- DOGS token formed bullish pattern with a potential breakout and a $0.0012000 price target

- 65% of DOGS holders were in profit, signaling potential for upward price movement

As a seasoned researcher with a penchant for deciphering market trends and patterns, I find myself intrigued by the bullish potential of the DOGS token on the TON blockchain. The inverse head and shoulders pattern, coupled with the majority of investors being “In the Money,” paints an optimistic picture for this memecoin.

The cryptocurrency world is buzzing about DOGS token, a fresh memecoin based on the TON blockchain. It’s been grabbing headlines due to its recent market behavior. Although it experienced a minor price drop in the last week, experts predict a potential bullish turnaround could be coming up.

Currently, one DOGS coin is valued at approximately 0.001038 USD. In the last 24 hours, a trading volume of around 310 million USD has been recorded for this cryptocurrency. This slight dip represents a decrease of 0.36% in the past day and a more substantial drop of 3.65% over the past week. With a circulating supply of about 520 billion DOGS tokens, the market capitalization currently stands at nearly 535 million USD.

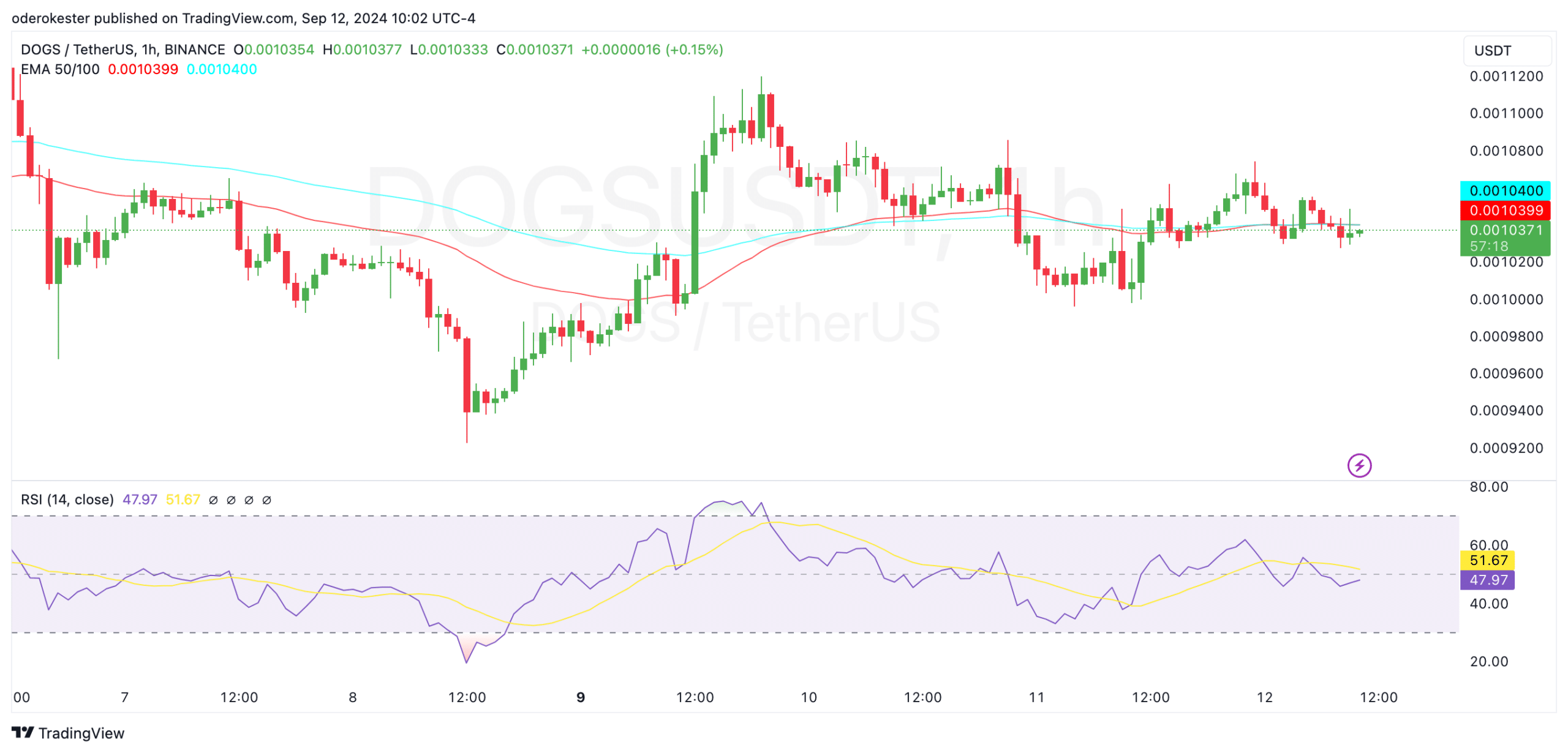

Technical indicators point to bullish reversal

As a crypto analyst myself, I’ve observed that the cryptocurrency DOGS seems to be shaping up into a technical configuration, specifically an inverse head and shoulders pattern. Typically, this pattern is perceived as a bullish reversal indicator.

Generally speaking, when there’s a specific pattern that has three dips, where the middle dip is the most pronounced, this is usually preceded by a surge or breakthrough beyond a “supporting line,” often referred to as the “neckline.

It appears that the cost of DOGS has been following a specific trend. If it manages to surge above the resistance line (neckline), we might anticipate a price objective of approximately $0.0012000.

Furthermore, the 50-day and 100-day exponential moving averages (EMAs) were found to be at $0.0010400, suggesting that the market is currently in a period of holding steady. In simpler terms, the current price is hovering around these potential resistance points, potentially causing uncertainty between buyers and sellers as they evaluate whether to buy or sell.

Currently, the Relative Strength Index (RSI) stands at 46, just shy of the neutral point at 50. This indicates a degree of bearish momentum, but it’s not yet signaling an oversold market condition. In other words, there’s still some scope for the market to move upward due to remaining buying opportunities.

Growing popularity on the TON blockchain

The growing popularity of DOGS on the TON blockchain is also fueling optimism. Since its Token Generation Event (TGE) where 17 million tokens were claimed within the first two weeks, user interaction with the token has surged.

Engaging in this popular hiking event has significantly increased the use of the TON blockchain, reinforcing DOGS as one of the most broadly owned tokens spanning various blockchain platforms.

It appears that people’s curiosity about DOGS is increasing, as indicated by a surge in transactions and user involvement, even with the ups and downs in price recently. With an expanding number of investors and increased market activity, the token could potentially bounce back more strongly.

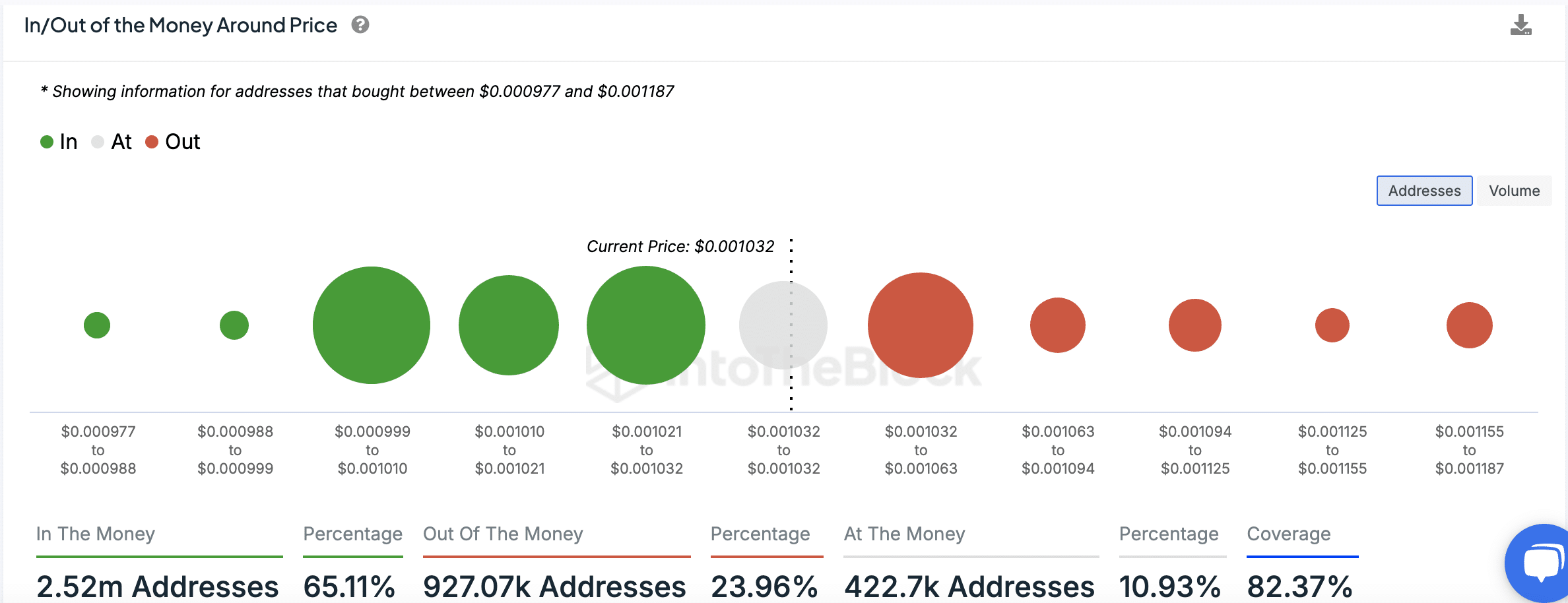

In/Out of the money data offers insight

Ultimately, the on-chain data gave us additional insights into DOGS’ current market standing. At its current price of $0.001032, approximately 65.11% of wallets were holding tokens they had purchased at a lower cost, which we refer to as being in profit or “In the Money.

Approximately 23.96% of these addresses had purchased coins at a price higher than the current market value, while about 10.93% bought around the same price as the current market rate.

Collectively, these findings show that most investors currently find themselves in a profitable situation. If a bullish trend gains momentum, it might result in heightened demand as more people look to buy.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Gold Rate Forecast

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-09-13 07:03