- Dogecoin’s price dropped by over 7% over the past week

- Sings of a trend reversal can be clearly seen though

As a researcher with a background in cryptocurrency analysis, I’ve seen my fair share of market ups and downs. And the recent trend with Dogecoin [DOGE] has been particularly challenging for investors. After observing the data from various reliable sources, it seems that while DOGE’s price did drop by over 7% in the past week, there are signs of a possible trend reversal on the horizon.

Investors holding Dogecoin (DOGE) have faced challenges recently, exacerbated by numerous price downturns in the coin’s market performance. The situation may grow more complex as certain data indicators hint at a potential prolonged recovery period for DOGE to rebound.

Let’s have a closer look at what’s going on.

Dogecoin investors under pressure

According to data from CoinMarketCap, the price of the most popular memecoin in the world experienced a significant decrease, dropping by more than 7% in just the last week. In addition, within the previous 24 hours, the memecoin’s price suffered an additional decline of over 4%. Currently, DOGE is being traded at $0.1363 and boasts a market capitalization surpassing $19.7 billion.

Based on recent price drops, approximately 23% of Dogecoin (DOGE) investors have experienced a loss on their investments, as per IntoTheBlock’s latest data.

Recently, well-known crypto analyst KNIGHT $INJ shared that the price of the memecoin is currently in its accumulation stage. This implies that there may be a few more weeks of gradual progression before the coin moves onto the next phase. However, following this phase, investors could potentially experience a significant price increase.

Based on this analysis, a surge past the accumulation level could potentially take Dogecoin to reach a price of $1.

Volatility might increase sooner

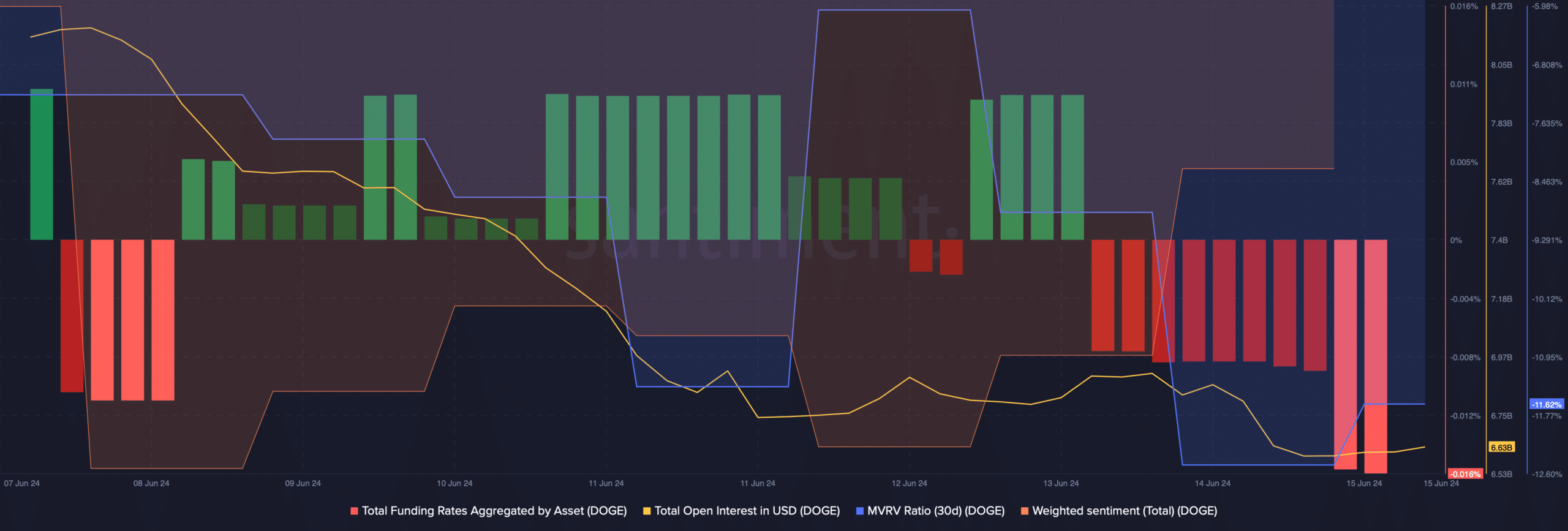

Based on the previous evaluation, it appeared that the market was experiencing some sluggish activity. However, upon examining Santiment’s data as an analyst with AMBCrypto, I discovered potential signs of an impending bullish trend. For example, the funding rate for DOGE has noticeably decreased over the past few days. Historically, price movements tend to oppose funding rates, implying that a bull rally could be on the horizon.

As a researcher studying the cryptocurrency market, I’ve observed that DOGE‘s open interest decreased in tandem with its price decline. This decrease is often an indicator that the current price trend may be coming to an end soon. Moreover, DOGE’s MVRV ratio exhibited a slight improvement on June 15, suggesting a potential reversal of the trend.

In addition to this, the sentiment analysis graph for Dogecoin shows an uptick – Indicating that positive attitudes toward the cryptocurrency are more prevalent than negative ones in the market at present.

Like the aforementioned metrics, a few of the market indicators also looked pretty optimistic.

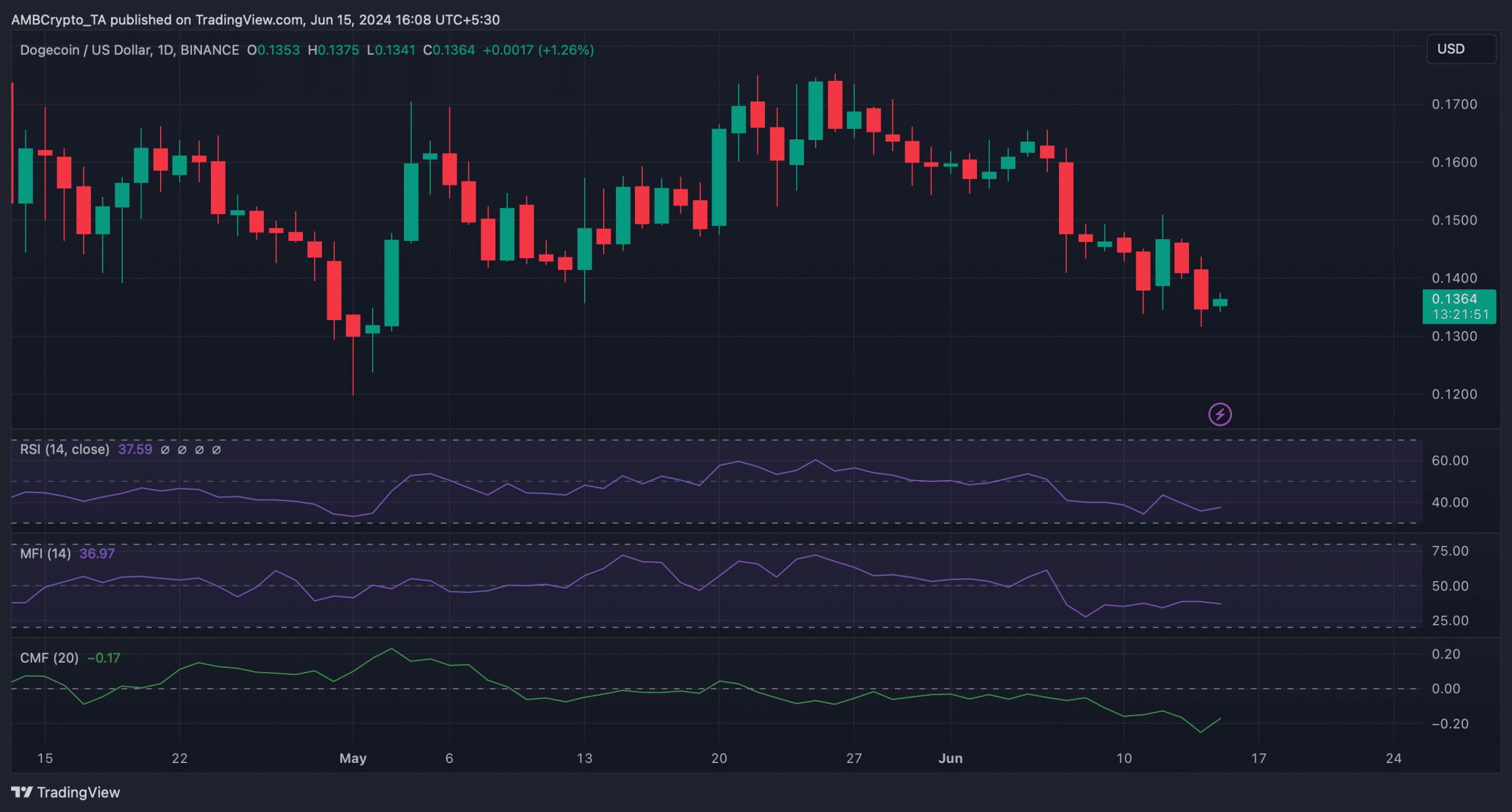

The Chaikin Money Flow (CMF) and Relative Strength Index (RSI) indicators for DOGE have recently increased, signaling that a price rise may occur in the near future.

On the other hand, the Money Flow Index (MFI) remained bearish as it headed south on the charts.

Is your portfolio green? Check the Dogecoin Profit Calculator

After examining the data from Hyblock Capital, AMBCrypto found that a potential bullish trend for DOGE could initially push its price up to around $0.147, triggering increased liquidations in the process.

If DOGE manages to surpass that price point, it could potentially reach $0.15. However, if the downward trend persists, DOGE may fall back towards its support at around $0.131.

Read More

2024-06-16 08:07