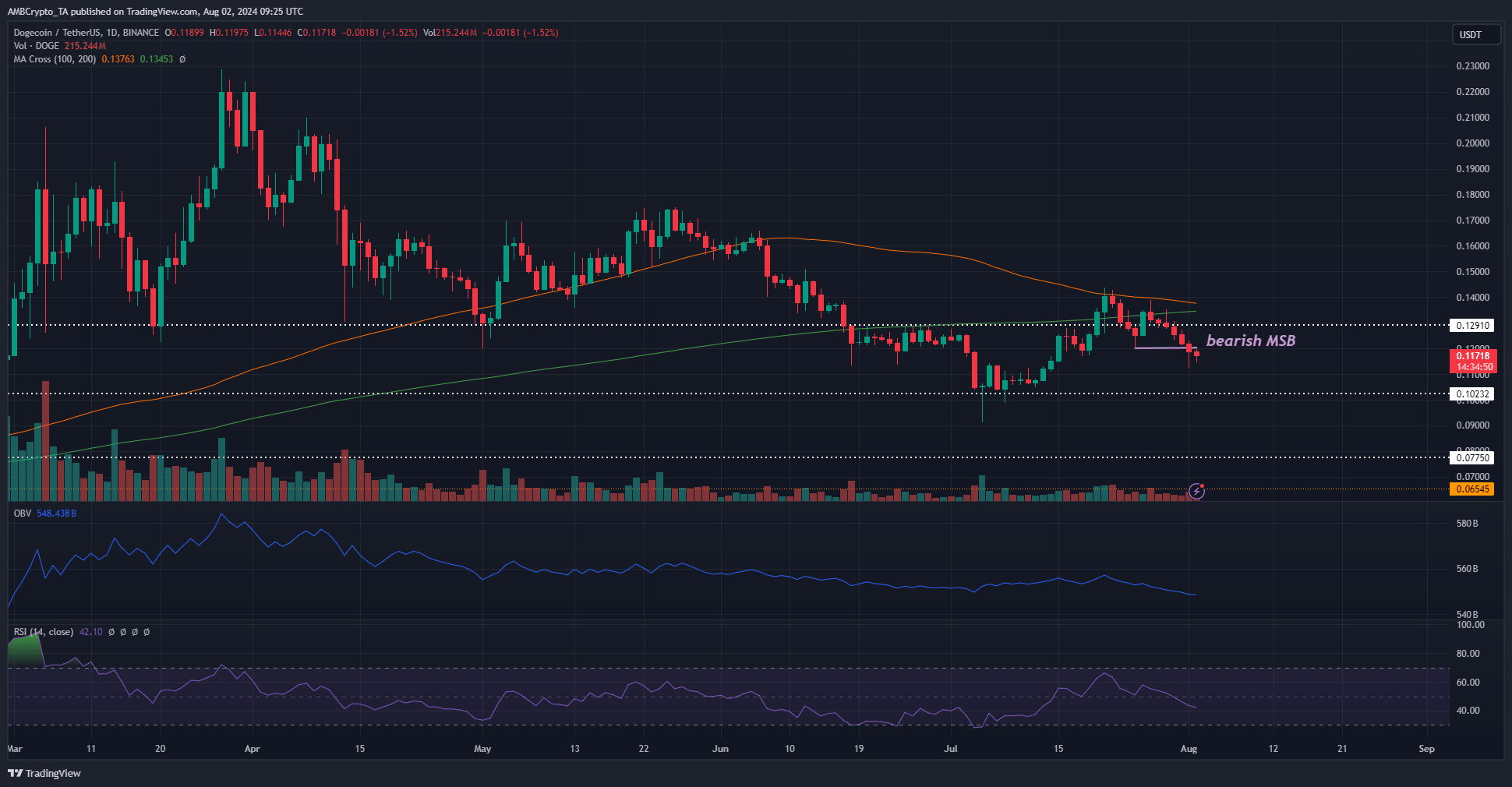

- Dogecoin has formed a bearish market structure.

- The rejection from the daily moving averages solidified the case of bearish momentum.

As a seasoned analyst with over two decades of market experience under my belt, I’ve seen bull runs and bear markets come and go. The current situation with Dogecoin [DOGE] is a bit concerning to me.

Over the last ten days, Dogecoin’s [DOGE] trading pattern has shown a downtrend. There’s a possibility that its daily moving averages could form a “Death Cross,” which is typically a significant bearish indicator.

This came after DOGE’s rejection at the $0.141 resistance.

crypto experts suggest that based on past trends, Dogecoin might reach $10 during this bull market. However, some question whether a possible “death cross” formation could dampen this optimistic prediction.

The feared death cross — should DOGE investors sell and wait for a trend reversal?

In the field of technical analysis, a “death cross” occurs when two longer-term moving averages intersect in a downward manner, signifying a potential bearish trend ahead. Specifically, the 200 and 100 day moving averages are often used for this purpose.

Dogecoin has already tested the 100 DMA as resistance at $0.141 and slid lower.

When the cost fell below the moving averages, it indicated that negative (bearish) movement was growing stronger. This trend was mirrored in the daily Relative Strength Index (RSI), which dipped below the neutral value of 50. Moreover, there wasn’t any noticeable buying pressure observed during this period.

According to the On-Balance Volume (OBV), the market’s downward trend aligned with the bearish price movement. In an attempt to recover in July, the OBV showed signs of rising, but the selling pressure, or bears, proved too intense. As a result, the OBV continued its decline, and on August 1st, a break in the bearish market structure was observed, further supporting the bearish outlook.

Overall, it appeared likely that the $0.102 support level would be tested in the coming days.

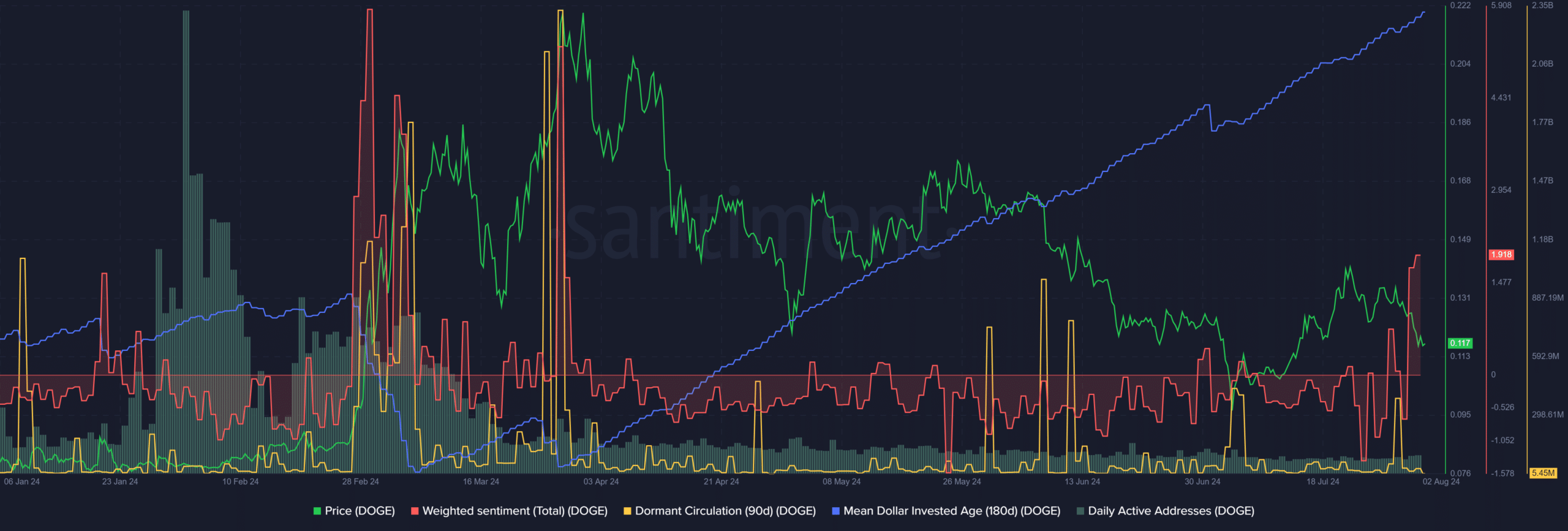

Social sentiment and sell activity were at odds

Social media sentiment significantly turned optimistic, indicating a generally positive and encouraging atmosphere among users. However, other measurements failed to show any strong bias in this direction.

The dormant circulation saw a spike like the one in the first week of July.

Read Dogecoin’s [DOGE] Price Prediction 2024-25

As a researcher, I’ve noticed an upward trend in the average dollar investment age for Dogecoin since March. This suggests that older tokens are being held onto, with fewer new investments seemingly making room.

As the network’s growth slowed, a decrease in the metric might facilitate the rise of the bull market.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-08-03 04:07