-

DOGE’s price might slip below $0.13 since liquidity in the derivatives dropped

Fewer coins moved over the week, indicating that the cryptocurrency’s run has taken a break

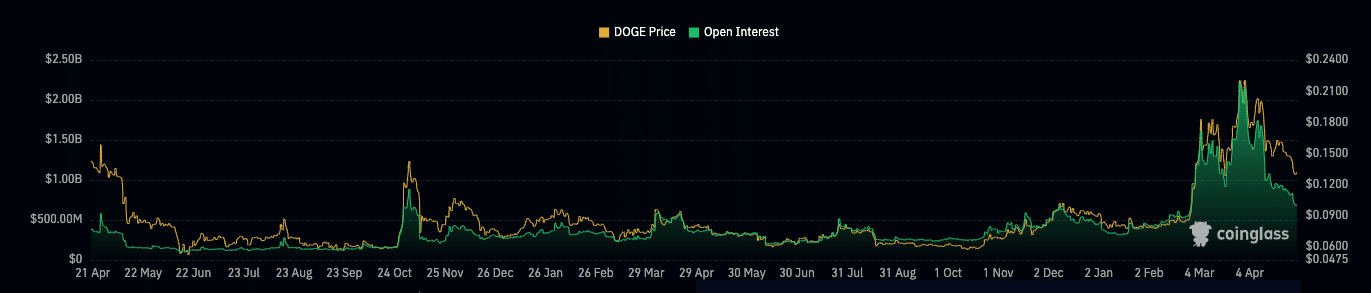

As an experienced analyst, I’ve closely watched Dogecoin’s [DOGE] market trends and observed a notable decline in its Open Interest (OI) and price over the past few weeks. The OI drop from $2.11 billion to $780 million within 30 days implies that sellers have been more aggressive, causing contracts worth over $1 billion to be closed. This trend has negatively affected DOGE’s price, which currently stands at $0.13 – a 28% fall in the last month.

As a crypto investor following market trends closely, I’ve noticed that according to Coinglass, Dogecoin‘s [DOGE] Open Interest has seen a significant decrease since April 1st. Open Interest (OI) refers to the total value of positions held by traders in the form of open contracts. This metric is influenced by both new and closed positions, making it an essential indicator of market sentiment. Specifically, Dogecoin’s OI has dropped from a substantial $2.11 billion to a more modest $780 million within this timeframe.

If the OI increases, it means new money is coming into the market and buyers are aggressive.

A lot of money leaves DOGE

Yet, the significant drop in Open Interest (OI) for Dogecoin indicates that approximately $1 billion worth of contracts were finalized within a short timeframe of around 30 days. In trading terms, this signifies that sellers have been actively selling while most traders withdrew their liquidity.

Inefficiencies have similarly taken a toll on DOGE‘s value. As of now, based on CoinMarketCap, DOGE is worth approximately $0.13. This represents a significant decrease of 28.11% over the past month.

Over the past 24 hours, the value of the memecoin has risen. However, considering the decrease in open interest, it appears that any downward trend may persist. If this is true, the price of DOGE might stabilize around $0.13 or potentially drop to $0.11.

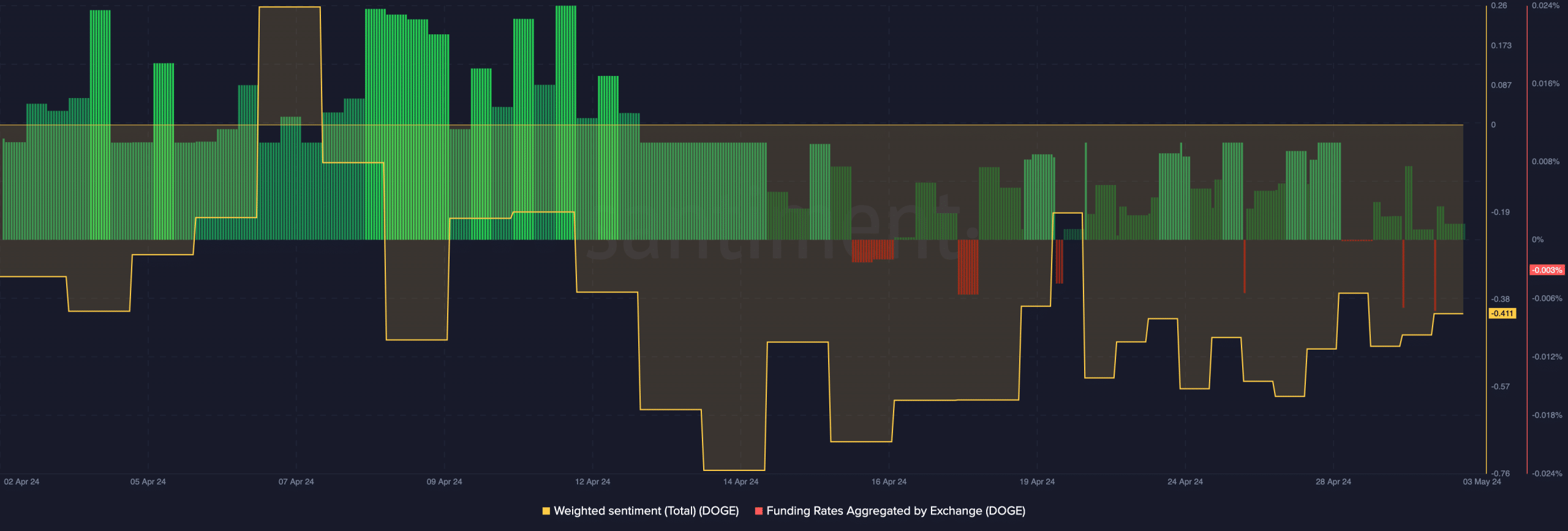

In addition, the larger cryptocurrency market holds a comparable viewpoint as well. According to AMBCrypto’s analysis based on the Weighted Sentiment.

As a crypto investor, I’d interpret the data from Santiment that Dogecoin’s Weighted Sentiment stands at -0.411 as an indication of pessimism among market participants towards DOGE. This negative sentiment suggests that they don’t anticipate a quick rebound for this cryptocurrency in the short term.

As a crypto investor, I took into account the concept of Funding Rates when evaluating my perpetual swap positions. Essentially, Funding Rate represents the ongoing cost of maintaining an open long or short position in these contracts. When the rate is positive, it signifies that longs are required to pay a fee to shorts, acting as an incentive for new short positions and reducing the overall buying pressure on the market.

No way to $0.15 now

In simpler terms, when the funding rate is positive for a short position, it means that shorts are effectively paying longs. At present, the DOGE‘s funding rate was favorable but trending downwards. As the price continues to rise and the funding payment decreases, perp buyers might be taken aback by this development.

Without much provocation from long-position holders, DOGE‘s price may avoid surpassing its current resistance level. Consequently, reaching a price of $0.15 or more in the coming days could prove challenging.

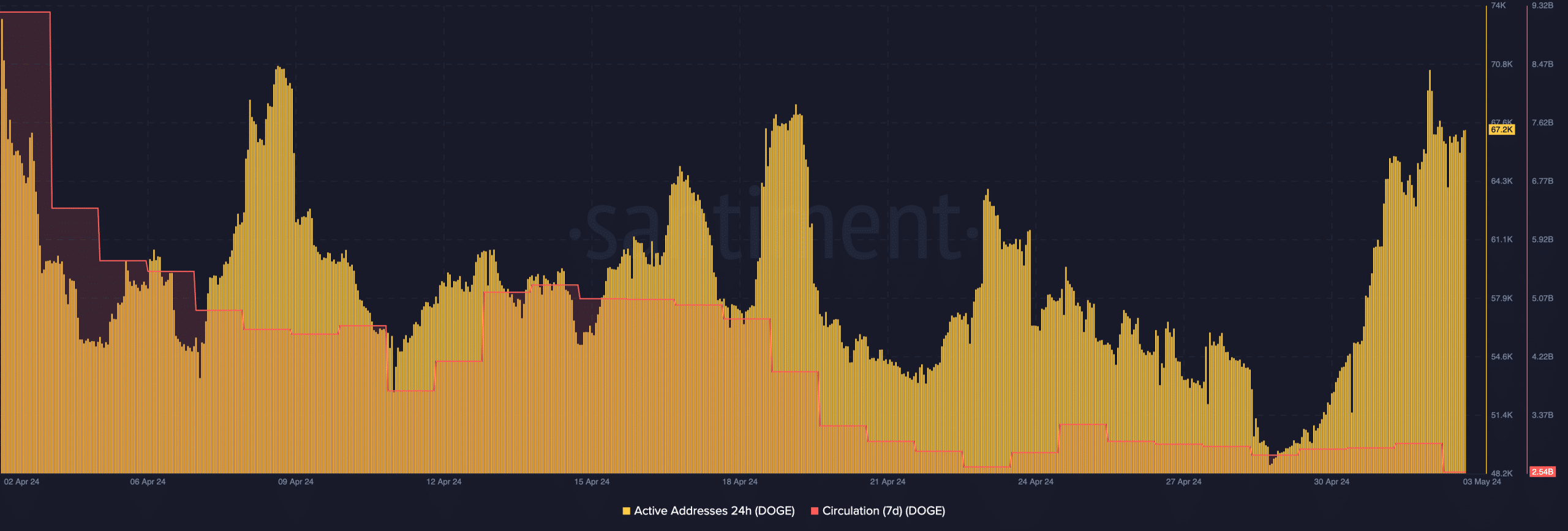

As a researcher studying the Dogecoin network, I’ve observed a notable increase in activity recently. Specifically, the number of active addresses on the network, which stood at around 49,000 on the 25th of April, has started to rebound.

As a researcher, I’ve observed an intriguing trend in the crypto space: active addresses indicate the number of unique wallets engaging with a particular project. At this moment, this figure has surged to a noteworthy 67,200. This data signifies that an impressive volume of transactions is taking place on the network once again.

Although the metric is currently far from the values reached when DOGE was traded at $0.20, if it persists at this point, there’s a possibility that DOGE’s price may rise. Nevertheless, it’s highly unlikely that the upward trend will endure.

Is your portfolio green? Check the DOGE Profit Calculator

The daily circulation of Dogecoin reached 2.54 billion, signifying a decrease in its usage based on the charts. Consequently, if the number of coins transferred continues to decline, it is possible that Dogecoin’s price may remain stagnant within a narrow range.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-05-04 03:03