- Dogecoin’s value has fallen by double digits over the last seven days

- Its declining Futures open interest pointed to liquidity exit from its derivatives market

Dogecoin (DOGE), the most popular meme coin in the market, continued to slip during the past week as it didn’t gain from the hype following its halving event. Its value was at $0.15 based on the current market data, reflecting a slight 0.13% increase over the previous 24 hours, according to CoinMarketCap’s latest figures.

Over the past week, DOGE‘s price has dropped by 10%, making it the memecoin with the largest price decrease of over 10% among the leading coins during this period.

What can coin holders expect?

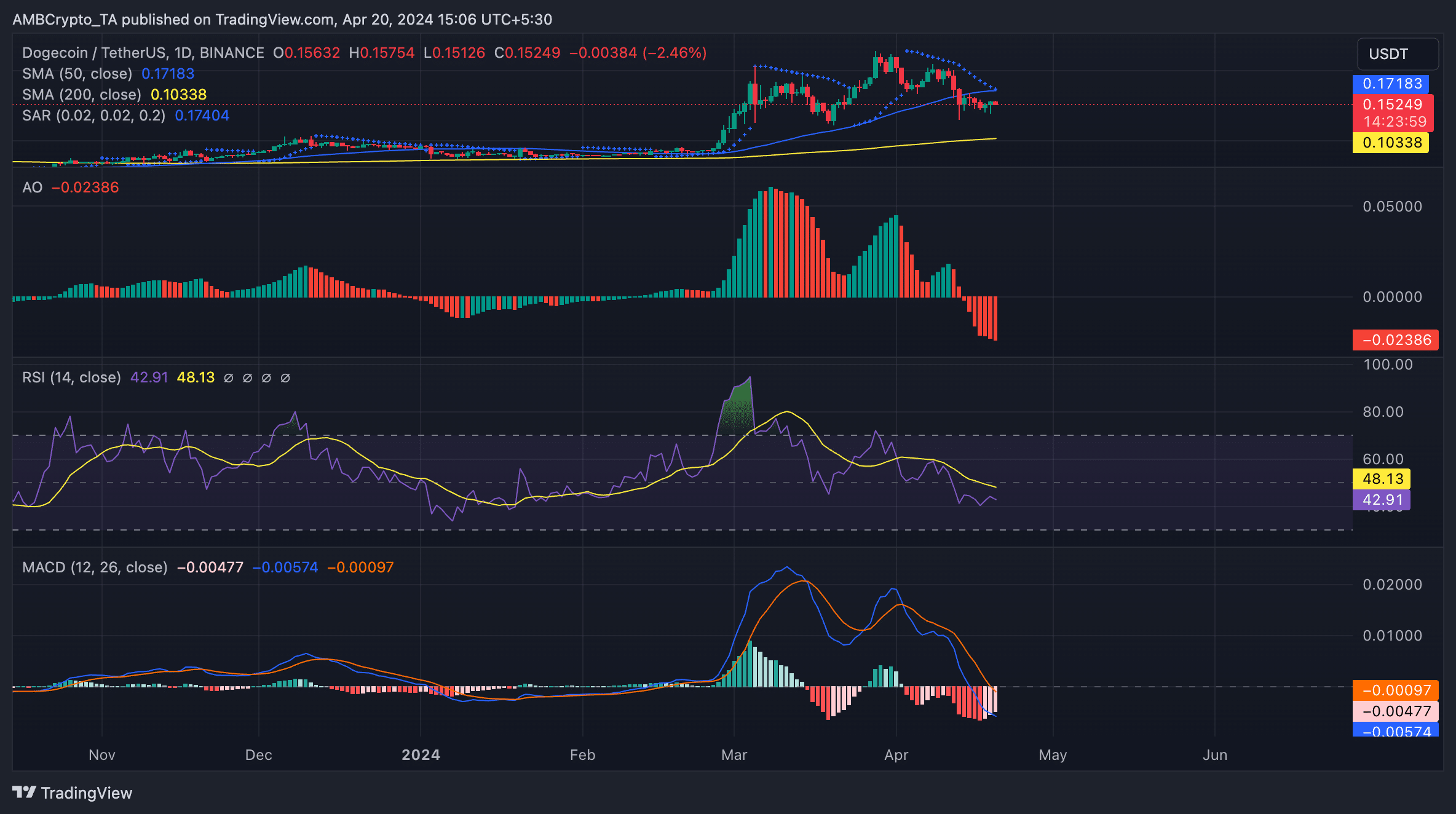

In simpler terms, the price of DOGE, an altcoin, has been showing bearish signs. Specifically, its value dipped below the 50-day moving average and remained below the 200-day moving average as of the current market update.

The drop in DOGE‘s price below its 50-day moving average indicated a change in the market’s attitude from pessimistic to optimistic. As it moves closer to its 200-day moving average, the memecoin might be approaching a significant support point at around $0.1.

In addition, the Awesome Oscillator, signaling DOGE‘s market momentum, displayed red histogram bars with a downward trend at present. This pattern has persisted since April 14th. A downtrend in an asset’s Awesome Oscillator suggests that selling pressure is strong.

In simpler terms, when DOGE‘s RSI dropped below its neutral level of 50, it signaled that demand for the memecoin was decreasing. At the moment, DOGE’s RSI stood at 42.87, indicating that traders were more inclined to sell DOGE rather than buy it.

At present, the MACD line (represented by the blue line) was situated beneath both the signal line (denoted by the orange line) and the zero line for the DOGE coin. This occurrence signified that the short-term direction of DOGE’s price movement was less robust compared to its long-term trend, as indicated by the crossover.

Realistic or not, here’s DOGE’s market cap in BTC’s terms

Traders view this as a sign to exit their long positions and take short ones.

At the current moment, the Parabolic SAR indicator for DOGE suggested that holding long positions might not be profitable in the future. Specifically, the indicator’s dots were positioned above the price candles.

In simpler terms, when the market shows such a trend, people usually understand it as a sign that the market is experiencing a decrease in prices and this downward trend may persist.

In the futures market for the dogecoin (DOGE), the number of outstanding contracts reached a 30-day low, with a reported value of $953 million based on Coinglass data.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- THETA PREDICTION. THETA cryptocurrency

- How Potential Biden Replacements Feel About Crypto Regulation

2024-04-21 02:15