- Bitcoin’s surge contrasts with Dogecoin’s struggle, dropping below key support at $0.40.

- Dogecoin’s next ATH hinges on retail interest and macroeconomic catalysts, despite current challenges.

As a seasoned researcher with years of experience tracking the crypto markets, I have to say that the current dynamic between Bitcoin and Dogecoin is intriguing. While Bitcoin’s surge above $100,000 is impressive, it’s hard not to notice the contrast in Dogecoin’s performance.

Bitcoin (BTC) and Dogecoin (DOGE) frequently follow similar trends in their market cycles, with Bitcoin usually taking the front seat, shaping Dogecoin’s price fluctuations.

However, despite Bitcoin recently surging above the $100,000 mark, Dogecoin has failed to follow suit, dropping below the key $0.40 support level.

The increasing gap between these two widely used cryptocurrencies sparks significant queries regarding their future interaction and if Dogecoin can regain its upward trend, given Bitcoin’s continued rise.

As Bitcoin resumed its climb, soaring by 7.5% to exceed $100,000, the movement of Dogecoin’s price tells a different story.

Although it peaked at $0.45 on December 8th, a level not achieved since 2021, the meme coin struggled to maintain its growth, continually encountering resistance at this price point. This obstacle has proven crucial, marking the third significant roadblock in the current market phase.

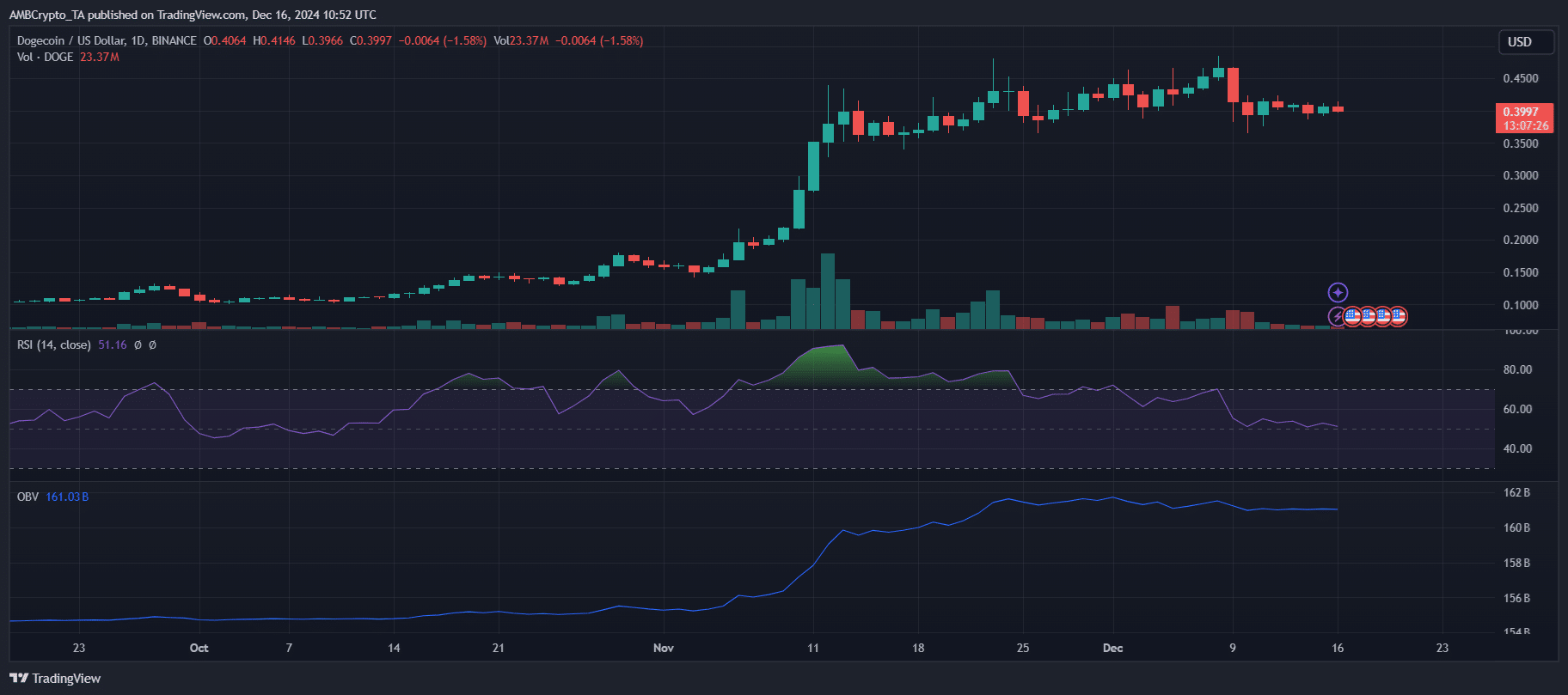

Currently priced at $0.3997, Dogecoin’s trading volume patterns suggest a decrease in momentum, as the buying pressure has noticeably decreased compared to the heightened interest in December. Additionally, the Relative Strength Index (RSI) is trending towards neutral levels at 51.16, signaling a reduction in bullish energy.

The fact that Dogecoin’s price movement differs from Bitcoin’s surge indicates a potential problem for investors, as the On-Balance Volume (OBV) is hovering around 161 billion, suggesting minimal new investment and casting doubt on Dogecoin’s capacity to regain upward momentum.

Is a DOGE ATH possible in this cycle?

Reaching Dogecoin’s all-time high (ATH) of $0.73, which was hit during the May 2021 cryptocurrency surge, still seems like a long shot for now. Although it’s theoretically possible to exceed this price in the current market cycle, there are numerous obstacles on the road ahead, especially since Dogecoin is no longer closely following Bitcoin’s continuing upward trend.

It seems that there’s a general feeling that Dogecoin could make a comeback, yet it needs a triggering event. In the past, major price fluctuations for Dogecoin have typically been caused by sudden increases in public interest, which are frequently ignited by popular social media discussions or rumors about potential applications, such as its use in transactions on platform X.

In order for Dogecoin to surpass its all-time high (ATH) achieved in 2021, it requires another wave of retail excitement, along with significant trading activity, and a return of interest from both individual and institutional investors.

A plausible situation for an All-Time High (ATH) in cryptocurrencies might occur as early as 2025, subject to significant changes in the broader economy. These alterations could encompass political transitions, such as the election of Donald Trump, which may spark enthusiasm within the crypto market and serve as a trigger for increased Dogecoin price movements.

Possible catalysts for DOGE’s fall

It’s possible that several significant elements may lead to additional price drops. One significant danger is its growing disconnection from Bitcoin’s price fluctuations. As Bitcoin soars past the $100,000 threshold, Dogecoin’s inability to mirror this growth stirs up worries about a possible change in investor attitudes.

As November drew to a close, the impact of the Federal Reserve’s interest rate and inflation concerns persisted, putting pressure on riskier investments such as cryptocurrencies.

If there’s a stricter control over the nation’s money supply or continuous worries about rising prices, it might decrease investors’ interest in risky investments such as Dogecoin and various other cryptocurrencies, potentially affecting their market value.

Additionally, the public opinion towards meme coins and risky investments tends to be extremely unpredictable.

Read Dogecoin [DOGE] Price Prediction 2024-2025

A decrease in consumer interest in retail, frequently initiated by changes in social media patterns or increased attention from regulators, might lead to a sudden drop.

In light of the increasing global regulatory uncertainties surrounding cryptocurrencies, as more countries contemplate stricter regulations, I find myself bracing for potential negative impacts on Dogecoin’s market worth. This could potentially chip away at its value over time.

Read More

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- OM PREDICTION. OM cryptocurrency

- Disney’s Animal Kingdom Says Goodbye to ‘It’s Tough to Be a Bug’ for Zootopia Show

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Jay-Z and Diddy Celebrate as Rape Lawsuit is Shockingly Dismissed!

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

2024-12-16 18:16