- Whale activity and technical indicators hint at a potential bullish move for Dogecoin.

- Rising active addresses and a slight bullish market sentiment support an upward price shift.

As a seasoned crypto investor with battle-scarred fingers from the 2017 bull run and the subsequent bear market, I’ve learned to read between the lines and decipher the subtle signs that the market gives us. The recent whale activity surrounding Dogecoin has me intrigued, as it often serves as a precursor to significant market shifts. However, I’m not one to jump into action without considering all factors.

Approximately 800 million Dogecoin tokens, valued at around $323 million, have been transferred between unidentified wallets, causing a buzz in the crypto community. As reported by Whale Alerts on platform X (previously Twitter), these large transactions often indicate significant changes in market dynamics.

As of the current news update, Dogecoin [DOGE] is being exchanged at $0.4067, marking a 0.57% increase over the past 24 hours. Yet, it’s worth pondering: Could this whale activity be an indication of an impending bullish surge, or merely a regular transaction from significant investors?

Is DOGE poised for a bullish move?

Examining its technical signals, Dogecoin seems to be displaying some optimistic trends, but it’s essential to remain vigilant. The Relative Strength Index (RSI) is presently at 68.22, slightly below the overextended threshold of 70.

It seems like Dogecoin might be quite robust, yet it’s getting close to being overbought. If purchasing momentum slows down, there may be a temporary dip coming soon.

From my perspective as an analyst, it’s worth noting that the 9-Exponential Moving Average (EMA) currently sits above the 21-EMA, suggesting a bullish signal for short-term momentum. Yet, we haven’t witnessed a confirmed crossover event yet. This implies that traders are cautiously observing, waiting for this confirmation before fully jumping on the bandwagon of a potential breakout.

Therefore, while the technical setup is encouraging, the market remains cautious.

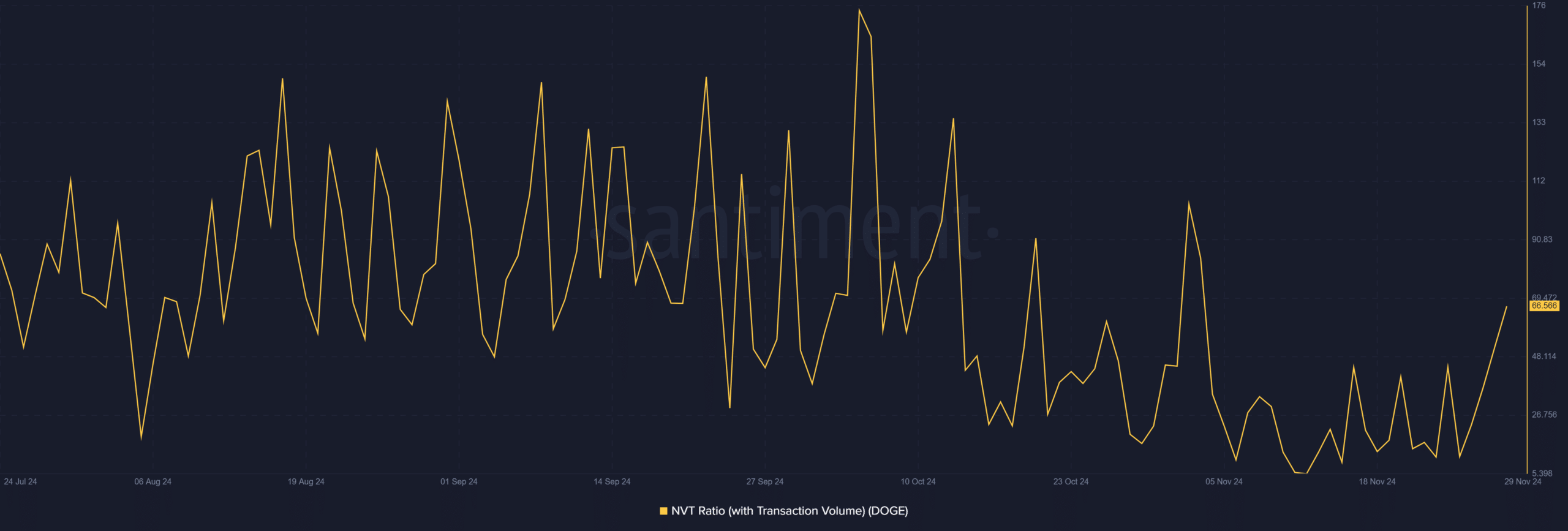

DOGE NVT ratio: Is market activity building?

Over the last 24 hours, the Network Value to Transactions (NVT) ratio for Dogecoin has gone up from 51.93 to 66.57. This rise indicates a higher transaction volume compared to Dogecoin’s current market capitalization, often signaling an increase in overall market activity.

In many cases, a higher Network Value to Transaction (NVT) ratio tends to coincide with rising prices because it indicates greater influx of capital into the system. Yet, as the increase in NVT isn’t particularly substantial at this point, investors might want to hold off on anticipating a major price change until they observe more consistent growth in transaction volume instead.

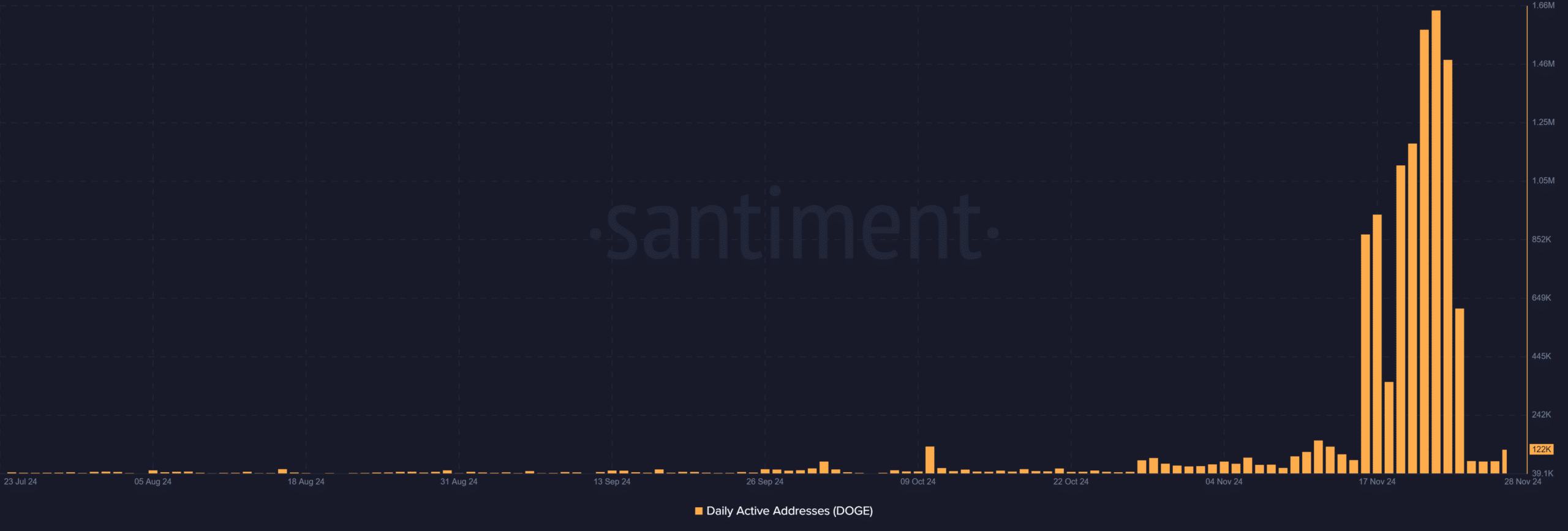

Surge in active addresses: What does it mean?

Furthermore, there was a significant jump in the number of daily active Dogecoin addresses, rising from approximately 82,700 to 122,840 within a single day. This represents a substantial 48% increase. This notable upsurge indicates a heightened level of user interaction with the network, which is typically considered a positive sign.

A rise in the number of actively used addresses might suggest heightened investor enthusiasm, potentially leading to a surge in the coin’s value. Consequently, an uptick in active addresses could be interpreted as a sign that Dogecoin is experiencing increased interest from investors.

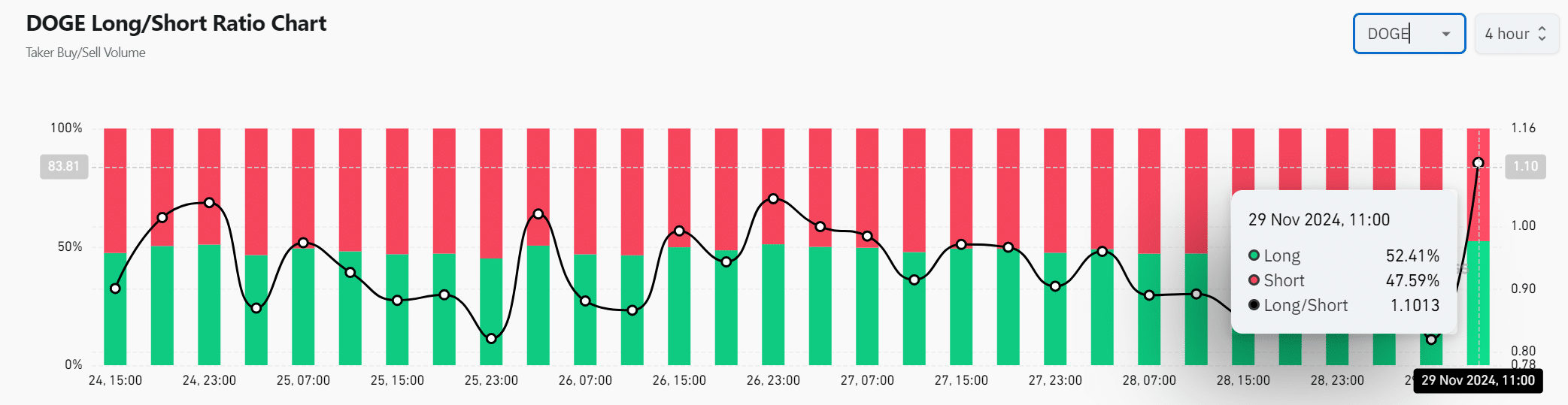

Market sentiment: Bulls slightly ahead

At the moment, approximately 52.41% of Dogecoin (DOGE) traders are going long, while around 47.59% are short-selling. This results in a long/short ratio of about 1.1013, indicating a slight tilt towards bullish sentiment. Essentially, more traders seem to be wagering on an increase in DOGE’s price.

On the other hand, a tight balance suggests that the market is still undecided, as neither the optimists nor the pessimists have received strong enough indications to act decisively.

Is a breakout imminent?

As increased whale activity, higher transaction volumes, and more active addresses hint at a potential bullish trend for Dogecoin, conflicting technical indicators urge careful consideration.

In simpler terms, the market is currently holding steady, so it’s best for traders to wait for additional signs before deciding to invest during a potential surge or drop.

Consequently, although there’s room for growth, the next significant step for Dogecoin will be influenced by consistent momentum and more definitive market indicators.

Read More

2024-11-30 04:08