-

Dogecoin still volatile, with most holders in profit despite a bearish long-term trend

DOGE’s market behavior didn’t seem to have any clear directional movement

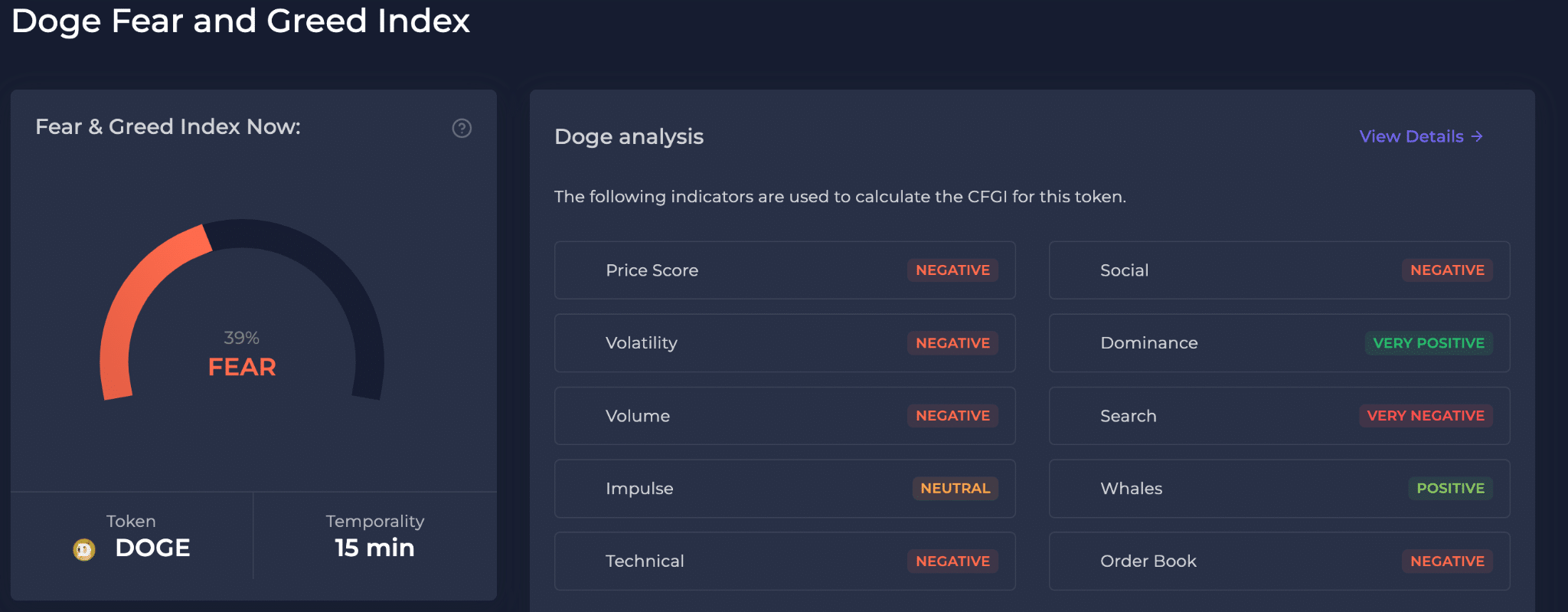

As an analyst with a background in cryptocurrency market analysis and a deep understanding of memecoins like Dogecoin (DOGE), I believe that while DOGE’s price action remains volatile, the overall sentiment among holders is positive due to their profitability. However, the lack of clear directional movement indicates a high degree of uncertainty in the market.

As a researcher studying the cryptocurrency market, I’ve noticed that Dogecoin (DOGE), which is often regarded as the blueprint for memecoins, hasn’t shone too brightly during this market cycle. However, there was a brief spurt of growth a week ago when Ethereum ETF news ignited excitement in the market. DOGE experienced an 8% surge in one day as a result. But at present, its chart is painted red, raising questions about whether Dogecoin has definitively entered a bearish phase.

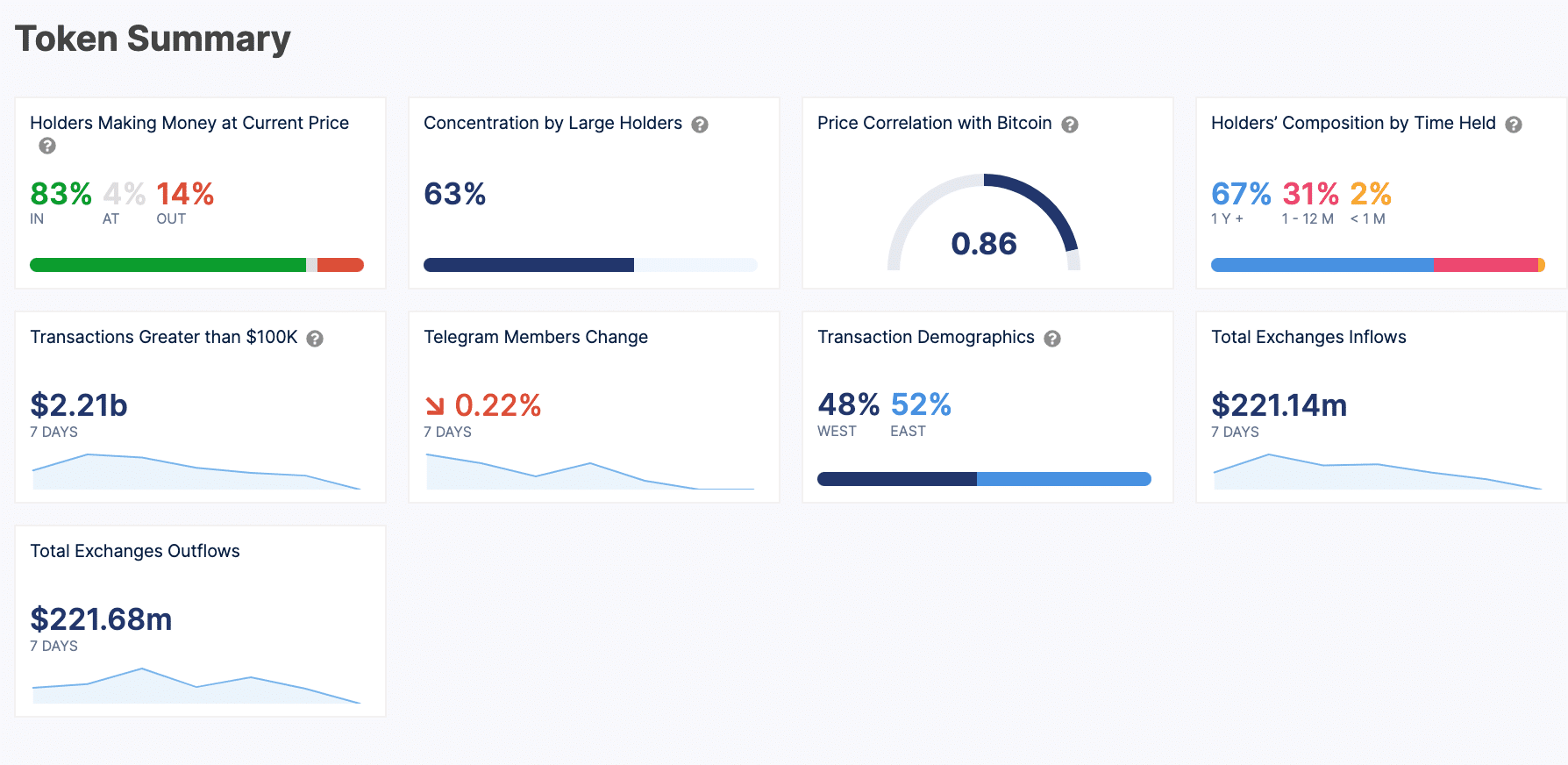

Initially, let’s examine the situation of DOGE investors according to IntoTheBlock’s findings. Approximately 83% of these investors are currently earning a profit with the current price level. Consequently, although there have been recent setbacks, long-term investors find themselves in a favorable position. Moreover, an impressive 63% of Dogecoin’s total supply is controlled by large investors or “whales.”

As an analyst, I would point out that the significant correlation between Dogecoin and Bitcoin, which stands at 0.86, underscores the substantial impact of Bitcoin’s market trends on Dogecoin’s price fluctuations. In simpler terms, Bitcoin’s price actions have a profound influence over Dogecoin’s price movements in the broader cryptocurrency market.

As a researcher studying the cryptocurrency market trends, I’ve observed an intriguing equilibrium between inflows and outflows from exchanges in the past week, with inflows amounting to $221.14 million and outflows at $221.68 million. This balance could indicate a harmonious buy-sell activity among traders in the Dogecoin market. The coin’s price action has remained stable as neither bullish nor bearish forces have dominated the charts, resulting in Dogecoin consolidating its position.

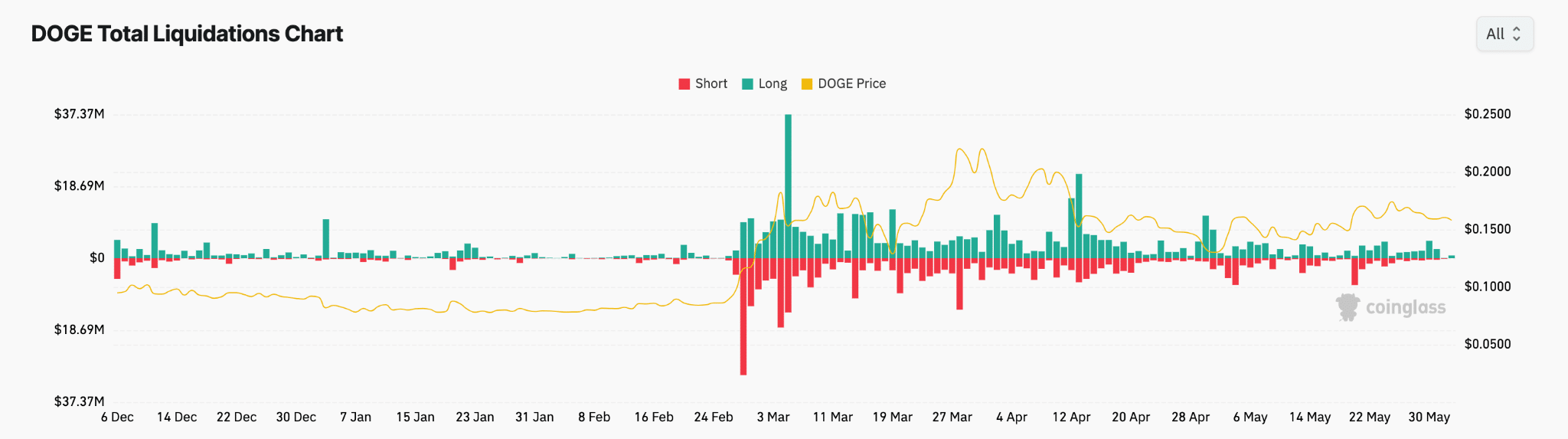

The sudden increases in Dogecoin’s value, particularly during brief market corrections, indicate that swift upward trends have caused short sellers to abandon their losing bets.

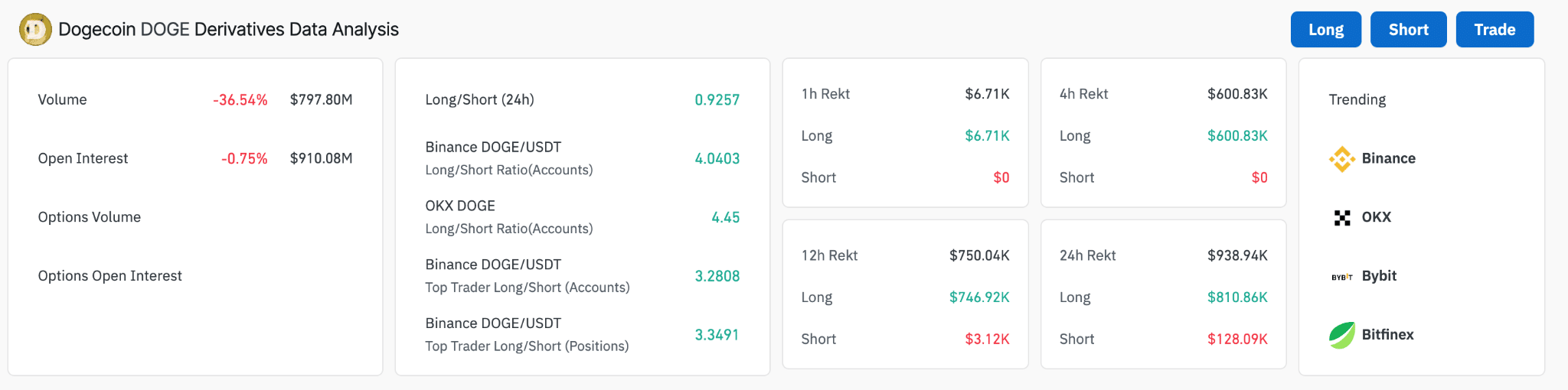

As a crypto investor observing the market trends, I notice a blend of both long and short positions being liquidated without a clear upward or downward trend lasting for an extended period. This indicates that the market is volatile and prone to sudden price swings due to speculative trading rather than a steady movement in any particular direction.

The way DOGE is being liquidated matches its current price trend. However, the market shows signs of uncertainty, with brief surges and dips, which is characteristic of a memecoin like DOGE.

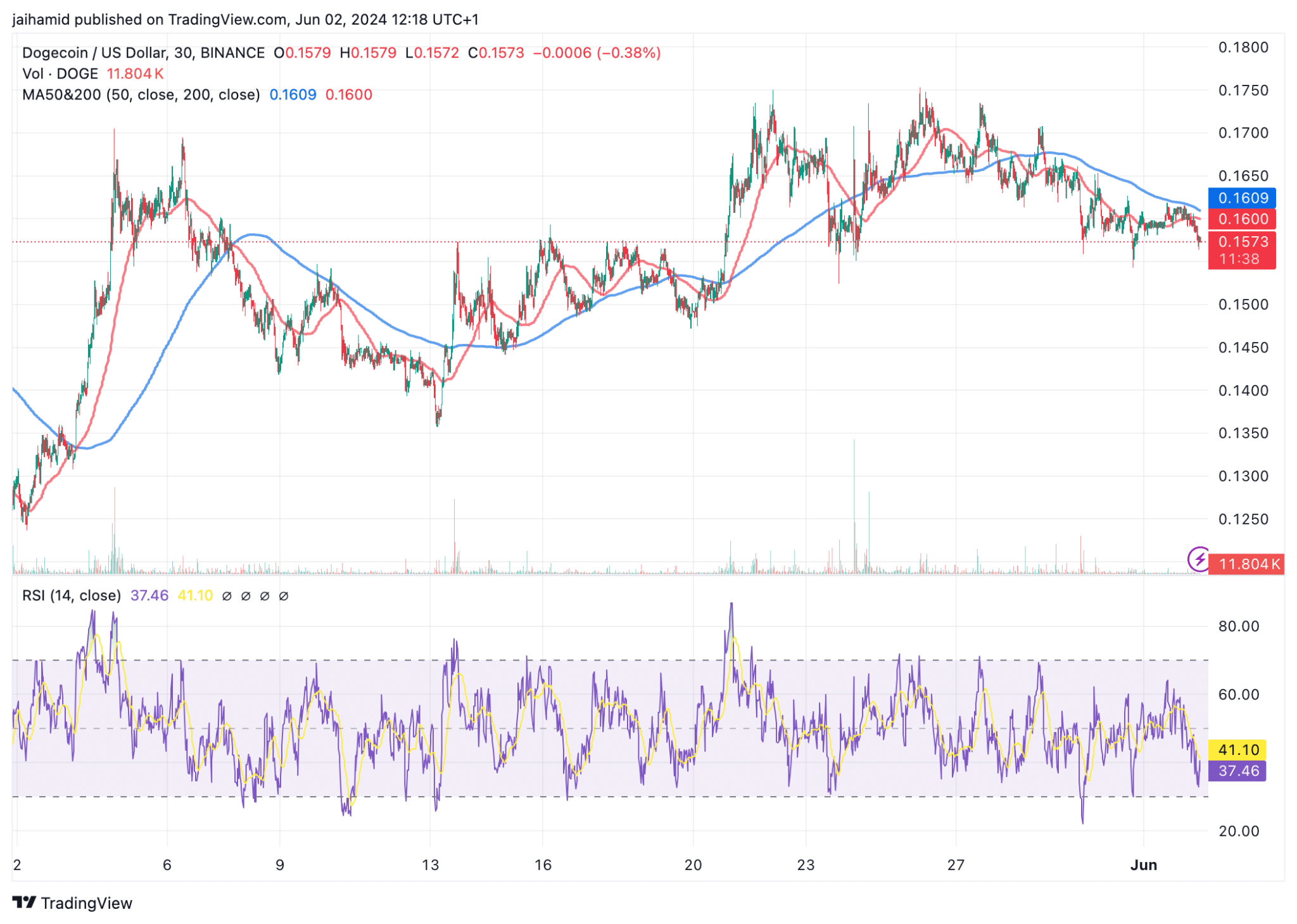

Examining Dogecoin’s monthly price trend uncovered its struggle with market volatility and sentiment. For the past month, DOGE displayed various price swings but mainly stayed within a narrow range between approximately $0.135 and $0.175.

The Memecoin’s Relative Strength Index (RSI) fluctuating between the ranges of 30 and 60 indicates its position in the neutral-to-bearish territory on the price charts.

The relationship between DOGE‘s moving averages provided a more distinct representation of its medium-term direction. Specifically, the 200-day average frequently sat above the 50-day, indicating that while there were short-term gains, the overall perspective remained negative for Dogecoin.

Read More

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- OM PREDICTION. OM cryptocurrency

- 1923 Sets Up MASSIVE Yellowstone Crossover

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Moo Deng’s Adorable Encounter with White Lotus Stars Will Melt Your Heart!

- Netflix’s Dungeons & Dragons Series: A Journey into the Forgotten Realms!

- Leslie Bibb Reveals Shocking Truth About Sam Rockwell’s White Lotus Role!

2024-06-03 08:07