- The EMAs formed a death cross, indicating that DOGE might drop below $0.12.

The 90-day MCA increased, suggesting selling pressure on the coin.

On April 27th, Dogecoin [DOGE] tried to reach $0.17 again, but its 4-hour chart indicated strong resistance at $0.15. Consequently, the coin’s price retreated and settled at $0.14 instead.

As a Dogecoin investor, I’ve noticed that the coin’s struggles appear to be more than just a simple rejection. Based on my analysis using the Exponential Moving Average (EMA) indicator, there seems to be a persistent trend against Dogecoin. For those less familiar with technical analysis, the EMA is a tool that helps identify the direction of a market trend over a given timeframe.

No buyers in sight

Based on my analysis as an equity researcher, when the 50-day moving average (yellow line) intersected above the 20-day moving average (also in yellow) on April 24th, it signaled a potential bearish trend unfolding. However, since then, these averages have maintained their positions without any further crossover events occurring.

The “death cross” trend for DOGE‘s price also goes by this name because it signals an increased likelihood of a significant downturn. This ominous prediction is reinforced by the Elder Force Index (EFI), which has confirmed these warnings.

As an analyst, I observe that the Event Frequency Indicator (EFI) for the Dogecoin/USD pairing on the 4-hour chart remains stagnant at present. This signifies a significant decrease in trading activity related to Dogecoin.

As a researcher studying the DOGE market, I discovered an intriguing finding using the Fibonacci indicator. Specifically, this tool signaled a potential crash for DOGE due to the alignment with the 1.618 Fib level, which is also recognized as the golden ratio in financial markets.

At present, the 1.618 Fibonacci level was located at approximately $0.12. This indicated a potential area of future support for Dogecoin. If the support held firm, Dogecoin could potentially rebound and advance towards $0.16.

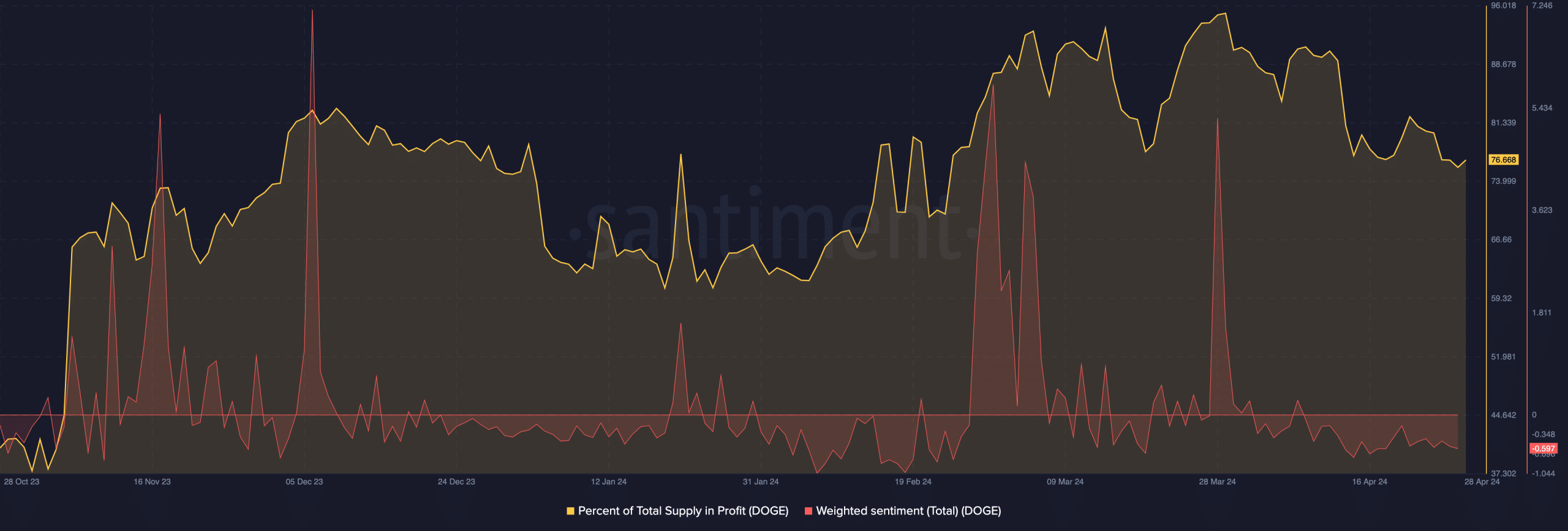

As a researcher studying the cryptocurrency market, I’ve noticed that if the $0.12 support level for Dogecoin (DOGE) is not defended against bearish pressure, there’s a risk it could slide down to $0.10. Interestingly enough, on-chain analysis reveals that approximately 76.66% of the total DOGE supply is currently in profit.

Heats hits DOGE

The coin’s 90-day performance might influence this ratio, as per AMBCrypto’s assessment of the market, there was a 83.65% price hike for the coin.

Having a large amount of profit gains in cryptocurrencies isn’t necessarily a positive sign. In fact, it could be a red flag as investors may choose to cash out their profits, particularly during periods when market momentum slows or even reverses.

Should this event transpire, the value of DOGE could potentially dip beneath $0.12, with the coin’s circulating supply generating profits falling below the 70% mark. According to data from Santiment, the Mean Coin Age (MCA) metric has surged.

As a crypto investor, I would explain it this way: The Mean Coin Age (MCA) represents the average age of all cryptocurrencies residing on the blockchain. This metric has a correlation with price movements. When MCA decreases, it signifies an influx of newly acquired tokens being moved to cold wallets for long-term storage.

Realistic or not, here’s DOGE’s market cap in BTC’s terms

If the situation held true, it could be indicative of a short-term price rise for Dogecoin. However, the coin’s advanced age suggested that a significant number of older coins had recently been transferred.

At this cost, the proposed selling pressure and market trends might align with the forced sale of these assets.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- THETA PREDICTION. THETA cryptocurrency

- How Potential Biden Replacements Feel About Crypto Regulation

2024-04-29 05:11