- Dogecoin price is trapped within a symmetrical triangle at it eyes a breakout at $0.163.

- On-chain metrics unveil reduced activity and stable whale transactions.

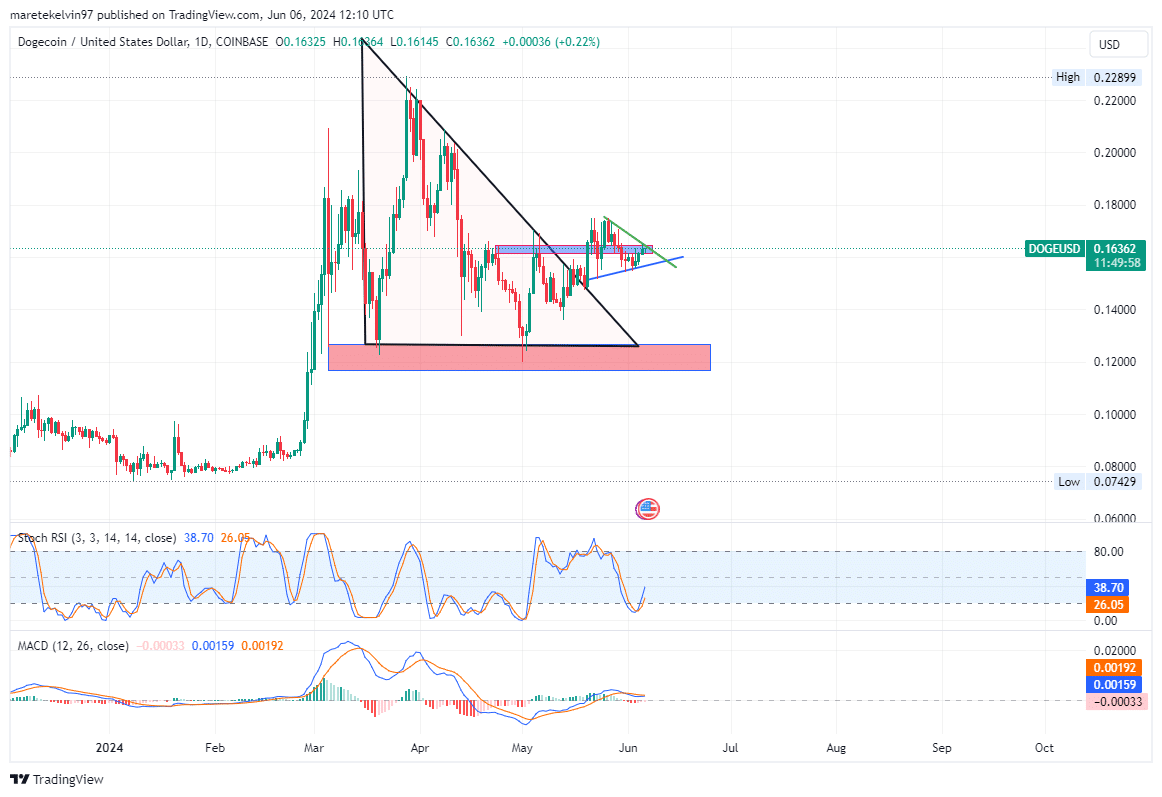

As a seasoned crypto investor with a keen interest in Dogecoin, I’ve been closely monitoring its price action and on-chain metrics. Based on the current technical analysis and on-chain insights, it seems that Dogecoin is trading within a symmetrical triangle at the $0.163 level, which could lead to a potential breakout if sufficient momentum is built up.

For the past three weeks, the price of Dogecoin (DOGE) has been stabilizing within a symmetrical triangle pattern after it surged out of an ascending triangle on May 16th.

At around $0.163, the price is approaching a level that could lead to an increase in cost. Should the price breach this resistance area, a significant price rise might ensue.

As a researcher studying market trends, I would note that if the price fails to gather sufficient momentum to breach its current resistance level, it’s likely that we’ll see a continuation of the consolidation phase in the near term.

At present, Dogecoin is priced at around $0.16 on CoinMarketCap. It has experienced a 0.37% increase over the past 24 hours, and there’s been a 2.56% growth during the last week.

Key levels to watch

The price of Dogecoin is currently moving within a symmetrical triangle pattern on the chart. Soon, it may reach a significant turning point, which is approximately at the $0.163 mark.

If the price of Dogecoin surpasses this mark, it may lead to a potential significant increase in value. The Stochastic RSI currently indicates a balanced situation, meaning it isn’t yet showing signs of being either overbought or oversold.

In simpler terms, when the MACD lines are closely aligned, it suggests that the market may move sideways for some time before revealing a definitive upward or downward trend.

This consolidation pattern suggests that Dogecoin may continue trading sideways in the short run.

Insights into Dogecoin’s network activity

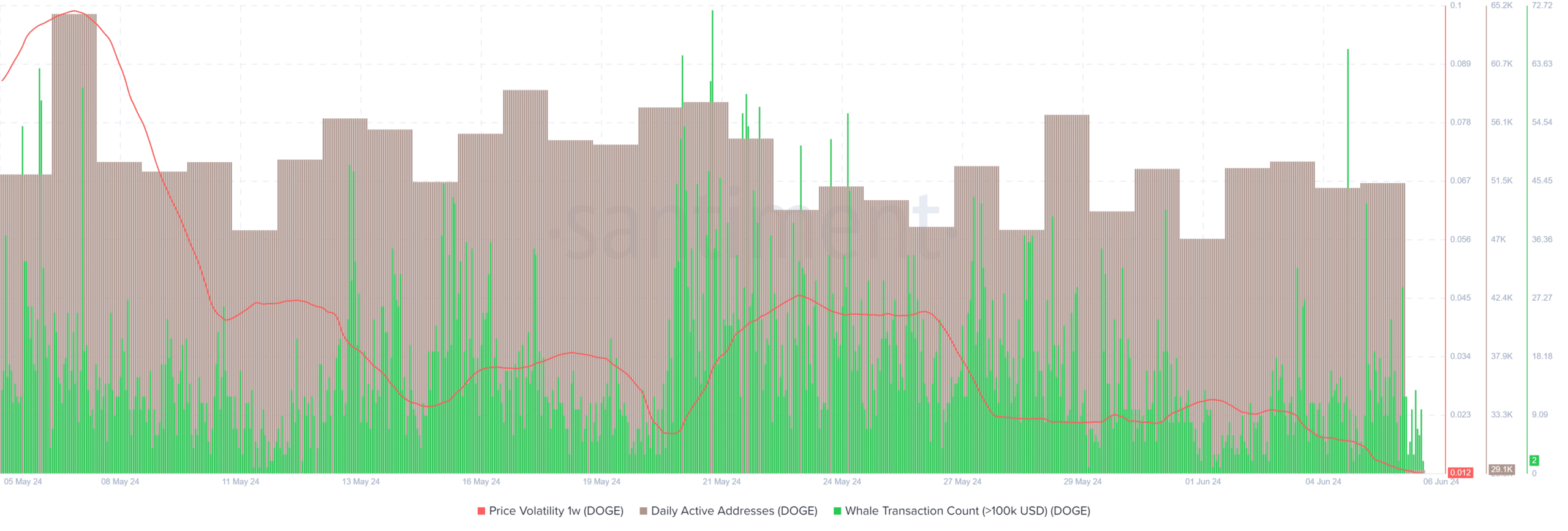

As a cryptocurrency analyst at AMBCrypto, I delved into Santiment’s data to validate the technical observations. Notably, Dogecoin’s price fluctuations have been on a downward trend, suggesting that the coin’s price is currently in the consolidation phase.

As a crypto investor, I’ve noticed that the number of daily active addresses on the network has decreased noticeably. In early May, there were approximately 65,000 daily active addresses, but by early June, this number had dropped to around 29,100. This reduction suggests a decline in network activity.

Large-scale whale transactions involving over $100,000 have shown a gradual decrease, suggesting less frequent trading by major investors. This trend is consistent with the current market consolidation phase.

What next

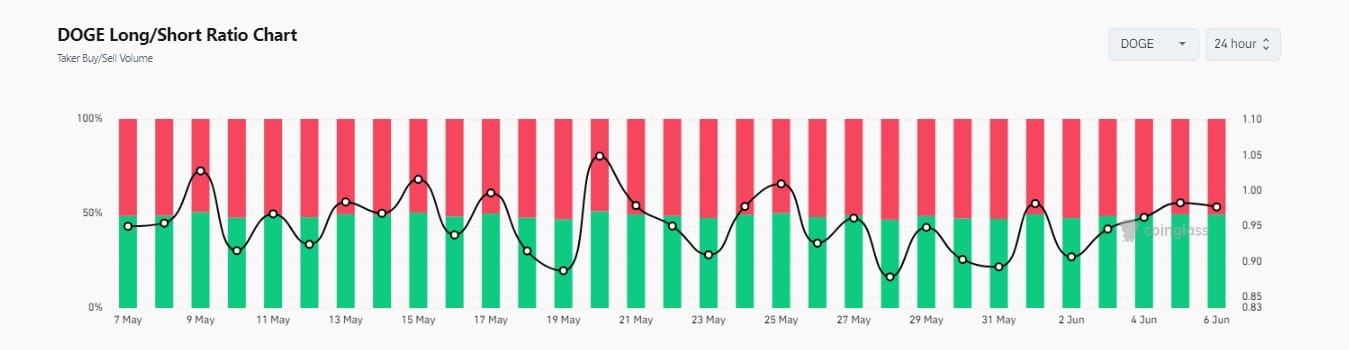

In simpler terms, the market mood, reflected in the long-to-short ratio, indicates a pessimistic outlook at present. This means that bearish traders have the upper hand in the near term as stock prices make corrections for any discrepancies.

Based on the analysis of technical indicators, it appears that a period of price stability or consolidation may be imminent. On the other hand, on-chain data reveals a decrease in trading activity that remains relatively constant.

Keep a keen watch on the $0.163 mark as any breaches could lead to a subsequent price rise. Once this level is surpassed, an uptrend may ensue.

However, consolidation may continue in the immediate run.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2024-06-06 17:11