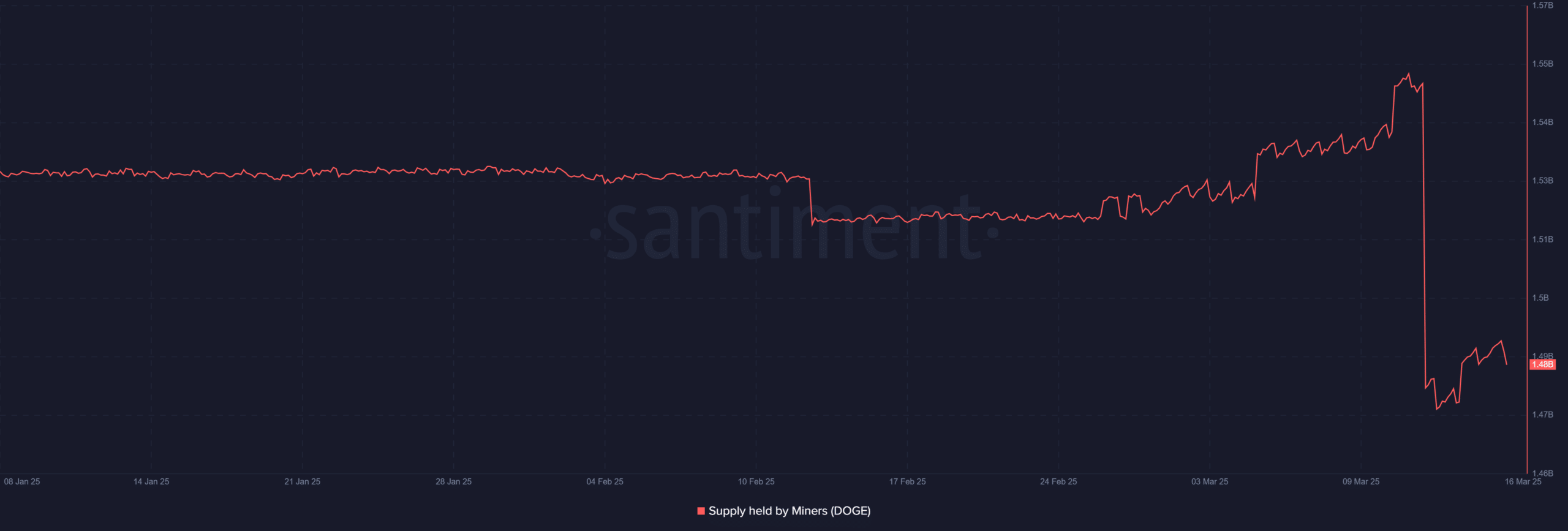

- Well, would you look at that! Dogecoin miner reserves took a nosedive from 1.55 billion to 1.48 billion DOGE, signaling a sell-off that would make even a seasoned gambler blush.

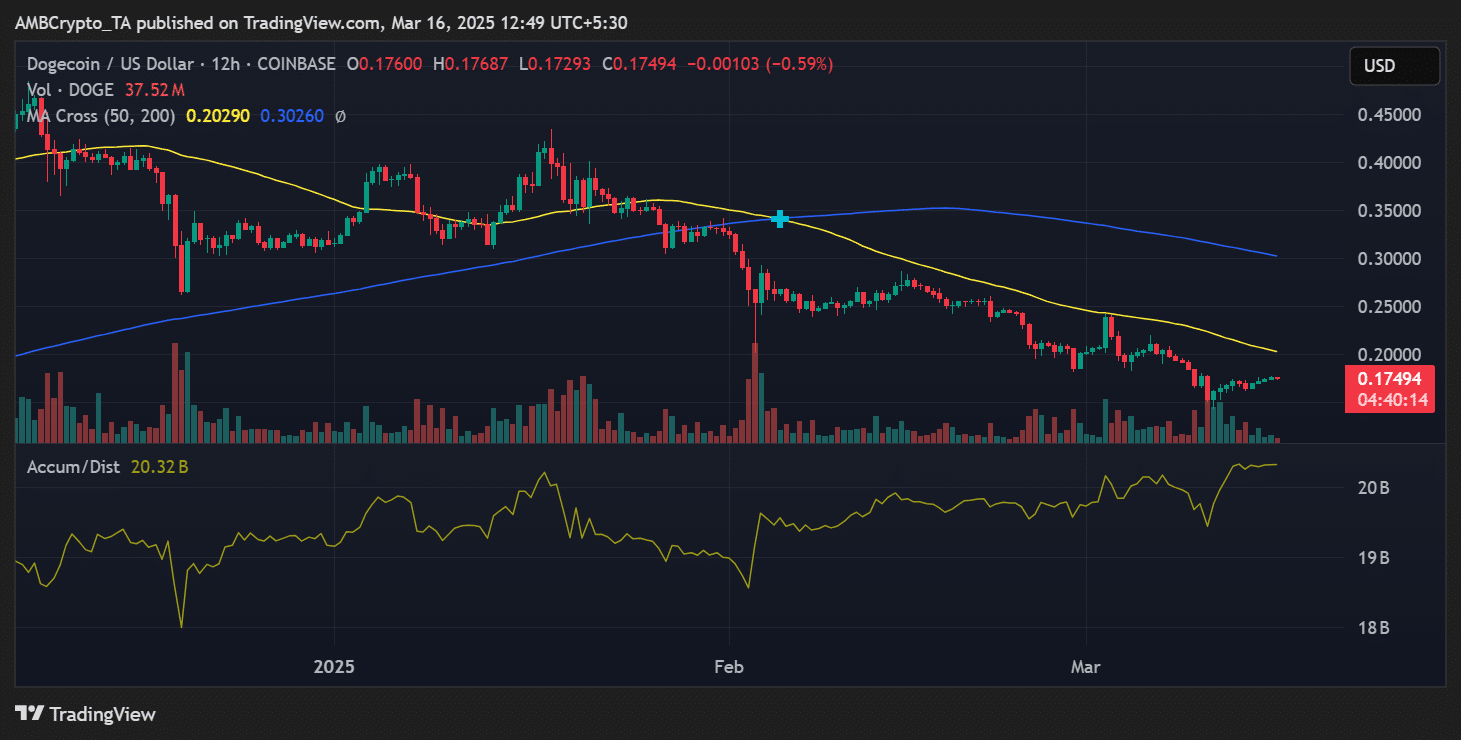

- Despite the great miner exodus, DOGE is still hanging around the $0.174 mark, like a stubborn mule, showing signs of stability amidst a growing pile of coins.

In a move that could make a cat laugh, Dogecoin [DOGE] miners have decided to offload a hefty chunk of their treasure. It’s like watching a bunch of squirrels suddenly decide to sell their acorns!

As the chart of miner reserves shows, this sell-off is one for the history books, marking a notable dip that would make even the most stoic investor raise an eyebrow.

Now, this little event raises a few eyebrows about what it might mean for DOGE’s price and the overall mood of the market. With DOGE struggling below key moving averages, one has to wonder: is this miner exodus a sign of doom, or will the market just shrug it off like a pesky fly?

Massive miner sell-off: A bearish signal?

Santiment’s chart has revealed that Dogecoin miners have slashed their holdings from a whopping 1.55 billion DOGE to a mere 1.48 billion DOGE in what feels like the blink of an eye. Talk about a quick getaway!

This sharp decline suggests that miners are liquidating their assets faster than a kid can eat candy on Halloween, possibly to cover their operational costs or simply because they’re feeling the heat of the market.

Historically, when miners decide to sell off in droves, it often leads to downward price pressure, as the increased supply meets a demand that’s about as static as a rock.

DOGE price reaction: Resilient or vulnerable?

As of this very moment, DOGE is trading at $0.174, reflecting a minor decline after the miner dump. It’s like watching a balloon slowly deflate—sad, but not entirely unexpected.

The 50-day moving average [$0.202] and 200-day moving average [$0.302] are acting like strong bouncers at a club, keeping DOGE from getting in and further restricting its upward momentum.

Interestingly, the miner sell-off gained momentum just when DOGE was trying to make a comeback after a series of unfortunate declines. Timing is everything, isn’t it?

Despite the miners throwing in the towel, accumulation among investors remains as stable as a three-legged dog, with the accumulation/distribution chart sitting at 20.32 billion at press time.

This indicates that while miner activity adds to the selling pressure, the broader market participants are still keen on hoarding Dogecoin like it’s the last cookie in the jar.

Will Dogecoin hold the support levels?

For Dogecoin to find its footing, it must cling to the $0.165 support level, a key zone where buying activity has historically stepped in like a knight in shining armor.

However, if the selling pressure from miners continues, DOGE might just find itself revisiting the $0.15 zone. On the flip side, if demand picks up, we could see DOGE reclaim $0.18 before making a valiant attempt at the $0.20 mark.

Final thoughts

The miner sell-off has injected a dose of volatility into DOGE’s price action, making near-term movements as uncertain as a cat in a room full of rocking chairs.

While the price hasn’t collapsed under the pressure, traders should keep a close eye on further miner activity and key resistance levels. A break below $0.165 could trigger a sharper decline for Dogecoin, while a successful recovery above $0.18 would indicate that DOGE has some fight left in it.

Investors should remain as cautious as a mouse in a room full

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

2025-03-16 15:07