- DOGE rose 3% to $0.157 in the hours following the Bitcoin halving.

Whales were taking long positions for DOGE in the futures market.

The Bitcoin halving, a significant event in the cryptocurrency sector, took place and the attention quickly turned towards the broader market’s response.

DOGE’s historical relationship with halving

Dogecoin [DOGE], the largest memecoin by market cap, rose 3% to $0.157 in the hours following the occurrence, data from CoinMarketCap showed.

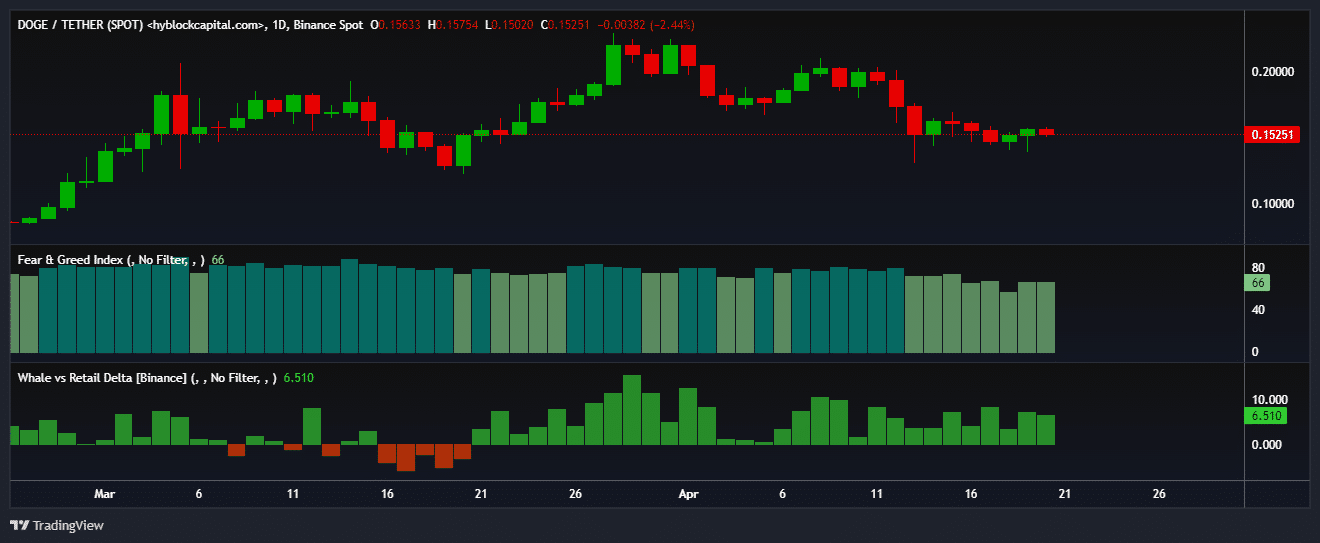

The price of DOGE had dropped back down to $0.152 at the current moment, leading some to sell and take profits. However, it was evident that investors were associating the potential growth of DOGE with its upcoming halving event.

DOGE existed during the last two halvings of Bitcoin [BTC].

In 2016, an event didn’t significantly affect DOGE‘s price. However, when something happened in 2020, DOGE’s price dropped by about 4% within a week, and close to 6% over the course of a month, according to AMBCrypto’s analysis.

Six months following the halving event, the price of DOGE began to increase. By the close of 2020, its value had reached $0.004592 on the market, marking a significant gain of 75% since the halving occurred.

The market’s positive momentum grew stronger, causing DOGE to reach its maximum price (all-time high or ATH) approximately one year after undergoing halving.

A faster journey towards ATH this time?

The DOGE community hopes to see another successful event like that. Luckily, DOGE might be able to do it even faster this time.

A well-known cryptocurrency trader, Kevin C., also known as Yomi, has daringly forecasted that the price of DOGE could approach or even reach its all-time high of $0.73 by July or August. He arrived at this prediction after analyzing historical trends from past market cycles.

Realistic or not, here’s DOGE’s market cap in BTC terms

Sentiment biased towards the bullish side

Based on Hyblock Capital’s data analyzed by AMBCrypto, it seems that large investors (referred to as “whales”) have shown optimism towards the coin’s future value by holding larger long positions compared to smaller retail investors on the Binance exchange (BNB) at this time.

Additionally, there was a shift in investor emotions towards greed, implying that more people were planning to buy, possibly leading to further purchases in the near future.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Injective at risk of pullback as key resistance holds strong – What now?

- Crypto mining ‘strengthens America’s energy grids’ – A 30% tax means…

2024-04-21 11:03