- Dogecoin was trading just above a short-term range’s lows

- The confluence with the Fibonacci retracement level offered chances of a bounce for the meme coin

As a researcher with experience in analyzing cryptocurrency markets, I believe Dogecoin’s current price action presents a challenging situation. The meme coin has been trading just above the short-term range’s lows, and the confluence of these levels with the Fibonacci retracement level offers some chances for a bounce. However, the total number of Dogecoin holders increasing in April might not be enough to justify a price recovery given the fearful market sentiment.

As a researcher studying the cryptocurrency market, I’ve observed that Dogecoin [DOGE] experienced setbacks with increasing selling pressure, causing it to incur losses in the past 24 hours. Conversely, Bitcoin [BTC], which I also follow closely, managed to maintain its ground and rebounded by approximately 4.3% from the $62.1k support level to reach a new price point of $64.5k during this period. Unfortunately, Dogecoin was unable to avoid touching its short-term range lows.

In April, the count of Dogecoin owners rose, yet this growth may not be sufficient to trigger a price rebound. The prevailing market mood remained apprehensive, implying that the meme coin might dip even further.

Extended consolidation is a possibility for DOGE

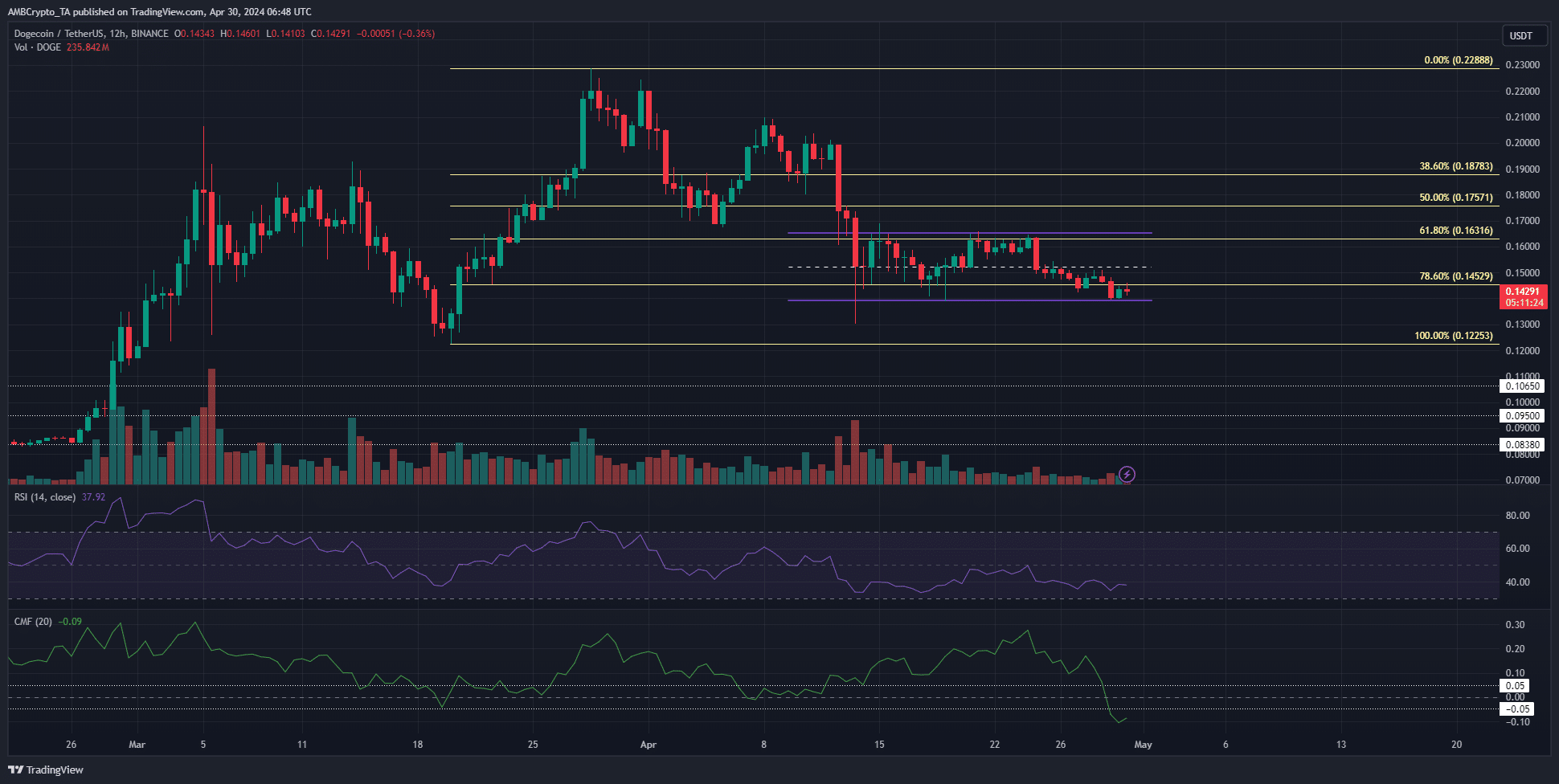

Between the prices of $0.14 and $0.165, a price range (denoted by the purple line) emerged. Throughout April, the midpoint of this range functioned as both a support and resistance level, underlining the validity of the depicted price range. The Chaikin Money Flow (CMF) indicator read -0.09, signaling substantial outflow of capital from the market.

With an H12 RSI reading of 37, Dogecoin’s price trend showed a consistent decline over the past five days. This downtrend was mirrored in the stock market indicator’s steady decrease. The proximity of Dogecoin’s support levels to the 78.6% Fibonacci retracement level offered some optimism for potential buyers.

The suggestion indicated a potential for buyers to enter and curb potential losses. Yet, the signs pointed towards further losses on the horizon.

Does the futures market support the possibility of a bounce?

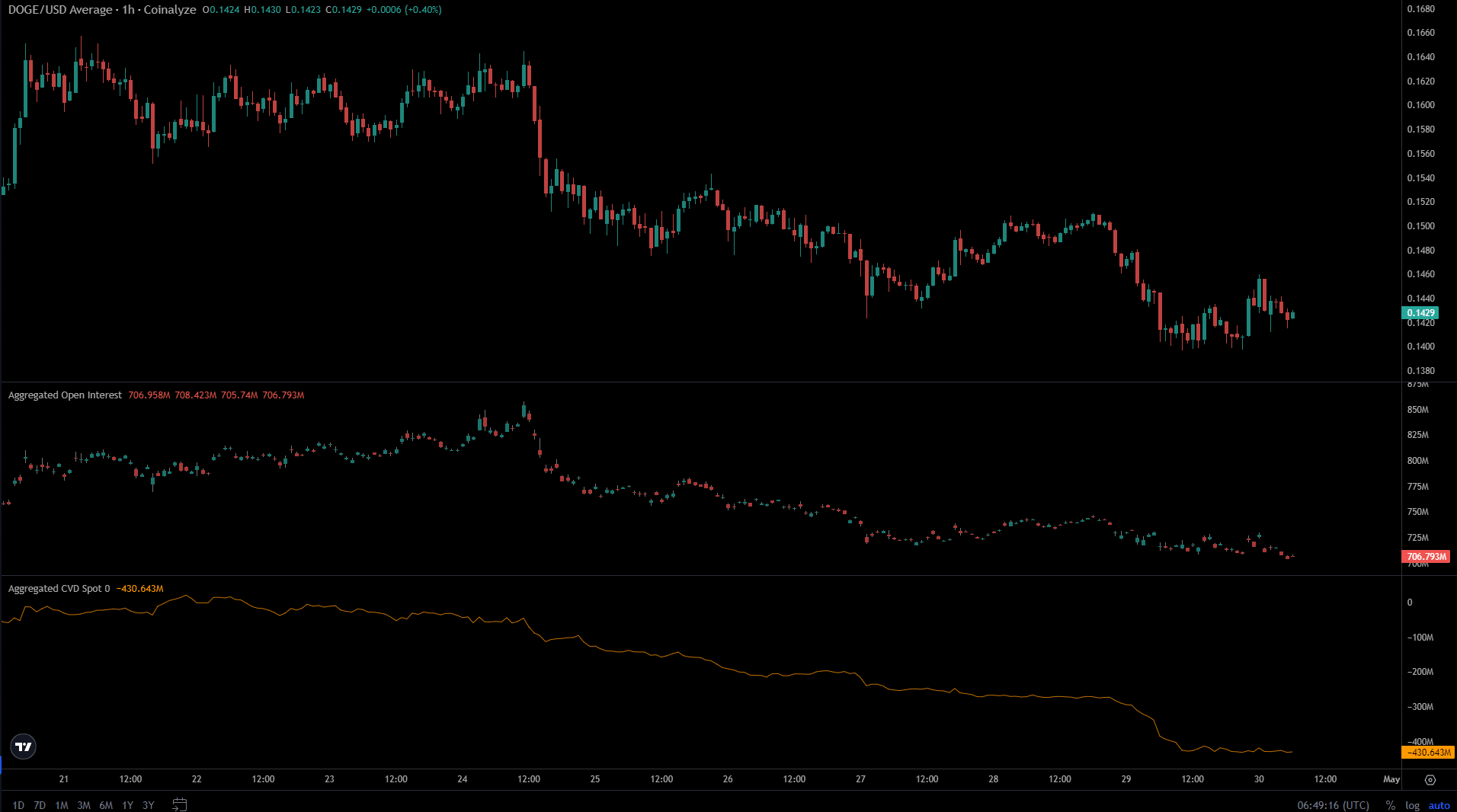

As an analyst, I examined the data from AMBCrypto’s analysis of Coinalyze, discovering a minimal inflow of capital into the market. This observation aligns with the CMF’s indications. Furthermore, Open Interest has been declining consistently in the past few days, reflecting a reluctance among speculators to enter bids.

Realistic or not, here’s DOGE’s market cap in BTC’s terms

Cardiovascular disease (CVD) has continued to decline since April 22nd, but its decrease has come to a halt in the last 24 hours. Instead of dropping further, CVD’s trend has shifted into a more horizontal, or sideways, movement.

As an analyst, I would interpret this statement as follows: If the price of spot Cardiovascular Diseases (CVD) continues to rise from its current level, it will provide a positive sign for investors considering entry at the lower price points.

Read More

- Disney’s Animal Kingdom Says Goodbye to ‘It’s Tough to Be a Bug’ for Zootopia Show

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Elevation – PRIME VIDEO

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

2024-04-30 21:11