- DOGS hits key Fibonacci levels with room to grow, supported by technical indicators.

- Bullish on-chain metrics and long liquidation dominance highlight strong support for further gains.

As a seasoned analyst with over two decades of experience navigating the crypto markets, I must admit that the current momentum behind DOGS is nothing short of impressive. The token’s recent 40% surge has caught my attention and made me bullish on its potential for further gains.

In the last seven days, there’s been a remarkable surge of approximately 40% in dog ownership or demand for dogs, fueled by robust purchasing enthusiasm and positive sentiment.

At the moment, the token is valued at $0.0007026. At the point of publication, it had dipped slightly by 1.54%. Despite the unstable market conditions, it has shown significant progress. As interest in DOGS increases, the question on everyone’s mind is: will it be able to maintain this upward trend?

DOGS technical analysis: What are the key levels to watch?

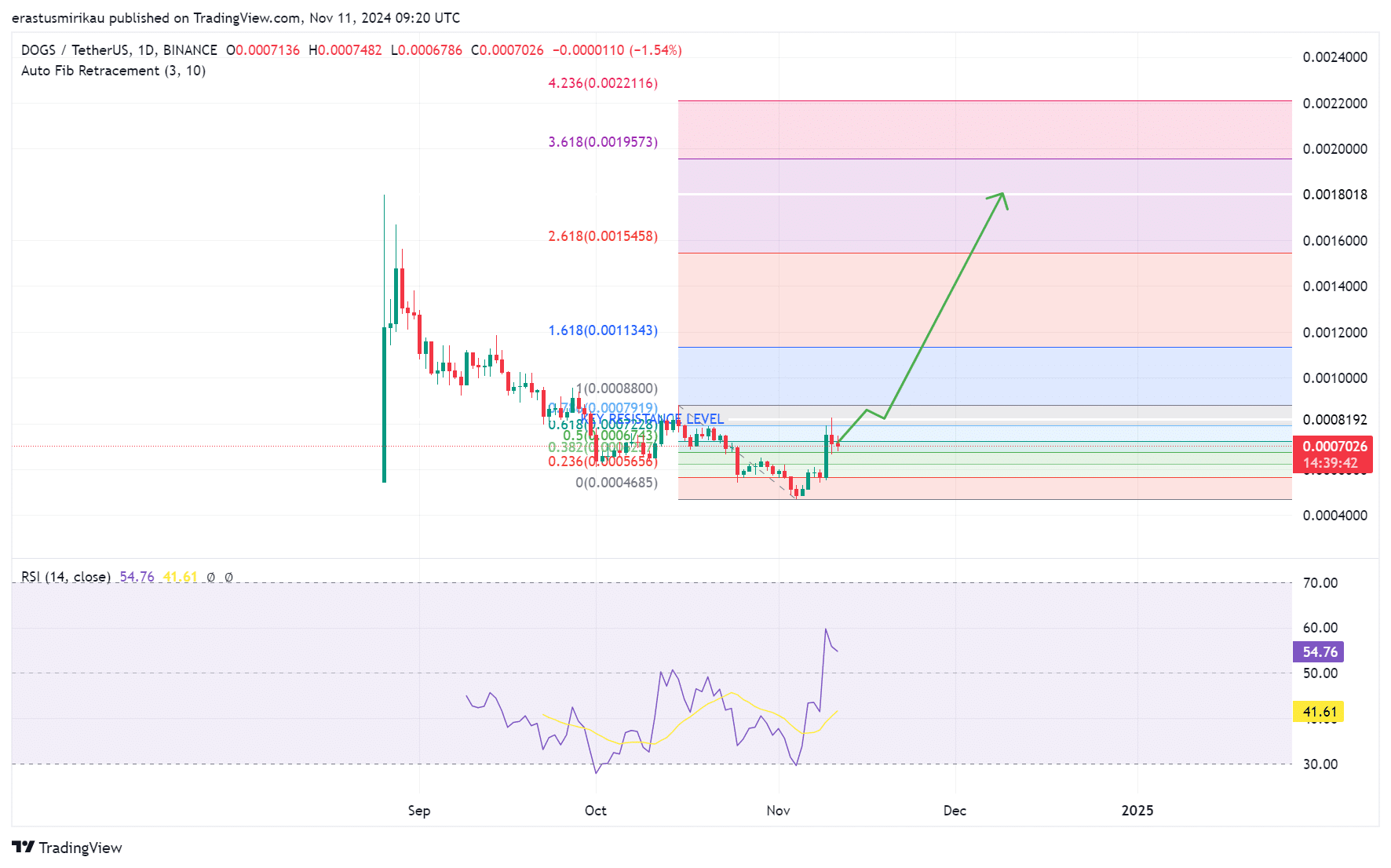

It appears that DOGS is exhibiting positive momentum, surpassing its past lows as it advances towards higher values. The Fibonacci retracement chart suggests significant points which may influence the token’s potential trajectory in the days ahead.

The price of DOGS seemed to linger close to the 0.618 Fibonacci support level, a point where it might potentially regain balance if there were any price drops.

Furthermore, the next potential resistance is approximately $0.0011343 based on the 1.618 Fibonacci extension. This point is significant because if DOGS manages to break through it, it might lead to a continued surge, potentially pushing the price up to the 2.618 extension level at $0.0015458.

If these resistance levels aren’t breached, there might be a period of holding steady, with potential support found near $0.0006565.

At present, the Relative Strength Index (RSI) is showing a value of 54.76, which means that the token isn’t quite in the overbought zone yet. This level hints that there might be further opportunities for DOGS to increase before it could potentially face increased selling activity.

Consequently, since the RSI (Relative Strength Index) is somewhat bullish, it could suggest that the upward movement might persist as long as the broader market conditions remain favorable.

DOGS on-chain signals remain bullish

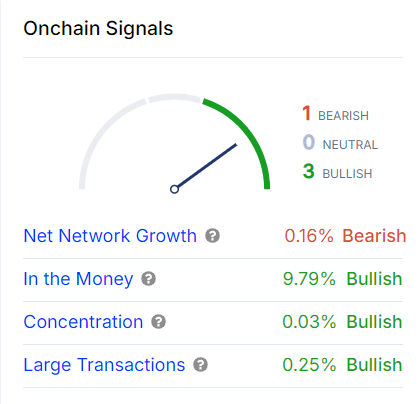

Based on blockchain data, there are several optimistic trends emerging. Although the overall expansion of the network has decreased slightly, three key indicators suggest a promising future. The “In the Money” metric, having risen by 9.79%, suggests that an increasing number of Dogecoin holders are realizing profits, which typically strengthens investor trust.

In a similar fashion, the “Concentration” indicator has increased by 0.03%, indicating that major investors, often referred to as “whales,” are keeping their investments steady. This could imply that they have confidence in the token’s future prospects.

Moreover, “Increase in Large Transactions” (by 0.25%) indicates a rise in significant trades, suggesting either institutional involvement or substantial investment activities.

The rising bullish indicators within the DOGS system suggest a growing backing, thereby bolstering its underlying foundation even during price volatility.

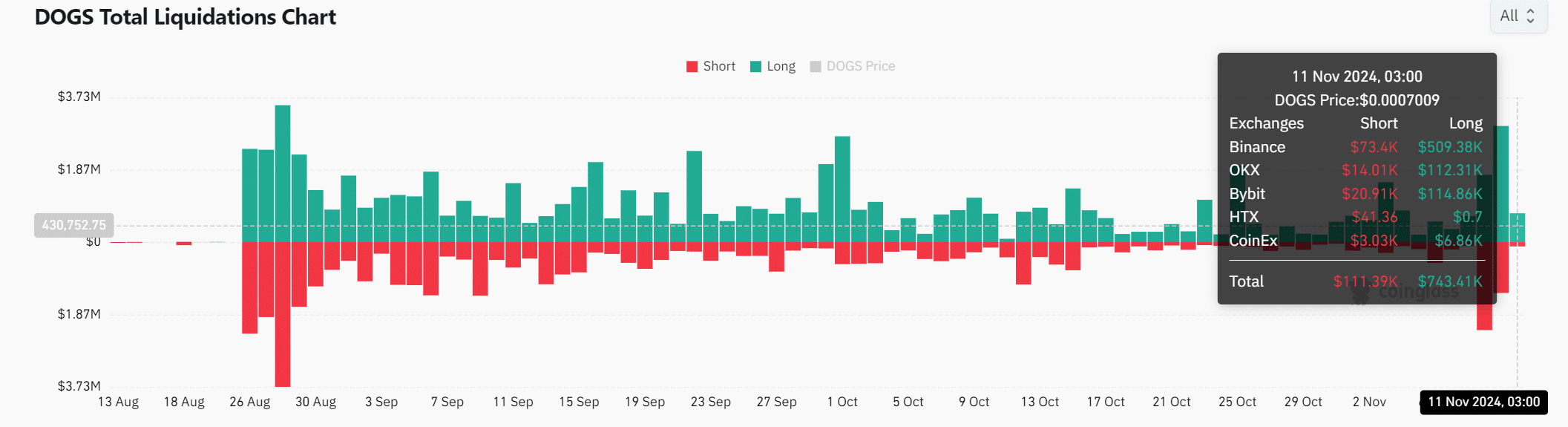

Liquidation data shows a leaning toward long positions

The chart showing the breakdown of trades indicates a significant increase in long positions being closed out, amounting to $743,410, whereas short positions totaled only $111,390. This imbalance implies that the majority of traders are bullish, predicting the price will keep climbing higher.

On Binance, the most substantial number of long liquidations was recorded at approximately $509,380. Bybit and OKX also reported notable long liquidations, amounting to more than $100,000 each.

Therefore, though there’s a sense of optimism, it’s wise for traders to tread carefully because elevated liquidation levels might lead to sudden changes in prices.

Read Dogs’ [DOGS] Price Prediction 2024–2025

Can DOGS maintain its upward trajectory?

It’s been impressive to see DOGS increase significantly by 40% in just a week, and both technical analysis and on-chain data point towards potential continued growth.

Nevertheless, significant resistance points and overall market mood will play a pivotal role in deciding whether this surge is sustained. Should DOGS maintain its present momentum and surpass important Fibonacci milestones, it could potentially keep ascending further.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-11-12 02:16