- Dogecoin has a bullish market structure and could climb higher next week.

- The metrics and the trading volume were not wholly supportive of the bullish bias.

As a seasoned crypto investor with several years of experience under my belt, I have learned to read between the lines when analyzing market structures and trends. And based on my analysis of Dogecoin (DOGE), here’s my take:

The price action of Dogecoin [DOGE] suggested a falling wedge formation, indicating a possible bullish reversal was imminent. However, some market analysts argued that this bullish trend may have already begun, with the breakout from the pattern having already taken place.

In either case, the price has stalled over the past week and wiped out some of the earlier gains.

In spite of this, the chart displayed a resilient bullish trend on a daily basis. However, the situation was more complex than it appeared, and the bulls faced considerable hurdles in the near future.

The first of many is the volume

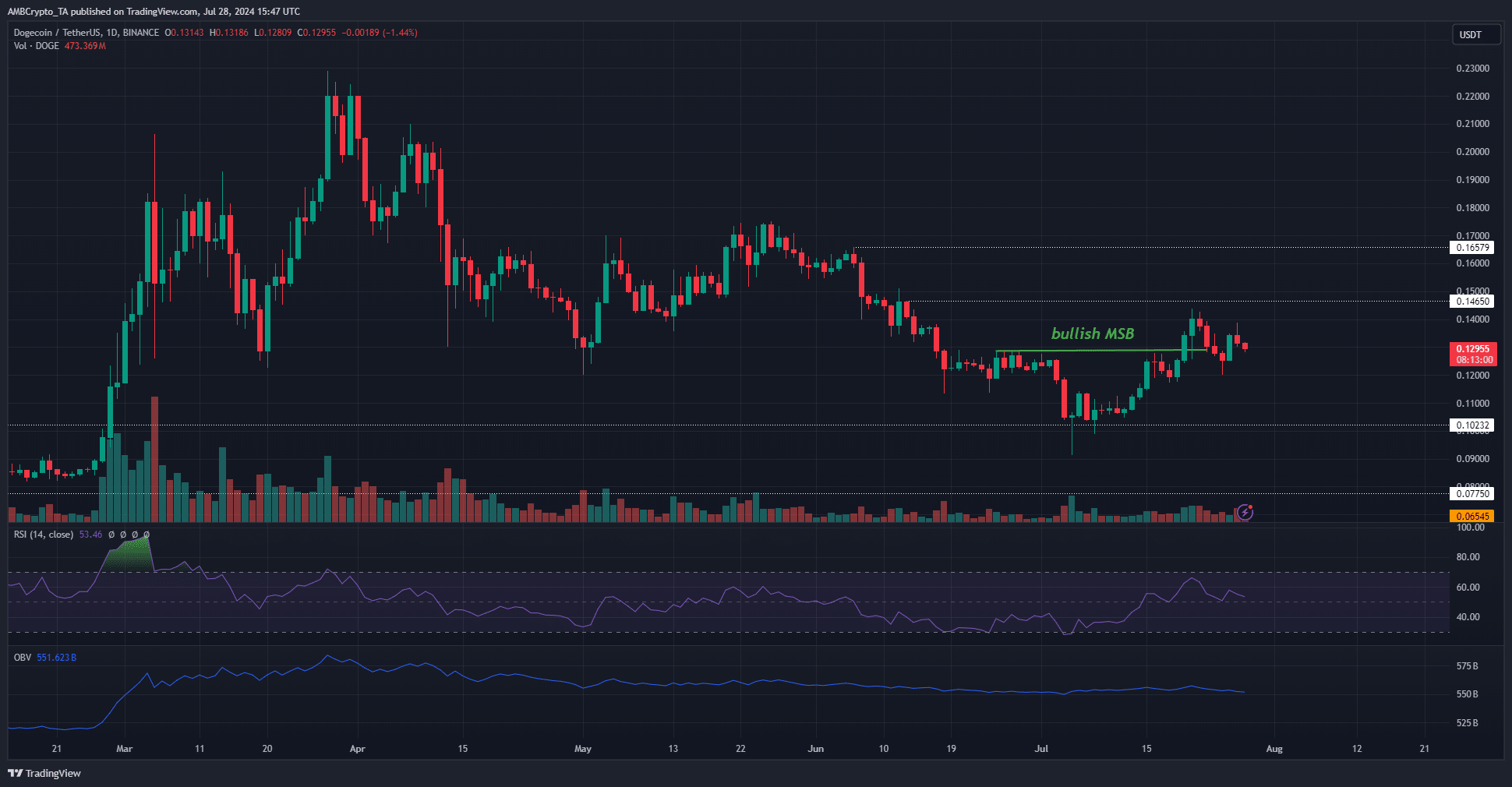

After the market structure shifted earlier this month, the bullish trend remained intact for the meme coin. No new lows have been reached since then, and the Relative Strength Index (RSI) has stayed above the neutral threshold of 50, albeit narrowly.

Together they showed that the bulls still have a chance of pushing prices higher.

Despite a noticeable lack of trading activity during July, the price increases towards the middle of the month failed to generate significant optimism among buyers.

In July, the OBV showed a subdued rebound, while more recently, it has once again started to decline.

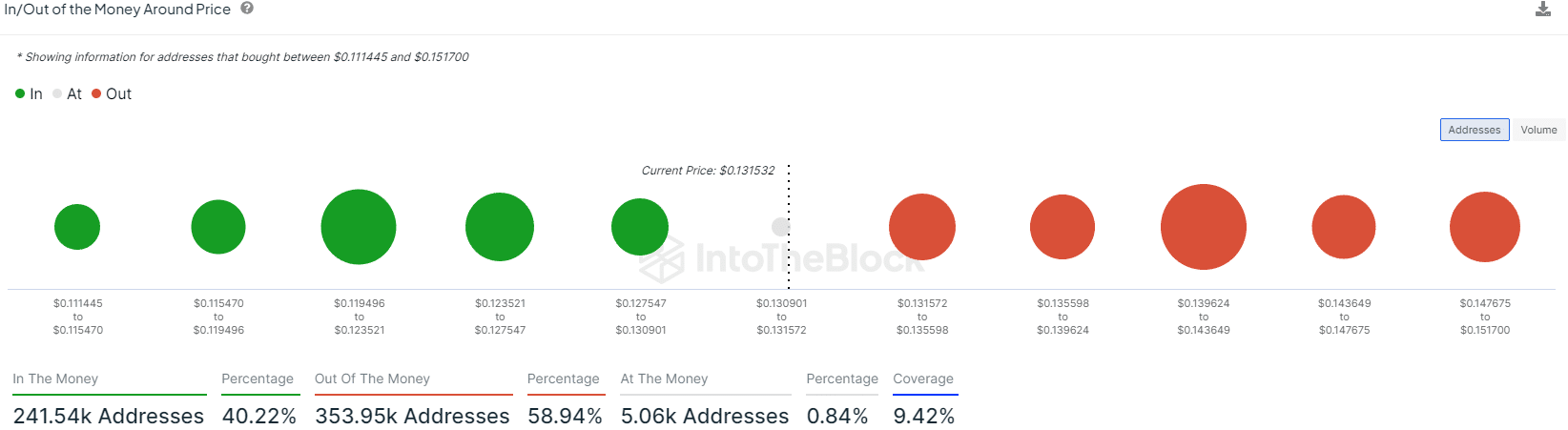

The area between $0.119 and $0.123 serves as the most significant support in the vicinity, while the resistance lies within $0.139 and $0.143. A potential revisit of the $0.12 support could be imminent, offering a prospective buying chance based on the bullish trend observed on the daily chart.

Dogecoin is still undervalued- should you buy it?

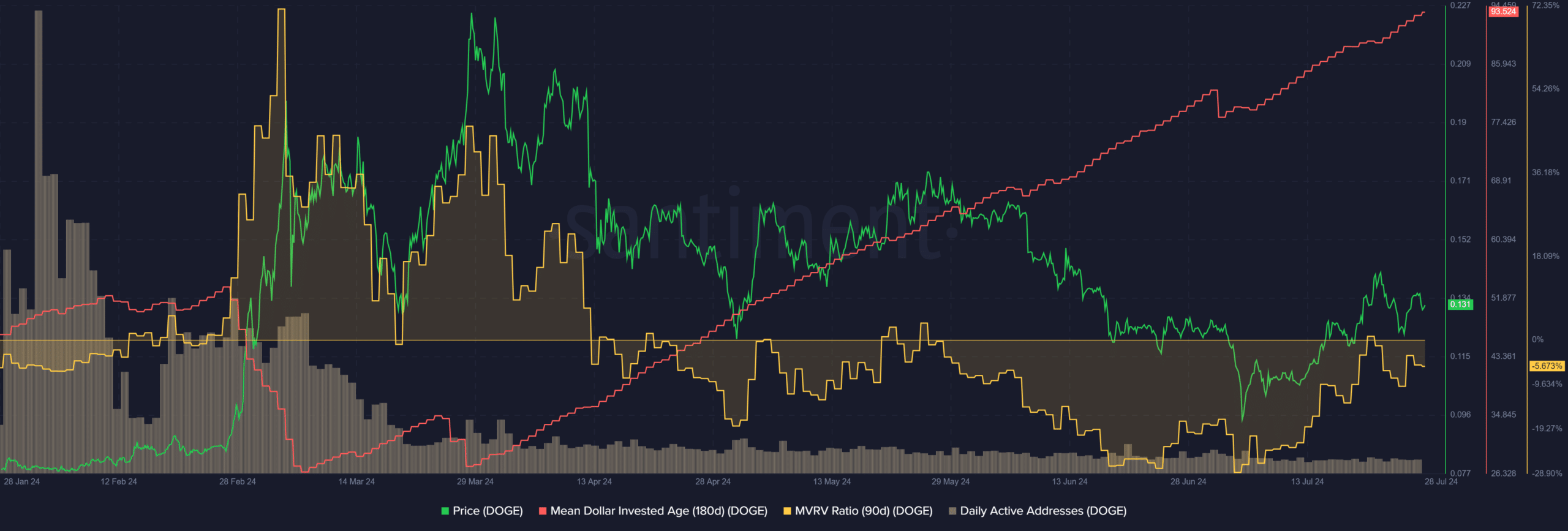

The average age at which a dollar was invested kept climbing upward. This implied that investments were becoming less dynamic, with people holding onto their money for longer periods instead of putting it to work.

Generally, a dip in the MDIA coincides with a strong uptrend, as we saw in late February.

As a researcher, I discovered that based on the 90-day Moving Average to Realized Value Ratio (MVRV), Dogecoin (DOGE) appeared to be undervalued despite its recent price bounce. This finding was uplifting as it decreased the probability of a significant wave of selling by profit-takers, thereby potentially maintaining the current market trend.

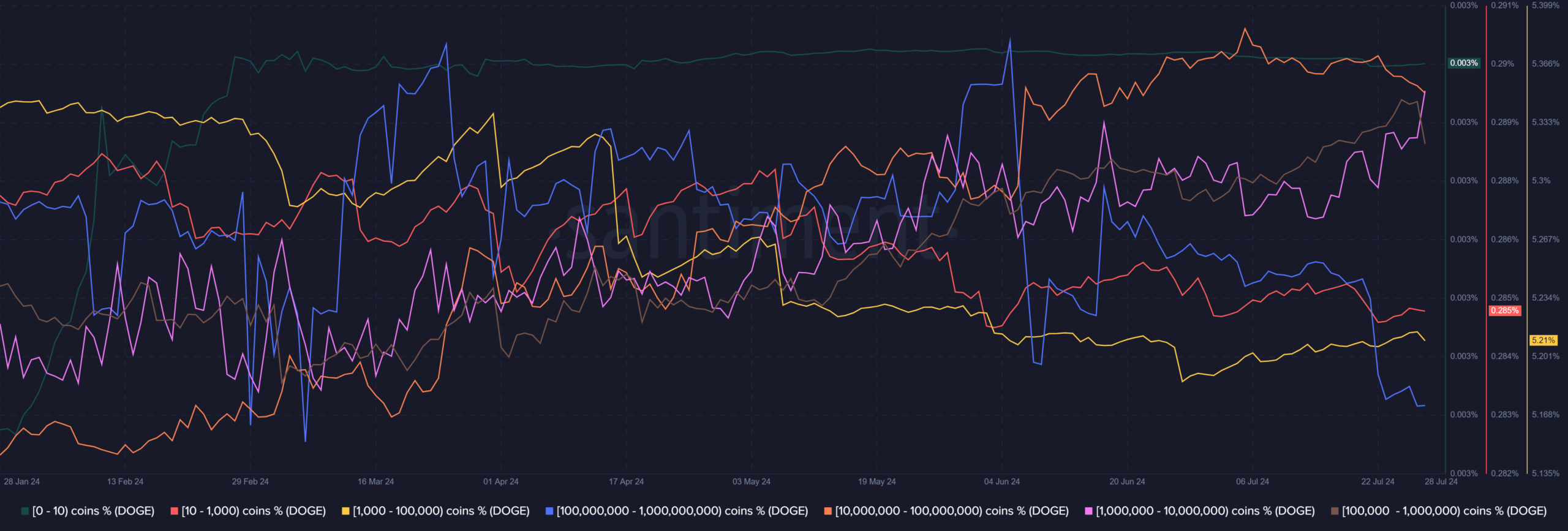

As a researcher studying cryptocurrency trends, I’ve come across intriguing data regarding the 10 million to one billion Dogecoin (DOGE) holders, represented by the blue and orange bars on the chart. These investors had amassed significant DOGE holdings as early as July. However, a shift in sentiment became apparent soon after, as they started to sell off their coins in large quantities. This mass exodus suggests a dwindling confidence or faith in the Dogecoin token among these major investors.

Read Dogecoin’s [DOGE] Price Prediction 2024-25

The concurrent occurrence of whale sales and insufficient trading activity made it unlikely for a robust price surge.

In current market circumstances, a pullback in Bitcoin (BTC) could have a significant effect on investor sentiment due to the strong positive correlation between Bitcoin and Dogecoin (DOGE), which was recently measured at +0.95.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Elden Ring Nightreign Recluse guide and abilities explained

2024-07-29 09:01