Income (staking, mining, airdrops, yield farming)

- Gifts and donations (which may have different tax implications)

3. Applying Tax Rules

Crypto tax laws are like a game of Twister—confusing and painful. In the U.S., the IRS treats crypto as property. In Germany, hold Bitcoin for over a year, and it’s tax-free. It’s like a choose-your-own-adventure book, but with your money!

Generating Tax Reports

Once everything is categorized, the software generates detailed tax reports. It’s like getting a report card, but instead of grades, you get a number that could ruin your day.

Filing Taxes

Now you can either file taxes yourself or hand it over to a professional. It’s like choosing between doing your own hair or going to a salon. One’s a gamble, and the other is just safer.

7 Best Crypto Tax Calculators in 2025

So, which crypto tax software is worth your time? Here’s a rundown of the seven best calculators this year:

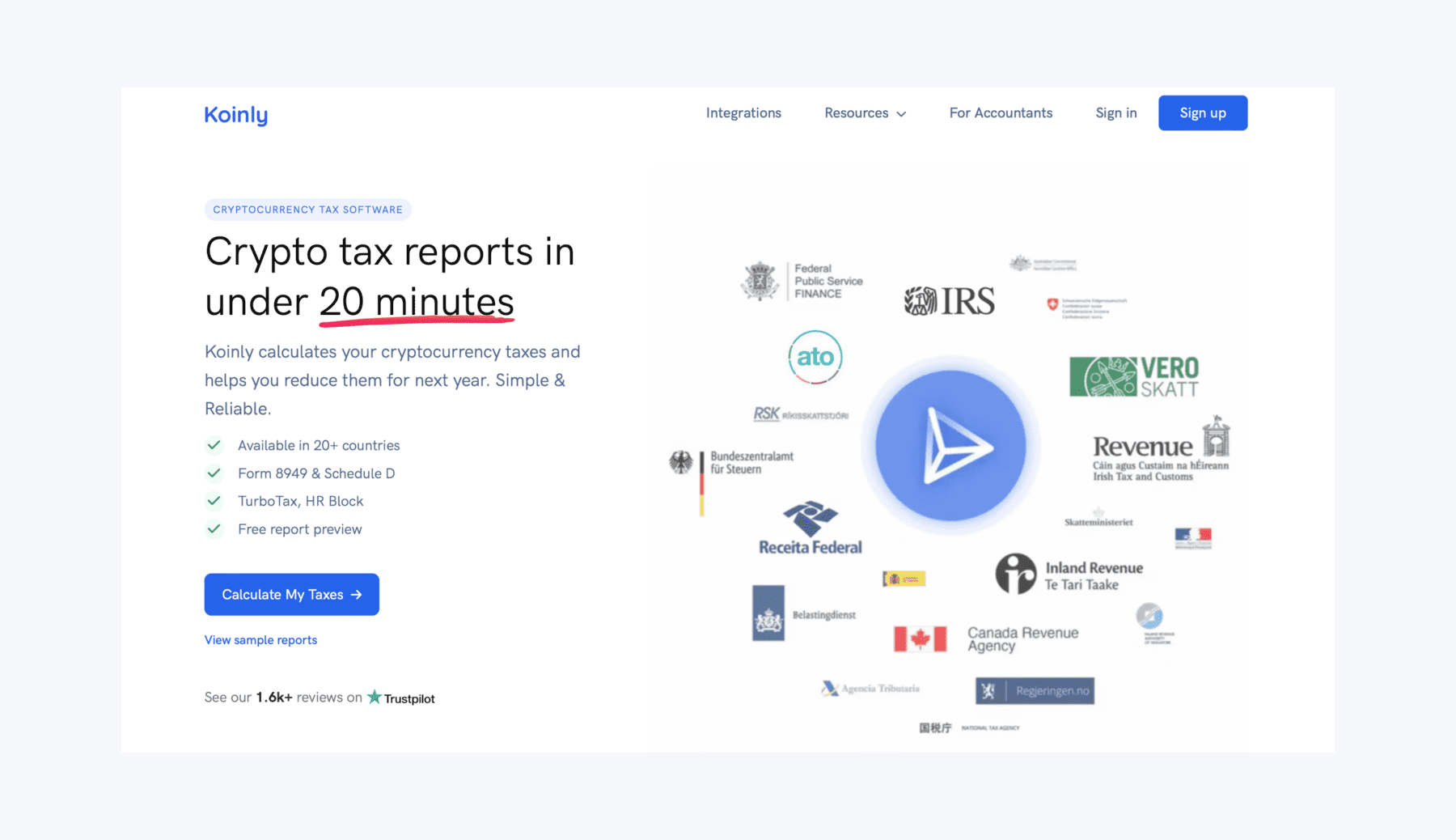

1. Koinly

Koinly is like the golden retriever of crypto tax solutions—friendly and easy to use. It supports over 400 exchanges and 170+ blockchains. It’s like the Swiss Army knife of tax calculators. 🐶

2. CoinTracker

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

- Quick Guide: Finding Garlic in Oblivion Remastered

- How to Get to Frostcrag Spire in Oblivion Remastered

- Disney Quietly Removes Major DEI Initiatives from SEC Filing

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

- BLUR PREDICTION. BLUR cryptocurrency

2025-03-03 19:57