-

SHIB and DOGE prices spike before quick corrections.

Metrics indicate increased market volatility for both memecoins.

As a seasoned researcher with extensive experience in the cryptocurrency market, I have closely observed the recent price movements of Dogecoin (DOGE) and Shiba Inu (SHIB). The sudden spikes in both coins’ prices before quick corrections are concerning, and as data shows, these trends indicate increased volatility for both memecoins.

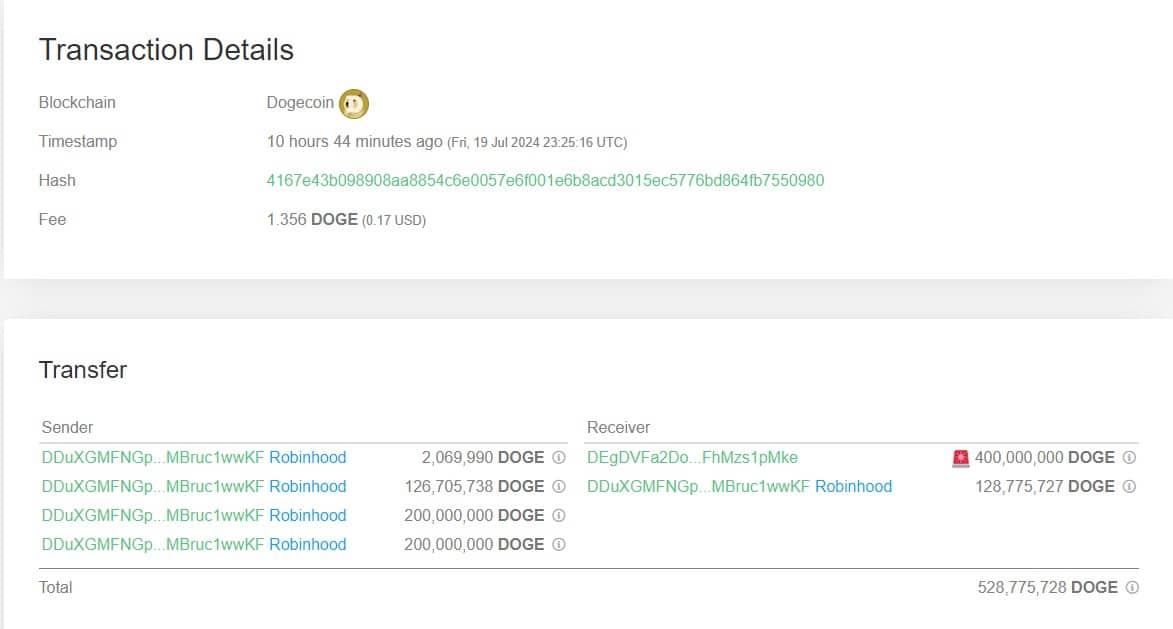

Recently, there has been a noticeable surge in significant transactions for Dogecoin (DOGE) and Shiba Inu (SHIB). According to Whale Alert data, a transfer of approximately 400 million DOGE, equivalent to around $50 million, was made from Robinhood to the wallet address DEgDV…Mke.

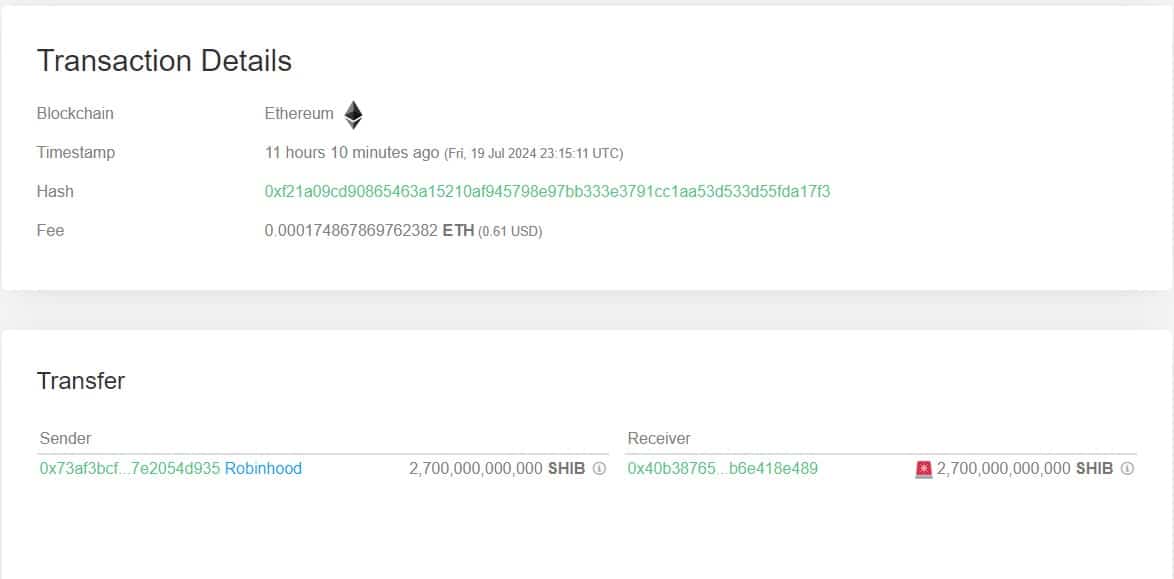

As a financial analyst, I’ve come across a significant transaction where 2.7 billion Shiba Inu (SHIB) tokens, equivalent to approximately $48.3 million, were transferred from Robinhood to an anonymous Ethereum wallet on the blockchain.

What next for Shiba Inu and DOGE

During the whale sale of SHIB, the coin was priced at approximately $0.00001703. Subsequently, the prices experienced a significant surge post-transaction.

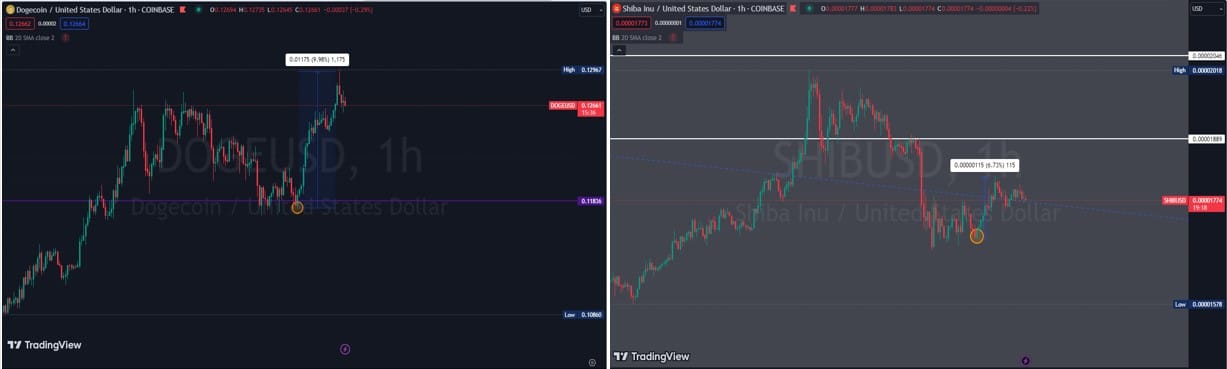

Reaching its zenith, Shiba Inu touched an impressive height of 0.00002018, marking a substantial 6.73% rise. Yet, this growth spurt proved fleeting as the price swung back down to 0.00001775.

Similarly, DOGE displays a similar pattern of volatility and price movements.

Before a substantial increase of 9.98%, Dogecoin was priced at $0.11797. Following this rise, the cryptocurrency reached $0.12958 after a notable whale transaction took place.

Approximately 528.7 million Dogecoins were moved across the Dogecoin blockchain in numerous transactions, creating an intricate flow of funds between various addresses.

Significantly, there was a transfer of approximately 400 million DOGE coins to an external wallet, followed by a return of around 128.7 million DOGE back to Robinhood’s wallet. This recurring exchange of funds could indicate strategic maneuvers or liquidity adjustments on the part of major DOGE holders.

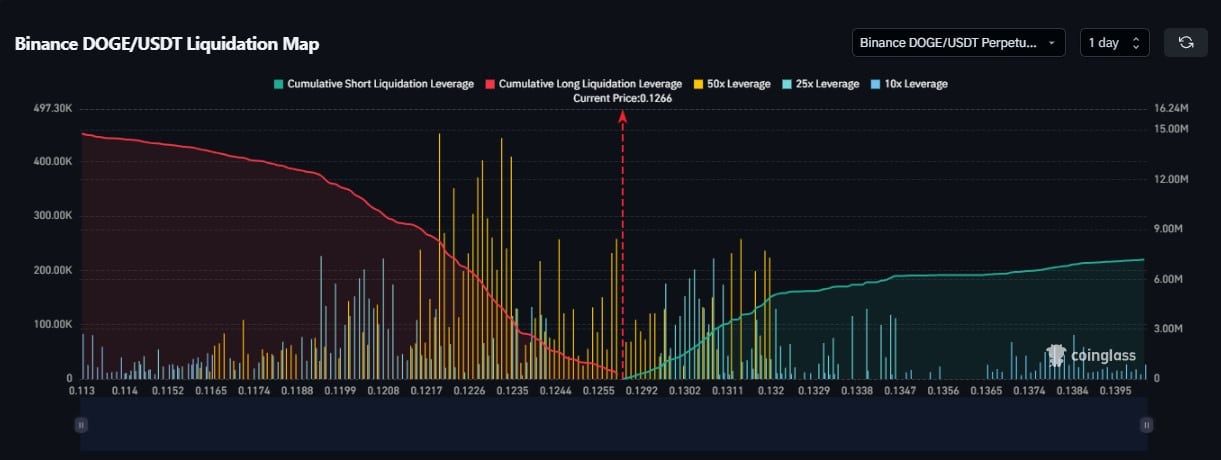

Based on the DOGE Liquidation Map analysis conducted by AMBCrypto, there is a noticeable market response to significant whale transactions. A surge in DOGE liquidations was observed when the price neared the 0.1266 level, affecting both long and short position holders alike.

Noting the significance of this occasion, it highlights the risky business of using borrowed funds for cryptocurrency trading in times of market volatility.

Read Dogecoin’s [DOGE] Price Prediction 2024-25

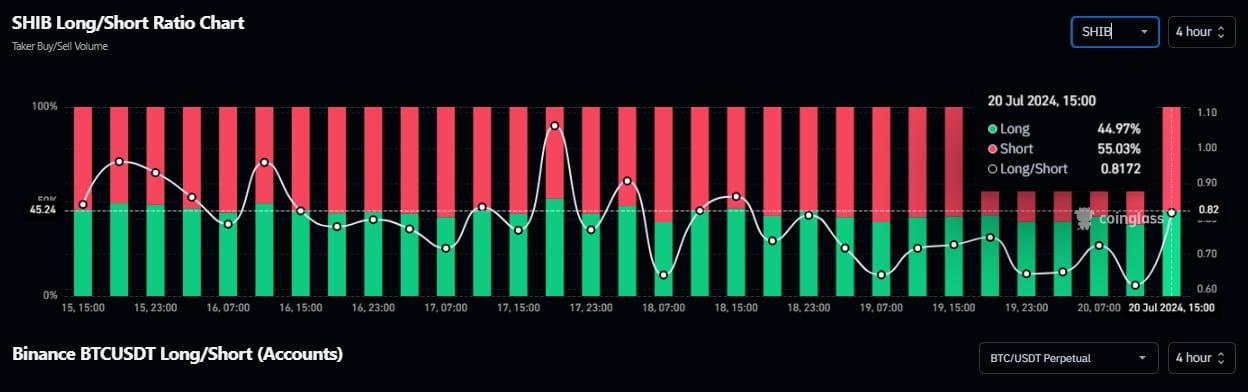

To expand on the previous discussion, we delved further into the Shiba Inu’s long-short ratio data in order to ascertain its leaning in the market.

With a ratio of 0.82, approximately 55.03% of investors held long positions for Shiba Inu. This shift in positioning doesn’t definitively indicate a bullish or bearish trend for the cryptocurrency.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-07-21 12:07