-

Historical pattern for DOGE/BTC suggest bullish Q4 for Dogecoin.

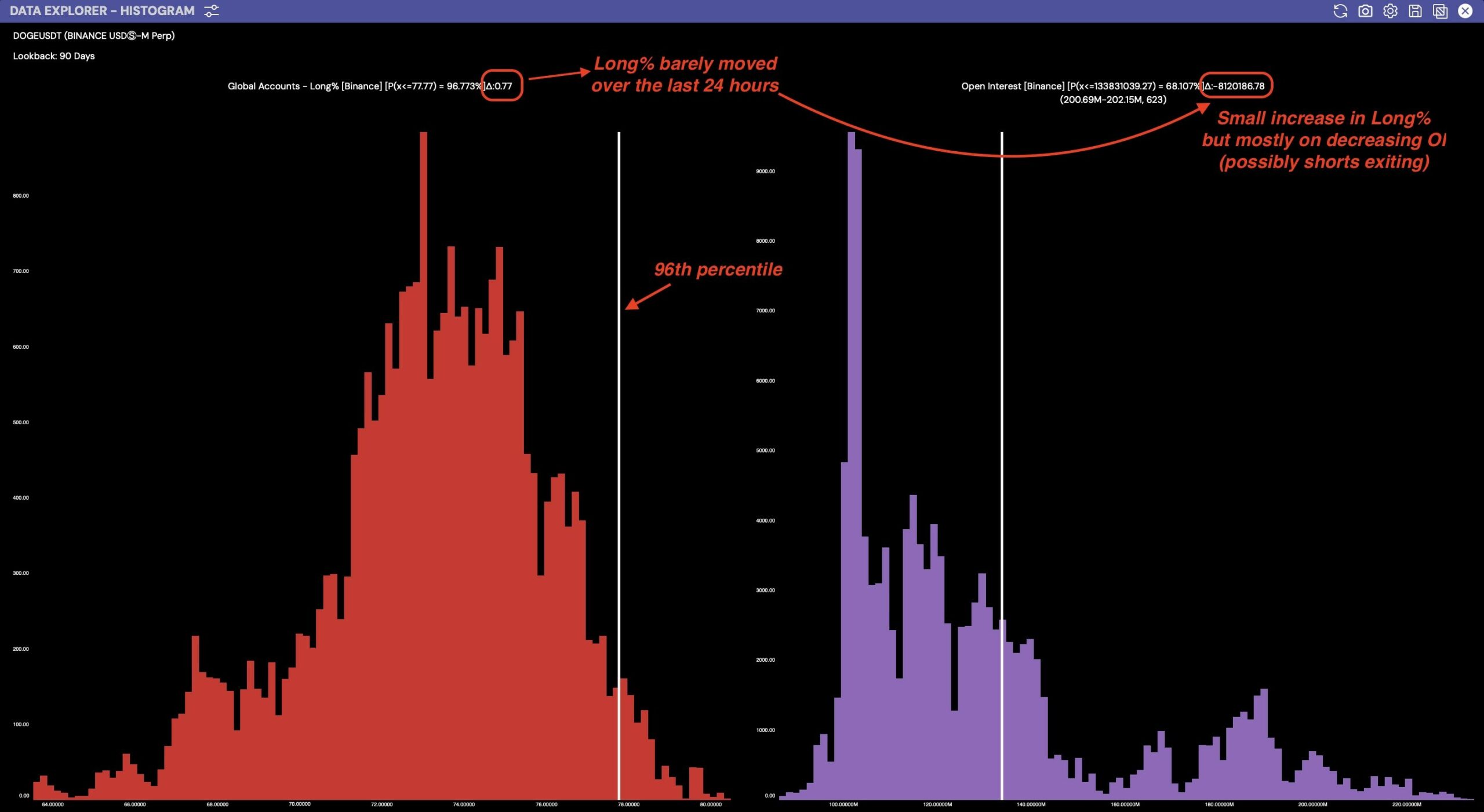

Dogecoin’s long accounts % is in the 96th percentile.

As a seasoned researcher with a penchant for deciphering patterns and trends in the crypto market, I find myself intrigued by the current state of Dogecoin (DOGE). With over a decade of experience under my belt, I’ve seen more than a few bull runs and bear markets.

Dogecoin (DOGE), the leading meme-based cryptocurrency, is preparing for the final part of the year as the broader crypto market is rebounding following a downturn caused by geopolitical disputes between Israel and Iran, which had an impact on the market.

It’s anticipated that Dogecoin (DOGE) could spearhead a surge among meme-based cryptocurrencies over this period, as historical trends in its price relative to Bitcoin (BTC) indicate a potentially exciting time for DOGE investors.

In the past, DOGE pumps started 235 days after Bitcoin halving, twice leading to significant gains.

This year, a pattern that’s quite comparable has surfaced, leading to speculation about whether Dogecoin (DOGE) might see growth exceeding 90% during the last three months of the year.

The repetition of these patterns strongly suggests a bullish outlook for Dogecoin in Q4.

Dogecoin RSI bounce

A significant element backing this optimistic viewpoint is the emergence of a divergence sign, typically hinting at a possible shift or continuation in patterns.

Here, investors expect a shift in favor of DOGE‘s bullish trend, signified by a possible reversal. This deviation took place when Dogecoin’s price dropped below its 200-week moving average line.

On the other hand, as the Relative Strength Index (RSI) rebounded from the oversold region, it suggests that this moment might offer a suitable opportunity for initiating long positions. There’s anticipation that Dogecoin (DOGE) could experience growth comparable to past cycles, with the possibility of surpassing 90% in increases.

Long accounts percentage

Another key indicator pointing to a positive Q4 for DOGE is the recent percentage of long accounts.

Based on information from Hyblock, the proportion of longer-term traders dealing with Dogecoin has remained consistent during the last 24 hours, which puts them among the top 96% of all trades. This consistency implies that long traders are dominating the market, thereby supporting a positive outlook or bullishness for DOGE.

Furthermore, an increment in the extended ownership of accounts appears to have influenced Dogecoin’s active trading contracts, resulting in a minor drop. Such a decrease in active trading contracts typically means that traders holding short positions are closing their positions, lending credence to a positive or bullish forecast for Dogecoin.

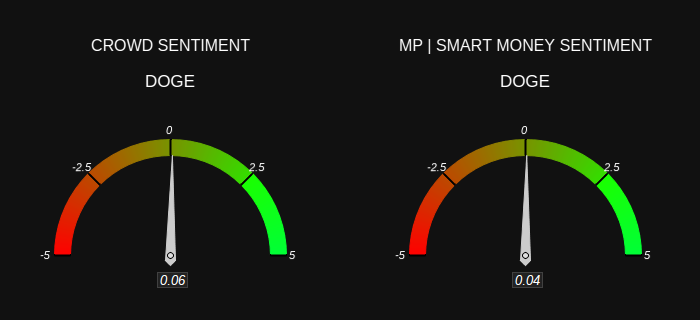

Crowd vs. Smart Money sentiment

As a researcher, I’ve noticed a shared optimism between seasoned traders and the broader public regarding Dogecoin (DOGE). Both groups seem to be leaning towards a bullish perspective, which strengthens the notion that Dogecoin could potentially see significant growth in the final quarter of this year.

As a researcher studying Dogecoin (DOGE), I must acknowledge that external factors, like geopolitical conflicts, can significantly impact its price trajectory. The recent escalation between Israel and Iran serves as an example, causing ripples throughout the crypto market. This incident underscores the inherent unpredictability of financial markets, emphasizing the importance of staying vigilant and adaptable to these ever-changing circumstances.

Read Dogecoin [DOGE] Price Prediction 2024-2025

It seems likely that Dogecoin could see substantial growth during the last quarter, as past trends, technical factors such as Relative Strength Index (RSI), and overall market optimism appear to be pointing towards a positive upward trend.

As I delve into my ongoing analysis, it appears that, despite external elements continuing to influence Dogecoin’s trajectory, the existing configuration seems to hint at a reprise of its past achievements. This could potentially result in a surge exceeding 90% by the year’s end.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-10-05 03:03