- Retail investors FOMOing Dogecoin suggested the possibility of another dip before rally continuation.

- Dogecoin RSI has been bouncing up from the oversold zone on 4-hour chart.

As a seasoned researcher with years of market analysis under my belt, I have observed cycles like this numerous times throughout my career. The current situation with Dogecoin [DOGE] brings to mind the saying, “History doesn’t repeat itself, but it often rhymes.

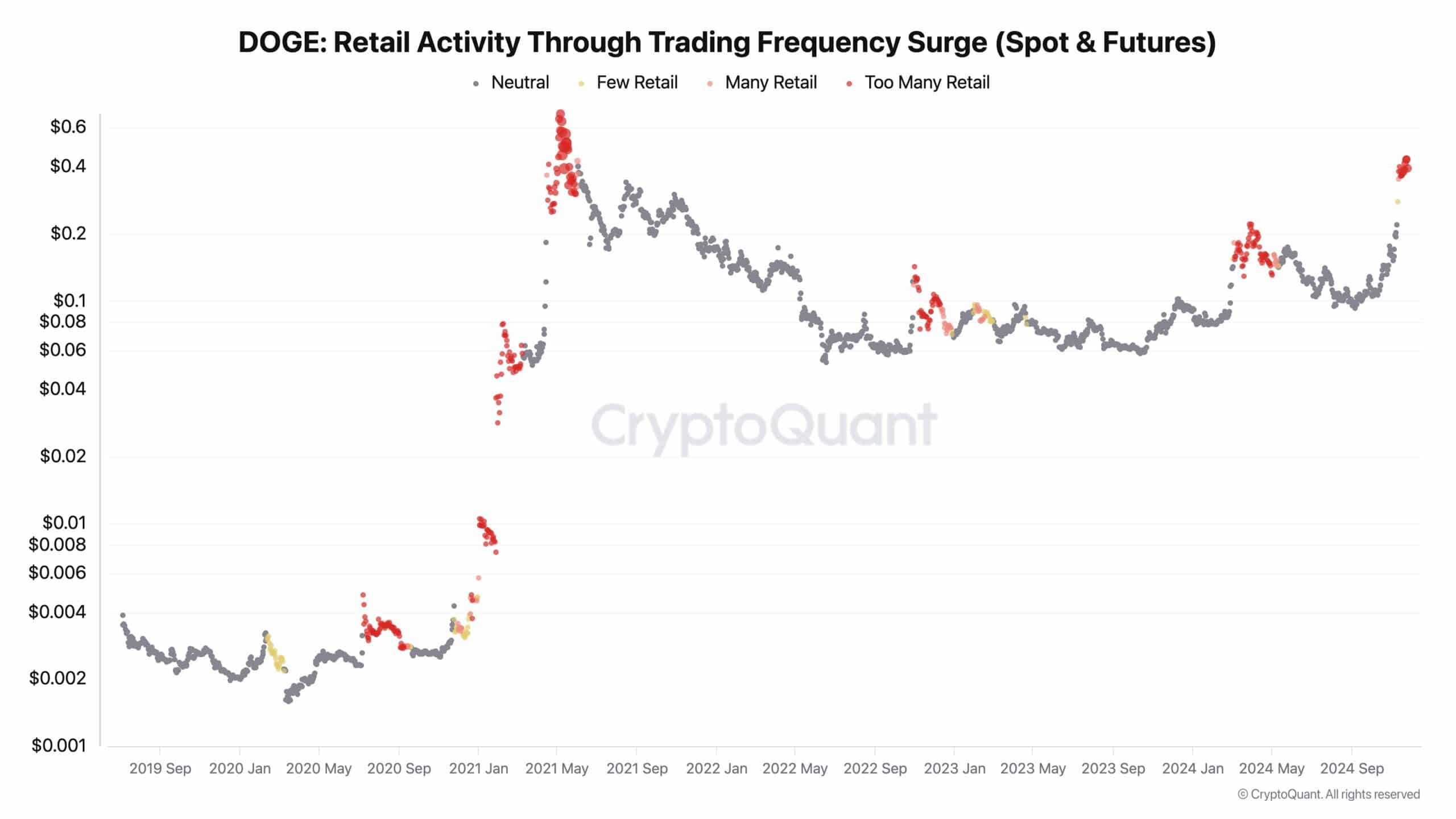

There’s been a noticeable increase in retail involvement with Dogecoin [DOGE], which is indicative of a period characterized by high retail engagement, as suggested by the latest study.

During this current phase often referred to as the “Overabundance of Retail Traders,” past trends indicate a potential forthcoming drop in Dogecoin prices, similar to what occurred in May 2021, January 2023, and again in May 2024.

Market experts view this surge in action as stemming from FOMO (Fear of Missing Out). This could potentially cause a sudden drop in prices, possibly due to manipulation intended to dissuade late investors entering the market.

However, this potential dip could set the stage for a major rally, possibly propelling DOGE to new ATHs.

Experts observed that these patterns often occur in dynamic meme-based markets, which can be influenced heavily by emotional trading, resulting in swift fluctuations in prices.

At present, there’s a strong surge in buying Dogecoin, which suggests a high level of demand, potentially leading to substantial price changes in the upcoming market.

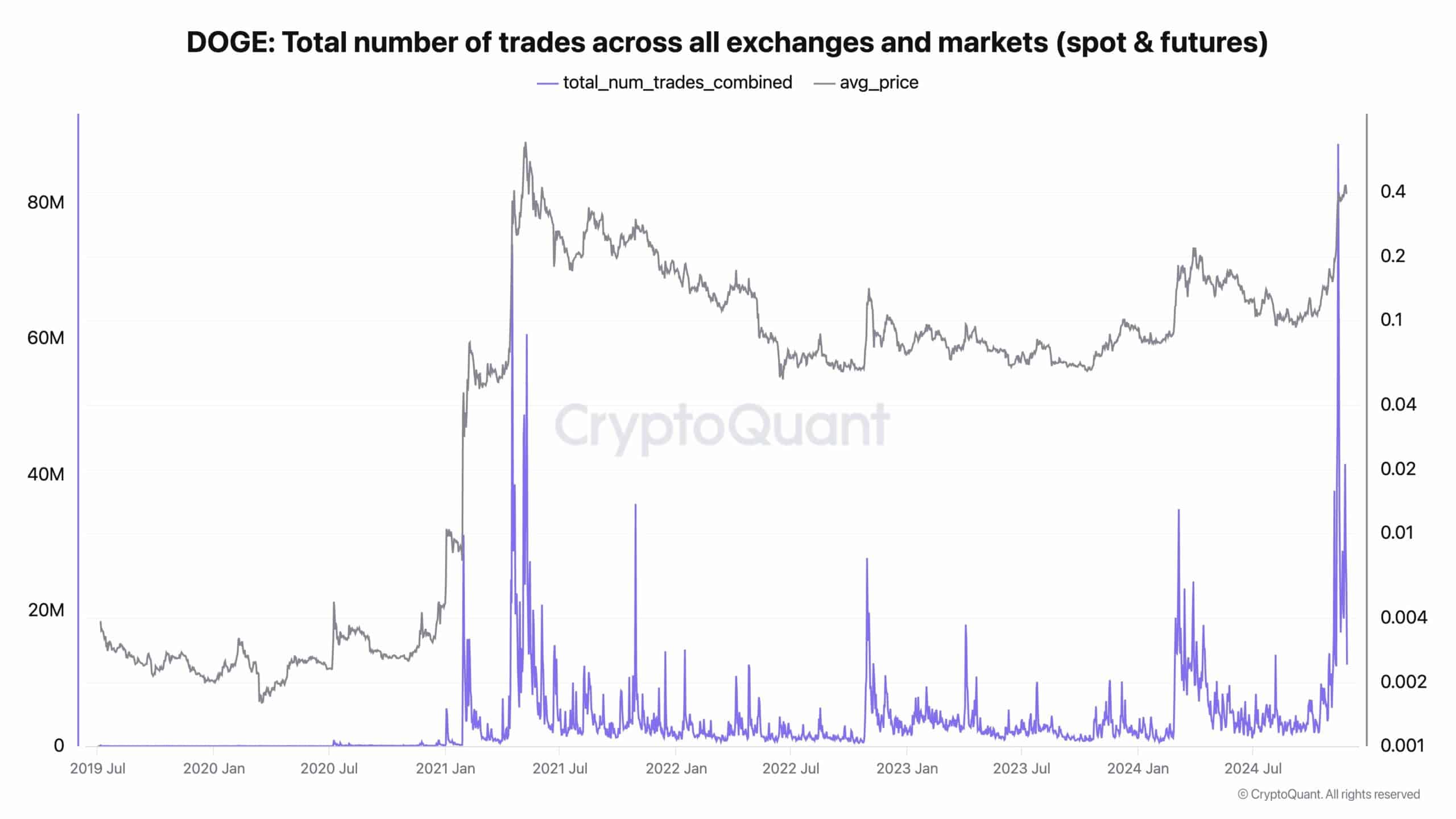

Number of trades on all exchanges

In November 2024, Dogecoin reached a new peak in trading volume, breaking its previous records by having the most transactions made on all trading platforms.

The increased trading of this meme cryptocurrency shows a rising curiosity about it, outpacing earlier highs recorded in early 2021 and mid-2023.

During this time, a surge in trades coincided with increased market fluctuations, implying higher levels of participation. With trade frequency rising sharply, Dogecoin’s price exhibited considerable price swings as well.

During November, there was a significant increase in trading activity, both in the spot and futures markets, which highlighted strong participation from traders across the globe.

The significant trading action surrounding Dogecoin indicates a revitalized interest within the cryptocurrency market, possibly setting the stage for increased focus and financial involvement in DOGE.

The digital currency is drawing in people from various backgrounds due to the strong backing it receives from its community and extensive news coverage, leading to its unpredictable yet captivating behavior in the market.

DOGE price prediction

Due to the fear-of-missing-out (FOMO) among retail investors regarding Dogecoin (DOGE), there’s a chance for another price drop that might entice current traders to enter the market. If this happens, an uptrend could develop, potentially reaching new all-time highs (ATHs).

On the four-hour graph, Dogecoin (DOGE) exhibited substantial price fluctuations accompanied by increased trading activity. Two distinct spikes are worth noting, as DOGE experienced significant upward momentum, hinting at potential future growth.

The first rally showed an increase from approximately $0.125 to $0.175, marking a 40.42% gain.

In a similar fashion, the second significant spike reaches approximately $0.43, suggesting yet another increase of around 208.59%, and it’s expected to rise further by an additional 208.58%, potentially exceeding the $1 mark.

As a crypto investor, I’ve noticed that those significant price surges often align when the Relative Strength Index (RSI) plunges into the “oversold region,” hinting at promising buying moments that shrewd traders could have seized.

Following every dip below an oversold region, there were noticeable price surges, indicating that strong purchasing activity tends to occur following considerable selling sprees.

Currently, the Relative Strength Index (RSI) is nearing the oversold region, suggesting a possible upcoming upward trend if historical tendencies continue.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-11-29 04:08