-

Dogecoin declined by 11.42% over the past week.

Indicators suggested that DOGE must reclaim $0.11 to avoid further decline.

As a seasoned researcher with years of experience observing and analyzing cryptocurrency markets, I have seen my fair share of bullish surges and bearish declines. The recent performance of Dogecoin [DOGE] has been no exception – while it saw a significant increase over the past month, the past week has been less favorable for DOGE investors, with a 11.42% decline.

During the last month, Dogecoin (DOGE) experienced notable growth in its value, increasing by approximately 13.66%. This surge propelled the meme-based cryptocurrency from a minimum of $0.088 to a maximum of $0.132 on price graphs.

Over the last day, there’s been a modest bounce back for DOGE, with a rise of approximately 2.8%. At this moment, a single Dogecoin is being traded at around $0.108. However, this price increase represents a drop of over 11% when compared to the weekly charts.

The latest changes in price are causing people to wonder if Dogecoin can bounce back and maintain its upward trend for the month, or if the bears might seize control of the market instead.

Based on observations by well-known cryptocurrency analysts Ali Martinez and Kevin, certain prerequisites should be fulfilled for a prolonged upward trend to occur.

What market sentiment says…

According to Kevin’s interpretation, it appears that pessimistic views are prevalent due to the existing market circumstances.

According to the analyst, DOGE faked out of the macro falling wedge, which is a bearish signal.

As an analyst, I’ve noticed that the memecoin has failed to hold onto its key moving averages for both a one-day and four-hour period, which is a clear indication pointing towards a potential bearish trend.

Consequently, the analyst believes that Dogecoin might need to drop down to approximately $0.08 and establish a new base before it can potentially rise again.

Conversely, Martinez referred to the instance of 60210 addresses containing approximately 36.40 billion DOGE with a value of around $0.11 each.

Based on this assessment, for Dogecoin to maintain a positive trend, it needs to surpass the $0.11 resistance point. If it doesn’t, there could be a significant drop in price as investors look to minimize their losses by selling off their holdings.

Typically, a large scale sell-off like this might lead to additional price drops and prolong the downward trend, much like we’ve seen in recent days.

What DOGE charts suggest?

Without a doubt, Martinez and Kelvin’s analysis points towards a pessimistic perspective. Now, let’s consider what other indicators might be saying.

Initially, the Open Interest for Dogecoin on each trading platform decreased noticeably during the last seven days, going from $224 million to $129.6 million.

This drop suggests that investors are exiting their investments without being replaced by new ones, indicating a pessimistic viewpoint about the market.

Furthermore, a negative divergence in Dogecoin’s Price Development Activity (DAA) occurred three days back. This negative DAA divergence indicates a decrease in user engagement within the Dogecoin ecosystem.

Thus, the recent rally is not fully backed by fundamentals but instead by speculation.

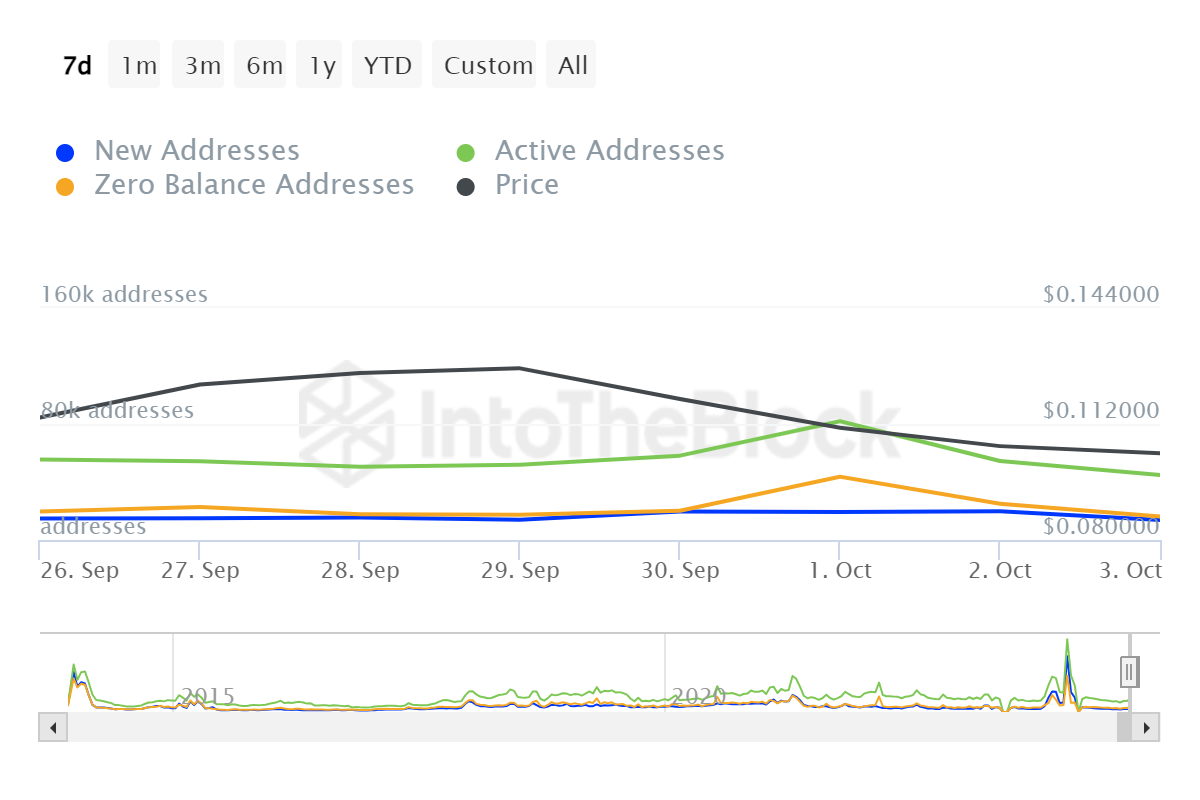

To put it simply, the number of daily active Dogecoin users has dropped significantly over the last four days, going from approximately 144,800 to 74,700. This decrease in active users might indicate a decrease in demand or waning interest in the meme-based cryptocurrency.

Read Dogecoin [DOGE] Price Prediction 2024-2025

In simpler terms, while Doge has seen a slight improvement over the daily graphs, its weekly losses still overshadow these recent advances.

Given the prevailing market mood, I wonder if Dogecoin can maintain its upcoming support at approximately $0.098. Yet, should we witness a turnaround, Dogecoin might regain control over the price point of around $0.011105.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-10-04 16:08