- Dogecoin’s selling pressure was weak and the $0.35 demand zone might not be breached soon

- The consolidation around $0.35-$0.45 could give DOGE bulls strength to drive the next rally in the coming weeks

As a seasoned analyst with years of experience navigating the crypto market, I find myself intrigued by Dogecoin’s current situation. The double bottom pattern suggests a potential rally, yet the technical indicators hint at a temporary consolidation.

It appears that Dogecoin’s [DOGE] price chart shows a double bottom pattern, indicating a potential significant surge could be imminent. Yet, it’s also worth noting that based on technical indicators and market conditions, there might be a temporary period of sideways movement or range formation ahead.

Which way will the leading memecoin run in?

Dogecoin defends local demand zone

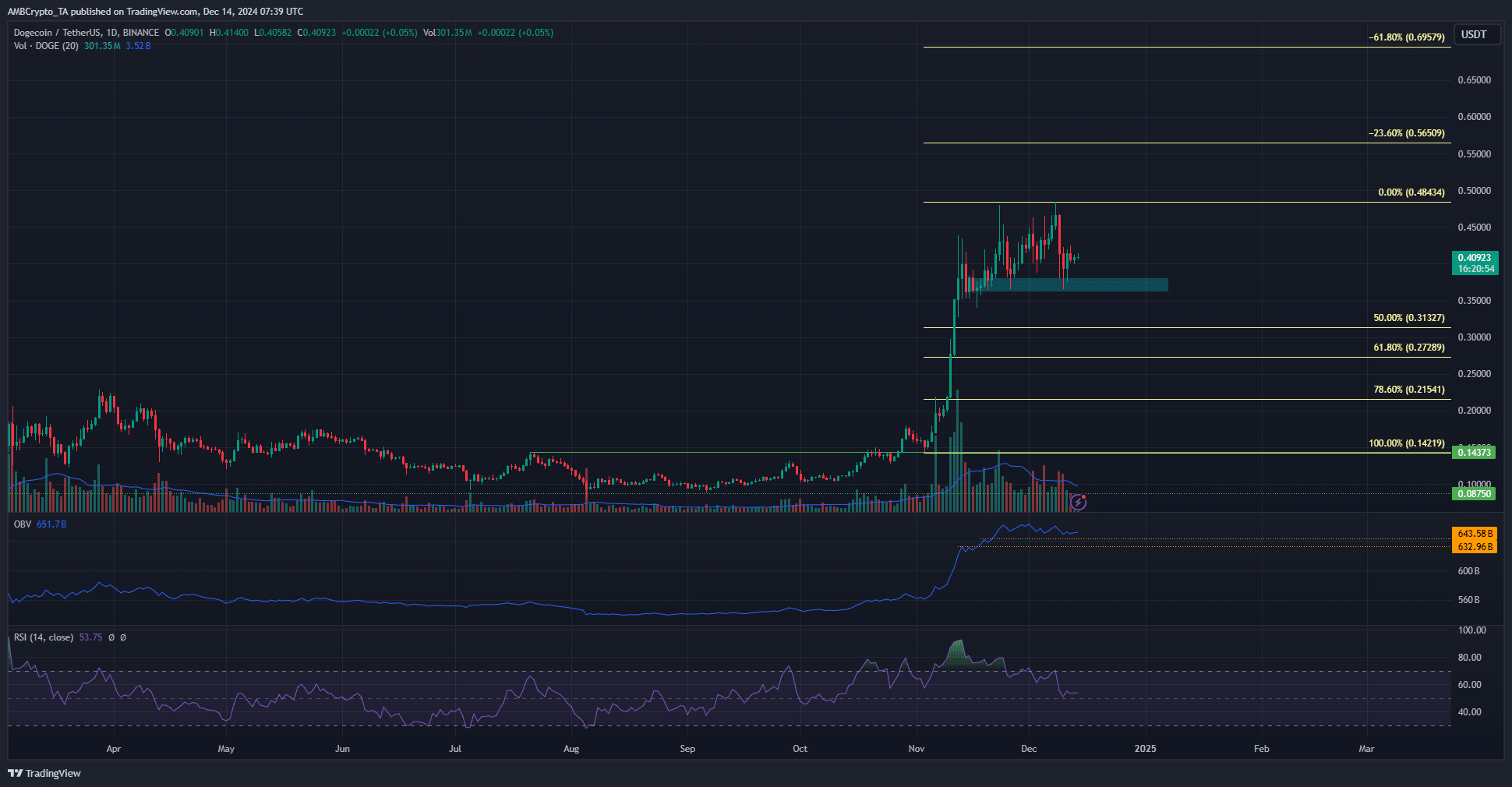

In November, a series of Fibonacci retracement and extension lines were drawn based on the upward trend that occurred. The $0.143 level, which was a high point in July, was utilized because it had been reversed to serve as support. Below the local demand area ranging from $0.36 to $0.38, the $0.272 and $0.215 levels were emphasized as significant areas of potential reinforcement.

At present, it seems unlikely that Doge will drop to such lows in the near future due to its current momentum. The Relative Strength Index (RSI) dipped to 53, indicating a decrease in bullish pressure on the daily chart. However, it remains above the neutral 50 mark, suggesting that buyers are still dominating the market.

In simpler terms, during its climb in November, Dogecoin (DOGE) surpassed previous highs, and the On-Balance Volume (OBV) was above these peaks. If the OBV subsequently drops below significant levels, it might suggest a bearish outlook. Currently, the data suggests that selling pressure is somewhat low.

Liquidation heatmap showed momentum is likely to remain neutral

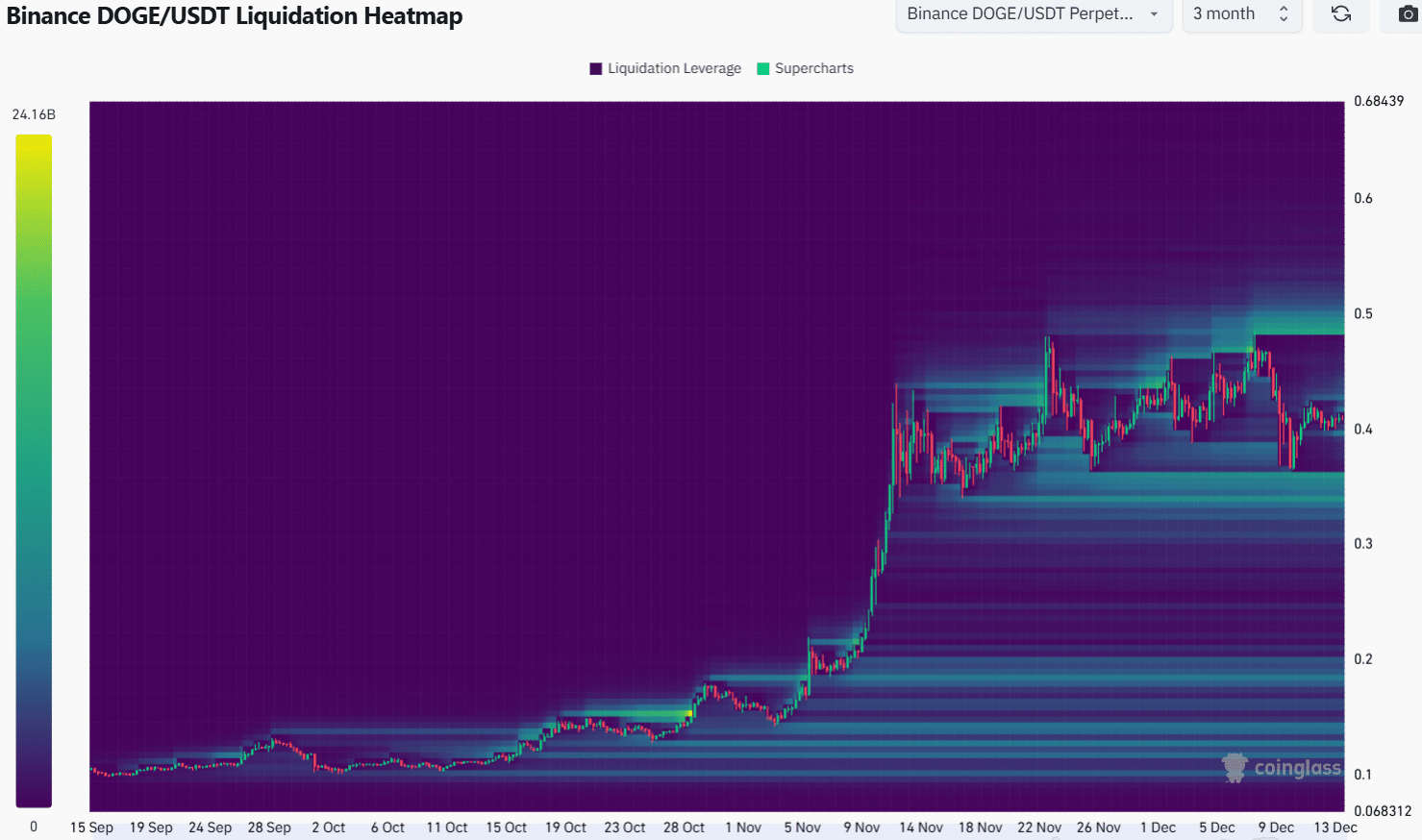

Over the past three months, we’ve seen a concentration of selling points at roughly $0.485 and $0.355. The lower one, which aligns with the local area of increased demand, might be revisited in the near future – possibly within the next few days or weeks.

Moving further south, there was an accumulation of liquidity at the price point of $0.34. Such liquid pools might draw prices downwards.

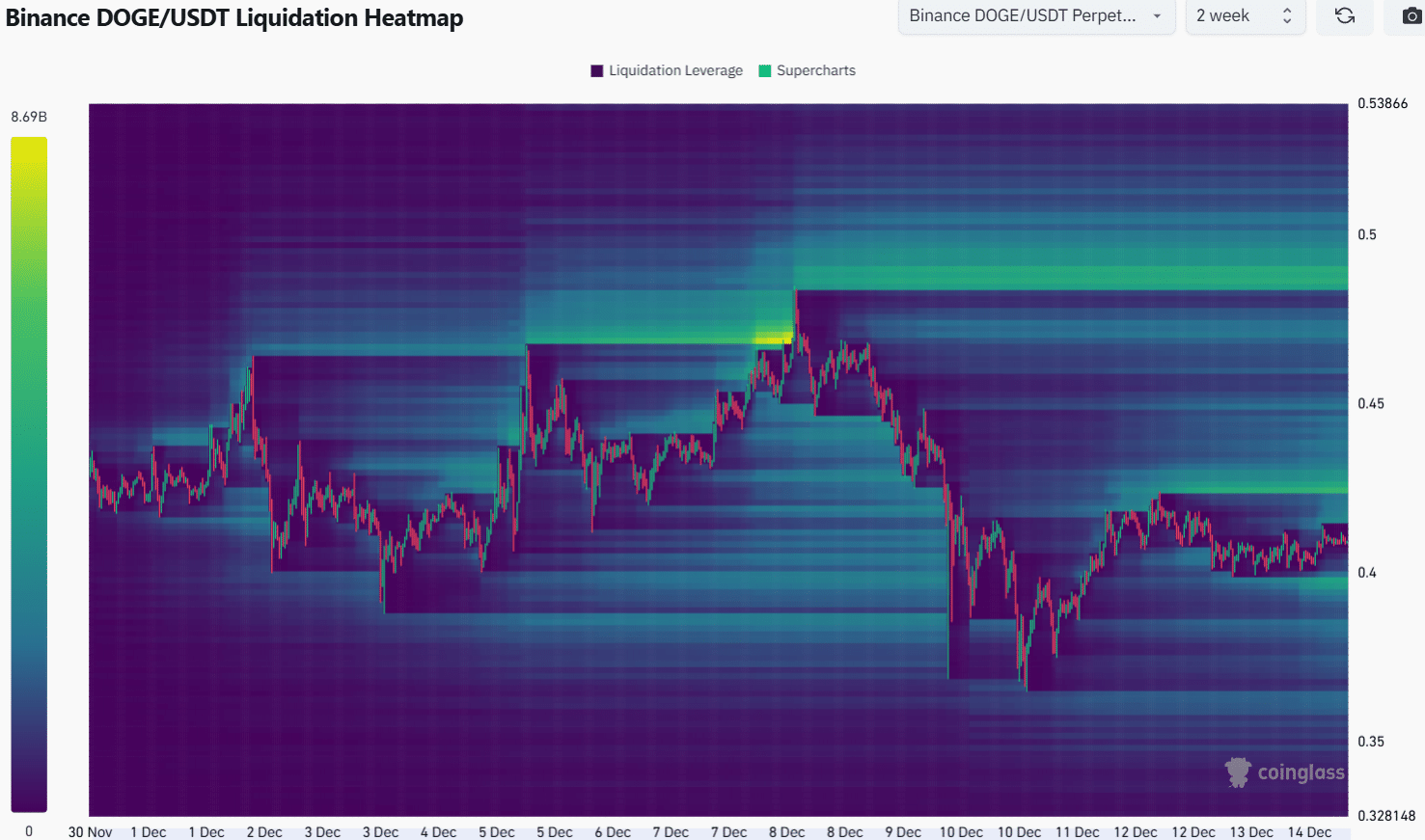

Looking closely at the liquidation map, it’s evident that the $0.395 and $0.425 prices have a significant amount of liquidity. With no clear trend on the daily chart and a standoff between buyers and sellers, there’s a chance Dogecoin could establish a temporary price range in the short term.

Realistic or not, here’s DOGE’s market cap in BTC’s terms

As an analyst, I am anticipating that if the price surpasses $0.43 in the near future, it might be an early indication that we are headed towards retesting the $0.5-level soon. Conversely, a dip below $0.395 and $0.355 could potentially signal a significant and prolonged correction for DOGE.

Read More

2024-12-14 19:03