-

New demand for DOGE peaked during the week

Memecoin’s MVRVA ratio hinted at a buying opportunity too

As a seasoned crypto investor with a few battle scars from past market fluctuations, I find the recent surge in new demand for Dogecoin (DOGE) and its accompanying low MVRV ratio intriguing. The 102% increase in new addresses creating trades for DOGE is a strong indication of growing interest in this memecoin. The fact that the daily active address count has also risen by 27% within a week further underscores the renewed enthusiasm among investors.

As an analyst, I’ve noticed an intriguing development in the crypto market with regards to Dogecoin [DOGE]. Based on data from IntoTheBlock, there has been a significant surge in new demand for this meme coin. Specifically, on May 2nd, approximately 28,000 new addresses were formed to engage in DOGE trading. This number represents a striking 102% increase compared to the monthly low in new demand recorded on April 29th.

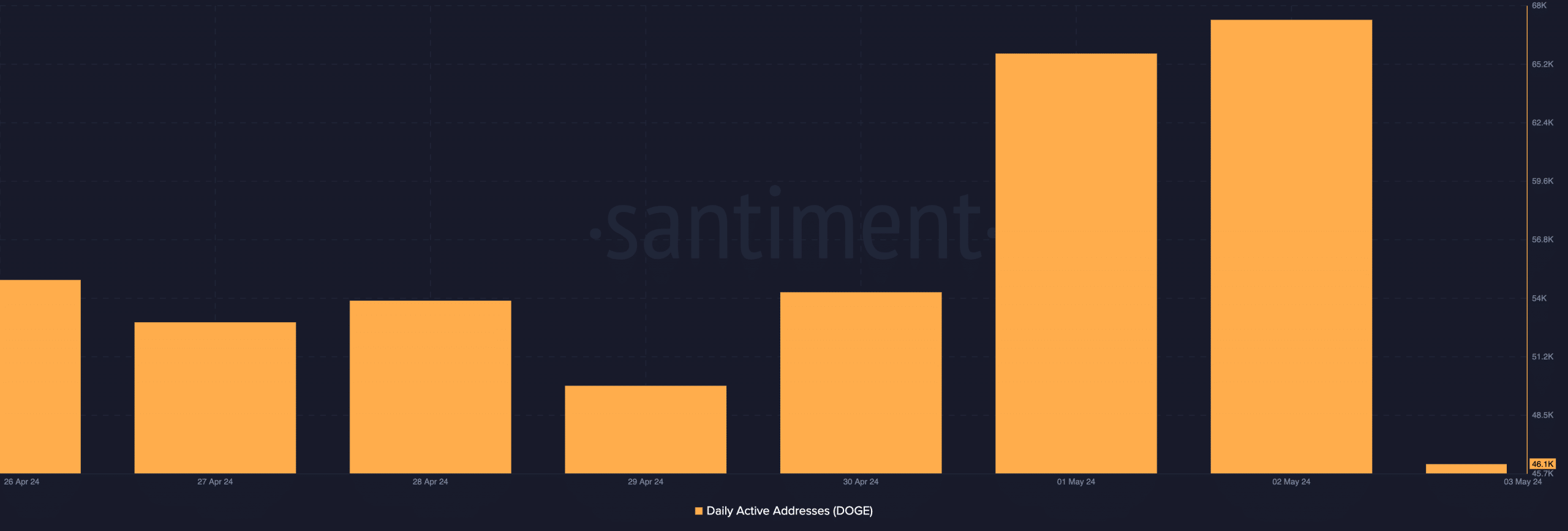

Over the last week, the number of unique addresses engaged in Dogecoin transactions has significantly increased along with surging demand. According to Santiment’s data, there was a notable 27% increase in daily active addresses for this memecoin within the past seven days.

Here is how DOGE reacted

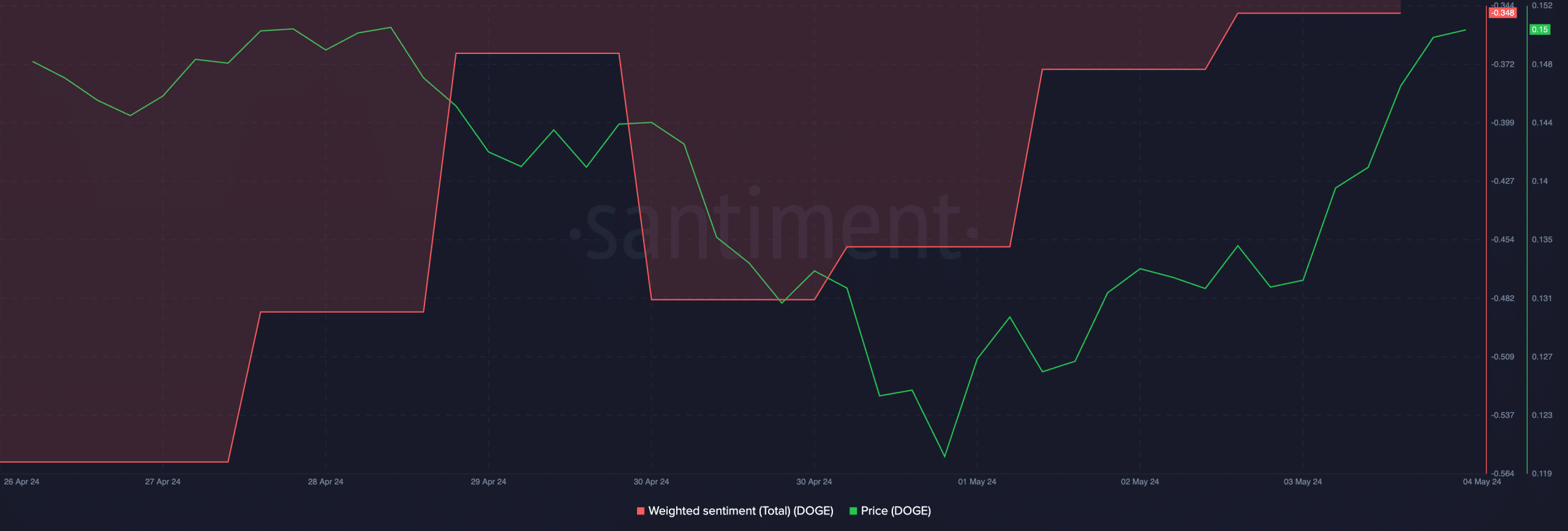

As a researcher studying market trends, I’ve observed that an increase in network activity for assets is typically a precursor to a price rally. However, my analysis of Dogecoin (DOGE) reveals a different scenario. Despite the consistent demand for this altcoin over the past week, there has been no substantial surge in its price.

At present, DOGE was priced at $0.15 in the market. As per CoinMarketCap’s latest data, this digital currency experienced a marginal gain of only 2% throughout the past week, with the majority of that increase taking place within the previous day. The recent minor uptick in DOGE’s price is consistent with the overall market trend during that timeframe, which saw declines. This slump in trading activity contributed to a dip in the total cryptocurrency market capitalization below $2.3 trillion on May 1st; however, it eventually bounced back.

However, DOGE’s hike over the last 24 hours is a sign of bullish sentiment.

According to Santiment’s analysis, DOGE‘s weighted sentiment is on an uptrend and is about to surpass its neutral center line. This indicator reflects the overall sentiment of the crypto market towards a particular asset. When it reads above zero, sentiment is bullish, while negative sentiment dominates when the value falls below the zero line.

Based on current news reports, DOGE‘s overall sentiment was recorded as -0.348 at the moment of check. However, this figure may increase if there is a surge in trading activities and DOGE continues to rise in the near future.

Realistic or not, here’s DOGE’s market cap in BTC’s terms

Now might be your time

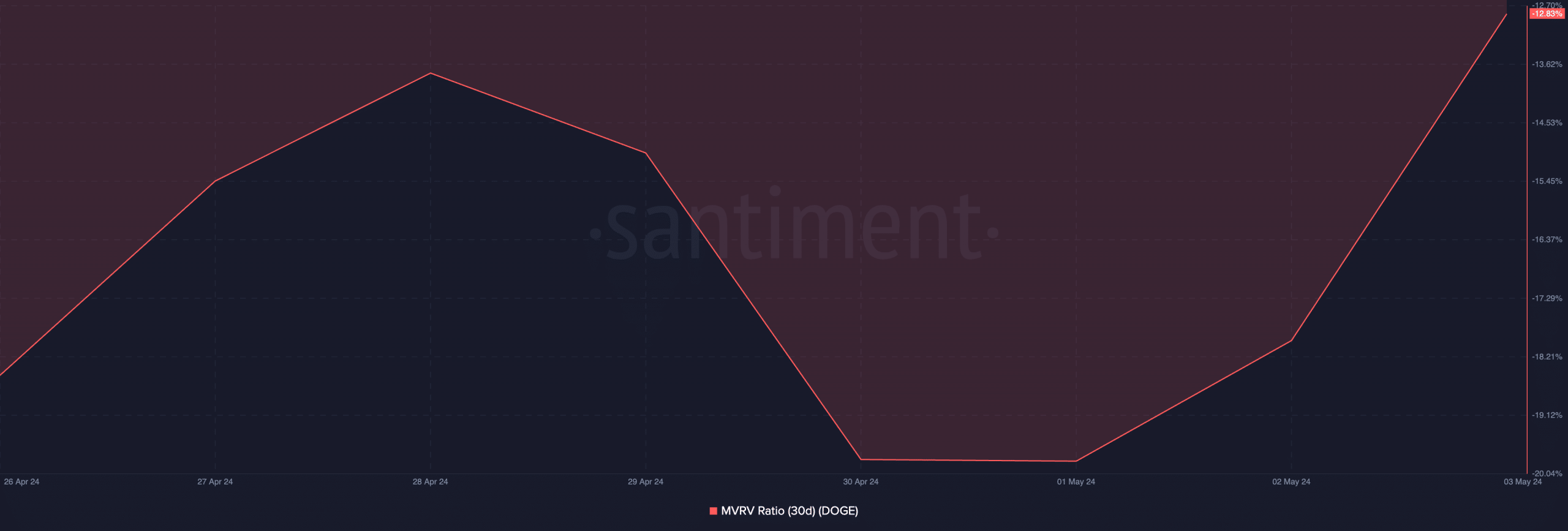

According to AMBCrypto’s analysis using the Market Value to Realized Value (MVRV) ratio for Dogecoin (DOGE), this indicator currently suggests it could be a good buying opportunity. The 30-day moving average of this metric stood at a negative value of -12.83% as of now.

The Market Value to Realized Value (MVRV) of an asset calculates the proportion between the current market worth and the cost basis of each individual coin or token within that specific asset.

If an asset’s value exceeds one, it implies that the market value is substantially greater than what most investors originally paid for their shares. In such cases, we refer to the asset as being overvalued.

When the asset provides a negative result instead, this signifies that its market value is less than the average cost at which all its circulating tokens have been bought.

Traders view a unfavorable Moving Average of Realized Value (MVRV) ratio as an indicator to purchase when prices have dipped, expecting a subsequent price surge.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- SOL PREDICTION. SOL cryptocurrency

- SUI’s price hits new ATH to flip LINK, TON, XLM, and SHIB – What next?

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- McDonald’s Japan Confirms Hatsune Miku Collab for “Miku Day”

- LINK’s $18 Showdown: Will It Break or Make?

- Michelle Trachtenberg’s Mysterious Death: The Unanswered Questions

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

2024-05-04 14:15