-

Dogecoin demonstrated some bullish strength amid signs of accumulation

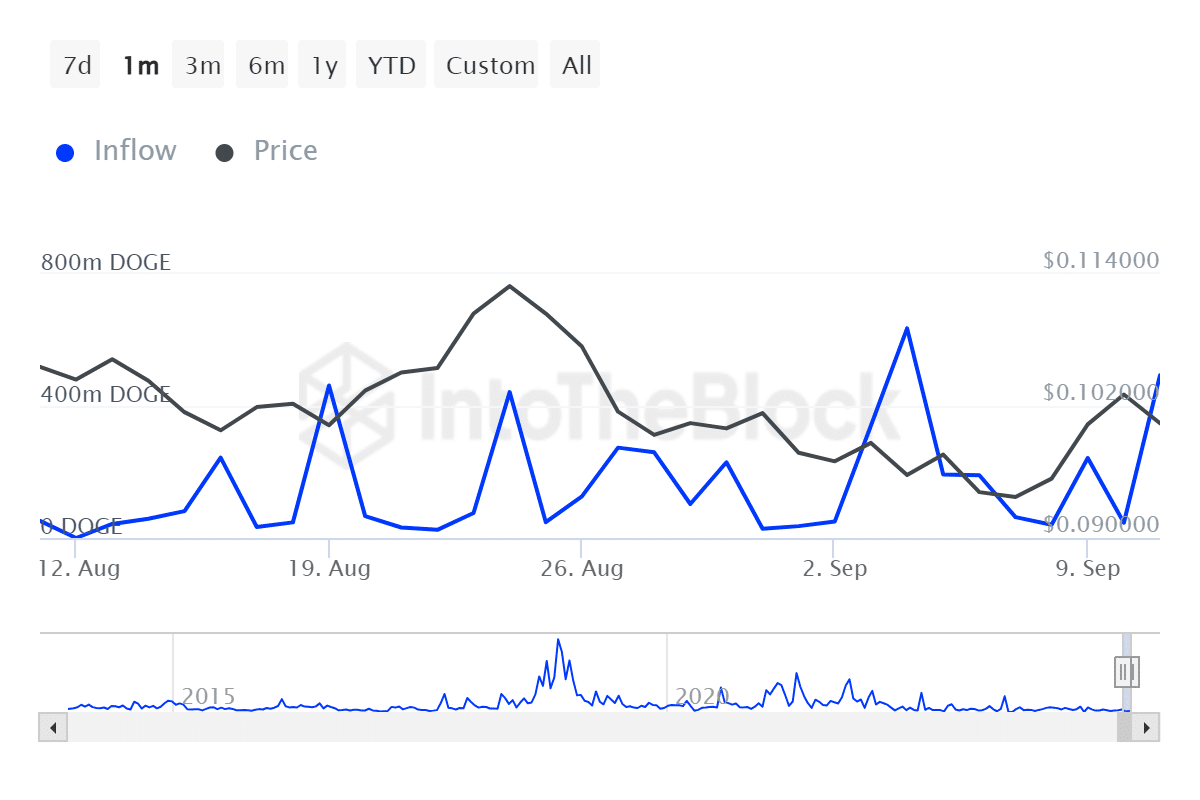

DOGE large holder inflows confirmed that bulls have been buying

As a seasoned crypto investor with a knack for deciphering market signals, I find the recent developments surrounding Dogecoin intriguing. Despite the bearish sentiment that has been plaguing the market, Dogecoin’s attempts at bullish recovery are a beacon of hope.

In my analysis, I’ve noticed a downward trend in Dogecoin’s price movements recently, which aligns with the broader market’s pessimistic outlook. This bearish trend appears to be gradually undermining investor confidence in the market’s most prominent meme coin, Dogecoin.

Despite occasional bearish trends, it makes frequent attempts at a bullish comeback. Lately, it seems to be experiencing one of these upturns.

This week, Dogecoin started off with a surge in positive momentum, but this rise was brief. However, this temporary increase could indicate a significant shift in the near future. In truth, the leading meme coin has primarily moved horizontally for about five weeks now.

Nevertheless, the Money Flow Indicator (MFI) suggested that there was a significant amount of buying activity or accumulation occurring.

As a researcher, I observed that the Money Flow Index (MFI) dipped to nearly 20 on the 5th of August. However, it has since rebounded to 63.87 at present. Similarly, the Relative Strength Index (RSI) indicated a similar trend in my analysis.

Indeed, it has surpassed its middle point lately without showing much signs of intense selling to dip below this mark. To put it simply, the Dogecoin market is witnessing a growing strength among buyers, as suggested by the price trends.

Are Dogecoin whales accumulating?

Additionally, it seems that whales have been buying up a significant amount of Dogecoin as per recent on-chain data. Specifically, according to IntoTheBlock’s large holder inflows metric for Dogecoin, whale holdings surged to approximately 493.15 million DOGE over just the past two days.

During this timeframe, significant holdings were increased by major investors, suggesting a robust build-up. However, it’s worth noting that the flow of funds from large holders decreased dramatically, moving from approximately 442.12 million DOGE to just 78.17 million. This implies a shift in holding patterns.

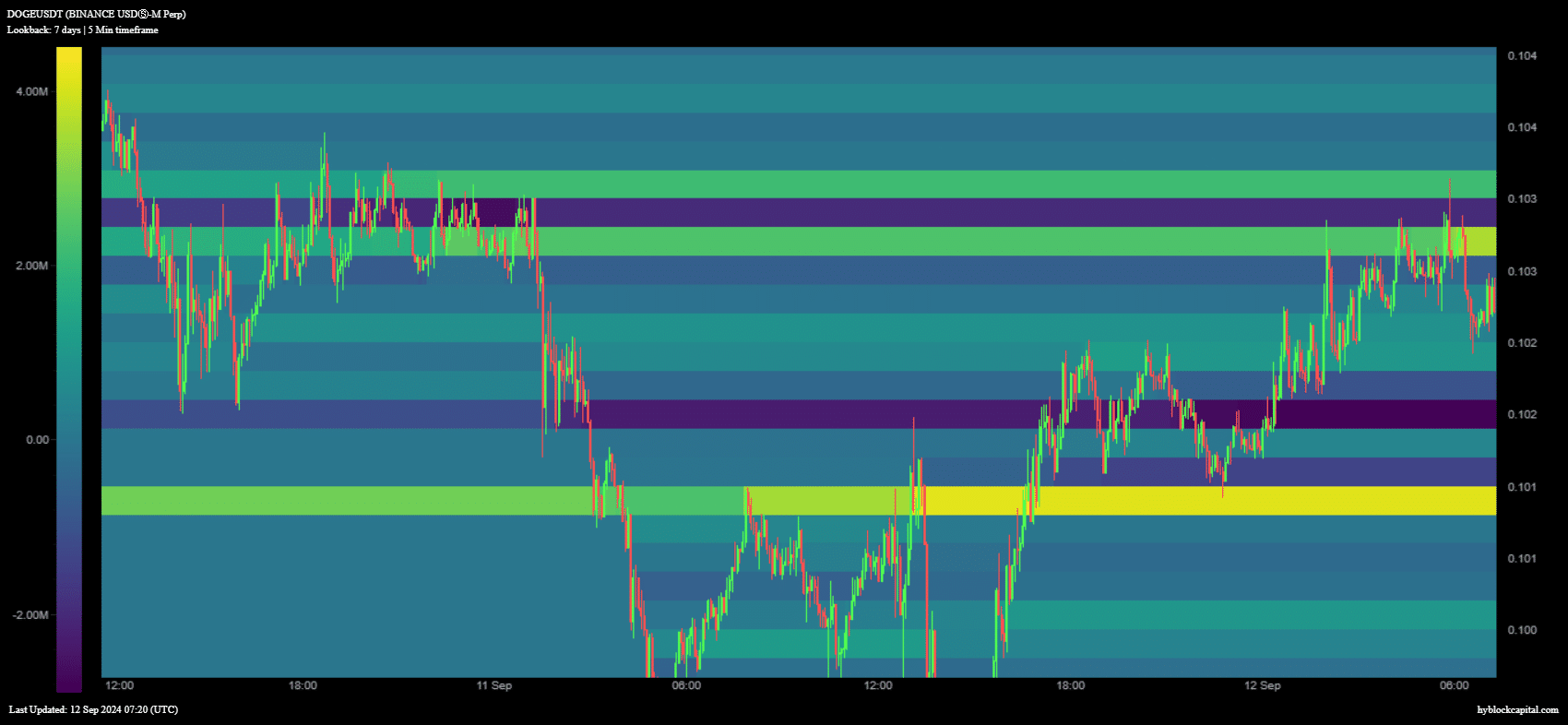

As an analyst, I’ve observed a significant shift in the whale behavior: from fueling sell pressure, they’ve started accumulating more coins, altering the market dynamics. Simultaneously, Dogecoin’s net long positions map indicates a retest of a popular hot zone, where investors have been increasingly taking long positions, particularly around the $0.101 price mark.

At the previously mentioned price point, the maximum number of long positions reached approximately 4.154 million. This occurred specifically when the asset was retested at the $0.101 level.

As a researcher, I’ve found that the peak number of net short positions within the same price range stood at approximately 1.54 million. Interestingly, since then, the price has risen. This suggests a stronger bullish sentiment compared to bearish at the point of observation, as evidenced by the higher number of net long positions relative to net shorts.

According to what we’ve seen so far, it seems possible that Dogecoin might experience a significant surge soon. However, this prediction assumes no sudden outbreak of negative news (FUD) that could shake the increasing optimism surrounding it.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-09-13 08:07