- Dogecoin holders are refraining from selling, potentially paving the way for a price increase.

- Technical indicators suggested a rise in momentum, while on-chain data showed that it was time to buy.

As an experienced analyst, I believe that Dogecoin’s recent trend of increasing Coins Holding Time and decreasing transaction volume, along with positive technical indicators such as a rising Awesome Oscillator and potential support levels identified by the Fibonacci Retracement indicator, suggest that it might be a good time to consider buying DOGE. The price DAA divergence further strengthens this argument, indicating that the participation rate on the network is currently lower than the price growth. However, as with any investment decision, it’s important to do thorough research and consider your own risk tolerance before making a move.

As a researcher studying the cryptocurrency market, I’ve observed that Dogecoin (DOGE) was relatively stagnant during the recent price surge among memecoins. However, based on current trends and market indicators, it seems likely that DOGE could follow suit and experience a similar upward trend in the near future.

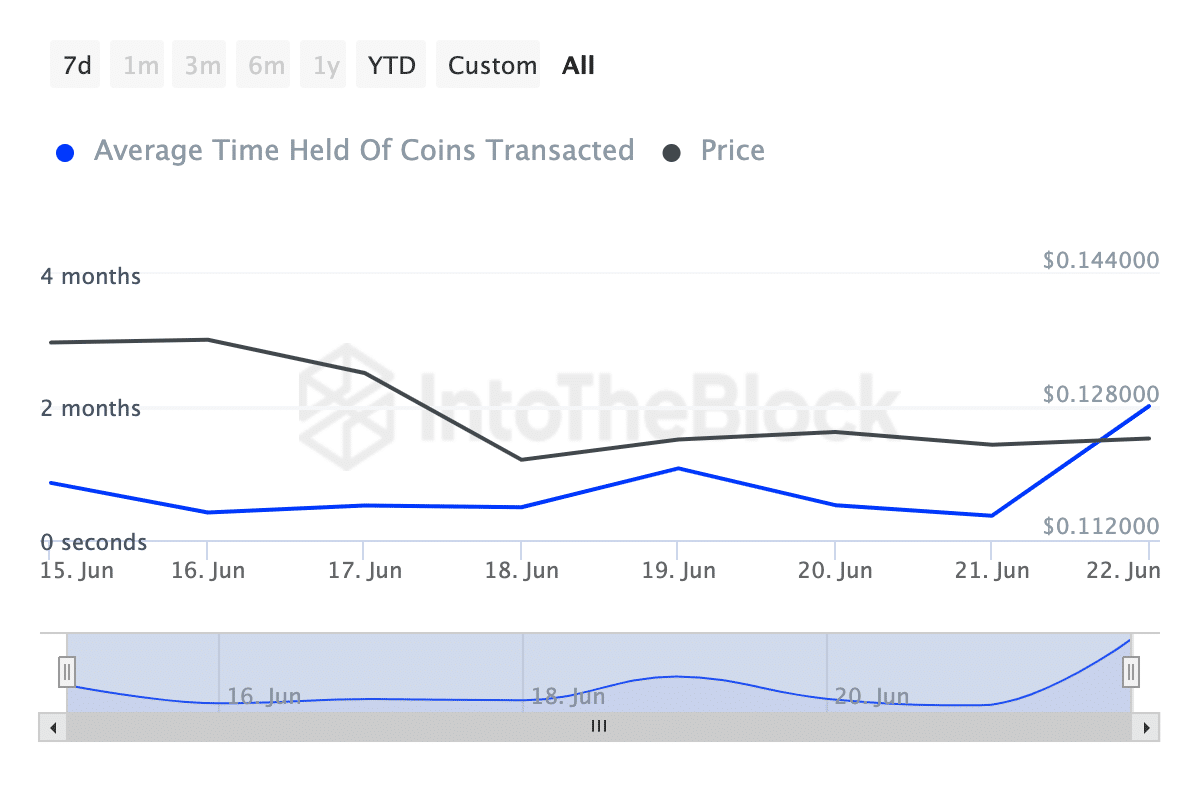

As a crypto investor, I believe that the length of time I’ve held onto a particular coin without making any transactions plays a significant role in my investment strategy. This metric is commonly referred to as the Coins Holding Time. Essentially, it represents the number of days a coin has remained in my digital wallet undisturbed.

HODLing is the name of the game

when the majority of coin transactions aren’t occurring, there is typically less pressure to sell, but heightened trading can indicate potential sell-offs within the market.

As a crypto investor, I’ve noticed an intriguing development according to IntoTheBlock’s latest data. The holding time for Dogecoin coins has seen a remarkable surge of 387.03% over the past week. This indicates that many holders have decided to hold onto their Dogecoin investments rather than sell, a strong sign of confidence in this cryptocurrency.

In the realm of cryptocurrencies, “HODL” is an acronym that signifies “Hold On for Dear Life.” This term encapsulates the mindset of investors who choose to keep their digital assets regardless of market volatility and price swings.

If this perspective persists, Dogecoin’s value could potentially become more steady. Should purchasing demand accompany it, the cost of Dogecoin may rise.

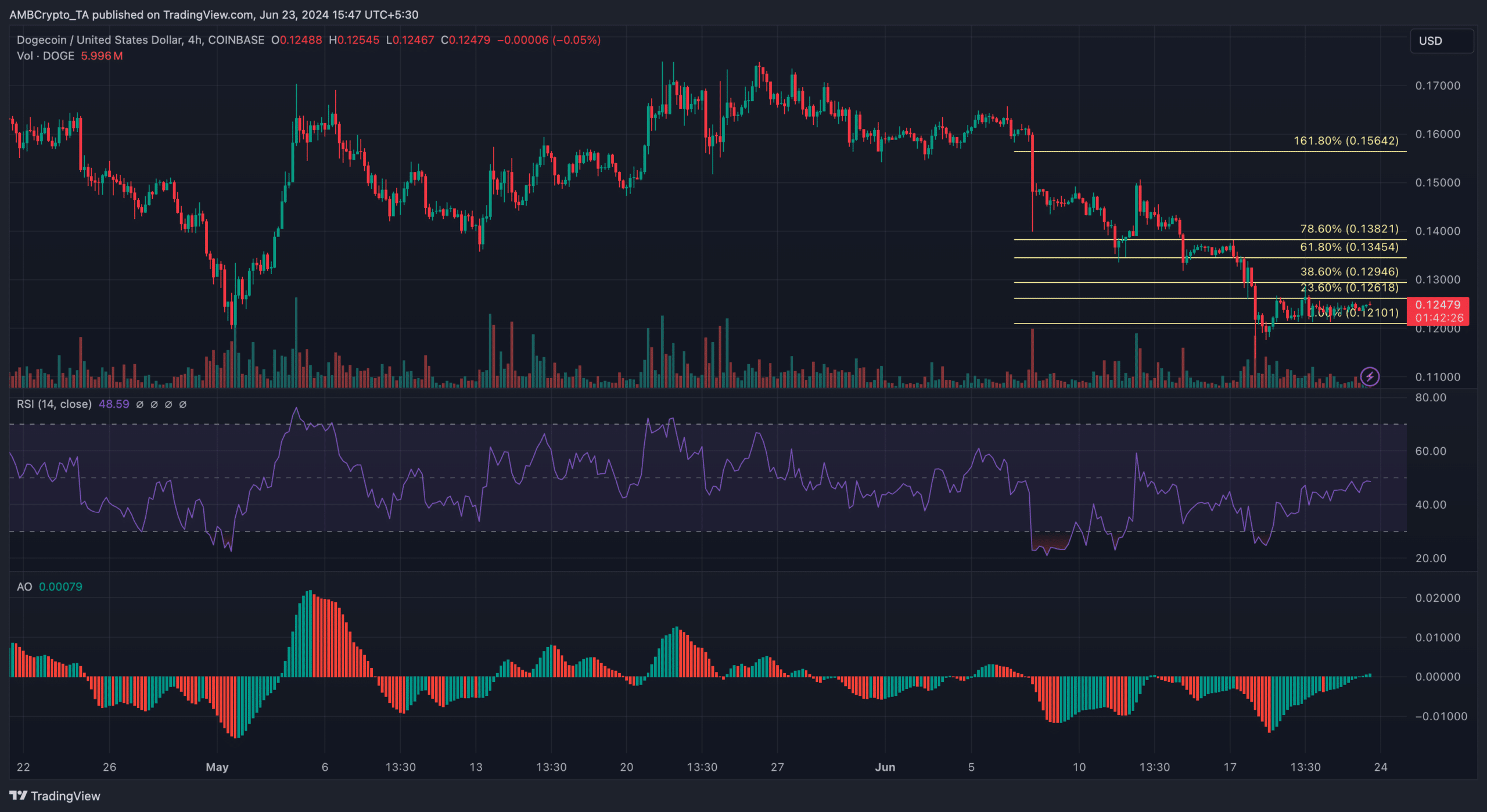

At the moment of publication, the price of DOGE was at $0.12. This represented a 20.78% decline in value over the past thirty days. According to our analysis by AMBCrypto, trading volume for this cryptocurrency saw a decrease of 33% during the same time frame.

As an analyst, I’ve noticed that the volume has been decreasing alongside a month-long downtrend for DOGE prices. This could be indicative of weakening bearish sentiment. Consequently, there’s a possibility that the DOGE price may rebound from its current lows.

The time to buy DOGE is now

As a researcher studying the Dogecoin (DOGE) market against the US Dollar (USD), I’ve observed an intriguing technical development based on the 4-hour chart. The Awesome Oscillator (AO) has recently moved into positive territory, signaling potential price strength.

The Automatic Ocean (AO) indicator signifies the rate at which a financial asset’s price is changing. In simpler terms, it indicates the momentum of an asset like Dogecoin. A positive AO reading implies that Dogecoin’s price momentum is gaining strength.

The RSI reading, similar to the AO, has been on an upward trend. Nevertheless, it hasn’t surpassed the 50.00 mark yet, indicating a lack of clear momentum. Consequently, the price may remain stable around the $0.12 area for a while.

As an analyst, I’ve noticed that surpassing the current resistance level could potentially propel DOGE‘s price upward. Additionally, by employing the Fibonacci Retracement indicator, we’ve pinpointed some key price levels that might come into play if there’s a pullback in the trend.

The Fibonacci tool in our chart identifies probable areas of support and resistance for DOGE. We noticed that the 61.8% Fib level was at $0.13, suggesting that the Dogecoin price may head towards that region.

From my perspective as an analyst, if market conditions continue to be favorable, the price may surge up to $0.15 in an optimistic scenario. Furthermore, during our analysis, we identified a Price Moving Average (PMA) and Demand Volume Indicator (DVI) divergence.

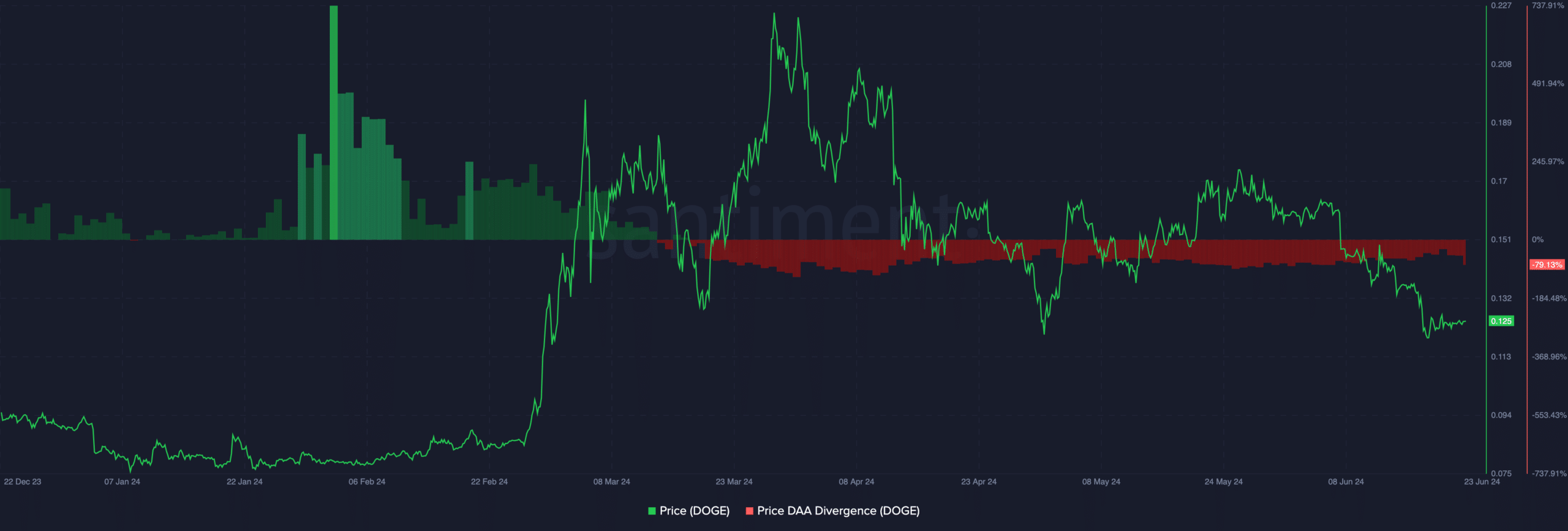

The acronym DAA represents Daily Active Addresses. This figure signifies the count of individual users engaging in transactions on a given blockchain daily. When considered alongside the current market price, this metric can provide valuable insights for determining potential buying or selling opportunities in cryptocurrencies.

In simpler terms, the buying signal occurs when the price increases at a faster rate than the moving average (DAA), while the selling signal is triggered when the moving average (DAA) starts to rise faster than the current price.

Is your portfolio green? Check the Dogecoin Profit Calculator

At the moment of publication, the Price Development Against Average (DAA) disparity for Dogecoin amounted to a significant 79.13%. This finding suggests that the engagement level on the network has been lagging behind the price surge.

Thus, it could be time to buy the coin before the potential upswing begins.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- You Won’t Believe Today’s Tricky NYT Wordle Answer and Tips for April 30th!

2024-06-24 00:07