-

DMM Bitcoin lost 4,502.9 BTC to hackers, planning a significant buyback to cover losses.

AMBCrypto analyzed the possible impact of this purchase on the Bitcoin market

As a seasoned crypto investor with several years of experience under my belt, I’ve witnessed my fair share of market ups and downs. The recent hack at DMM Bitcoin, resulting in the loss of 4,502.9 BTC, is concerning but not entirely unexpected in this volatile space.

On May 31st, there was a major security incident at DMM Bitcoin, a well-known Japanese cryptocurrency exchange, leading to the theft of roughly 48 billion yen (equivalent to $305 million) in Bitcoin [BTC].

Security analysts from Blocksec reported that a security breach resulted in the unauthorized removal of 4,502.9 Bitcoins from the exchange’s reserves. They added that the stolen bitcoins were subsequently divided into groups of 500 BTC and distributed among ten separate wallets.

DMM Bitcoin’s plan to undo a hacker’s payday

After taking a significant financial blow, DMM Bitcoin is implementing a thorough plan to make things right for their impacted clients without causing unnecessary turbulence in the larger Bitcoin market.

The company revealed intentions to obtain approximately 50 billion yen (equivalent to $321 million) in order to buy back the Bitcoin that was previously lost. This action is a component of a wider strategy aimed at strengthening the platform’s operations and rebuilding confidence among its users.

Significantly, this hack, identified as the seventh largest cryptocurrency heist by Chainalysis, led to swift regulatory response.

The Financial Services Agency of Japan has ordered DMM Bitcoin to conduct a comprehensive investigation into the cause of the security incident they experienced, as well as outline their plan for compensating affected customers.

Currently, Finance Minister Shunichi Suzuki has pledged to strengthen defensive strategies for averting potential security threats in the digital currency marketplace.

To date, the corporation has obtained a loan totaling 5 billion yen. Meanwhile, it’s currently working on increasing its capital by approximately 48 billion yen.

Possible impact

It’s worth mentioning that DMM’s announcement of buying over $320 million in Bitcoin may appear noteworthy. However, in actuality, this substantial investment from the crypto exchange is unlikely to cause major market disruptions.

With this transaction, you’ll be using less than 0.023% of the total Bitcoin supply in circulation – around 4,500 coins – as indicated by data from Coingecko.

US spot Bitcoin ETFs are making substantial purchases, totaling over $500 million, which significantly impact Bitcoin’s price movements.

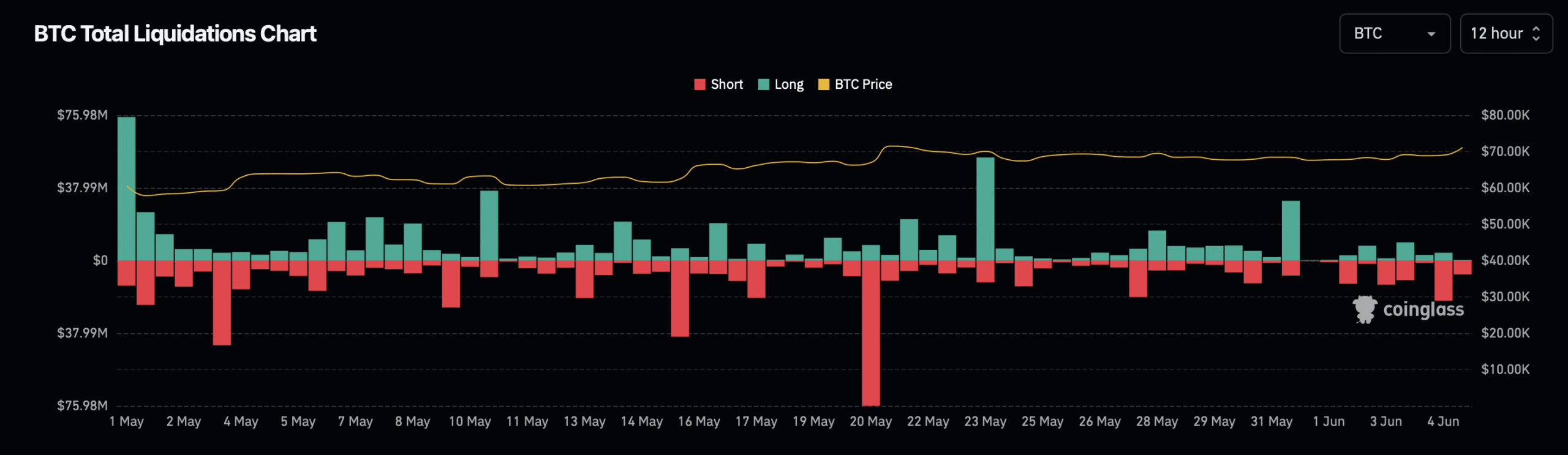

Currently, Bitcoin’s value hovers around $71,000. In the last 24 hours, BTC experienced a 2.9% growth, and over the past week, it surged by 4.6%. This upward trend, however, triggered approximately $30 million in market liquidations, according to Coinglass.

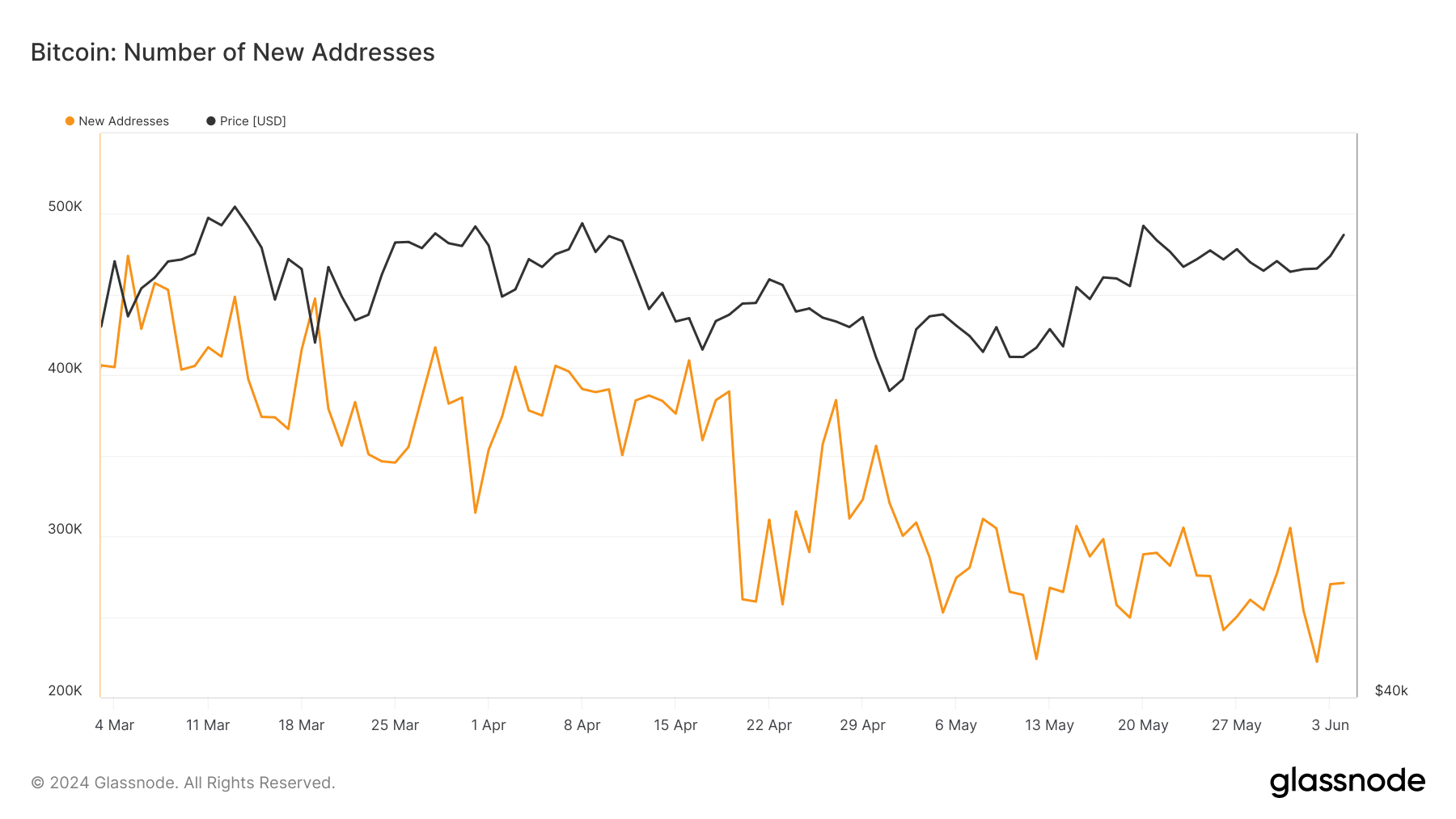

The increase in Bitcoin’s price is reflected in a significant surge in the number of new Bitcoin wallets identified by Glassnode’s data, implying revived enthusiasm and possibly higher worth in the future.

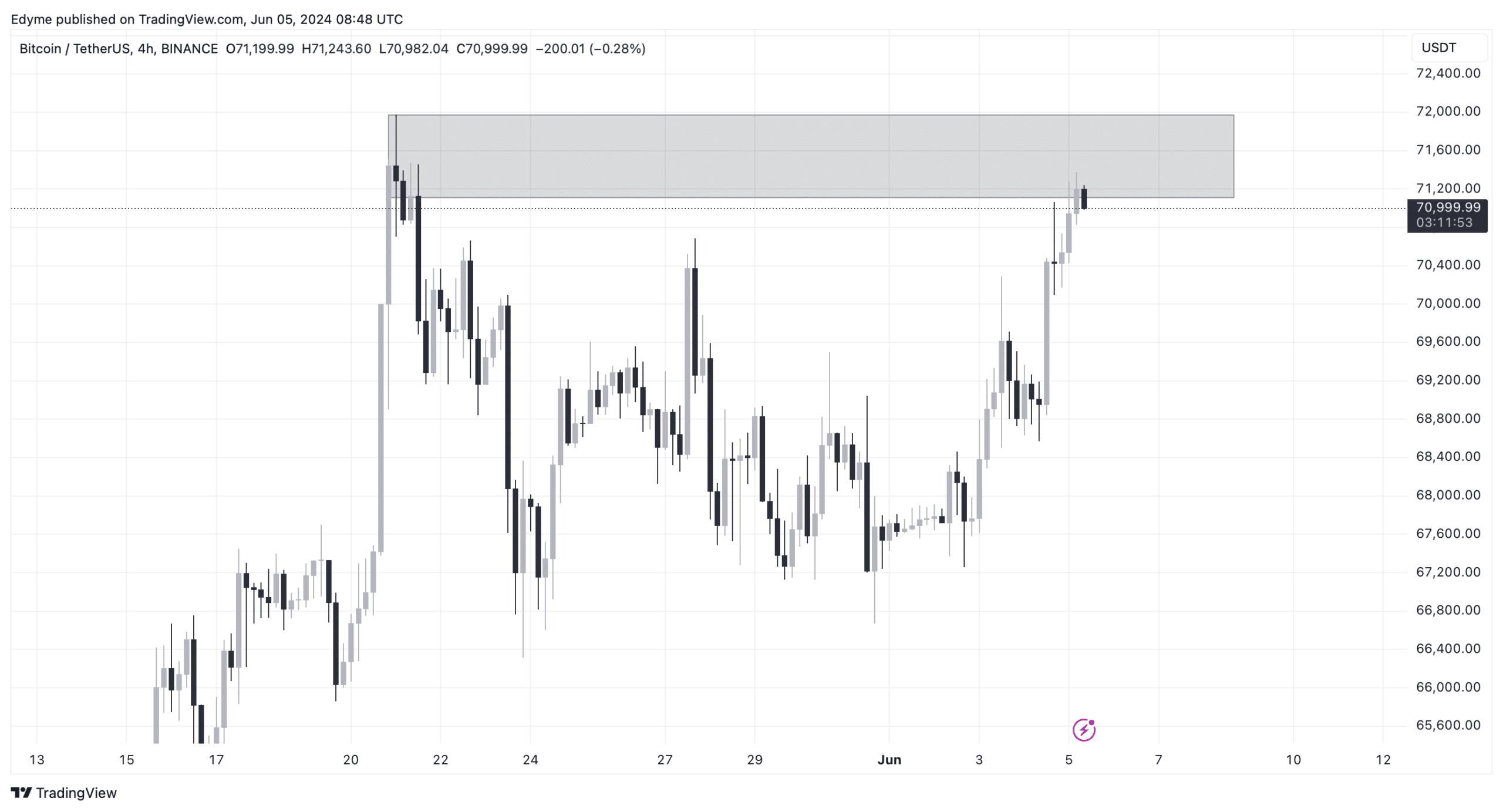

As a technical analyst, I’ve been closely monitoring Bitcoin’s price movements. Currently, the charts suggest that Bitcoin is making an effort to surmount a notable resistance level on the daily chart. If it manages to do so, this could trigger a significant price increase, propelling Bitcoin to previously unexplored price ranges.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

As a financial analyst, I’ve observed an intriguing trend in the crypto market based on the Network Value to Transactions (NVTS) ratio reported by AMBCrypto. This metric calculates the market capitalization of a cryptocurrency divided by its transacted volume. In simpler terms, it indicates how much value is being traded for every dollar of network value. Recently, I’ve noticed that this ratio has been on an upward trend.

This metric suggests that BTC might currently be overvalued based on its transaction capabilities.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Elden Ring Nightreign Recluse guide and abilities explained

2024-06-05 20:07