- Dogecoin’s long liquidations totalled $16 million on 12 April

- Bearish sentiments continue to trail the memecoin

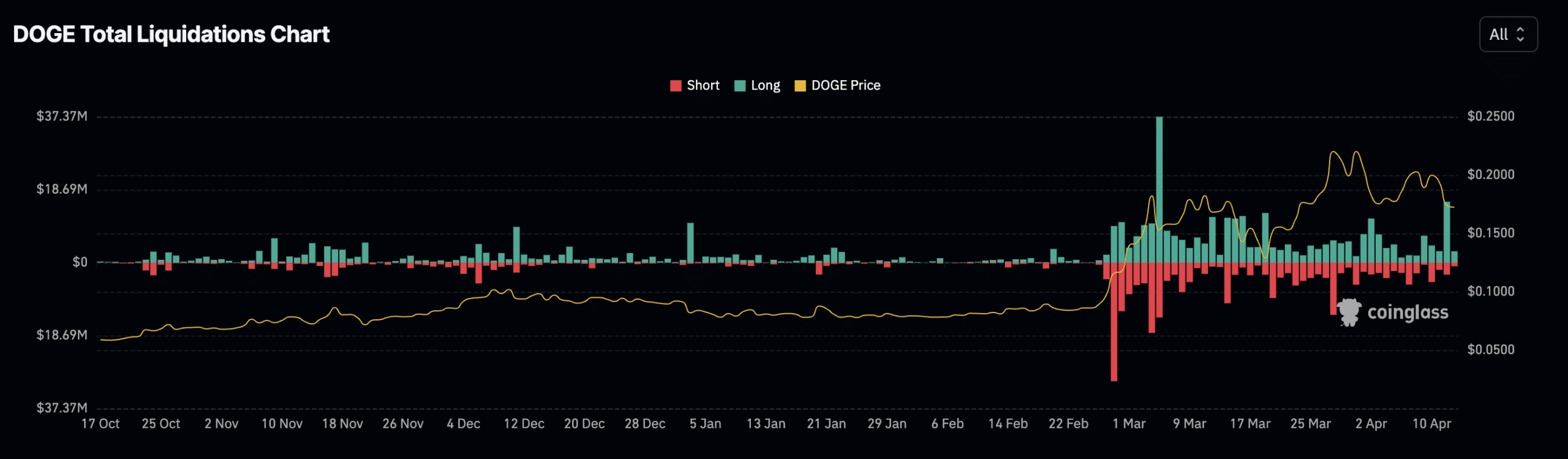

Over the past 24 hours, the number of Dogecoin’s [DOGE] open positions with large losses reached a 30-day peak, as reported by Coinglass. This occurred during a broader market downturn following Bitcoin‘s price decrease on the charts. In total, over $860 million in cryptocurrency trading positions were liquidated among approximately 271,000 traders.

Data from the blockchain showed that a total of $16 million worth of DOGE positions were liquidated due to being underwater (unprofitable) in the cryptocurrency’s Futures market. The last instance of this magnitude occurred on 6 March.

In simple terms, a liquidation in the Futures market refers to the forcible closure of a trader’s position due to insufficient funds. This typically happens when prices unexpectedly drop for long positions, compelling traders who had bet on a price increase to sell their assets.

On that specific day, the total value of DOGE short positions being liquidated came up to $3.08 million according to Coinglass’s statistics.

Brace for further value decline

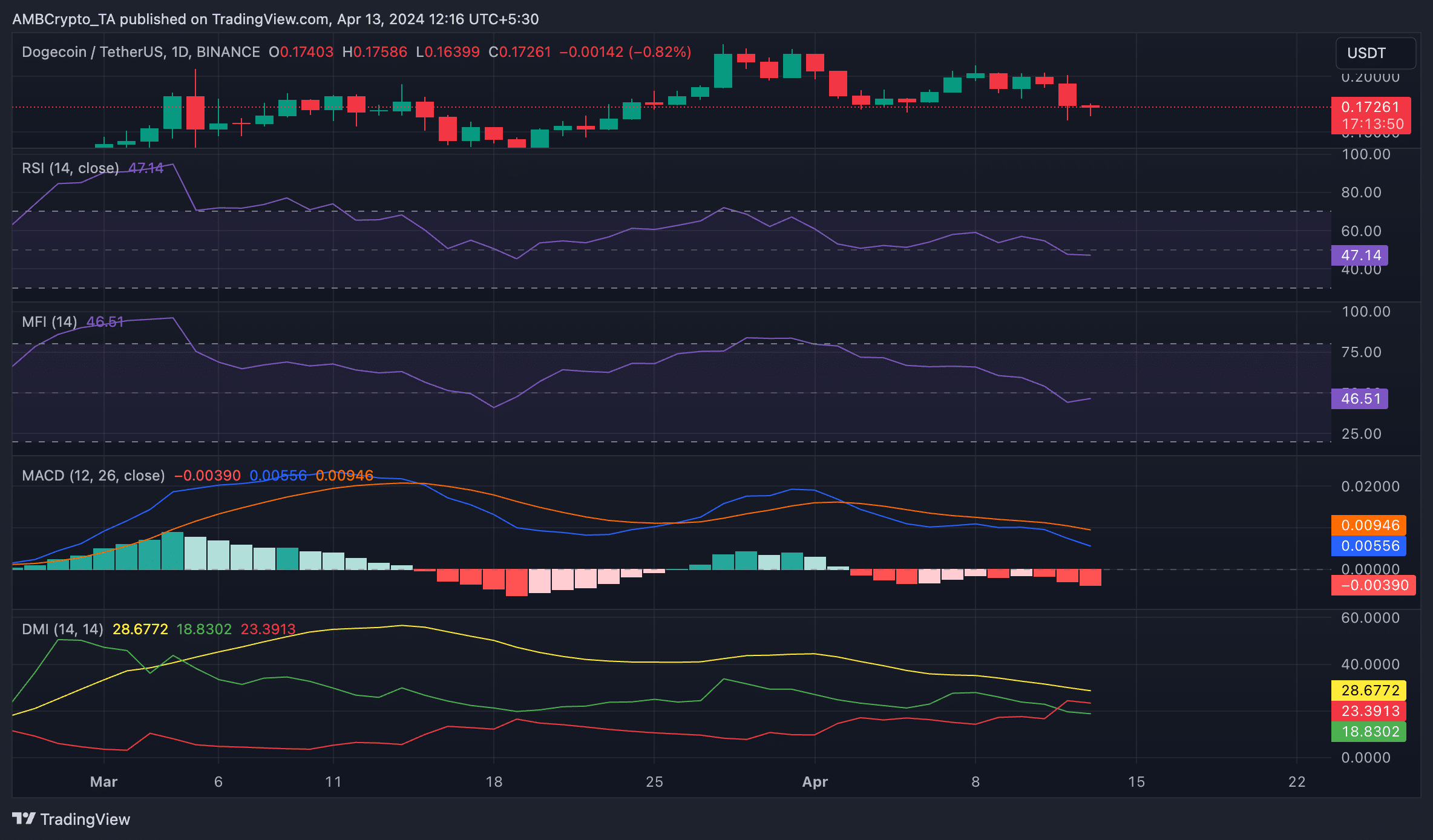

In the past day, DOGE‘s price has dropped an additional 13%, bringing its total weekly loss to 19% based on data from CoinMarketCap. At this moment, the popular memecoin is priced at $0.1721 according to market charts.

Examining the 1-day chart for the altcoin, it appears that further price drops could occur this weekend based on its recent trend. The canine-themed token, DOGE, seems to be experiencing decreasing demand as suggested by key momentum indicators.

The RSI and MFI readings of this altcoin were 46.85 and 46.53 respectively, signaling a decrease in investor interest and an increase in selling activity among market participants.

Realistic or not, here’s DOGE’s market cap in BTC’s terms

On April 12th, the Directional Movement Index (DMI) readings for the coin indicated that its positive directional index (represented by green) dropped below its negative index (represented by red). This occurrence suggests a change from bullish to bearish sentiment. It’s a warning sign of bears re-emerging and an increase in profit-taking actions.

At present, the MACD line of DOGE sits above its Signal line, suggesting that DOGE’s short-term moving average is currently greater than its long-term moving average. This alignment indicates a potential bullish trend for DOGE.

If these lines are organized in this way, it’s interpreted as a warning to increase the selling of Dogecoins. Therefore, it may become challenging for Dogecoin holders.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-04-14 07:03