- A sharp increase in high-volume transactions, alongside a rise in exchange netflow, indicated a growing lack of confidence

- Traders holding long positions have suffered significant losses, erasing their profits

As an analyst with over two decades of experience in the financial markets, I’ve seen my fair share of market fluctuations, and the current state of Dogecoin (DOGE) is reminiscent of a rollercoaster ride that’s taking a downward spiral. The sharp increase in high-volume transactions, alongside a rise in exchange netflow, indicates a growing lack of confidence among traders, which is never a good sign.

Dogecoin (DOGE) is finding it tough to sustain its upward market trend, as the meme-based cryptocurrency has been swiftly giving up its monthly earnings. In fact, over the past week and day, DOGE experienced a decrease of 9.63% and 2.54% respectively, leaving its monthly gains at only 4.95%.

Lately, it seems the fall in Dogecoin’s worth might be fueled by a noticeable decrease in investor trust. This trend appears set to persist as well.

Volume spikes and higher supply trigger DOGE’s decline

Currently, DOGE is experiencing a downward trend primarily due to increased large transaction volumes and a rise in exchange outflows.

When the flow of DOGE being traded on exchanges is predominantly incoming (i.e., more DOGE going in than coming out), it signifies a large accumulation of this cryptocurrency. This excessive availability could lead to an increase in supply, which might cause the price to decrease.

Over the past week, data from IntoTheBlock shows a rise of approximately 135.2 million Dollar worth of Dogecoin (DOGE) being moved out, signifying that investors have been quite active in offloading their holdings.

Over the past day, there was a significant increase in larger transactions, with approximately 1,560 transactions taking place alone. Interestingly, the highest number of transactions recorded in the last seven days was 1,580.

Given these market conditions, the probability of DOGE’s price continuing to fall is highly likely.

Market downturn intensifies as DOGE faces steep decline

Furthermore, there was a significant 33.94% decrease in Dogecoin’s trading volume, indicating a notable decrease in market activity and enthusiasm. Similarly, derivative trades have experienced a recent dip in user interaction.

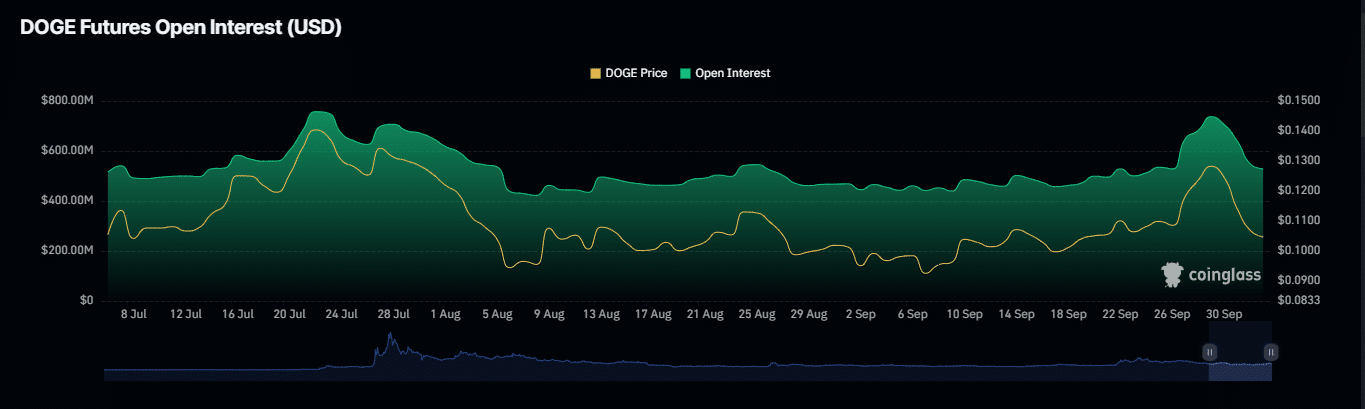

The interest among traders for DOGE, as reflected by the Open Interest indicator provided by Coinglass, mirrored a decline in its value. Specifically, over the past 24 hours, the Open Interest had dropped by 7.41%, amounting to approximately $509.53 million.

At the same time, this economic slump resulted in the selling off of over 4.16 million dollars’ worth of long-term Dogecoin (DOGE) investments. Those who had bet that DOGE would surpass its past market values have suffered substantial losses.

This group of indicators shows a decrease in enthusiasm for the asset, as bulls appear ready to yield to bears and take control of the market. Consequently, AMBCrypto has looked into possible future movements for DOGE within this market context.

Next potential levels for DOGE amid market turbulence

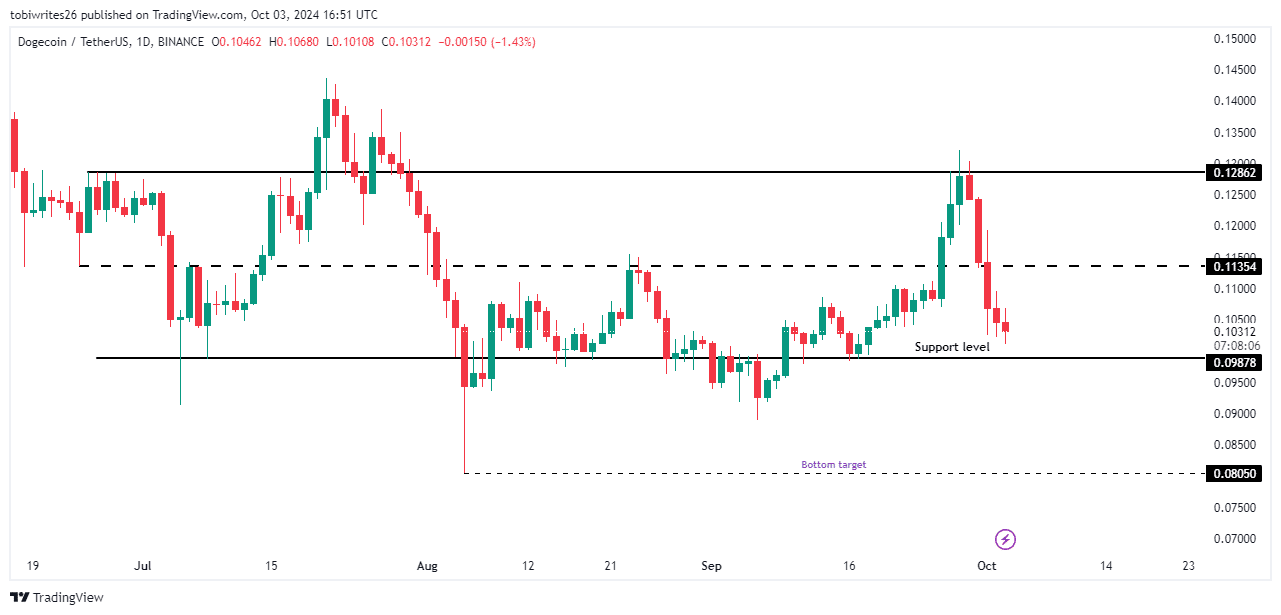

As I write this, Dogecoin appeared to be aiming for two significant price levels according to chart analysis, as it failed to surpass the resistance of 0.12862 during its price range.

It seems quite possible that Dogecoin (DOGE) could return to its support level of 0.09878 in the near future. Yet, it’s also important to note that there’s a significant probability that DOGE might drop below this support, potentially leading to a further decrease.

As an analyst, based on current on-chain indicators and market trends, a potential downward shift for DOGE could take it to around $0.08050. If bearish sentiments among traders persist, further declines might ensue.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- WCT PREDICTION. WCT cryptocurrency

2024-10-04 09:11