- Dogecoin price has dropped by 1.6%, trading at $0.1071 at press time, with a sluggish performance.

- An analyst predicted a potential rally, citing a pattern similar to Dogecoin’s 2021 bull run.

As an experienced crypto investor who has witnessed the wild rollercoaster ride of the cryptocurrency market, I have learned to navigate the ups and downs with cautious optimism. The recent 1.6% drop in Dogecoin’s price, trading at $0.1071, leaves me feeling a bit like a seesaw in a windstorm – always waiting for the next big swing.

Over the last week, the humorously originated digital currency known as Dogecoin (DOGE) has been grappling with market fluctuations, despite earlier efforts aiming for a surge.

Last week, Dogecoin experienced a 2.7% rise, showing a minor uptick. However, its latest performance has left something to be desired.

Over the past day, the value of the digital currency decreased, reaching an all-time low of 0.1065 USD, but has since rebounded slightly to its current trade price of 0.1071 USD as we speak.

Over the last day, there was a 1.6% decrease which continues a slow trajectory, causing some uncertainty among investors as to whether this asset can recover.

Historical pattern of DOGE

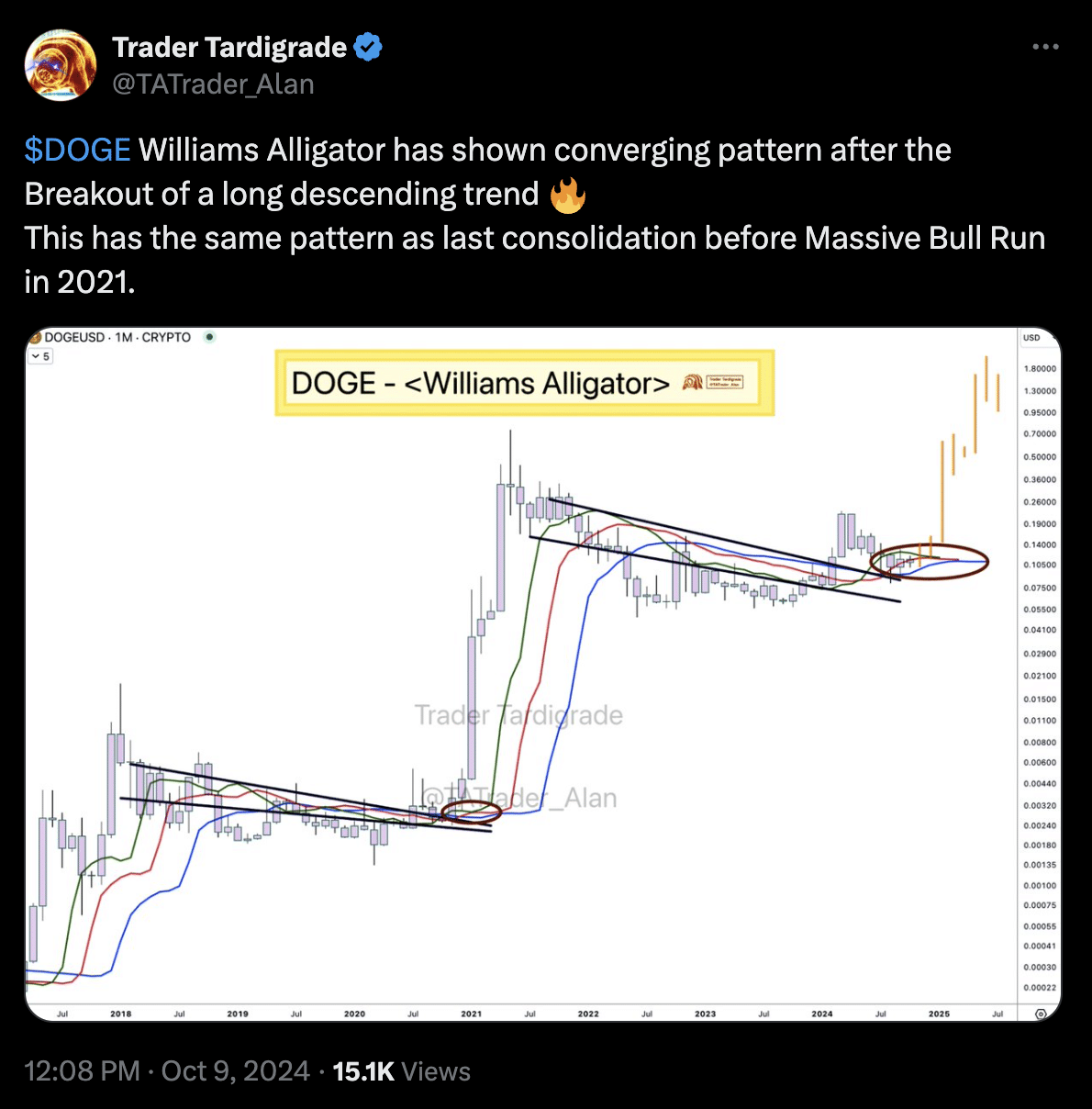

Significant news emerged as well-known cryptocurrency expert Trader Tardigrade expressed a positive perspective about Dogecoin through his platform, which is now known as X (previously Twitter).

The analyst pointed out a technical pattern known as the “Williams Alligator,” which suggested that Dogecoin could be primed for a breakout.

Trader Tardigrade observed that a recent pattern, breaking away from a prolonged downward trend, resembled the consolidation period seen prior to the significant bull market in 2021.

This insight has ignited debates about the possibility of Dogecoin experiencing another major surge in the coming days or weeks.

Bull run on the horizon?

Although the technical aspect suggests possible bullish trends, a thorough examination of Dogecoin’s underlying values might provide a more definite view of its future direction.

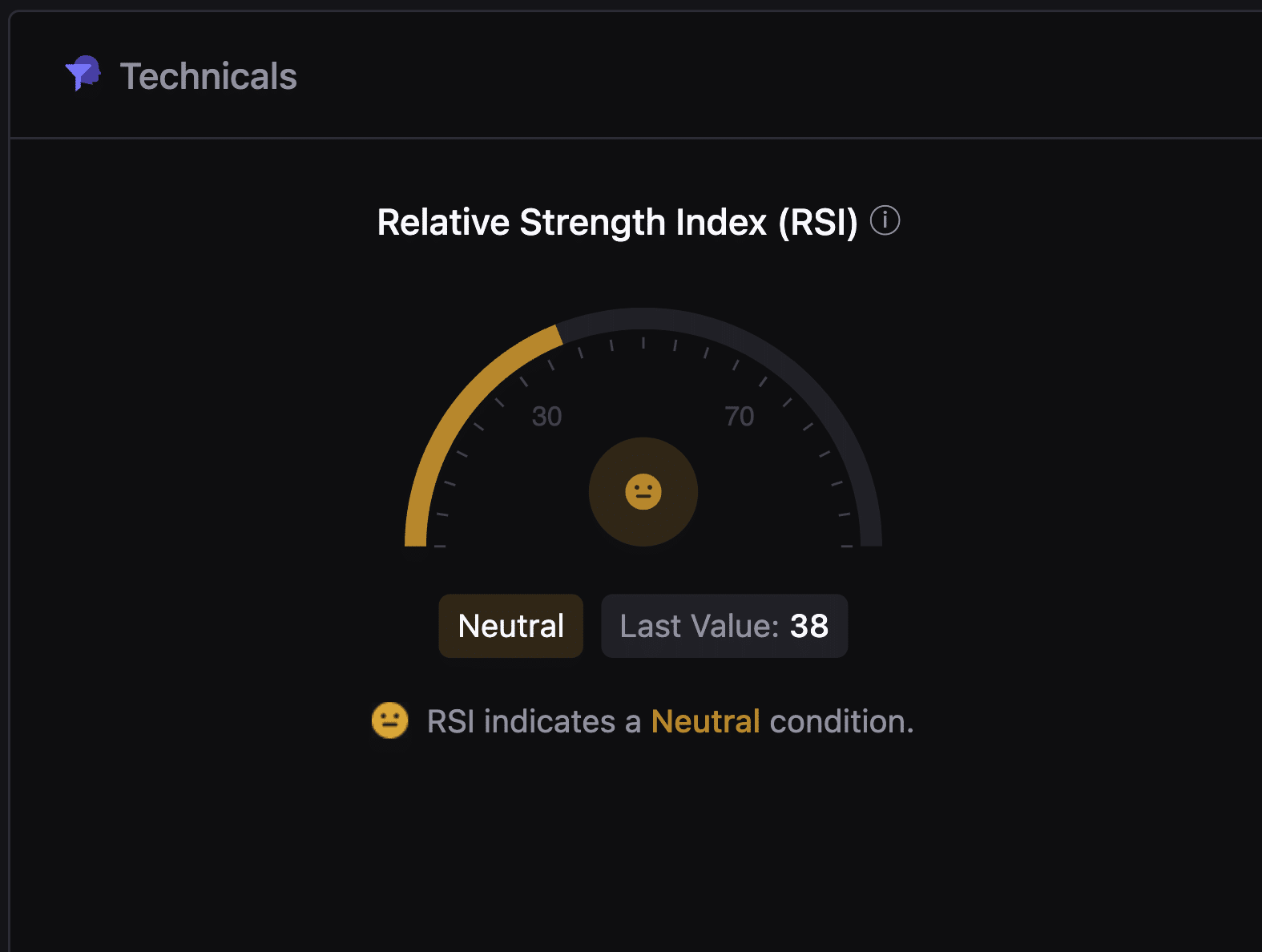

Keeping an eye on the Relative Strength Index (RSI) is important, as it assesses both the rate and direction of price fluctuations.

As per the data from CryptoQuant, the Relative Strength Index (RSI) for Dogecoin stood at a neutral value of 38 at the current moment.

From my years of trading experience, I have learned that when an asset neither shows signs of being overbought nor oversold, it suggests there’s still room for movement in either direction. This means that the market sentiment can drive the price to rise or fall further, based on factors like investor confidence and economic news. In such situations, I always make sure to stay cautious yet alert, keeping a close eye on the market trends before making any moves in my investment strategy.

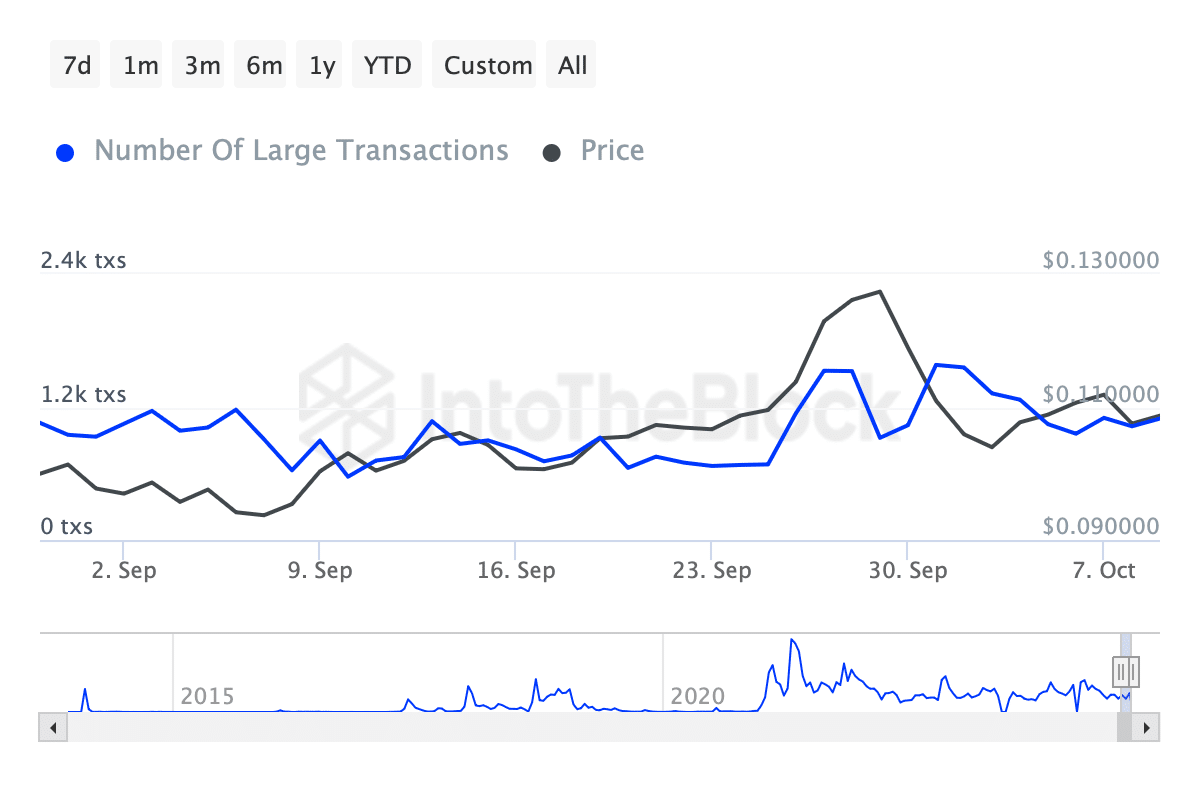

In addition to RSI, whale activity can provide valuable insight into market behavior.

Transactions involving whales (large sums exceeding $100,000) are frequently used to gauge the level of investment interest from institutions or wealthy individuals.

Read Dogecoin’s [DOGE] Price Prediction 2024–2025

According to data from IntoTheBlock, we’ve seen a substantial decrease in whale transactions involving Dogecoin this month. Specifically, the number of these transactions has dropped from approximately 1,560 to only 1,100 at the present moment.

A decrease might indicate less enthusiasm or faith among big investors, potentially suppressing the likelihood of an instant price jump.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-10-11 03:03