-

BNB closed above resistance on 3rd June.

This confirms a spike in buying pressure.

As an experienced market analyst, I believe that BNB‘s closing above the resistance level on 3rd June is a significant development in its price action. This breakout confirms a spike in buying pressure and suggests that the uptrend may continue.

As a crypto investor, I’ve noticed that Binance Coin [BNB] broke above the resistance level and the upper line of its horizontal channel on June 3rd. This bullish move suggests increased demand for BNB, potentially leading to further price increases.

As an analyst, I would describe an asset’s price action as following a sideways trend or moving horizontally within a defined range. This occurs when the buying and selling forces evenly counteract each other over an extended period.

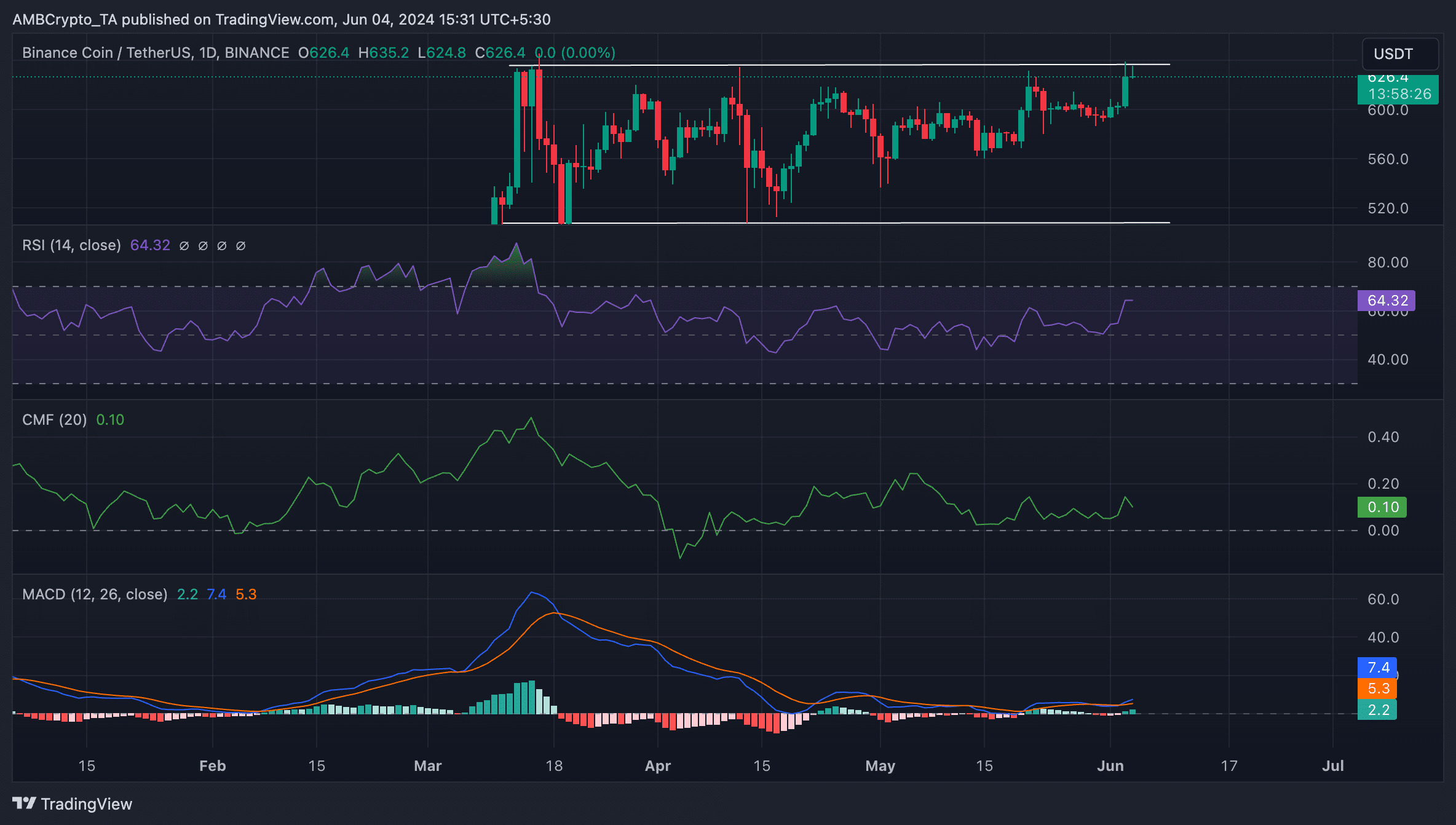

As an analyst, I’d interpret the chart data by stating that there are two significant lines on the channel for BNB. The upper line acts as a barrier to price increase, creating resistance, whereas the lower line functions as a floor, providing support. In our recent analysis, BNB encountered resistance at the level of $636.9, while it found solid support around $508.6.

The price has risen above the upper boundary of the horizontal trading range it has been stuck in since March 13th, signifying a breakthrough and move beyond the previous resistance level.

Will the uptrend continue?

An analysis by AMBCrypto of BNB‘s crucial technical signals on a daily timeframe revealed a renewed optimistic outlook for the altcoin.

At the current moment, the Relative Strength Index (RSI) for BNB has increased and was last recorded at 65.54. This rise indicates a surge in buying activity. It’s an indication that market participants were more inclined to buy BNB rather than sell their existing holdings.

Additionally, the Chaikin Money Flow (CMF) of BNB signaled a surge in demand for the altcoin, as this indicator measures the net flow of money moving in and out of the BNB market. A positive CMF value above zero implies a strong market with an influx of liquidity.

As of this writing, BNB’s CMF was 0.12.

Additionally, the MACD indicator of the coin displayed a bullish signal on June 3rd when its MACD line (represented in orange) crossed above its signaling line (also depicted in orange).

The point where BNB‘s short-term trend line intersects with its long-term trend line in an upward direction indicates that the former lies above the latter. This bullish indication encourages traders to buy and consider closing out their existing long positions.

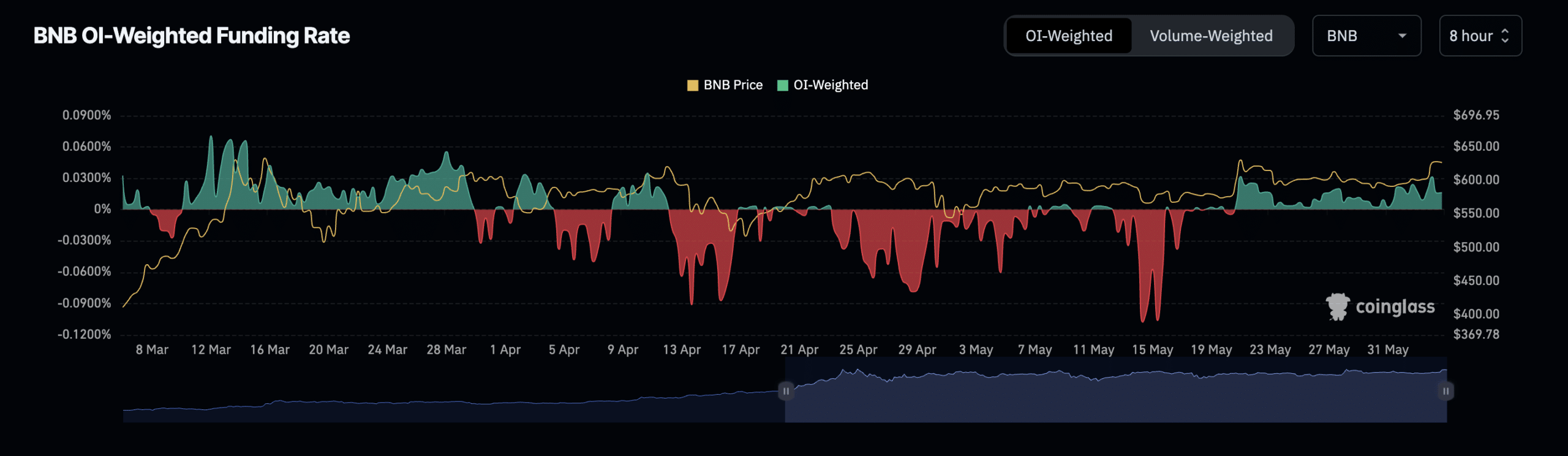

Affirming the ongoing bullish market condition, the funding rate for Binance Coin (BNB) on cryptocurrency exchanges is currently showing a positive figure as of now. To provide some background, this trend has persisted since May 21st.

Prior to that day, May had been predominantly marked by negative funding rates.

Realistic or not, here’s BNB’s market cap in BTC terms

In perpetual futures contracts, funding rates serve the purpose of adjusting the contract’s price to align with the current market price (the spot price).

When they rise, it suggests a strong demand for long positions. It is considered a bullish signal.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-06-05 07:03