-

DOGE up 15% on the weekly charts, but hit former Q3 support at $0.12

Miners held steady with their tokens and could offer DOGE more room to rally.

As a seasoned researcher with years of experience in the dynamic world of cryptocurrencies, I find myself intrigued by the recent developments in the Dogecoin [DOGE] market. The 15% weekly rally may seem modest compared to Shiba Inu’s [SHIB] 36%, but the potential for DOGE to catch up is quite promising.

On Thursdays trading session, Dogecoin [DOGE] appeared to be trailing behind Shiba Inu [SHIB], which led a powerful surge. Notably, Shiba Inu took the lead in weekly performance with a 36% increase, whereas Dogecoins gains were slightly less, amounting to only 15% over the same time frame.

Currently, there’s a possibility that DOGE might surge by as much as 33%, potentially matching SHIB‘s value. But, in order for this upward trend to continue, an obstacle needs to be overcome first.

Q3 support at $0.12

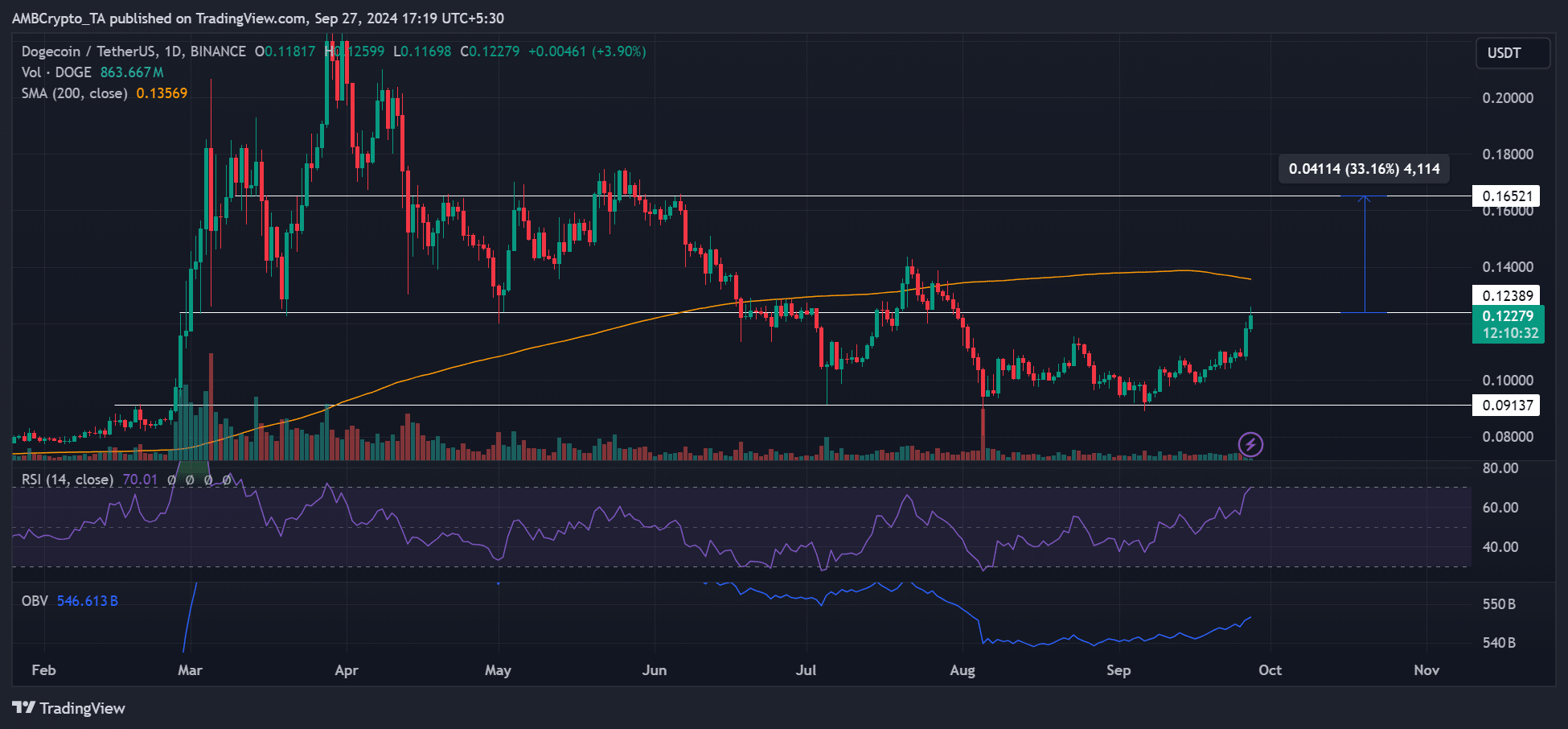

On a daily basis, Dogecoin (DOGE) recently tested its Q2 support at 0.12 USD. As of now, it has remained below this level since late July. Even though the meme coin didn’t experience an immediate surge after reclaiming the support in mid-July, regaining it could potentially steer it towards a target of 0.16 USD.

As an analyst, I find myself contemplating that if Dogecoin (DOGE) manages to push through to approximately $0.16, it could potentially yield a 33% growth for its bullish supporters. However, a noticeable hurdle lies at the 200-day moving average, currently hovering around $0.13. A robust surge beyond this moving average might propel Dogecoin’s upward momentum towards $0.16.

The increasing number of trades (OBV) and the Relative Strength Index suggest a significant demand for purchasing Dogecoin. This might help Dogecoin’s efforts to regain the support it had in Q2.

However, a price rejection at $0.12 would invalidate the bullish outlook.

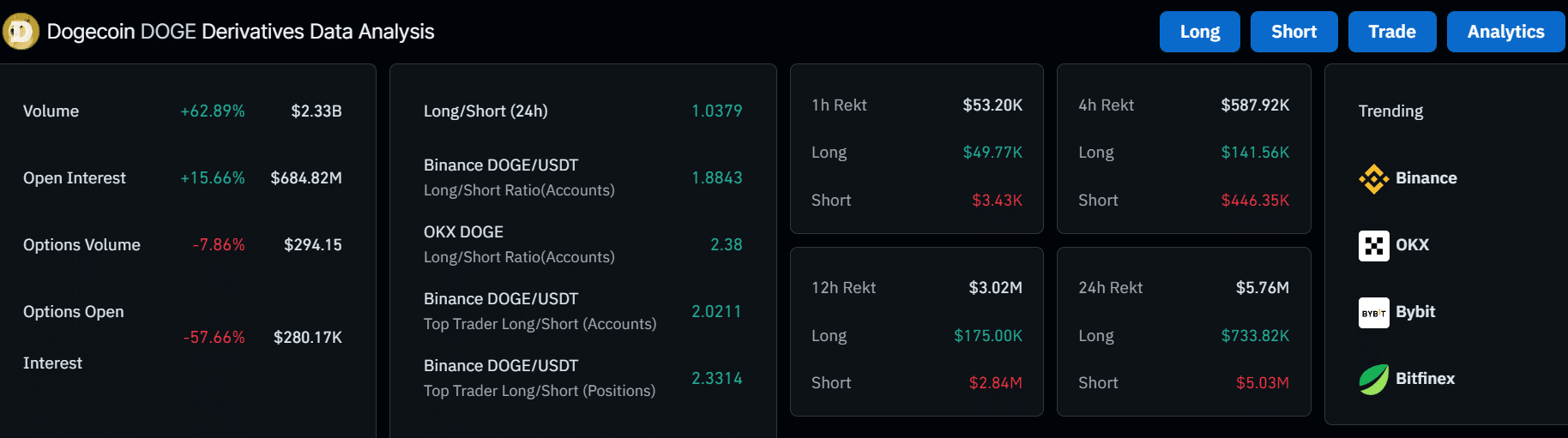

Short-sellers suffer $5 million loss

In summary, it appears that the futures market for DOGE showed a robust bullish trend. This is indicated by an increase in Open Interest (OI) and a significant number of short positions being closed out. In just the past day, approximately $5 million worth of these short positions were liquidated.

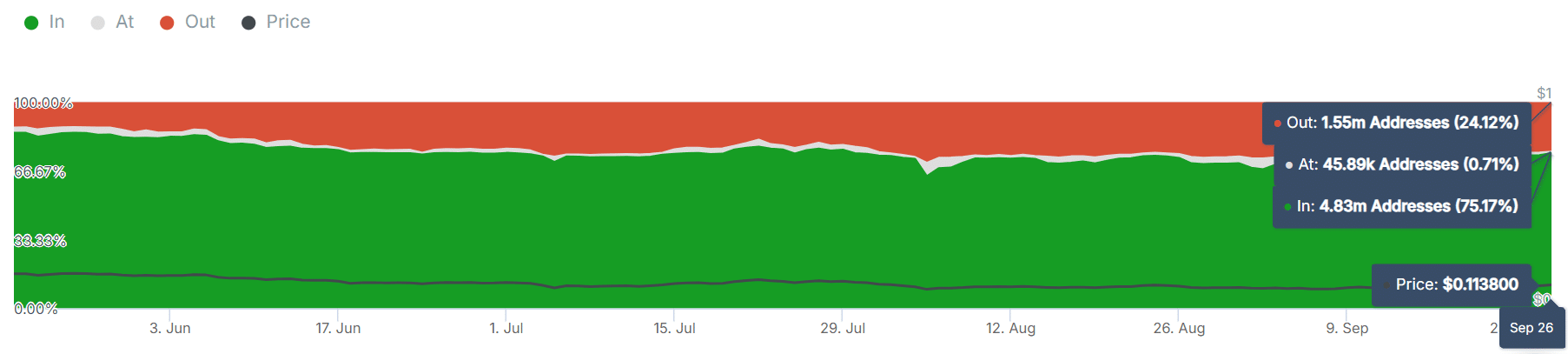

Consequently, the latest surge to $0.12 has put around 75% of Dogecoin holders in a position where they have potential profits. This might prompt them to cash out some of their gains at the resistance level of $0.12. If this happens, it could potentially disrupt the ongoing recovery process.

Read Dogecoin [DOGE] Price Prediction 2024-2025

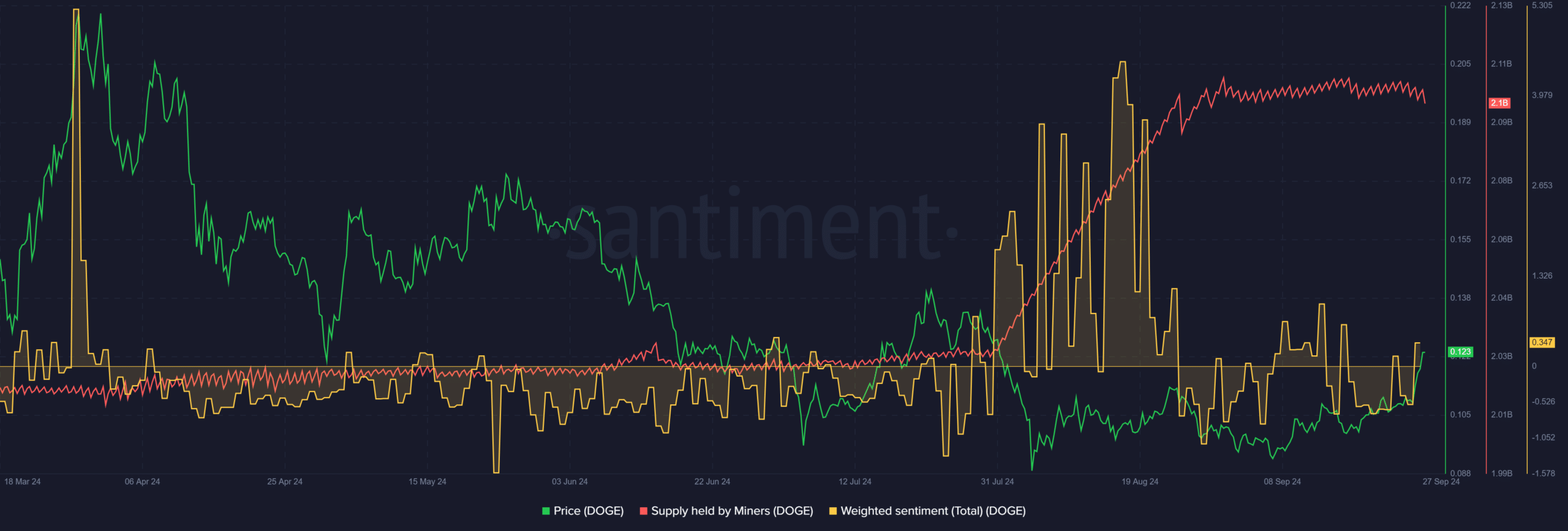

Instead, it’s worth noting that miners, a crucial factor in Doge’s supply, have maintained their hold on the tokens they’ve mined since August.

Indeed, starting from July, there was a noticeable increase in the rate at which they accumulated holdings, as evidenced by the surge in Miner’s Supply (represented in red). This decrease in supply pressure from miners might provide Dogecoin (DOGE) additional space to mount another rally.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-09-28 08:07