- Dogecoin bulls showed up strong as the memecoin demonstrated its dominant position

- Whales have been accumulating, but exchange flows suggested that profit taking is happening

As an analyst with over two decades of experience in the crypto market, I’ve seen my fair share of memecoins come and go. However, Dogecoin continues to impress me with its resilience and ability to bounce back from adversity. Its latest rally is a testament to its staying power and the strong community support it enjoys.

It seems that Dogecoin is mirroring Bitcoin‘s recent trends in terms of market performance. Notably, both cryptocurrencies have experienced a significant surge since mid-October, indicating that Dogecoin continues to dominate among meme-based coins.

Initially, back in mid-October, Dogecoin’s influence was only 0.74%. However, it has bounced back and surpassed 1% for the first time since May. At this moment, it stands at 1.04%. This upturn can be attributed to the robust bullish rally that Dogecoin has experienced lately.

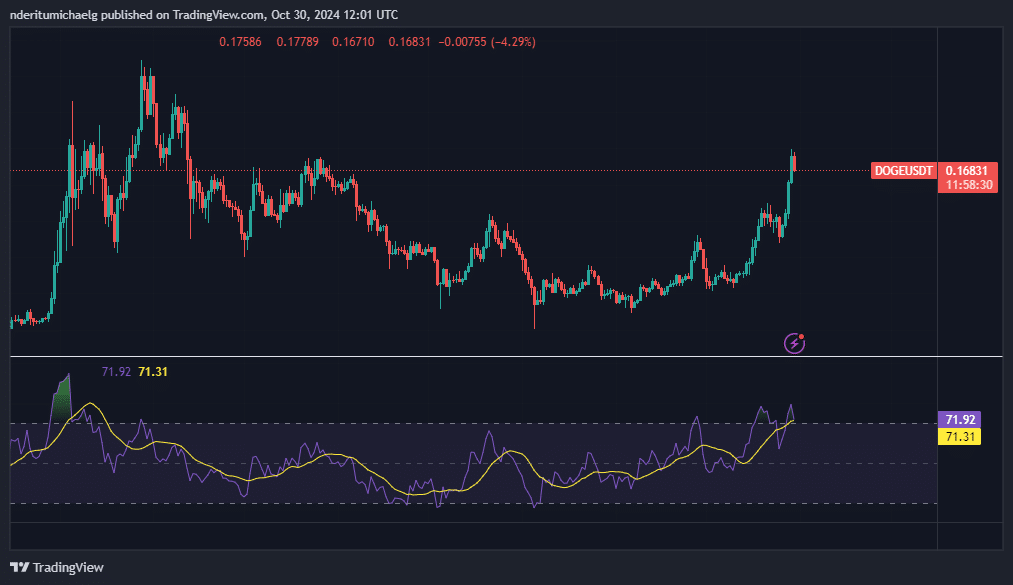

From a comparative viewpoint, Dogecoin hit an all-time high of $0.179 on Tuesday, which is the same price it last held back in April this year. It’s experienced a significant surge, rising by approximately 74% from its lowest point in October to its current peak, and a further increase of around 62% to its present value of $0.168.

Could it be possible that DOGE is about to experience a cooling-off period? There have been several indicators recently that point towards potential profit-taking in the near future. For instance, its most recent high was right at a historically tough resistance level, and there’s already been a small decline over the past 24 hours.

Additionally, it appeared that Dogecoin had significantly exceeded its buying point following its recent surge. Yet, the potential for decline seemed constrained – A hint suggesting that investors may be preparing for further bullish growth.

Dogecoin whales continue accumulating

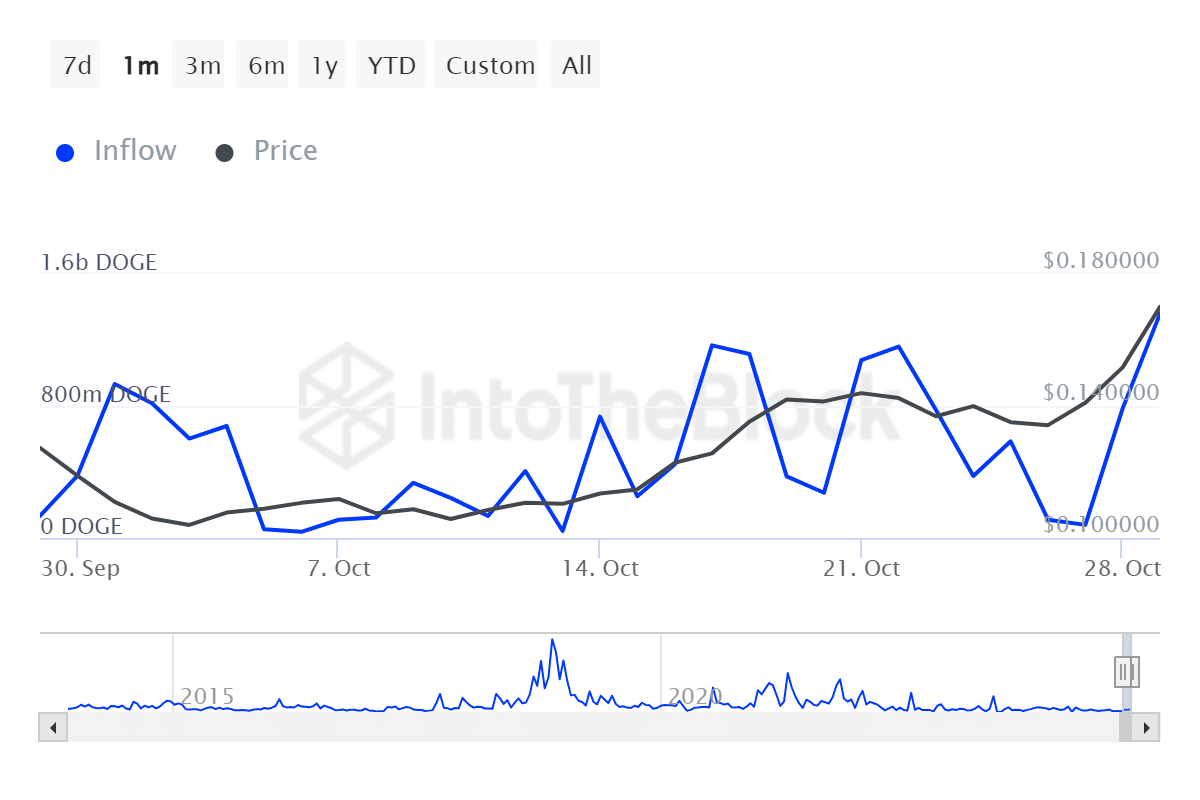

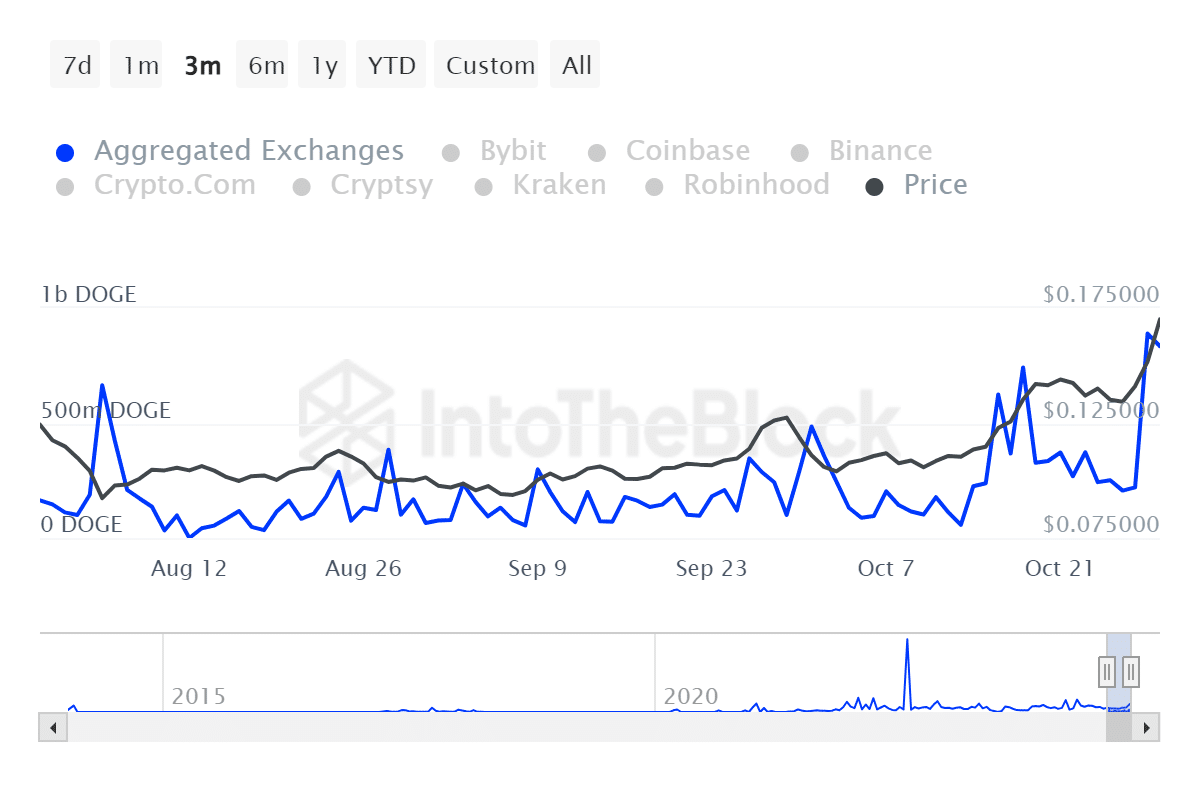

Recent on-chain analysis shows that the recent surge in Dogecoin’s price is primarily driven by strong buying interest from large investors or “whales.” Specifically, there was a significant increase in deposits into the accounts of major holders, with 79.55 million DOGE entering on one end and 1.36 billion DOGE on the other as of October 29th.

During the same duration, the amount of DOGE moving out increased dramatically, from 74.42 million to a staggering 782.45 million. This substantial rise suggests that whales were purchasing much more DOGE than they were selling.

Is it likely that selling pressure will continue at its present strength, given that there’s evidence of increased exchange flows? The data indicates that this trend may already be underway. Specifically, at the time of writing, inflows to exchanges exceeded 833 million Dogecoin, while outflows were approximately 597 million Dogecoin.

A situation where the rate of money flowing out is less than the rate coming in could suggest a trend towards increased selling, driven by investors looking to take profits. This might be the reason behind the observed scenario where exchange inflows exceeded outflows.

As we consider the information mentioned earlier, it’s important to note a prevailing sense of market optimism as well. This positive outlook might persuade some investors to hold onto their gains, anticipating further price increases in the near future. Consequently, potential losses could be minimized under such circumstances.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Elden Ring Nightreign Recluse guide and abilities explained

2024-10-31 11:03