- DOGE has surged by 26.61% over the past month.

- Market indicators suggest Dogecoin may decline as a bearish crossover appears on DMI.

As an analyst with over a decade of experience in the crypto market, I’ve seen my fair share of bull and bear runs. The recent surge in Dogecoin (DOGE) is noteworthy, but it seems we might be nearing a correction.

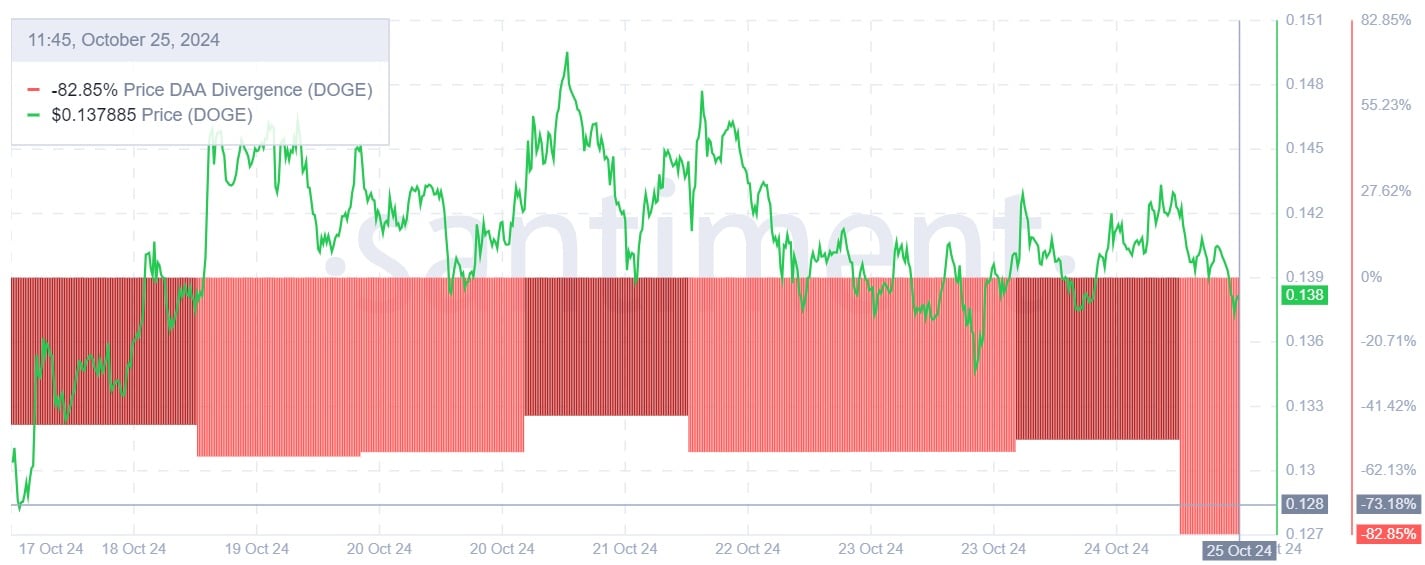

From its peak of $0.149 on October 21st, Dogecoin [DOGE] has seen a decrease of approximately 8.05%. At the moment, it’s being traded at around $0.137. However, over the past week, there’s been a 2.59% rise, and on a monthly basis, Dogecoin has experienced a growth of about 26.61%.

As a crypto investor, I’ve noticed that while we’re still in the green for the month, the upward momentum seems to be slowing down. This observation is particularly evident when looking at Dogecoin (DOGE). At the beginning of October, it jumped from $0.102 to $0.149, a significant increase of 46.05%. However, since then, its growth pace appears to have slowed, indicating potential market consolidation or a correction.

Consequently, the latest trading movements suggest that the memecoin’s momentum is waning, as traders seem to be increasingly selling and taking over the market.

The shift in market mood can be observed through a bearish signal, which occurs when the Negative Directional Movement Index (-DI) line crosses above the Positive Directional Movement Index (+DI). As of now, -DI is at 32 and +DI is at 29, with -DI having increased while +DI decreased over the past day.

It appears that the downward trend is picking up speed, as evidenced by the significant increase in the ADX. Over the course of a week, it rose from a minimum of 17 to a maximum of 32.

When the Directional Movement Index (DMI) of an asset is configured in this manner, it implies that sellers are gradually gaining dominance and the selling pressure is growing stronger than the buying pressure. If this pattern continues, it might initiate a prolonged decline for Dogecoin.

What Dogecoin charts suggest

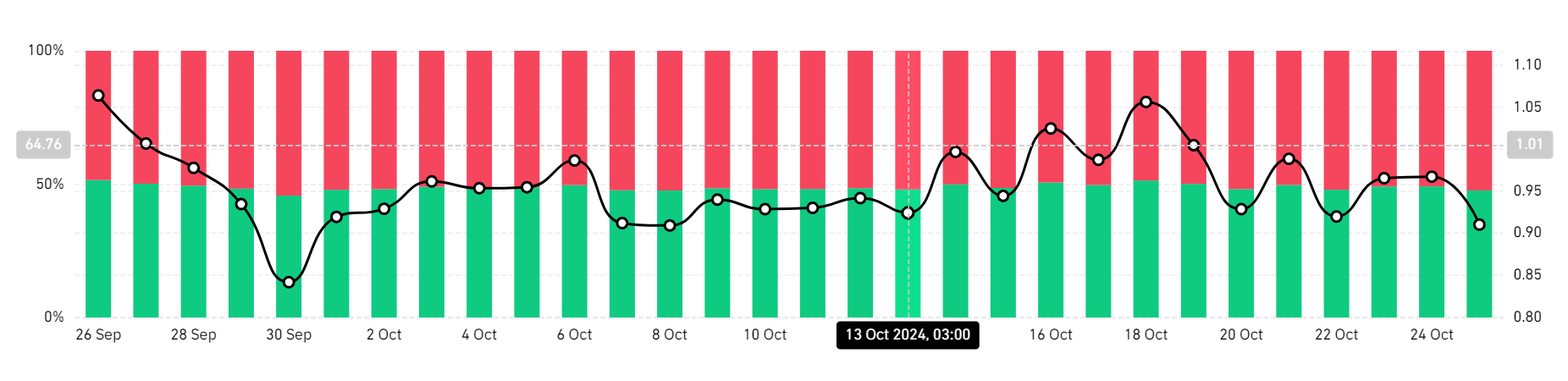

The pessimistic outlook in this market is reinforced as a greater number of investors have opted to sell short rather than buy. As per Coinglass data, over the last 24 hours, approximately 52.35% of investors have chosen to engage in selling short positions.

This implies that most investors anticipate DOGE prices to decline near term.

Over the last seven days, I’ve observed that Dogecoin’s Daily Averaged Price (DAA) divergence has persisted in a negative trend, which typically indicates a waning bullish energy. This suggests that there might be a decrease in active market participants.

Read Dogecoin’s [DOGE] Price Prediction: 2024-2025

As an analyst, I’m observing that this price surge appears to be more about speculative activity rather than robust underlying fundamentals. Historically, such situations often lead to a price adjustment or correction.

Dogecoin’s trend seems to be changing as bullish energy lessens. If this market trend persists, Dogecoin could undergo a price adjustment. In the short term, if there is a drop, the next potential level of support for Dogecoin might be around $0.12.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-10-26 07:03