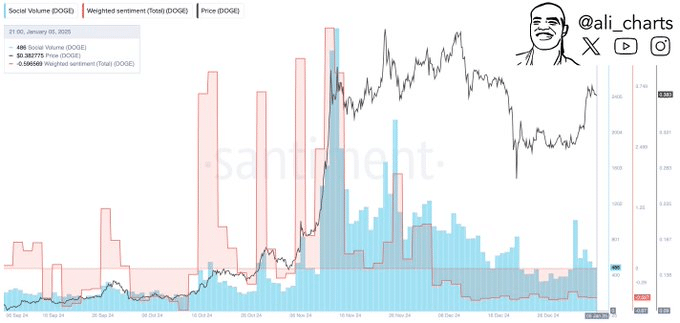

- DOGE’s weighted social sentiment remains at -0.60, reflecting persistent public caution.

- If DOGE breaks above the upper Bollinger Band in the coming days, it could trigger a bullish rally fueled by renewed investor confidence.

Dogecoin‘s [DOGE] price has lately piqued the interest of traders due to its varied performance. It climbed up to $0.38641, but subsequently dipped by 1.23% following its recent surge, which is fueling anticipation for a possible breakout.

Historical patterns indicate a strong possibility that the value of $DOGE could experience significant growth in the future, given its previous rapid increases of around 1,000% over the periods of 42 and 27 days during market uptrends.

Discussing January’s typical gain of 83.9%, which adds fuel to the speculation, is also accompanied by a decrease in selling pressure due to the massive transfer of 399.9 million DOGE from Binance to a personal wallet.

Although positive indicators suggest it, Ali, a researcher from X (previously known as Twitter), notes that Dogecoin’s overall public sentiment is still negative (-0.60) due to lingering skepticism among the public.

As I delve deeper into the technical and on-chain analysis of Dogecoin ($DOGE), I aim to provide insights into its potential direction over the coming weeks.

In this report, I’m focusing on key metrics that could influence DOGE’s trajectory, offering a comprehensive outlook for those interested in understanding its future movement.

Identifying volatility and breakout potential

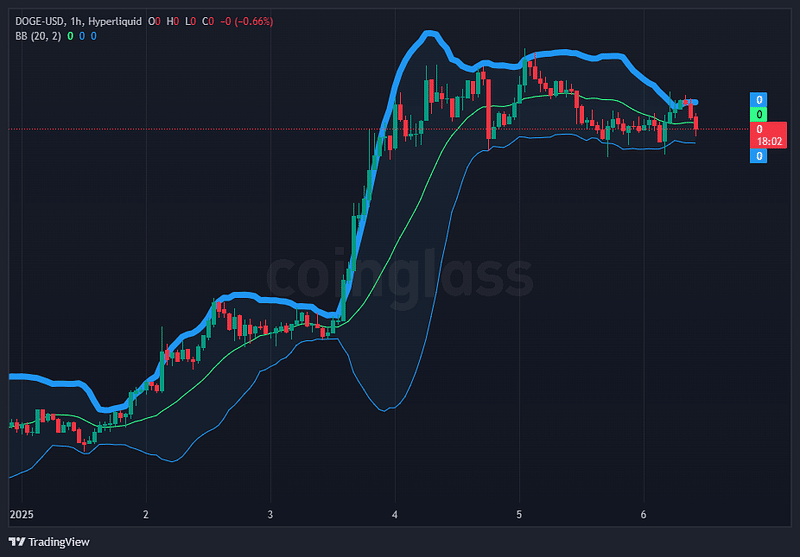

The Bollinger Bands help us understand Dogecoin’s (DOGE) price fluctuations and possible instances of a price breakout. Observing the latest price trends, it appears that DOGE has been experiencing a consolidation following its surge in November, with the bands becoming much narrower by late December, suggesting reduced volatility.

Strengthening Bollinger Bands typically indicate an imminent breakout, which may head upwards or downwards based on the current momentum trend. In simpler terms, when the bands become tighter, it’s a sign that a significant price movement could be coming soon.

The graph illustrates Dogecoin (DOGE) steadily recuperating close to $0.386, as the price hovers around the midpoint of the Bollinger Band. This indicates equal market pressure following a recent downtrend. The narrowing gap implies less volatility, possibly suggesting that a significant shift might be imminent.

If Dogecoin (DOGE) surpasses its upper Bollinger Band in the near future, it may ignite a bullish trend driven by increased investor optimism. Contrarily, falling beneath the lower band could initiate a wave of selling activity.

On the other hand, the decreased amount of Dogecoin in circulation, evident through Binance’s wallet transfer, seems to support a bullish outlook. Keep a close eye on this metric, as Dogecoin has shown a tendency for sudden price fluctuations in the past.

Insights into trader engagement and future price action

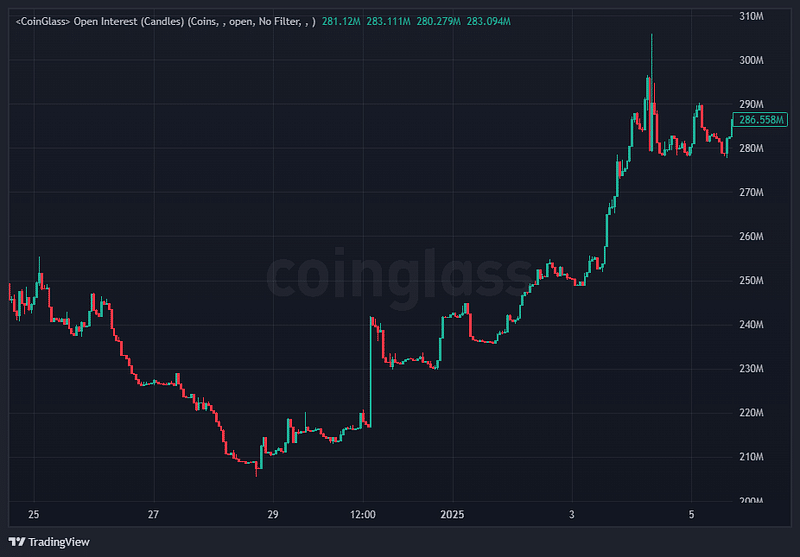

The concept of Open Interest (OI) offers an insightful perspective on the attitudes and financial movements of traders, as well as the direction of capital flow. Notably, there has been a significant surge in Dogecoin’s (DOGE) OI, which aligns with its price rebound to $0.386.

source:Coinglass

This rise indicates a rising curiosity about the possibility of DOGE’s price surge, as traders are preparing for a situation where it could break out.

In simpler terms, when the number of contracts being traded (open interest) increases significantly, it often happens during times of significant price changes (volatility). If the open interest for DOGE keeps growing but its price remains stable, this might suggest potential risks for positions that are heavily leveraged and could be forced to sell.

On the contrary, consistent price growth accompanied by increasing Open Interest (OI) suggests a bullish trend fueled by fresh capital flowing into the market. Given decreased selling pressure and a robust historical track record in January, the current Open Interest pattern bolsters the argument for an upcoming market surge.

The bottom line

Dogecoin is experiencing a captivating period characterized by price stabilization, conflicting opinions, and powerful historical trends pointing towards a possible surge in value (bullish breakout).

Bandwidths by Bollinger suggest decreasing market fluctuations, possibly hinting at an upcoming significant price change. Increased open interest suggests more traders are active, boosting the chance for a notable trend reversal.

Despite a prevailing negative sentiment of -0.60 suggesting ongoing public doubt, historical trends and blockchain signals point towards positive prospects for Dogecoin in January. This month has historically been favorable for Dogecoin’s performance.

Read Dogecoin’s [DOGE] Price Prediction 2025–2026

Looking at a potentially optimistic trend for Dogecoin over the next few weeks due to lessened selling activity and heightened investor attention. Yet, it’s crucial to stay alert for any external influences that might derail its progress.

As a contrarian analyst, I find myself drawn to the possibility that Dogecoin (DOGE) may be primed for another surge in line with its historical pattern of rapid expansion.

Read More

- PI PREDICTION. PI cryptocurrency

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- How to Get to Frostcrag Spire in Oblivion Remastered

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Is the HP OMEN 35L the Ultimate Gaming PC You’ve Been Waiting For?

- Whale That Sold TRUMP Coins Now Regrets It, Pays Double to Buy Back

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

2025-01-06 17:12