- 73% of Dogecoin holders were in profit at press time.

- However, Dogecoin metrics gave mixed signals.

As an analyst with a background in market analysis and data interpretation, I find the current situation of Dogecoin intriguing. Based on the available data, 73% of Dogecoin holders are in profit at press time, which is a positive sign for the coin’s health. However, Dogecoin metrics give mixed signals.

I’ve observed today that Dogecoin was trading at a price of $0.1073, marking a 1.5% increase in value over the past 24 hours based on my current perspective. As for its market size, the data from CoinMarketCap indicated a market capitalization of approximately $15.2 billion for Dogecoin.

As an analyst, I’ve observed a significant surge in trading activity, with a 36.63% increase in volume that reached a remarkable $954.5 million. Such a substantial uptick may indicate heightened investor interest in the coin.

The value of Dogecoin has been experiencing some volatility recently. There was a 1.5% increase in its price over the past day, but it declined by a significant 12.15% within the last week. Despite these price swings, the majority of Dogecoin holders are still earning a profit.

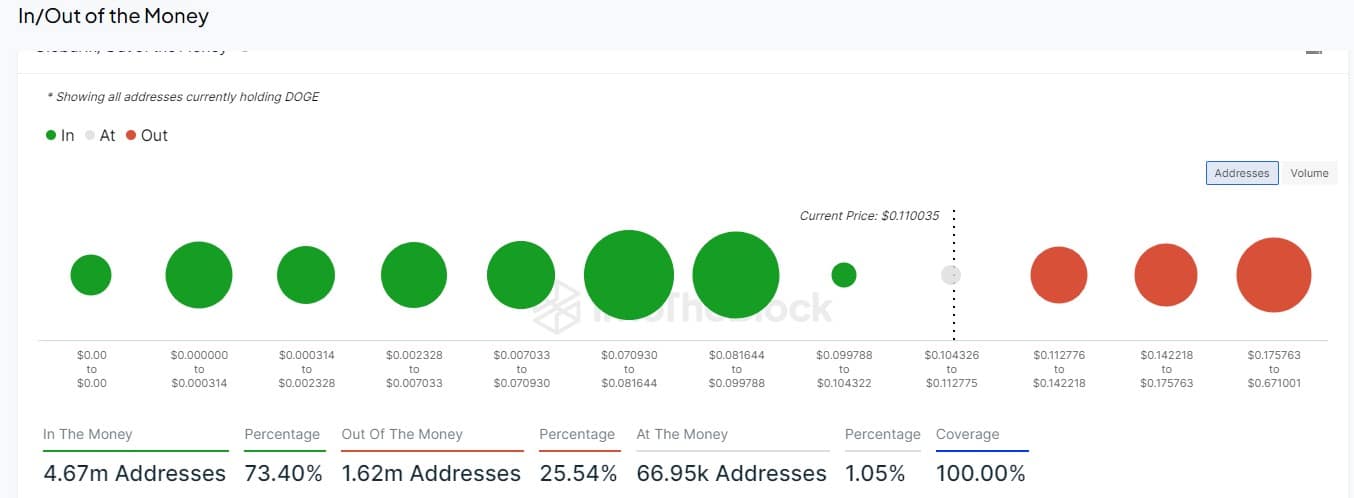

As a crypto investor, I find it intriguing that nearly three-quarters (73%) of Dogecoin (DOGE) holders are currently in profit. This means they purchased this digital asset at prices below its current value. According to data from IntoTheBlock, these investors have made a positive return on their investment.

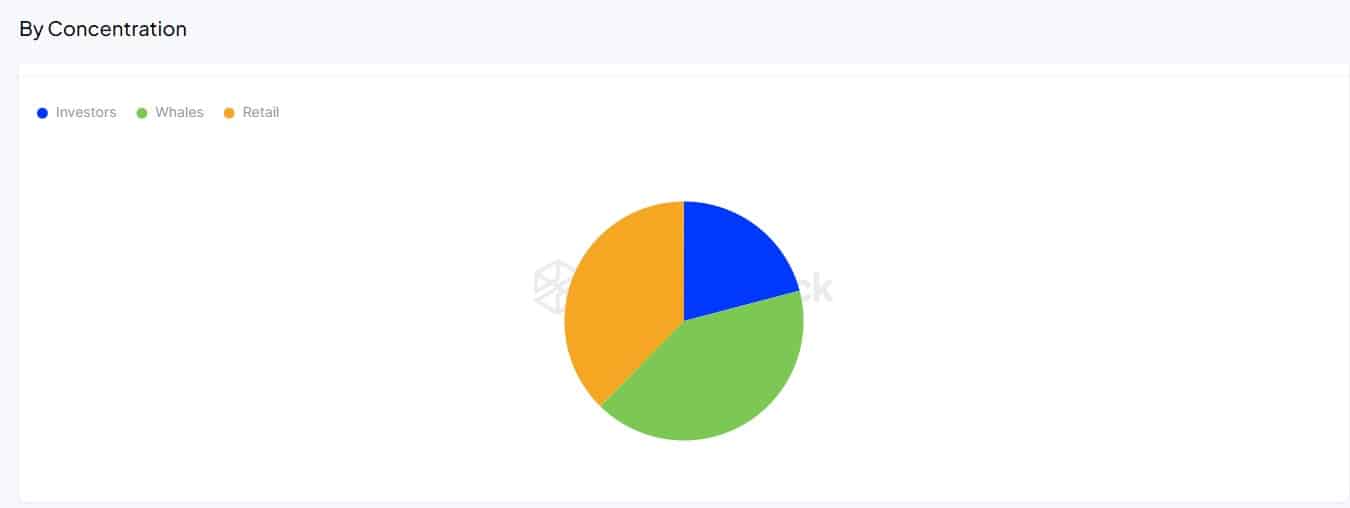

Dogecoin whales are in control

While many small investors own Dogecoin, whales are in control of the market.

Further, AMBCrypto’s analysis of the IntoTheBlock data shows that 62% of all Dogecoin is in the hands of these large investors. This indicates that a small number of people could have a big effect on its price.

Mixed signals in the market

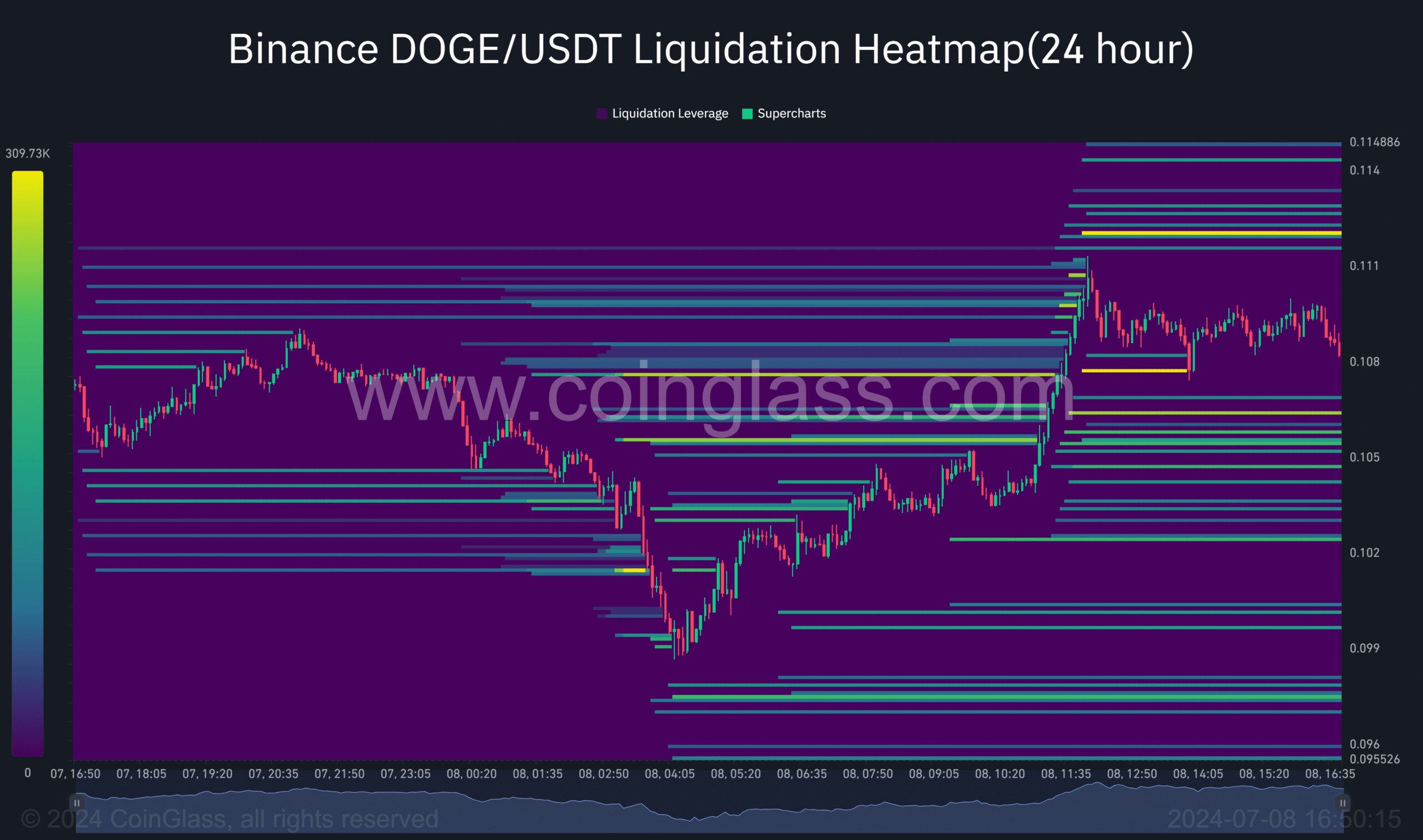

It’s intriguing to note that the majority of investors are currently in a profitable position. However, data from Coinglass’s heatmap indicates that some investors harbor expectations for a price decrease.

This difference between holder profits and trader interests creates an unusual situation for DOGE.

As an analyst, I’ve observed that when a significant number of investors are seeing profits with their Dogecoin holdings, it can create a ripple effect leading to increased buying activity. Consequently, the price of Dogecoin may potentially experience a rally as a result.

However, the negative positions held by some traders make it hard to predict what will happen next.

Realistic or not, here’s DOGE’s market cap in BTC’s terms

What’s next for DOGE?

From my perspective as an analyst, Dogecoin finds itself in an intriguing position currently. Majority of the investors are experiencing profits, yet there exists a sizable group harboring bearish sentiments. The significant influence wielded by large-scale investors over the Dogecoin market introduces an additional layer of uncertainty.

Dogecoin’s next move will likely depend on how these different factors cancel out

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Everything Jax Taylor & Brittany Cartwright Said About Their Breakup

- The Battle Royale That Started It All Has Never Been More Profitable

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- Chainlink: Checking LINK’s 20% drop amid a 4x jump in fees

- Your Friendly Neighborhood Spider-Man Boss Teases Surprising Doc Ock Detail

- How to get tickets to see Kendrick Lamar and SZA on their Grand National world tour

- Best Axe Build in Kingdom Come Deliverance 2

- Meghan’s Sweet Kids Tribute in Latest Vid!

2024-07-09 13:11