- DOGE’s bearish thesis will only hold if it closes a daily candle below the $0.30 level.

- Currently, 58.3% of top DOGE traders hold short positions.

As an analyst with over two decades of experience in the financial markets, I have seen my fair share of bull and bear cycles. The current price action of Dogecoin [DOGE] is giving me a sense of déjà vu, as it mirrors similar market conditions that preceded significant corrections in the past.

In simpler terms, the well-known and widely used digital currency based on internet memes, Dogecoin (DOGE), seems likely to experience a substantial drop in value due to its formation of a bearish trend in its price movement.

On the 26th of last month, I witnessed a significant drop in the prices across the crypto market, which includes Bitcoin [BTC], Ethereum [ETH], and XRP. This event has noticeably altered the market mood, nudging it towards a bearish trend.

Evidence indicates that the primary elements sustaining a negative trend for Dogecoin (DOGE) at present are predominantly the broader market’s pessimistic attitude, active selling from traders, and downward price movements.

Dogecoin technical analysis and key level

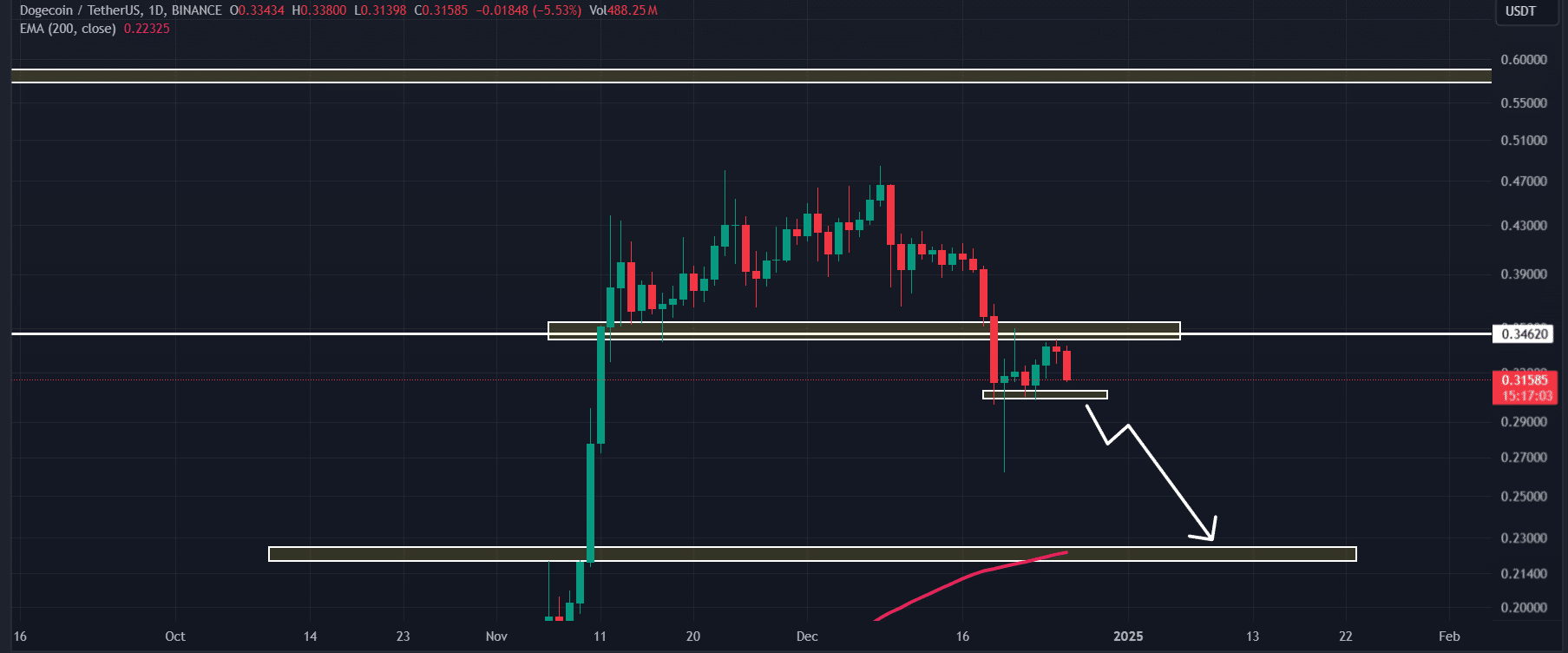

Based on AMBCrypto’s technical assessment, Dogecoin (DOGE) appears ready to break away from a compact holding area. This area was established following its inability to maintain the $0.35 support line.

Due to the recent drop in value, the memecoin is now resting near the bottom limit of its holding range which is around $0.30.

According to technical analysis, if Dogecoin (DOGE) can’t sustain its current lower limit and ends the day trading under $0.30, it’s likely we might see a drop of around 25%. This could potentially push the meme coin down to approximately $0.22.

Dogecoin’s bearish prediction will be validated if its daily closing price falls below $0.30; otherwise, it might not materialize.

DOGE’s bearish on-chain metrics

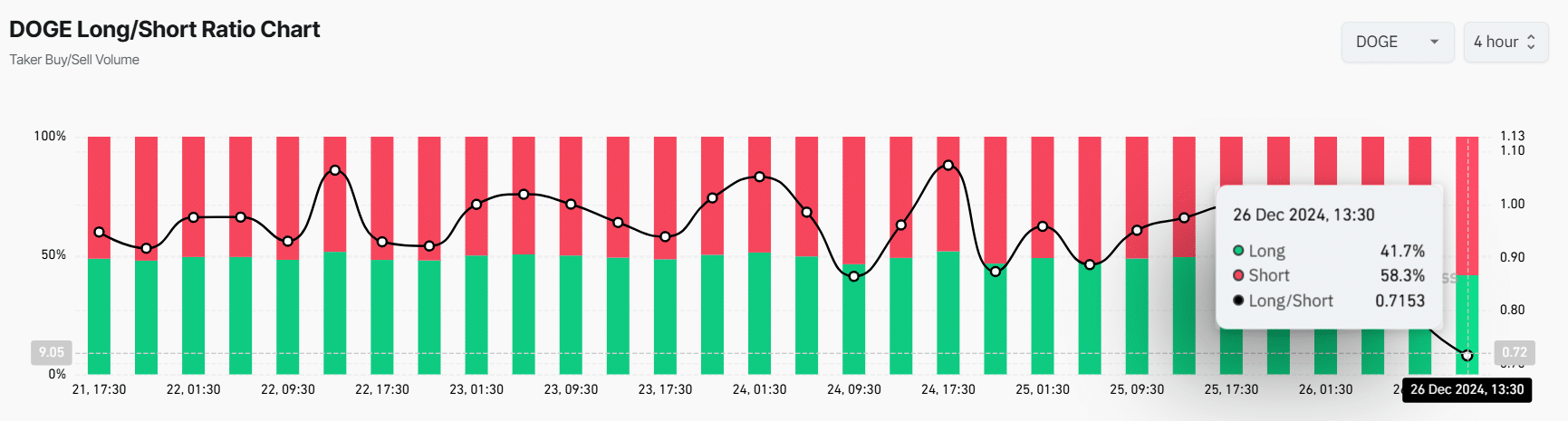

The recent downward trend in the market has noticeably altered the attitude of traders towards Dogecoin (DOGE). As reported by the analytics company Coinglass, the Long/Short Ratio for DOGE stood at 0.71 as of the latest update, which is the lowest it’s been since early December 2024.

A ratio less than one suggests a significant bearish outlook among traders in the market. Notably, about 58.3% of prominent Dogecoin traders were holding short positions, as opposed to 41.7% who had long positions at that particular time.

Alongside negative sentiment among traders, it seems that long-term investors are buying up this asset off exchanges, according to information provided by Coinglass.

The data on DOGE’s exchange transactions shows that approximately $32.75 million worth of DOGE has been taken out of the exchanges.

This significant release implies a favorable purchasing point, hinting at possible upward growth in the future.

Read Dogecoin’s [DOGE] Price Prediction 2024–2025

Current price momentum

Currently, Dogecoin (DOGE) is being exchanged around $0.315, showing a drop of more than 6.89% in its value over the last day.

Over that time frame, there’s been a 13% decrease in trading activity, suggesting less involvement from dealers and financiers due to apprehensions about a possible drop in prices.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-12-27 01:11