- Dogecoin breaks below wedge pattern, but there’s a potential double bottom at $0.38 mark.

- DOGE’s social sentiment rises as funding rates spike to new peaks.

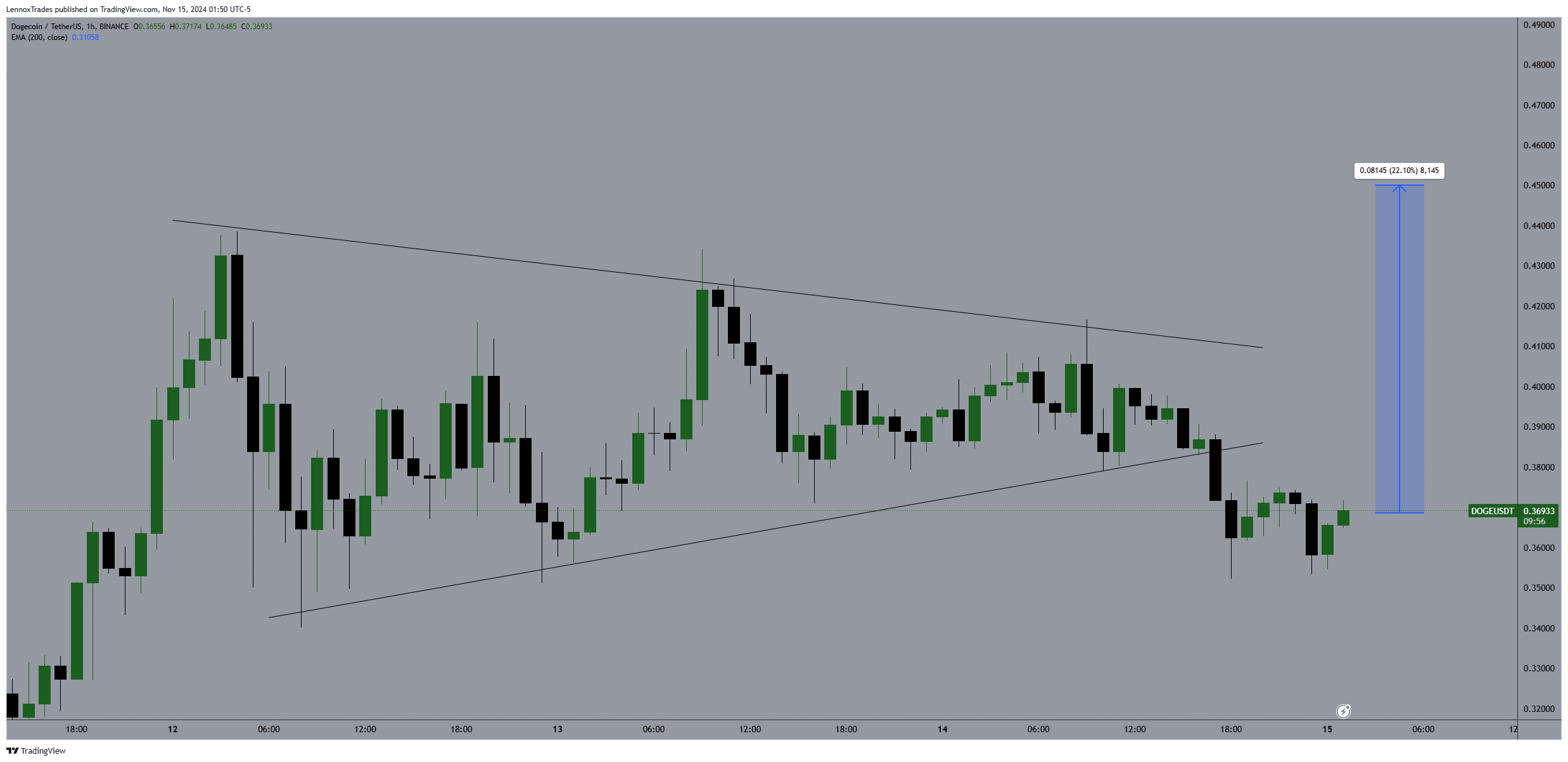

As a seasoned analyst with over two decades of experience navigating the volatile world of cryptocurrencies, I find myself cautiously optimistic about Dogecoin [DOGE]. The recent break below the wedge pattern at $0.38 presents a potential double bottom formation that could signal a 22% price increase if DOGE manages to hold above its resistance at $0.42.

In simpler terms, the value of Dogecoin (DOGE) has been indicating a possible increase, as its price fluctuated within a specific range, varying from approximately $0.42 to $0.38.

Looking at the graph, DOGE reached the $0.38 point, suggesting a potential double bottom pattern which might lead to a 22% rise in its price.

If DOGE surpasses and maintains a position above the $0.42 mark, it might propel further by as much as 22%, according to this pattern. Conversely, not regaining this level may prolong the current price decrease.

Traders seeking a more cautious strategy might find it prudent to wait for a definitive price surge beyond the $0.42 resistance level, which could offer a safer trading opportunity.

A significant surge like this one might solidify a robust bullish trend, possibly setting the stage for a prolonged climb. This crucial point demands close monitoring since it may well influence Dogecoin’s immediate market trends.

Social dominance and sentiment

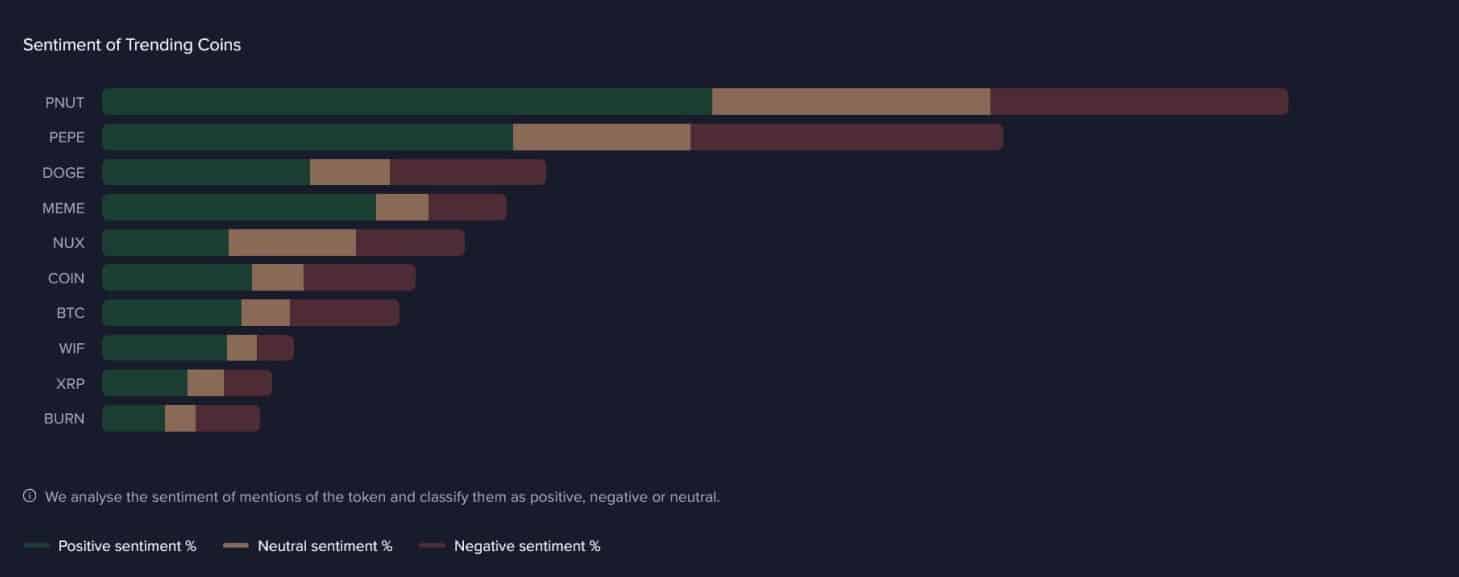

Doge persisted in holding its ground as a leading meme-based cryptocurrency within the social media landscape, finding itself ranked third among popular digital tokens currently making waves.

The focus on Dogecoin underscores its continued appeal and possibility of surging over 22% more if the price remains above $0.42, fueled by speculative enthusiasm, amidst the unprecedented surge in the cryptocurrency market.

In terms of meme-based cryptocurrencies, it was Dogecoin, together with PNUT and PEPE, that sparked the most conversations on social media platforms. This highlights Dogecoin’s robust impact and dominance in the space.

When I see Bitcoin, my go-to crypto, being overshadowed by several meme coins in terms of conversation rate, it’s a clear sign that investor attention has started to gravitate towards more speculative and trendy assets.

As a researcher, I’ve observed an infectious optimism among DOGE’s community, which hints at a persistent bullish trend. Additionally, Market Prophit indicates that the ‘smart money’ is also bullish on X. This alignment could potentially trigger higher trading volumes and perhaps a surge in price as more investors are attracted to these buzzworthy memes.

As an analyst, I believe that this momentum could significantly strengthen Dogecoin’s standing within the market, enticing both experienced traders seeking lucrative opportunities and novices drawn to swift profits amidst a lively trading atmosphere.

Open interests and funding rates

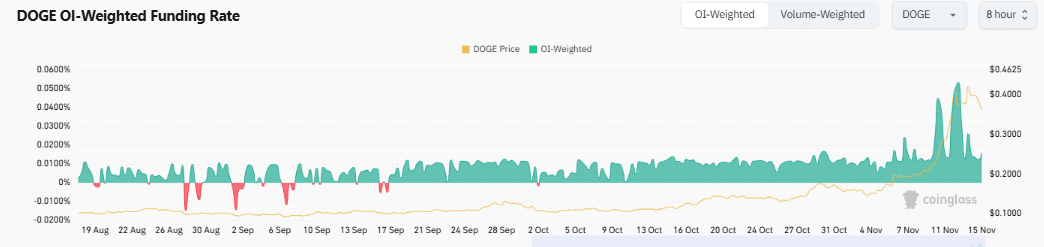

Recently, the weighted funding rate for Dogecoin has typically been around 0.0158%, suggesting a relatively even balance between optimistic buyers and cautious sellers.

Dramatic fluctuations in the funding rate, whether increasing or decreasing, signaled temporary instances where either long or short positions incurred higher fees.

Lately, the funding rate reached its highest point coinciding with an observable surge in Dogecoin’s price, particularly following its rise beyond $0.42.

Read Dogecoin’s [DOGE] Price Prediction 2024–2025

This mountainous point signals elevated action, possibly hinting at a rise in market speculation or borrowing.

If the high funding rates persist, it could be indicative of potential price adjustments due to excessive trader leverage on Dogecoin (DOGE), impacting its price consistency. On the flip side, a return of funding rates towards zero might lead to more stable price fluctuations, potentially propelling DOGE’s value beyond 22%.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-11-15 21:12