-

The demand for DOGE has declined.

This has caused its price to trade within a range.

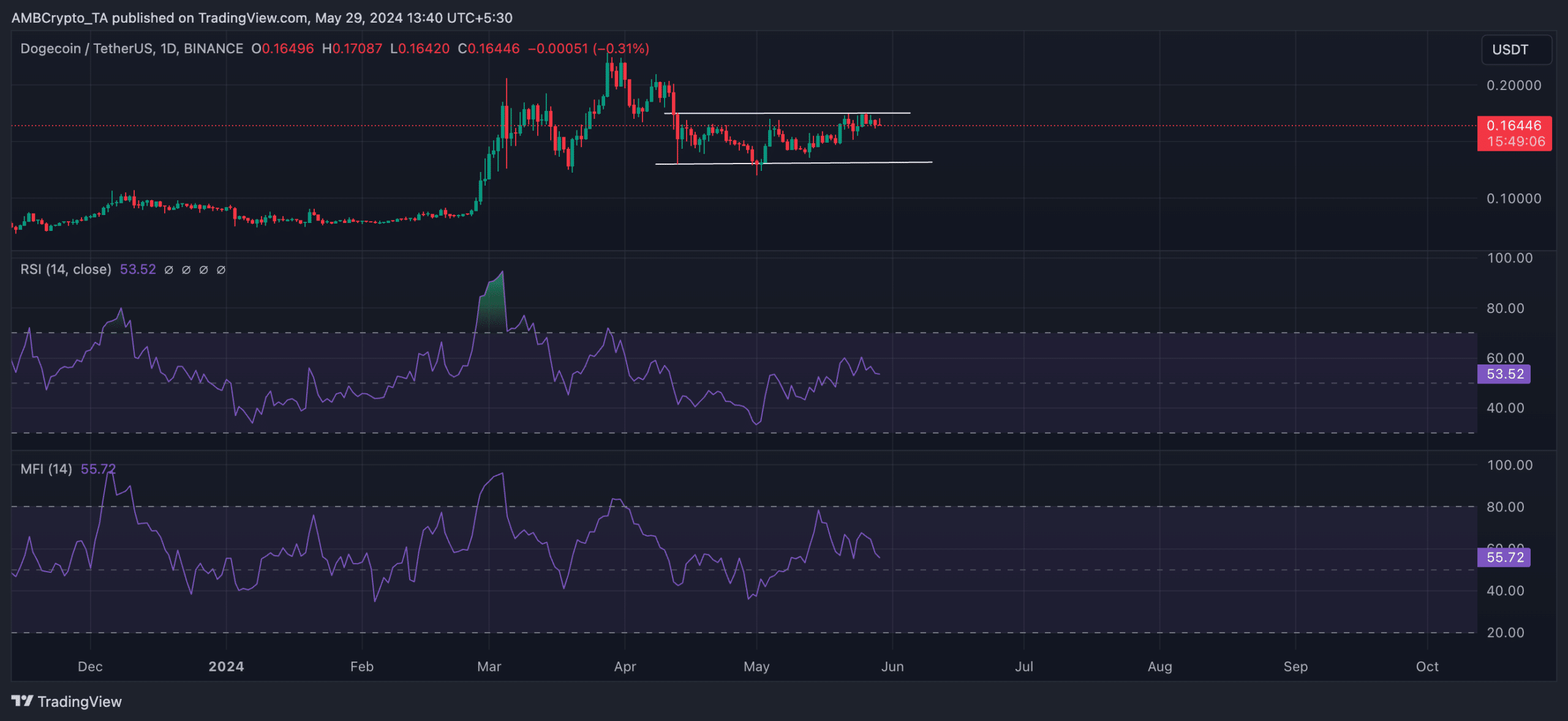

As a researcher with experience in analyzing cryptocurrency markets, I’ve noticed that the demand for Dogecoin (DOGE) has declined significantly over the past week. This decrease in network activity has led to DOGE trading within a tight price range, forming a horizontal channel.

In the past week, there’s been a decrease in the desiredness for Dogecoin (DOGE) based on on-chain indicators. As a result, the cryptocurrency’s network activity has waned, leading to its price moving back and forth within a narrow band, creating a flat trendline or horizontal channel.

During the reviewed timeframe, DOGE‘s price declined by 1%, whereas the values of other prominent meme assets experienced growth.

Over the last week, I’ve noticed impressive price surges in various cryptocurrencies. Shiba Inu (SHIB) grew by 9%, Pepe (PEPE) jumped by 14%, dogewhiz (WIF) soared by an astounding 35%, and Bonk (BONK) climbed by a substantial 30%.

DOGE trends within a range

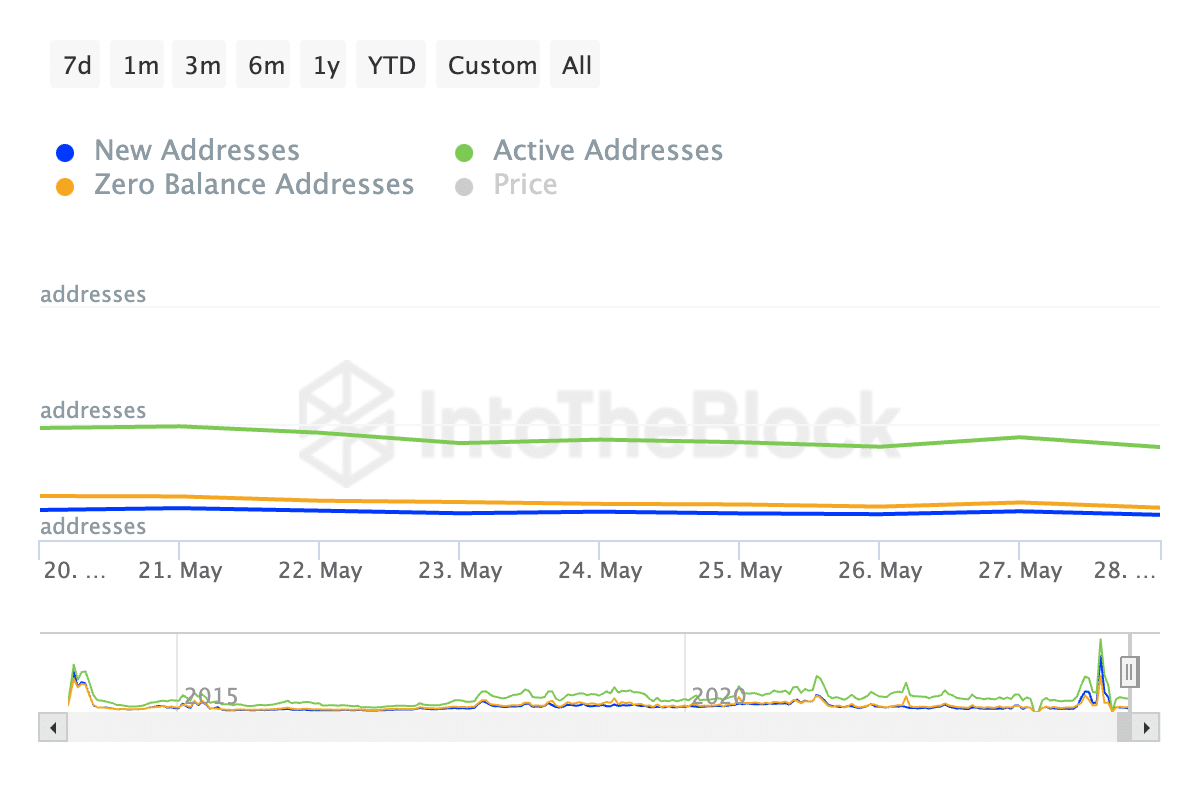

Based on IntoTheBlock’s data analysis, there has been a significant decrease of 18% in the number of unique addresses transacting with Dogecoin (DOGE) over the past week.

As an analyst, I’ve noticed a decrease in new demand for DOGE, the meme coin. Based on data from the same provider, there was a 21% drop in the number of new addresses created to trade this cryptocurrency during the specified timeframe.

A drop in the number of daily active addresses for a particular asset may indicate a decrease in the amount of trading activity, or volume, surrounding that asset.

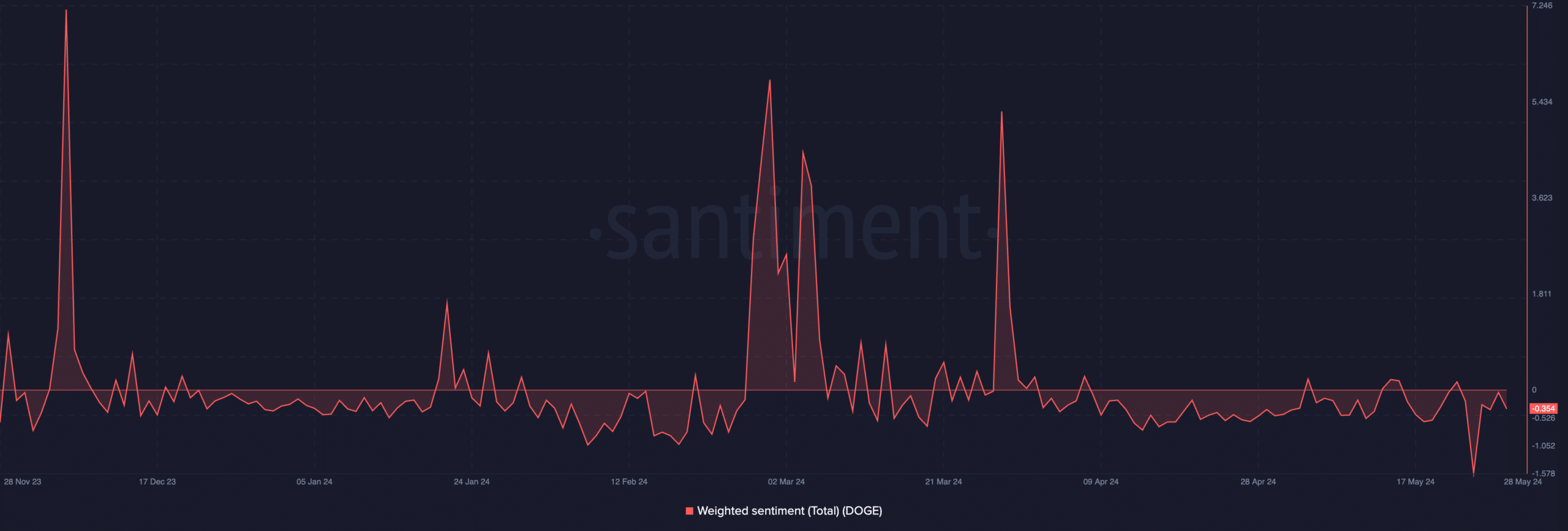

Based on Santiment’s figures, the trading volume for DOGE reached a high of $3.01 billion on May 24th. Since then, there has been a decrease of approximately 53%.

As a crypto investor, I’ve noticed that the trading volume of DOGE has decreased significantly over the past week. Part of this decline can be attributed to the persistent negative sentiment surrounding the coin. For the most part, DOGE has been met with a pessimistic outlook in the market.

On the 24th of May, the Weighted Sentiment hit a YTD low of -1.56, marking a significant drop.

At present, the feeling tone assigned to DOGE, based on available data, stands at a weighted sentiment score of -0.35. This indicates that the prevailing sentiment towards the popular meme coin is predominantly negative.

When an asset’s price stays within a specific price range, it indicates that buying and selling forces are evenly matched. Neither the buyers (bulls) nor the sellers (bears) have enough power to initiate a sustained trend upward or downward, respectively.

At the current moment, the RSI and MFI readings for DOGE offered confirmation of this trend. Specifically, the RSI stood at 53.52 and the MFI at 55.72.

As a researcher studying market trends, I found that neither the buying side nor the selling side held a clear dominance based on my analysis of the indicators.

The trading volumes for buying and selling were roughly equal, resulting in no clear dominant side.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-05-30 07:03