- Is Dogecoin on the cusp of a bearish retracement after its latest rally?

- On-chain data showed sustained demand, although there are signs of a potential profit-taking build-up.

As an analyst with over two decades of experience in the crypto market, I have seen my fair share of bull runs and bear markets. Based on the current data, it appears that Dogecoin [DOGE] is showing signs of a potential retracement after its impressive rally. The sustained demand, as evidenced by the high percentage of holders being in the money at current price levels, suggests that there may be profit-taking build-up occurring. However, the resilience shown by the bulls indicates that they are expecting prices to continue on a bullish trajectory.

Dogecoin [DOGE] went through the most bullish two weeks that have been observed in months.

Given its strong showing, it’s now teetering on the edge of being overbought, causing some uncertainty. Is it wise for traders to cash in their short-term gains or hold out for further price increases?

At the moment of reporting, Dogecoin was being traded at around $0.145, representing a 41.95% increase from its current lowest price recorded in October.

In other words, Dogecoin bulls have been quite busy putting up a firm assault against the bears.

Could it be that the Dogecoin bulls might take a break soon? As we’ve seen historically, the popular meme coin may encounter resistance around the $0.141 price level, potentially halting its upward momentum.

Over the past three days, the bulls have struggled to keep up their pace and hold prices above the significant mark they initially surpassed.

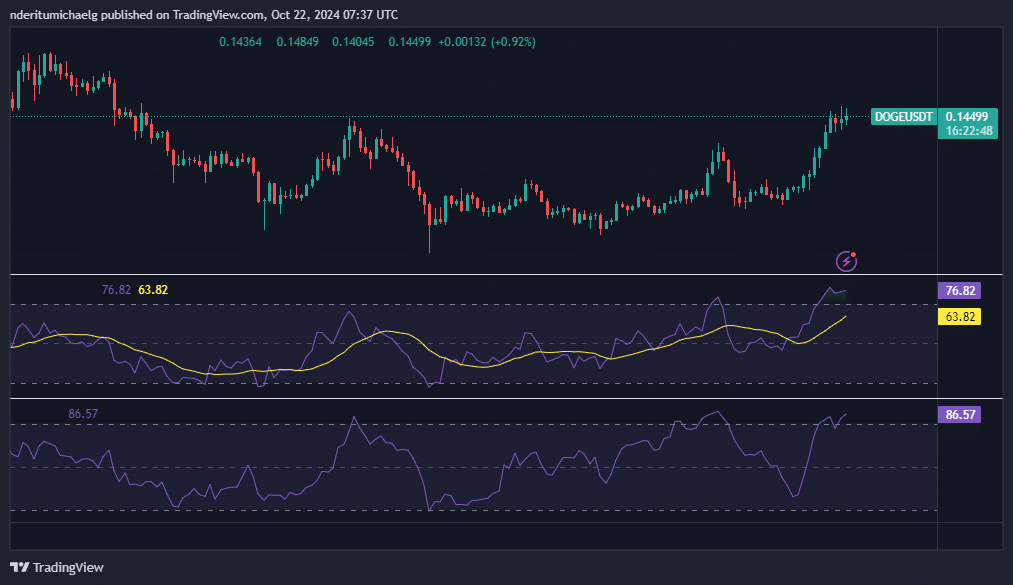

dogecoin’s Relative Strength Index (RSI) had previously moved into overbought conditions, suggesting a potential decrease in the coin’s strong upward trend or bullish momentum.

Likewise, a small decrease in MFI indicates that some traders might be cashing out their earnings as it suggests the market has become overbought.

As a crypto investor, I’ve noticed that despite the increasing opposition, the bullish sentiment remains strong. This is evident in the absence of a panic sell-off, suggesting that investors are holding onto their positions with determination.

It implies that many Dogecoin owners anticipate the prices will keep rising along an upward trend. However, at the moment of reporting, the cost of Dogecoin is substantially less than its year-to-date peak.

Will Dogecoin induce profit-taking?

According to IntoTheBlock’s data, approximately 80% of Dogecoin owners are currently profiting at these price points.

Only 16% were out of money, which meant there was a lot of demand near the bottom range.

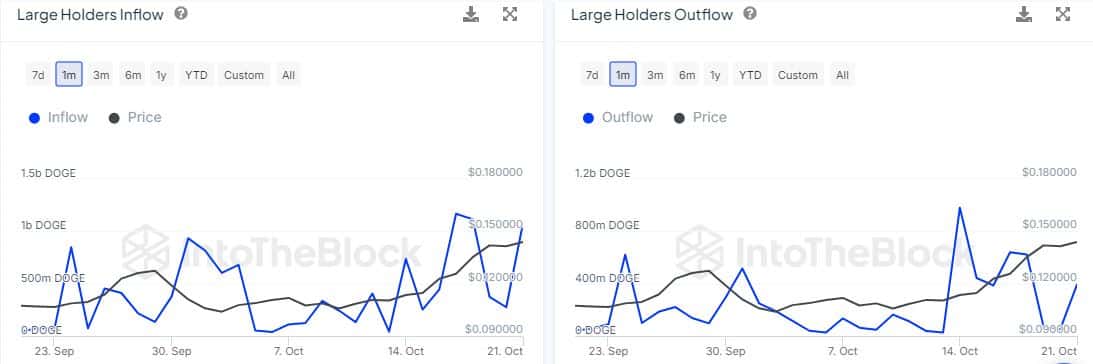

On October 20th, a significant holder’s Dogecoin inflows amounted to 274.5 million DOGE. However, the next day, on October 21st, this figure skyrocketed to 1.08 billion DOGE. This suggests a strong increase in buying activity, or bullish momentum.

Conversely, during that same timeframe, the amount of cryptocurrency leaving the hands of large holders jumped significantly, from 52.23 million to 392.2 million. This indicates a significant increase in selling activity among the ‘whale’ group.

Yet, it’s worth noting that inflows into big account holders were significantly greater, accounting for why the price continues to maintain its recent advancements.

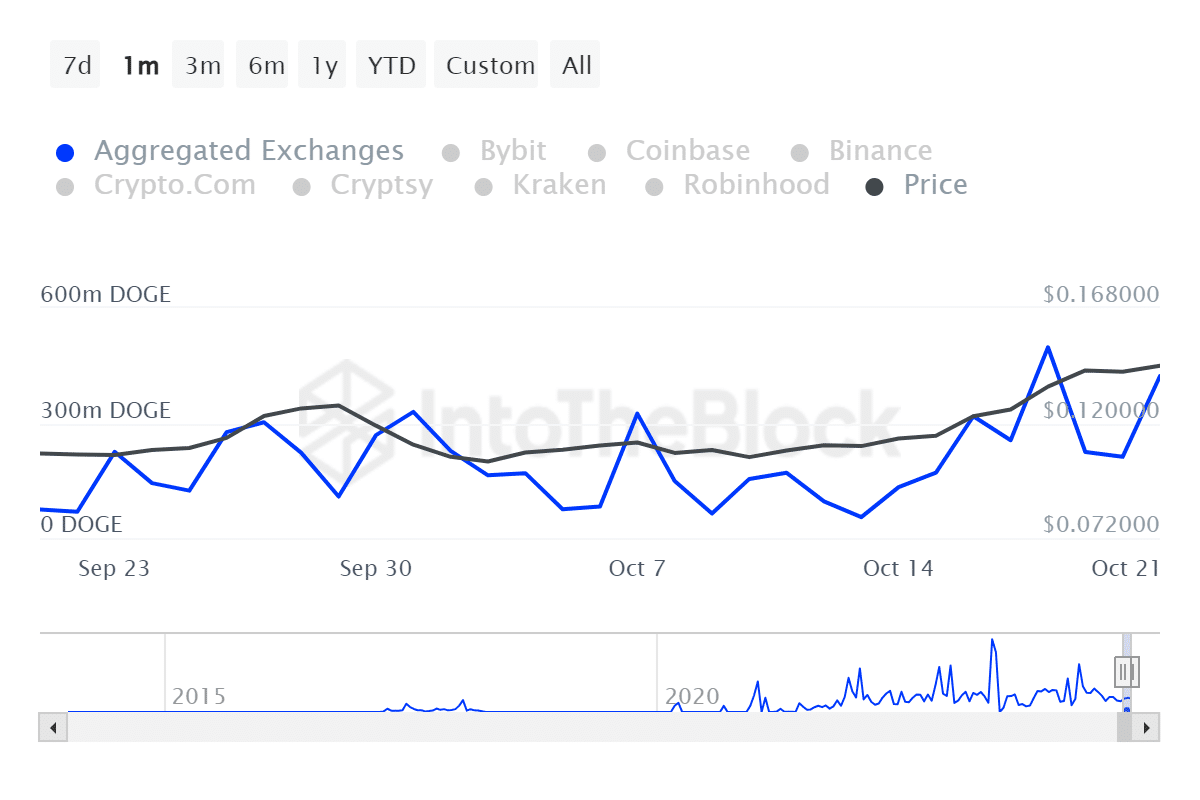

On October 21st, the largest amount of Dogecoin (DOGE) moving out from exchanges was approximately 422.56 million DOGE. The amount coming into exchanges was relatively smaller, with about 371.71 million DOGE. This suggests a higher volume of DOGE being withdrawn compared to deposited.

Realistic or not, here’s DOGE market cap in BTC’s terms

As a crypto investor, I observed an intriguing trend on October 18th: the inflow to exchanges significantly surpassed the outflow during that particular trading session, according to AMBCrypto’s analysis.

For the first time, there could be signs of increased demand to sell. Yet, withdrawals from exchanges have resumed their superiority over deposits ever since.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-10-23 11:04