-

DOGS hit a support at $0.00095 as traders eyed a potential bounce back to retest $0.0011844.

New memecoins CATI and HMSTR could steal trading volume, impacting DOGS’ recovery.

As a seasoned researcher with over a decade of experience in analyzing cryptocurrencies, I have seen my fair share of market fluctuations and trends. The current situation with DOGS [DOGS] is fascinating, to say the least.

Dogs [DOGS] dipped to the bottom of its established trading range, with support around $0.00095 and resistance at $0.0011844.

Investors are keeping a close eye on whether the price will rebound from its support point, which might push it up again towards testing the highest point of the price range once more.

According to crypto analyst Zen,

As anticipated, the value of $DOGS decreased and subsequently rebounded to $0.0011844 – this current level marks the upper limit of its fluctuation span. Conversely, the lower boundary can be found around $0.00095, which is where its price stands at present.

Zen implied that if dogs leap off from this support level, it’s likely they will revisit the upper boundary of the range again, given the strength of the possibility.

If the price surpasses this barrier, it might spark additional upward movement, potentially overpowering the bearish influence that’s been keeping prices low as of late.

Key technical levels and bullish breaker target

The key technical levels to watch include the $0.00104 area, identified by Zen as the day bullish breaker equilibrium (EQ). Another critical level is the lower breakout point at $0.001023.

If DOGS reach these levels again, traders could anticipate a possible uptrend that may lead to the $0.00121 mark, offering a profitable 2:1 risk-reward opportunity.

According to the analysis by Mikybull Crypto, it seems that the cryptocurrency known as DOGS is shaping up like an inverse head and shoulders pattern, which typically indicates a bullish turnaround.

This specific pattern on a chart has three downturns, where the middle one is the most pronounced. Frequently, it’s succeeded by a jump over the “neckline,” which is a horizontal line connecting the two shallower troughs.

Investors are keeping a close eye on this pattern, as it might suggest a change in the overall market mood towards a potential bullish surge.

Rising competition from memecoins

As DOGS appears to be making progress towards a possible recovery, the introduction of fresh meme tokens such as CATI and HMSTR on Binance‘s Launchpad could potentially disrupt its current trajectory.

These new projects could dilute trading volume and interest in DOGS as traders shift their focus to the next popular meme coin.

Keeping an eye on the market shift towards new releases could potentially influence the performance of DOGS, so it’s crucial for traders to observe how the token reacts to this intensified competition.

Market activity and address decline

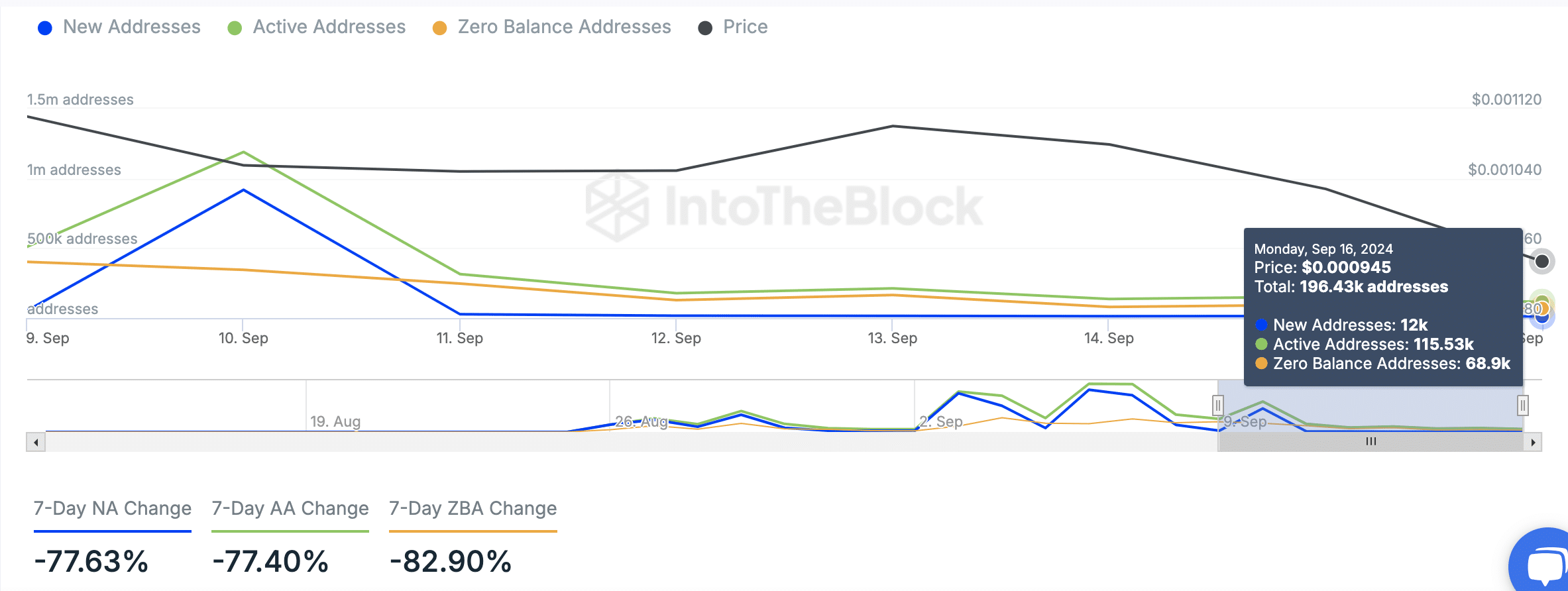

16th September saw DOGS register approximately 115,530 active addresses and around 12,000 newly active addresses according to data from IntoTheBlock.

Over the last week, there was a significant decline – a 77.40% drop in active addresses and a 77.63% reduction in newly created addresses.

Furthermore, we reached approximately 68,900 zero-balance accounts, suggesting lessening activity. A decrease in the number of active addresses might indicate reduced user interaction, which potentially affects Dogecoin‘s short-term price dynamics.

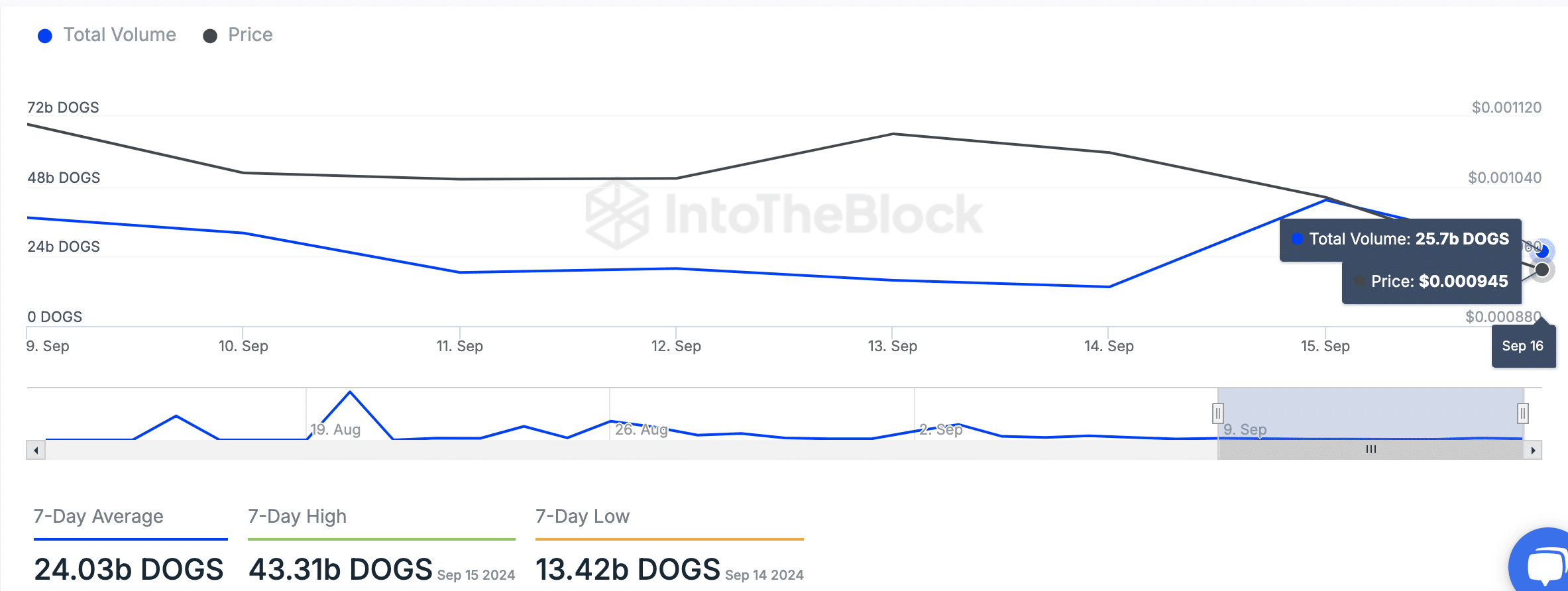

Concurrently, trading activity for the $DOGS token has shown some variability. At present, the total trading volume stands at approximately 25.7 billion DOGS, and the token’s price is currently $0.0009605.

Read Dogs’ [DOGS] Price Prediction 2024–2025

During the last seven days, the average daily trading volume was approximately 24.03 billion DOGS. The highest volume was recorded on September 15th at around 43.31 billion DOGS, while the lowest was on September 14th at about 13.42 billion DOGS.

As an analyst, I’m observing that the market volatility around DOGS might indicate a lingering uncertainty among traders regarding its future trajectory. They seem to be on the lookout for a definitive sign, whether it’s a breakout indicating a new direction or continued consolidation signaling stability in the current trend.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-09-18 01:12