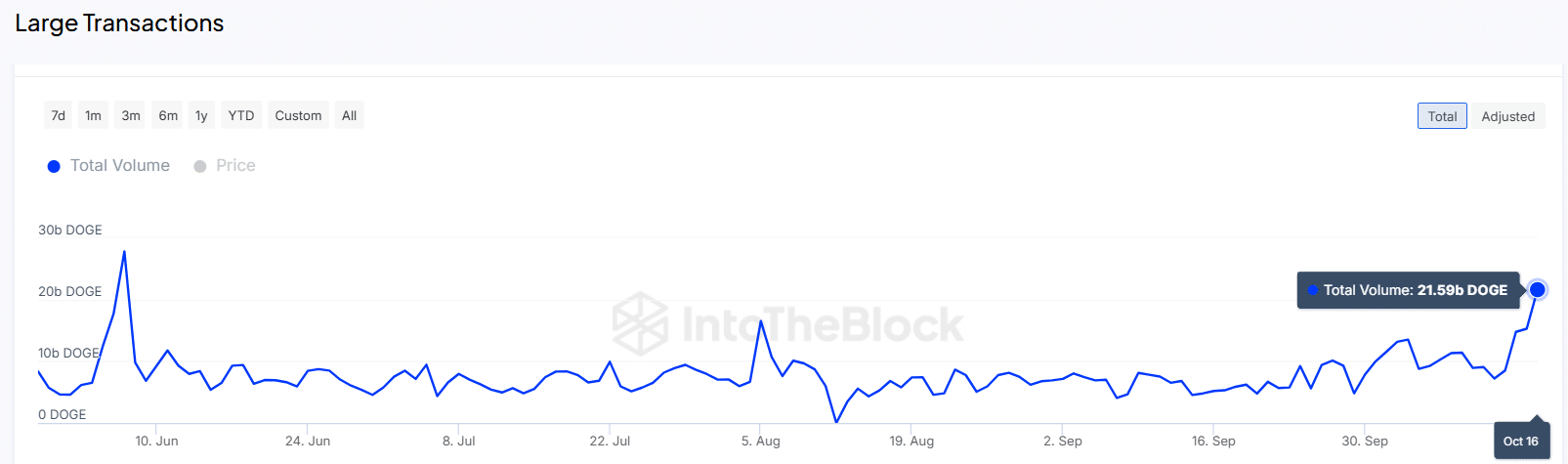

- Large Dogecoin transactions have increased from 15.27 billion to 21 billion.

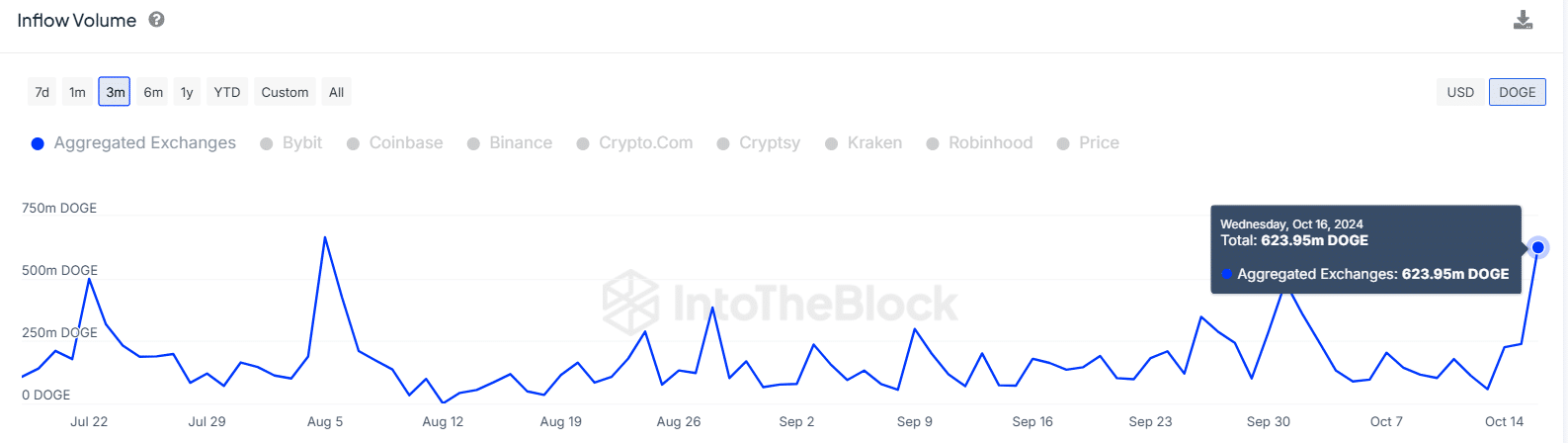

- Exchange inflows also reached an eight-week high of more than 623 million, which could increase the selling pressure.

As a seasoned crypto investor with years of experience under my belt, I’ve seen enough market fluctuations to know that every coin has its own unique dynamics. Dogecoin [DOGE], being no exception, has been on quite a rollercoaster ride lately.

In simple terms, Dogecoin (DOGE), often recognized as the largest digital coin based on memes, has been a standout among the top ten biggest cryptocurrencies. Over the past week, DOGE has experienced a 13% increase and is currently trading at $0.12 as we speak.

According to data from CoinMarketCap, it appears that the increase in value is likely due to a surge in popularity for this meme coin, as trade volumes have risen dramatically by approximately 60% at the current moment.

It’s possible that whale activity played a role in the increase, as there has been a 40% surge in significant Dogecoin transactions, reaching a four-month peak of 21 billion tokens.

The surge in whale interactions with DOGE might explain the current market fluctuations, yet it’s also possible that this increase could lead to increased selling activity based on an examination of exchange inflow information.

On October 16th, over 623 million Dogecoin tokens moved to exchanges, which represented the highest amount of inflow into exchanges in a two-month period.

As an analyst, I’ve observed a surge in substantial transactions and incoming exchanges, which might indicate that Dogecoin (DOGE) is currently in a distribution stage. This suggests that ‘whale’ investors are cashing out, potentially diminishing the current upward trend.

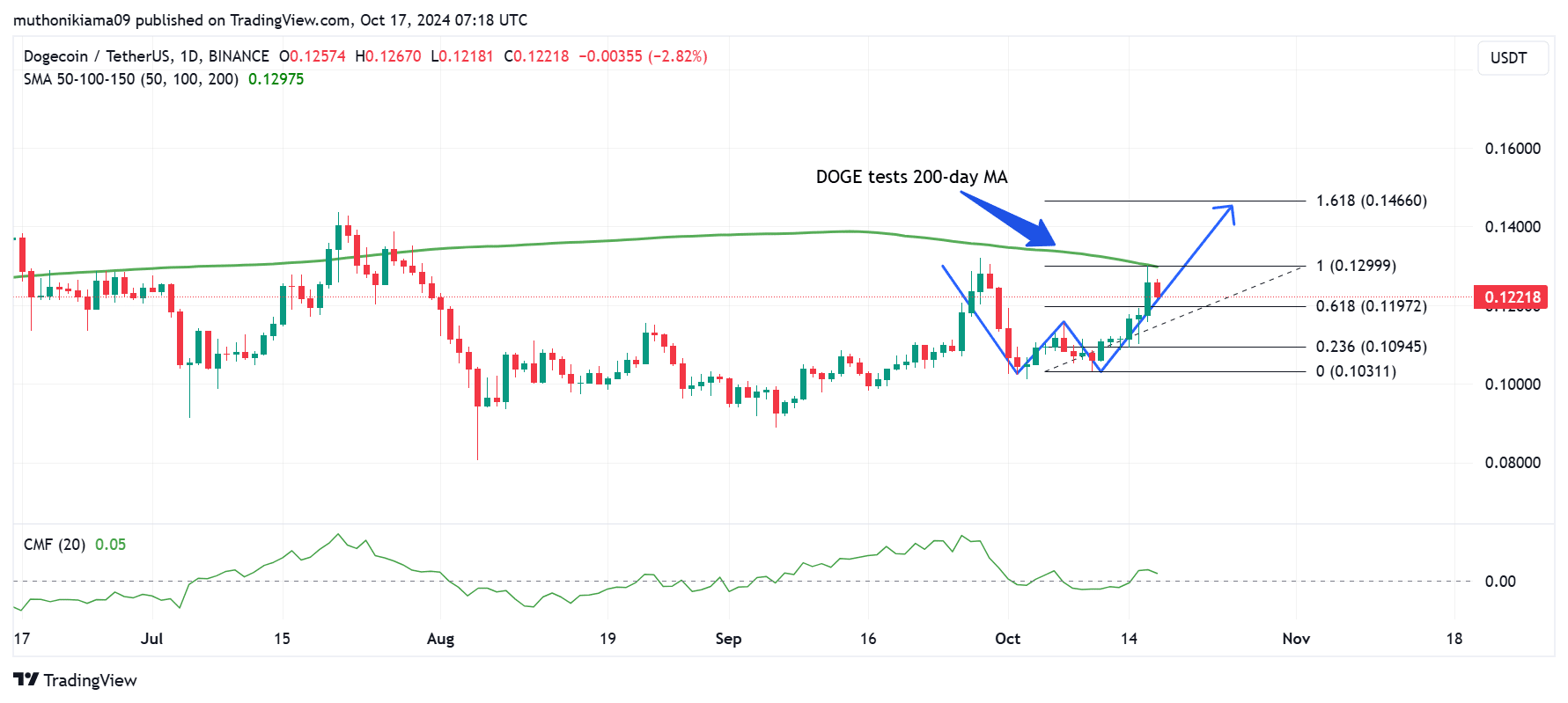

Dogecoin price analysis

Examining today’s graph reveals a bullish W formation in Dogecoin (DOGE). This bullish reversal pattern implies that DOGE might be preparing to continue its upward trajectory, aiming for a potential new price level of around $0.146.

To achieve a breakthrough for DOGE, it’s crucial that it surpasses its 200-day Simple Moving Average (SMA), turning it into support rather than resistance. The Chaikin Money Flow indicates a positive trend, suggesting that the demand from buyers is stronger than the supply from sellers, potentially reinforcing this potential breakout.

If DOGE cannot overcome this resistance point, there’s a possibility that its price might decrease to retest the Fibonacci support level, which is approximately $0.109.

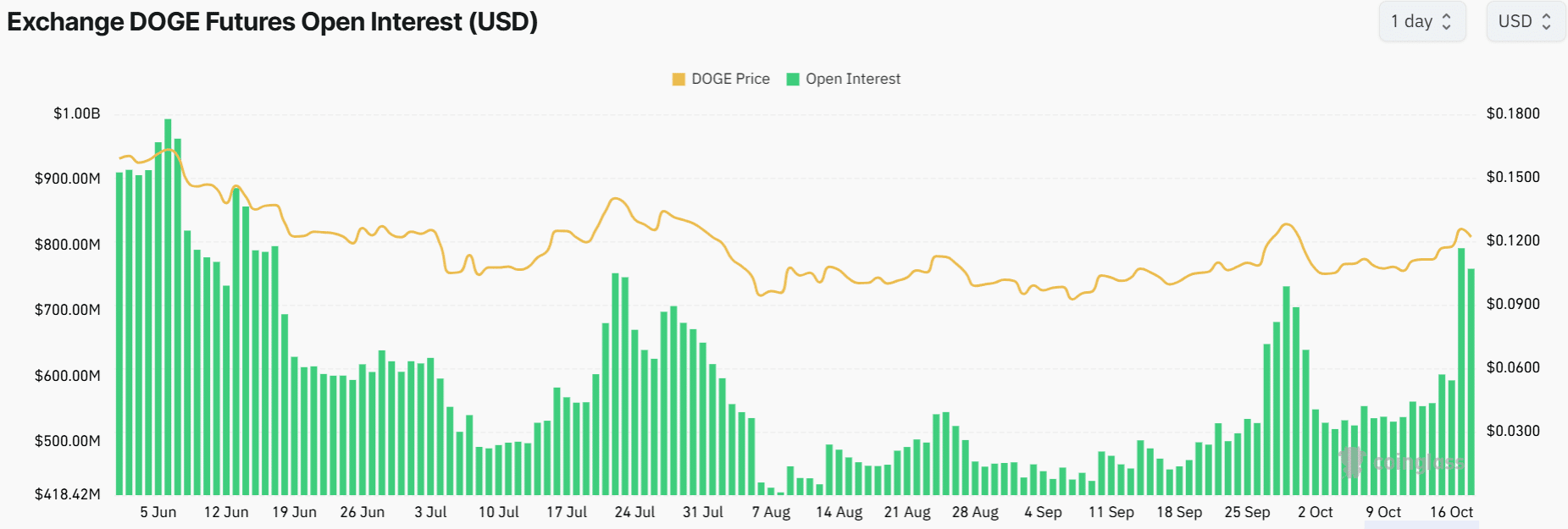

It seems that the surge in Dogecoin’s value is being fueled by an escalation in the number of open trades, reaching a peak of $795 million at this moment, which suggests that investors are actively creating new investment opportunities in Dogecoin.

Conversely, since the long/short ratio has decreased from 1 to 0.86 as of now, it might imply that traders are starting to establish short positions, potentially signaling a price increase.

Realistic or not, here’s DOGE market cap in BTC’s terms

Moreover, an increasing number of futures investors are showing interest in DOGE, but this trend isn’t mirrored in the traditional market where the number of Dogecoin owners has decreased by approximately 106,000 as per AMBCrypto’s recent report.

This suggests that the meme coin is currently experiencing a distribution period, during which traders might be cashing out their earnings.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

2024-10-17 17:43