- A cohort of BTC whales have continued to fill their bags.

This has happened despite the coin’s recent price action.

As a researcher with a background in cryptocurrency and blockchain technology, I’ve closely monitored the Bitcoin market over the past few weeks. The recent trend of large-scale BTC whales accumulating coins despite the asset’s price volatility has piqued my interest.

As a researcher studying the Bitcoin market, I’ve observed an uptick in significant investors, referred to as “whales,” actively purchasing more Bitcoins (BTC) even though the coin’s price has dipped below the $62,000 mark recently.

Based on information from data provider Santiment, there was an influx of approximately 15,121 Bitcoins, worth around $930 million, into the wallets of BTC holders possessing between 1000 and 10,000 coins during the time frame from the 7th to the 8th of May.

This pushed the cohort’s total BTC holding to its highest level in 14 days.

With Bitcoin hovering around the $61,000 to $64,000 mark over the last day, substantial whales have taken advantage of this narrow price range and increased their holdings. Wallets containing between 1,000 and 10,000 Bitcoins have amassed approximately $941 million in coins, returning to their peak holding amount within the past two weeks.

— Santiment (@santimentfeed) May 8, 2024

Currently, this particular band of Bitcoin investors possessed approximately 7.68 billion Bitcoin coins out of a total of 20 million in circulation, representing a 38% ownership stake.

BTC has the bears to contend with

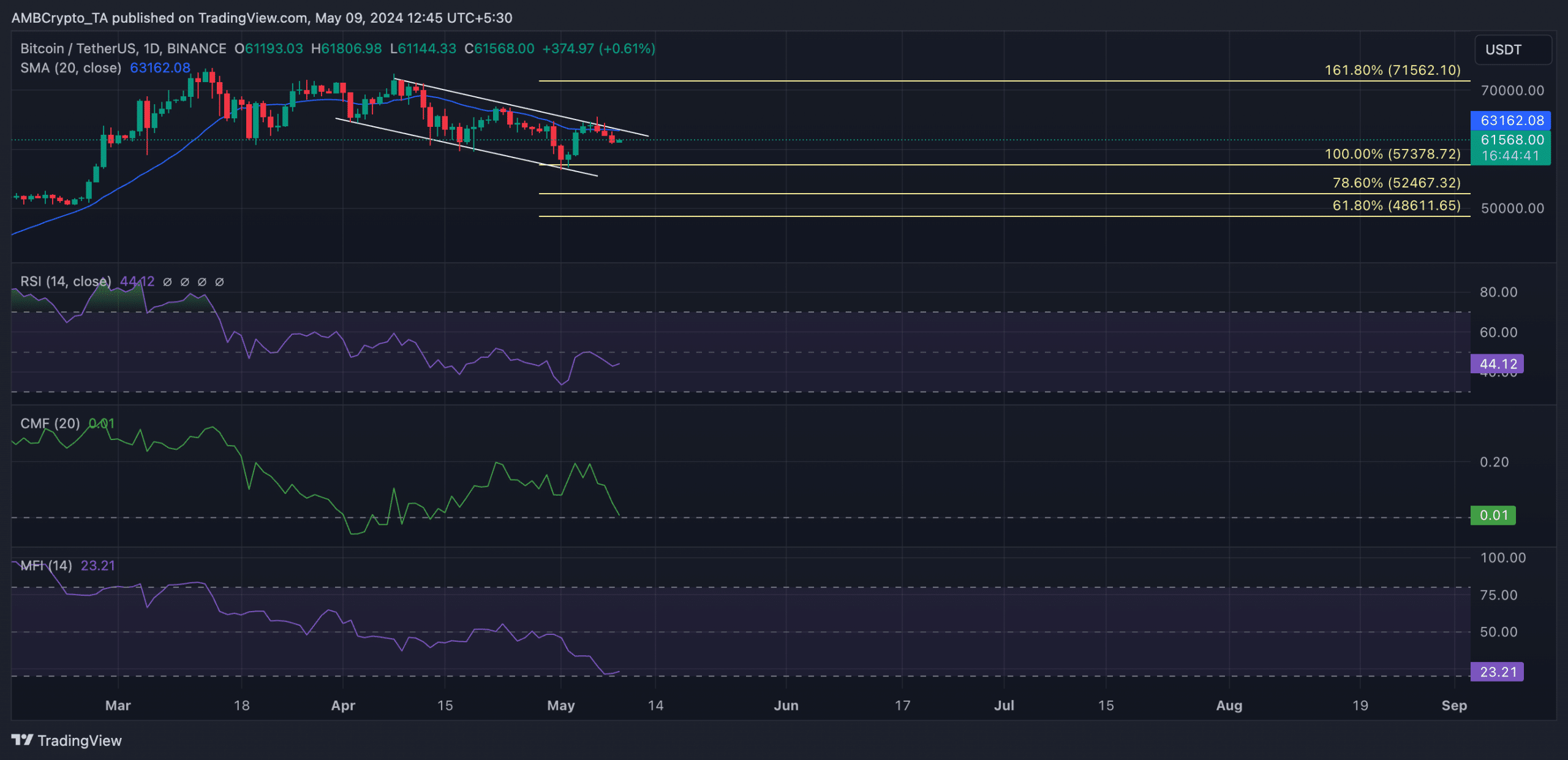

Currently, Bitcoin is being traded at the price of $61,621 per coin. Not too long ago, it dropped beneath its 20-day moving average (SMA). This means that there’s a possibility for Bitcoin to experience a more significant decrease in value in the near future.

If an asset’s price dips beneath its 20-day Simple Moving Average (SMA), this often implies a short-term descending trend for the asset.

In simple terms, when market players observe such a trend, they usually interpret it as a signal that sellers hold the upper hand and that the value of the asset may further decrease.

The 1-day chart for Bitcoin’s pricing indicated a drop below its 20-day moving average on May 7, leading to a subsequent decrease of approximately 3% in its worth.

As an analyst, I’ve observed a decrease in interest for the coin from the broader market. Upon examining its crucial momentum indicators, I found that they were all resting below their averages at the current moment.

As an analyst, I would interpret the coin’s Relative Strength Index (RSI) being at 44.12 and its Money Flow Index (MFI) at 23.21 as clear signs of strong downward momentum in the market from my perspective.

From my perspective as a researcher, the Chaikin Money Flow (CMF) for the coin I’m studying is currently on the brink of dropping beneath the zero mark at the moment I’m writing this. This indicator calculates the inflow and outflow of money in the coin’s market.

A CMF value below zero indicates market weakness, suggesting increased liquidity exit.

As a crypto investor, if the bearish sentiment grows stronger, I may observe the price of my coin being dragged down towards the underlying support level in Bitcoin’s descending channel pattern.

Read Bitcoin’s [BTC] Price Prediction 2024-25

As a cryptocurrency market analyst, I would interpret a potential occurrence as resulting in the major digital asset being bought or sold around the $57,000 mark.

As a crypto investor, if the bearish outlook proves to be incorrect and bullish trends pick up steam, Bitcoin’s price could surge towards the resistance level indicated by the pattern, aiming for a potential breakthrough.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- THETA PREDICTION. THETA cryptocurrency

- How Potential Biden Replacements Feel About Crypto Regulation

2024-05-10 02:16