-

After falling below the $0.13 baseline, Dogecoin broke out of a bearish pattern on its daily chart

DOGE’s funding rate declined amid an increasing bearish edge

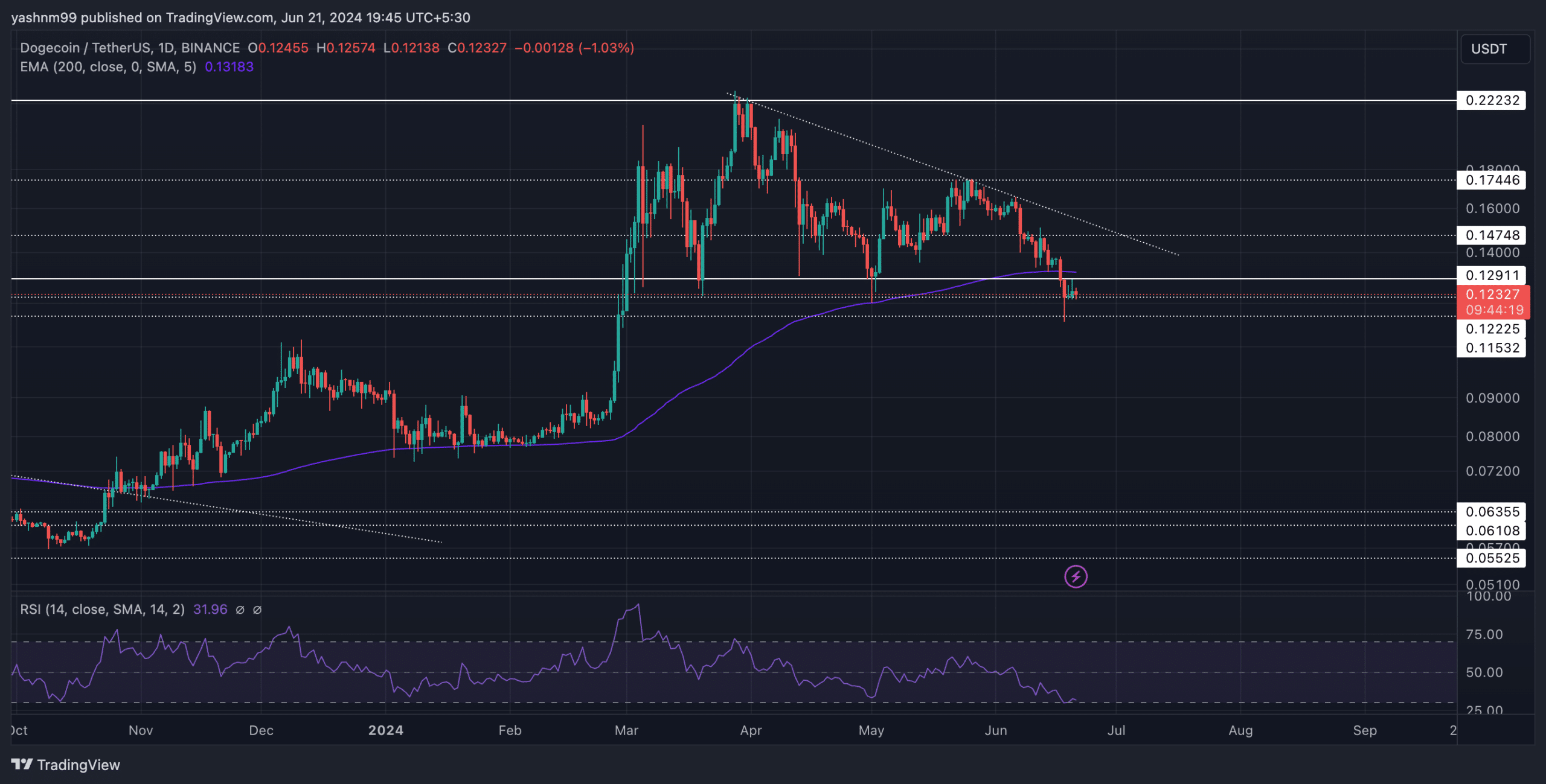

As a researcher with experience in cryptocurrency analysis, I’ve been closely monitoring Dogecoin’s [DOGE] price action and market sentiment. After falling below the $0.13 resistance, DOGE broke out of its bearish descending triangle pattern on the daily chart, which is a significant technical development. However, this breakout was followed by a decline below its 200-day Exponential Moving Average (EMA) and confirmed a long-term bearish sentiment.

As an analyst, I’ve been closely monitoring Dogecoin’s [DOGE] price action, and I must admit that the recent breakdown below the $0.13 resistance was a pivotal moment for this memecoin. This event marked the completion of a classic descending triangle pattern on the daily chart, a bearish technical formation. Subsequently, DOGE plummeted beneath its 200-day Exponential Moving Average (EMA), further confirming a prolonged bearish trend.

At the same time, the altcoin’s funding rate became negative due to bearish market conditions as a large investor moved over ten million dollars in Dogecoin from an undisclosed wallet to Robinhood.

As a researcher observing the Dogecoin market, I’ve noticed that surpassing the resistance level above $0.13 could significantly shift the storyline. Currently, the coin is priced around $0.0122 at the time of my analysis.

Can DOGE buyers induce a rally?

Observing more than double the usual returns within a single month during the prior rally in March, the bulls faced a significant challenge at the $0.22 resistance level. The bears capitalized on this opportunity and instigated a decline that persisted over several weeks, exacerbated by heightened market-wide uncertainties.

The shift from $0.13 being a support (previously a resistance) led to a period of price consolidation on the charts. During this time, the market formed a triangle pattern with a downward trend on the daily chart. The recent drop below this level has strengthened the bearish outlook as the coin reached its lowest point in four months on June 18th.

If the price reverses upward above the 200 Exponential Moving Average (EMA) close to the $0.13 resistance level, it could trigger a short-term bounce back for buyers. Potential rebound levels would be around the $0.147 area.

If the price moves in a downward direction and falls below the 200 Exponential Moving Average (EMA), it could signal a potential reversal of the bullish trend. In such an event, the initial support level to watch out for would be around $0.11.

With the Relative Strength Index (RSI) hovering around the 30 mark, this signifies the market is oversold and ripe for a potential turnaround. Buyers may anticipate a noteworthy price rebound from these levels imminently.

Funding rate turned negative

Based on Coinglass’s statistics, the funding rate for DOGE has experienced a significant decrease recently. Notably, this figure had not been reached since May 2024.

Based on the historical relationship between price movements and this specific metric, there is a possibility that the price may continue to decrease in the near future. On the other hand, any improvements or positive changes regarding this factor could potentially shift the market sentiment back towards optimism among buyers.

At the present moment, Doge and Bitcoin exhibited a strong correlation of 75% over the past thirty days in terms of price movements. Consequently, it’s advisable to monitor Bitcoin closely, taking into account these additional technical aspects.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

2024-06-22 10:15